We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine an investor in the UK buying shares in a Japanese tech company or bonds from a Brazilian corporation. How do they tap into global markets without moving an inch? The answer lies in Foreign Portfolio Investment (FPI). This powerful tool allows individuals and institutions to diversify their portfolios across borders.

So, what makes FPI so appealing? Is it the lure of higher returns or the ability to spread risk across different economies? In this blog, we’ll delve into the world of FPI, uncovering its types, benefits, and potential risks. Ready to explore? Let’s dive in!

Table of Contents

1) What is Foreign Portfolio Investment?

2) Types of Foreign Portfolio Investments

3) How to Create a Foreign Portfolio Investment Account?

4) Factors Influencing FPI

5) Benefits of Foreign Portfolio Investment

6) Drawbacks of Foreign Portfolio Investments

7) Conclusion

What is Foreign Portfolio Investment?

Foreign Portfolio Investment (FPI) refers to investing in financial assets like stocks, bonds, and securities in foreign markets by non-resident investors. Unlike Foreign Direct Investment (FDI), FPI focuses on financial returns without taking control of companies. FPI allows investors to diversify internationally and tap into overseas market opportunities, enhancing returns. It plays a major role in global financial markets by influencing capital flows, market liquidity, and economic growth in host countries.

Types of Foreign Portfolio Investments

Foreign Portfolio Investments (FPIs) are a vital part of the global financial landscape, enabling investors to diversify their holdings by acquiring assets in foreign markets. Here are the main types of FPIs:

Exchange-Traded Funds (ETFs)

ETFs are traded on stock exchanges and consist of assets like stocks, bonds, or commodities. They provide access to global economies with different risk levels. For instance, a US investor can invest in an ETF that tracks Asian or European markets, benefiting from global economic trends without direct stock purchases.

American Depositary Receipts (ADRs)

ADRs represent shares in foreign companies, allowing US investors to trade on domestic exchanges like NYSE or NASDAQ without engaging directly with foreign stock exchanges. For example, US investors can buy shares of Volkswagen through an ADR listed in the US.

Global Depositary Receipts (GDRs)

GDRs are similar to ADRs but are issued outside the US and listed on international exchanges. They offer access to shares in emerging and developed markets, often denominated in US dollars or Euros.

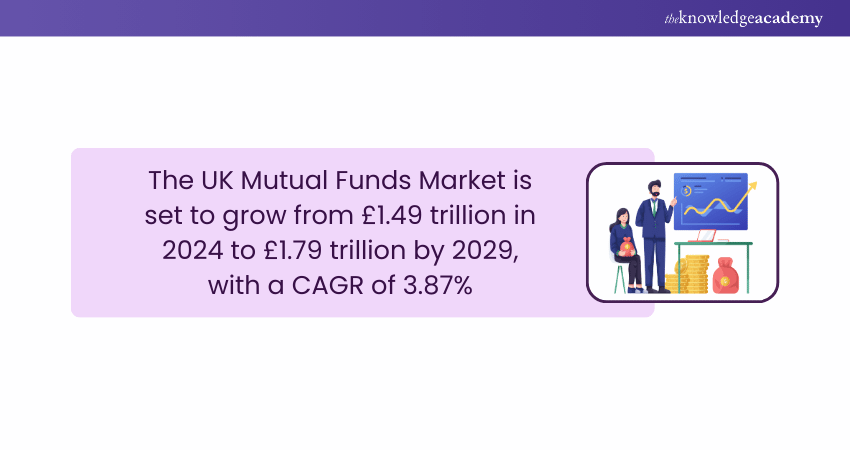

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, including foreign assets. International mutual funds specifically invest in overseas markets, giving investors access to global investment opportunities without the need to manage individual foreign stocks.

These funds are managed by professional Fund Managers who make investment decisions based on market research and analysis, providing a convenient way for investors to gain international exposure.

Discover the secrets of successful investing and trading – join our expert-led Investment and Trading Training now!

Stocks

Investing in foreign stocks involves purchasing shares of companies listed on international stock exchanges. This type of Foreign Portfolio Investment allows investors to gain exposure to the growth potential of companies operating in different economic environments. By diversifying their stock holdings globally, investors can benefit from the performance of various industries and markets, potentially enhancing their overall returns while spreading risk.

How to Create a Foreign Portfolio Investment Account?

Creating a Foreign Portfolio Investment (FPI) account involves several steps to ensure compliance with international regulations and to facilitate smooth transactions. Here are the key steps to create an FPI account:

a) Choose a Brokerage: Select an international broker with access to foreign markets.

b) Open an Account: Provide necessary documentation and meet regulatory requirements.

c) Fund the Account: Transfer funds, considering currency conversion rates and transaction fees.

d) Select Investments: Choose from stocks, ETFs, ADRs, or mutual funds based on your investment goals and risk appetite.

e) Monitor Performance: Regularly review your portfolio and adjust as needed.

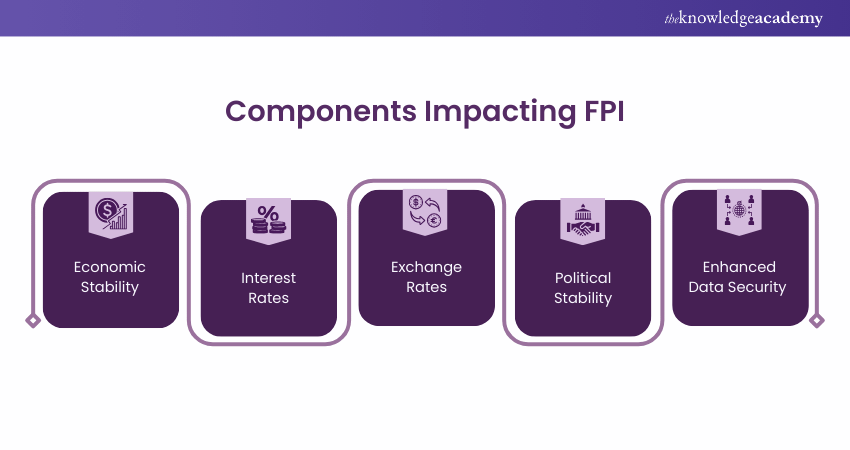

Factors Influencing FPI

Several factors can significantly impact Foreign Portfolio Investment (FPI) decisions, shaping the flow of capital across borders. Here are some of the main factors influencing FPI:

a) Economic Stability: Investors are drawn to stable economies with low inflation and strong growth prospects.

b) Interest Rates: Higher rates attract FPIs by offering better returns on bonds.

c) Exchange Rates: Currency strength can enhance foreign investor returns.

d) Political Stability: Stable and transparent environments attract FPIs.

e) Market Accessibility: Low entry costs and advanced trading platforms encourage FPI inflows.

Benefits of Foreign Portfolio Investment

Foreign Portfolio Investment (FPI) offers numerous advantages that can significantly enhance an investor’s financial strategy. Here are some key benefits of FPI:

1) Diversifying Investment Portfolios

FPI allows investors to diversify their portfolios by including international assets, reducing risk through exposure to different markets. Diversification helps spread investment risk across various geographies, industries, and currencies, enhancing overall portfolio resilience.

2) Access to International Credit

Investing internationally provides access to foreign credit markets, enabling investors to benefit from interest rate differentials and favourable borrowing conditions. This access is particularly advantageous in markets with higher yields compared to domestic ones.

3) Opportunities in Markets with Varying Risk-Return Profiles

FPI offers exposure to markets with different economic cycles and risk-return profiles. Investors can capitalise on emerging market growth or stabilise returns by investing in mature economies, balancing their overall investment strategy.

4) Enhancing the Liquidity of Domestic Capital Markets

FPI contributes to the liquidity of domestic capital markets by increasing trading volumes and capital flows. This liquidity helps improve market efficiency, reduces transaction costs, and makes it easier for companies to raise funds through equity or debt issuance.

5) Supporting the Growth of Equity Markets

Foreign investments stimulate the growth of domestic equity markets by providing capital to local companies. This capital influx helps businesses expand, innovate, and improve competitiveness, contributing to broader economic development.

Master the skills required for high-stakes financial transactions – sign up for our Investment Banking Course today!

Drawbacks of Foreign Portfolio Investments

While FPI offers numerous benefits, it also comes with potential drawbacks. Let’s discuss them in detail:

a) Volatility: FPI can contribute to market volatility, as foreign investors may withdraw funds quickly in response to economic or political changes.

b) Currency Risk: Fluctuations in exchange rates can impact returns, particularly in volatile markets or during periods of currency devaluation.

c) Regulatory Risks: Changes in government policies, tax regulations, or market restrictions can affect FPI, leading to uncertainties for investors.

d) Lack of Control: Unlike FDI, FPI does not provide control over the invested companies, limiting investors’ influence on management decisions.

Conclusion

In summary, Foreign Portfolio Investments (FPIs) open doors to global financial opportunities, allowing you to diversify and strengthen your investment portfolio. By leveraging FPIs, you can enhance returns and mitigate risks. Stay informed about global market trends to make the most of your FPI strategy.

Acquire the skills to excel in the competitive Real Estate industry – register for our Real Estate Agent Course now!

Frequently Asked Questions

What is the Difference Between FDI and Foreign Investment?

FDI involves direct control and ownership of foreign companies, while Foreign Portfolio Investment focuses on financial assets like stocks and bonds without active management. FDI typically involves long-term commitments and business operations, whereas FPI is more liquid and passive.

What is the Limit of Foreign Portfolio Investors?

The limit for Foreign Portfolio Investors (FPIs) is generally capped at 10% of the total paid-up equity capital of a company. Additionally, the aggregate limit for all FPIs combined is set at 24%, which can be increased up to the sectoral cap with board and shareholder approval.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Trainings, including the Real Estate Agent Course, Investment Management Course, and Investment Banking Training. These courses cater to different skill levels, providing comprehensive insights into Accounting Principles.

Our Business Skills Blogs cover a range of topics related to Foreign Portfolio Investment, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Investment skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Forex Trading Course

Forex Trading Course

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please