We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Compliance risks pose significant challenges to organisations. There are many different Types of Compliance, each carrying its own implications and potential consequences, including legal and financial impacts. Understanding and effectively managing these compliance risks are vital for organisations.

Compliance Management is a very rewarding career with high pay and benefits. The median salary of a Compliance Manager in the UK is £59,459 annually, as per Glassdoor's website. In this blog, you will learn about the different Types of Compliance with relevant examples. Moreover, you will also learn about the three risk types in Compliance.

Table of Contents

1) Types of Compliance

a) Internal Compliance

b) External Compliance

2) Types of Compliance Risk

3) Mitigating Compliance Risks

4) Conclusion

Types of Compliance

Compliance is a multifaceted concept that encompasses different areas and requirements within an organisation. If you are wondering how many Types of Compliance are there? Then you are in the right place. Here, we explore the various Types of Compliance that organisations need to consider:

Internal Compliance

Internal Compliance refers to the adherence to rules and regulations established within an organisation. It encompasses the policies, procedures, and controls that are implemented internally to ensure ethical conduct, data security, and operational efficiency.

Internal Compliance focuses on aligning business practices with the organisation's goals, values, and industry best practices. Let's take a look at some examples of internal compliance:

1) Code of Conduct and ethics policies: Organisations establish a code of conduct and ethics policies that outline the expected behaviour of employees. These policies promote integrity, honesty, and transparency within the organisation.

2) Data protection and privacy policies: Internal compliance includes implementing policies and procedures to protect sensitive data and make sure compliance with data protection laws and regulations.

3) Financial and accounting controls: Organisations establish internal controls and procedures to ensure accuracy, transparency, and compliance in financial and accounting practices. This includes proper bookkeeping, financial reporting, and adherence to accounting standards.

4) Human Resources policies and practices: Internal compliance involves maintaining compliance with employment laws and regulations, ensuring fair and ethical treatment of employees, and promoting a safe and inclusive work environment.

5) Health and Safety Regulations: Compliance with health and safety regulations is crucial to maintain a safe and healthy workplace. Internal compliance includes implementing policies and procedures to make sure compliance with occupational health and safety standards.

Internal compliance is essential for organisations as it helps maintain ethical standards, mitigate risks, and build trust among stakeholders. By establishing robust internal compliance practices, Organisations can operate with integrity, ensure legal compliance, and foster a positive work culture.

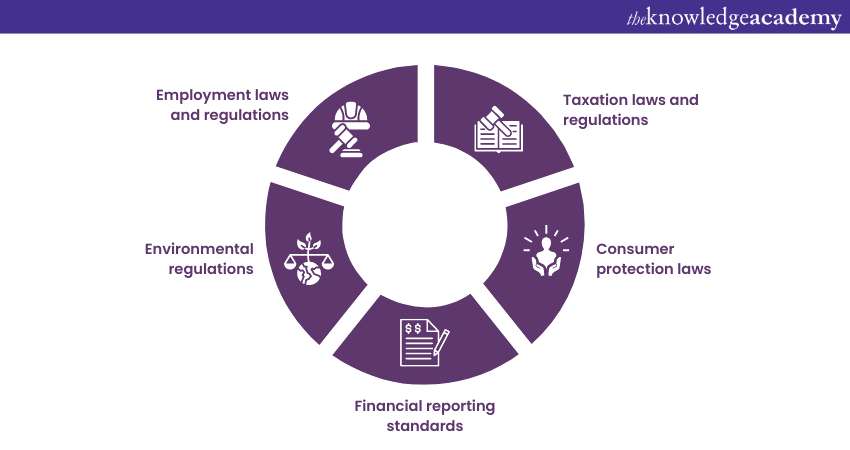

External Compliance

External Compliance refers to the adherence to laws, regulations, and standards imposed by external governing bodies, such as government agencies, industry regulators, or professional associations. It encompasses the requirements and obligations that organisations must meet to operate legally and ethically within their industry. Here are some examples of external compliance:

1) Taxation laws and regulations: Organisations must comply with tax laws and regulations by accurately reporting and paying taxes on time. This includes income tax, sales tax, payroll tax, and other applicable taxes.

2) Employment laws and regulations: External compliance involves adhering to laws and regulations related to employment practices, such as minimum wage, overtime, working hours, anti-discrimination, and health and safety standards.

3) Environmental regulations: Many industries are subject to environmental regulations aimed at protecting the environment and natural resources. External compliance requires organisations to comply with regulations related to waste management, emissions, pollution control, and sustainable practices.

4) Financial reporting standards: Publicly traded companies and organisations may have to comply with financial reporting standards imposed by regulatory bodies, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP).

5) Consumer protection laws: External compliance includes complying with laws and regulations aimed at protecting consumers' rights and ensuring fair business practices. This may involve disclosure requirements, product safety standards, or handling customer complaints appropriately.

External compliance is crucial for organisations to maintain their legal standing, reputation, and trust among stakeholders. By actively complying with external regulations, organisations demonstrate their commitment to ethical practices, protect themselves from legal and financial risks, and contribute to a fair and transparent business environment.

Elevate your compliance practices with our Effective Compliance Training that empowers your workforce and ensures regulatory adherence. Sign up today!

Types of Compliance Risk

Different Types of Compliance risks can pose challenges to organisations, potentially leading to legal, financial, and reputational consequences. Here are the three Types of Compliance risks:

1) Regulatory Compliance Risks: These risks arise from non-compliance with laws, regulations, and industry standards. Failing to meet regulatory requirements can result in penalties, fines, and legal disputes.

2) Financial Compliance Risks: Financial Compliance Risks involve violations of accounting standards, improper financial reporting, or non-compliance with financial regulations. These risks may lead to financial losses, fines, and reputational damage.

3) Data Privacy and Security Compliance Risks: With the growing emphasis on data protection, non-compliance with Data Privacy laws and regulations can lead to breaches, unauthorised access, and loss of sensitive information.

It is crucial for organisations to proactively identify, assess, and mitigate these compliance risks to safeguard their operations and reputation.

Mitigating Compliance Risks

In order to effectively mitigate compliance risks, organisations should implement the following measures:

1) Establish robust compliance programs tailored to industry, size, and risk profile, including policies, procedures, and training.

2) Conduct regular risk assessments and audits to proactively identify vulnerabilities and non-compliance areas.

3) Implement internal controls and monitoring systems for compliance with laws, regulations, and standards.

4) Provide ongoing compliance training and awareness programs to ensure employee understanding and responsibility.

5) Maintain updated policies and procedures reflecting changes in laws, regulations, and industry practices, and communicate them effectively throughout the organisation.

6) Incorporate specific measures for medical compliance to ensure adherence to healthcare laws, regulations, and standards relevant to the industry, such as GPDR, data privacy, and patient confidentiality.

Equip yourself with the knowledge and skills needed to navigate complex medical compliance regulations with our Medical Compliance Training. Sign up today!

Conclusion

We hope you read and understood the different Types of Compliance. Adherence to compliance is crucial for organisations to navigate regulations and uphold ethical standards. By ensuring compliance, organisations can maintain legal integrity, mitigate risks, and foster a culture of ethical conduct.

Take a proactive step towards compliance excellence and strengthen your organisation's integrity and success with our Compliance Training. Sign up now!

Frequently Asked Questions

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 16th Jan 2025

Thu 6th Mar 2025

Thu 22nd May 2025

Thu 24th Jul 2025

Thu 25th Sep 2025

Thu 11th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please