We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

What are Fictitious Assets, and why do they appear in financial statements? Fictitious Assets are intangible, non-physical items like preliminary expenses or accumulated losses. They don’t have actual value but are recorded on the balance sheet for accounting purposes. These assets represent costs that the business needs to write off over time rather than immediately.

Understanding Fictitious Assets can help provide a clearer picture of a company’s financial health and long-term expenses. Want to know more about Fictitious Assets and their role in accounting? Read this blog to understand why they matter in financial reporting.

Table of Contents

1) What Are Fictitious Assets?

2) Importance of Fictitious Assets in Financial Reporting

3) Key Features of Fictitious Assets

4) Types of Fictitious Assets

5) Challenges in Fictitious Asset Valuation

6) Differences between Fictitious Assets and Intangible Assets

7) Impact of Fictitious Assets on Investment Decisions

8) Conclusion

What Are Fictitious Assets?

Fictitious Assets are assets that lack physical existence and realisable value. Despite this, they are recorded as actual cash expenditures in financial statements. These are expenses and losses that are not recorded in the profit and loss account. This means that these remain unclaimed during the period of their occurrence.

These assets should be written off in the profit and loss account by reducing their value in the balance sheet. This process is spread over one or more accounting periods. Although the term ‘fictitious’ implies they are not real assets of the company, they are still represented in the assets section of the balance sheet.

Importance of Fictitious Assets in Financial Reporting

Fictitious Assets, though intangible, play a key role in financial reporting. They represent costs like preliminary expenses or losses, which lack immediate value but still impact a company’s finances. Here’s why Fictitious Assets matter in financial reporting:

1) Tracks Initial Business Costs: Fictitious Assets like preliminary expenses allow businesses to record and gradually write off start-up costs over time.

2) Improves Profitability Appearance: Spreading costs over multiple periods reduces immediate expenses, helping to show stable profits year-to-year.

3) Enhances Transparency: Recording these assets on the balance sheet ensures that all business costs, even those without immediate value, are visible.

4) Supports Financial Planning: By understanding Fictitious Assets, businesses can better plan for amortisation, helping in budgeting and forecasting.

5) Reflects Accurate Financial Health: These assets help present a complete view of a company’s financial status by including all incurred costs.

Key Features of Fictitious Assets

Here are some features of Fictitious Assets:

1) No Physical Existence: They have no tangible form and are considered part of intangible assets.

2) Business Expenses: These are expenses incurred in running a business but are categorised as assets in the balance sheet. The idea is that, like assets, these expenses will bring returns to the organisation over time.

3) No Resale Value: Since they are expenses for running the company, they cannot be recovered and have no realisable value.

4) Amortised Over Years: The recognition of these expenses is spread over future accounting periods, not accounted for in a single year but over multiple years.

These simplified points capture the essence of Fictitious Assets and their treatment in financial statements.

Enhance your career with Project Accounting skills – Sign up with our Project Accounting Course now and bring value to every project!

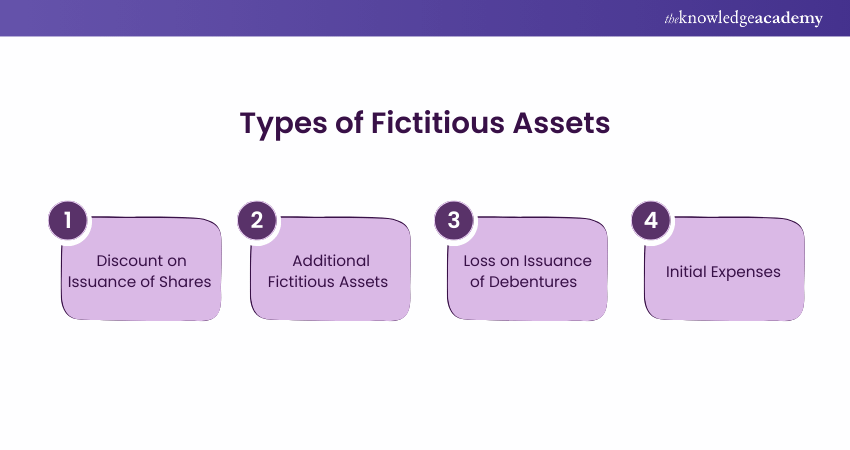

Types of Fictitious Assets

Fictitious Assets are recorded costs without physical form, like share issuance discounts, debenture losses, and initial expenses. They lack immediate value but are amortised over time to reflect financial obligations accurately. Here’s a look at common Types of Fictitious Assets.

Discount on Issuance of Shares

If shares are distributed at a price lower than their face value, the difference is considered a discount on the issue of shares. This discount is considered as a fictitious asset and amortised over the life of the shares.

Additional Fictitious Assets

There are other assets without physical existence that are still accounted as assets in the balance sheet. These are underwriting commission, promotional expenses, and other expenses that cannot be capitalised.

Loss on Issuance of Debentures

When debentures are distributed at a price lower than their face value, the difference is considered as a loss on the issue of debentures. This loss is recorded as a fictitious asset and amortised over the life of the debentures.

Initial Expenses

These are costs incurred before a company starts operations, like legal fees and registration fees. Since they cannot be capitalised, they are treated as Fictitious Assets and amortised over time.

Learn the art of bookkeeping and make sense of finances. Join our Book Keeping Course now!

Challenges in Fictitious Asset Valuation

Valuing Fictitious Assets is challenging for accountants due to their intangible nature. Here are the main difficulties:

1) Intrinsic Value: Determining the real value of Fictitious Assets is hard. Unlike tangible assets, they don’t have a clear market value and are valued based on perceived economic benefits, which are subjective and require expert judgment.

2) Economic Benefits: Fictitious Assets are expected to bring future economic gains, but predicting these benefits is difficult. Accountants must make assumptions and estimates about future cash flows, which adds complexity.

3) Useful Life: Unlike physical assets, Fictitious Assets’ useful life is not simple. Accountants must consider factors like the asset’s nature, the industry, and the company’s future plans to estimate how long these assets will benefit the company.

Valuing Fictitious Assets demands accounting expertise, as it involves assumptions, estimates, and careful consideration of various factors.

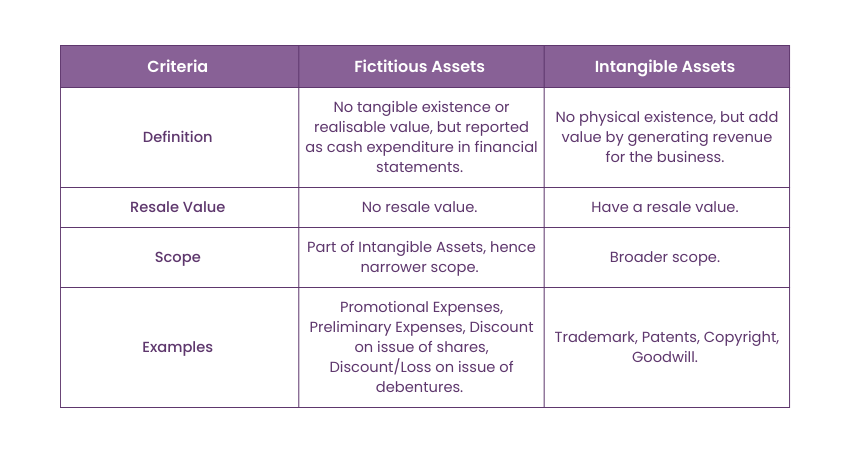

Differences between Fictitious Assets and Intangible Assets

Here are the main differences between Fictitious Assets and Intangible Assets:

Ready to Excel in Accounting? Register with our expert-led Accounting Courses and level up your knowledge!

Impact of Fictitious Assets on Investment Decisions

Fictitious Assets can greatly influence investment decisions and a corporation's financial health. Here’s how:

1) Nature of Fictitious Assets: Fictitious Assets have no real value but are recorded on the balance sheet. They don’t generate revenue or cash flow and may be used to inflate a corporation’s value or manipulate financial reports.

2) Impact on Investors: Investors rely on financial statements for decision-making. Fictitious Assets can mislead them by inflating the company's value, making investors pay more for shares than they are worth or believe the company has more capital than it does.

3) Effect on Financing: Lenders assess creditworthiness using financial statements. Fictitious Assets can create a healthier financial appearance, potentially leading to a better credit rating and loan terms. However, the discovery of these assets could bring legal and financial consequences.

4) Balance Sheet Distortion: Fictitious Assets, often recorded as fixed or current assets, inflate the balance sheet. This leads to inaccurate assessments of the corporation's liquidity, solvency, and liabilities, impacting its perceived debt obligations.

5) Importance of Due Diligence: Investors should carefully review financial statements to detect any Fictitious Assets. Corporations should report accurately to provide investors and lenders a true view of their financial position.

Want to take control of Asset Accounting? Sign Up for our Fixed Assets Accounting And Management Course today!

Conclusion

Fictitious Assets are intangible items recorded on financial statements that don’t hold real value. While they may serve certain accounting purposes, they can mislead investors and distort a corporation’s financial health. It’s essential for investors to examine financial statements closely and for companies to report accurately, ensuring transparency and fair assessments.

Frequently Asked Questions

No, advertising expenses are not considered Fictitious Assets. They are typically classified as regular operating expenses and are recorded as such in financial statements. Unlike Fictitious Assets, which are gradually written off, advertising expenses are usually expensed in the period they occur.

No, a patent is not a fictitious asset. It’s an intangible asset with legal rights that can generate future economic benefits. Patents have intrinsic value and contribute to revenue through product exclusivity. They differ from Fictitious Assets, which lack real value and are created for accounting purposes.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including Fixed Assets Accounting and Management Course, Book Keeping Course and Project Accounting Course. These courses cater to different skill levels, providing comprehensive insights into the What is Cash Management.

Our Accounting and Finance Blogs cover a range of topics related to Fictitious Asset, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Fixed Assets Accounting and Management Course

Fixed Assets Accounting and Management Course

Fri 20th Dec 2024

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please