We may not have the course you’re looking for. If you enquire or give us a call on 01344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial transparency and accountability - These are two of the most critical moral pillars of the corporate world. One way to ensure that these pillars stand firm is through SOX Compliance. Derived from the Sarbanes-Oxley Act of 2002, SOX Compliance sets stringent financial practices and corporate governance standards. Anyone involved in publicly traded companies must know What is SOX Compliance.

Its primary goal is to protect investors from fraudulent financial reporting by corporations. This blog delves into the core aspects of What is SOX Compliance, its significance, the best practices, and the associated challenges. Let's dive in.

Table of Contents

1) An introduction to What is SOX Compliance

2) Key Components of SOX Compliance

3) Why is SOX Compliance important?

4) The SOX Compliance process

5) Challenges in achieving SOX Compliance

6) Best practices for SOX Compliance

7) Conclusion

An introduction to What is Sox Compliance

SOX Compliance is a set of rules and regulations designed to improve the accuracy and reliability of financial reporting within publicly traded companies. It was enacted in 2002 in response to several high-profile accounting scandals, such as Enron and WorldCom, which severely shook investor confidence in the financial markets.

What is the Sarbanes-Oxley Act?

Before we delve deeper into What is SOX Compliance, let’s look at the Sarbanes-Oxley Act. The Sarbanes-Oxley Act, often abbreviated as SOX, a crucial piece of legislation that was enacted by the United States Congress in 2002.

The purpose of the Sarbanes-Oxley Act is to establish stricter regulations and guidelines for financial reporting, internal controls, and corporate governance. Its overarching aim is to restore faith in the accuracy and reliability of financial information provided by publicly traded companies. By doing so, the act seeks to prevent accounting fraud, enhance transparency, and protect the interests of shareholders.

Key Components of the Sarbanes-Oxley Act

One critical component of the Sarbanes-Oxley Act is the requirement that companies maintain adequate internal controls. Internal controls refer to the systems and processes put in place to:

a) Ensure accurate financial reporting

b) Prevent fraudulent activities

c) Safeguard company assets

This includes measures such as:

a) Segregation of duties

b) Regular reviews and audits

c) Establishing whistleblower hotlines

d) Improving financial reporting practices

By upholding the regulations outlined in the Sarbanes-Oxley Act, companies demonstrate their commitment to ethical conduct, corporate governance, and financial transparency.

Elevate your expertise with Sarbanes-Oxley Training – Get started on your path to compliance success!

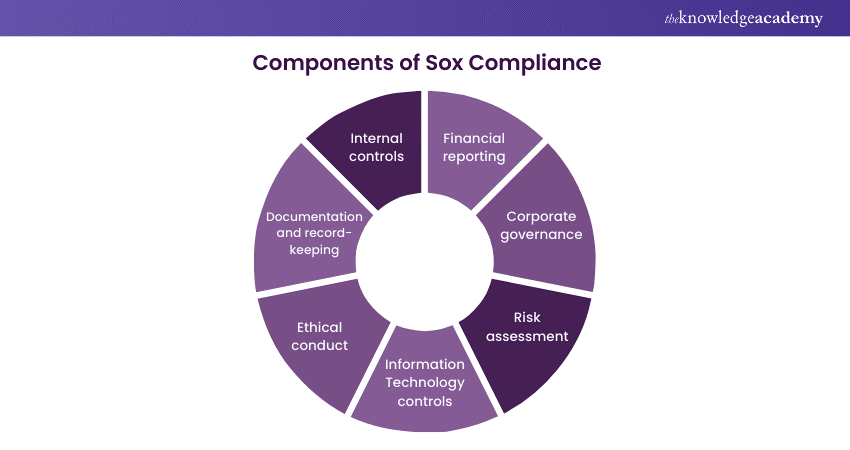

Key Components of Sox Compliance

Now that we have defined SOX Compliance, we will move on to exploring its components. SOX Compliance encompasses several key components that are essential for ensuring the integrity of financial reporting and corporate governance within publicly traded companies. Let's delve deeper into each of these components to understand their significance:

Internal Controls

Internal controls are the policies, procedures, and mechanisms put in place to ensure accurate financial reporting, prevent fraud, and safeguard company assets. They provide checks and balances, reducing the risk of financial misstatements and irregularities. Sox Compliance emphasises the need for robust internal controls, including segregation of duties, regular reviews, and the establishment of whistleblower hotlines. These controls promote transparency, accountability, and the identification of potential risks or irregularities.

Financial Reporting

Financial reporting involves the timely and accurate disclosure of financial information to stakeholders, including shareholders, regulatory authorities, and the public. SOX Compliance mandates transparent financial reporting practices to maintain the trust of investors. This includes providing accurate financial statements, disclosing material information, and adhering to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Accurate and transparent financial reporting is essential for decision-making, investor confidence, and the overall stability of the financial markets.

Corporate Governance

Corporate governance is, essentially, the system of rules and practices by which a company is directed and controlled. SOX Compliance promotes good corporate governance practices by establishing guidelines for board independence, executive compensation, ethical conduct, and the protection of shareholder rights. Strong corporate governance ensures that companies have proper oversight, accountability, and transparency in their decision-making processes. It helps prevent conflicts of interest, unethical behaviour, and abuse of power within the organisation.

Risk Assessment

Sox Compliance requires companies to assess and manage risks associated with their financial reporting processes. This involves identifying and evaluating potential risks, such as errors, fraud, or non-compliance with regulations. By conducting thorough risk assessments, companies can implement the appropriate controls and measures to mitigate these risks effectively. Regular risk assessments help identify areas of vulnerability, ensure compliance with SOX regulations, and strengthen the overall risk management framework.

Information Technology Controls

With the increasing reliance on technology in financial reporting processes, SOX Compliance also focuses on Information Technology (IT) controls. Companies must establish and maintain controls over IT systems and data to ensure the integrity, confidentiality, and availability of financial information. This includes measures such as data security, backups, disaster recovery plans, and user access controls. Effective IT controls help safeguard against data breaches, unauthorised access, and potential disruptions in financial reporting processes.

Ethical Conduct

SOX Compliance emphasises the importance of ethical conduct within companies. Executives and employees must adhere to high ethical standards, demonstrating honesty, integrity, and accountability in their financial reporting and business practices. This includes avoiding conflicts of interest, maintaining independence, and disclosing any potential ethical violations. Ethical conduct ensures the reliability and credibility of financial reporting, fosters a culture of trust, and protects the interests of stakeholders.

Documentation and record-keeping

SOX Compliance requires companies to maintain comprehensive documentation and records related to their financial reporting processes. This includes documenting policies, procedures, controls, and any changes made to them. Proper documentation ensures transparency, facilitates audits and assessments, and helps demonstrate compliance with SOX regulations. It also enables effective communication, knowledge sharing, and the ability to address any audit or regulatory inquiries promptly.

Stay compliant and ensure the highest standards of medical practice with our comprehensive Medical Compliance Training Course. Sign up now!

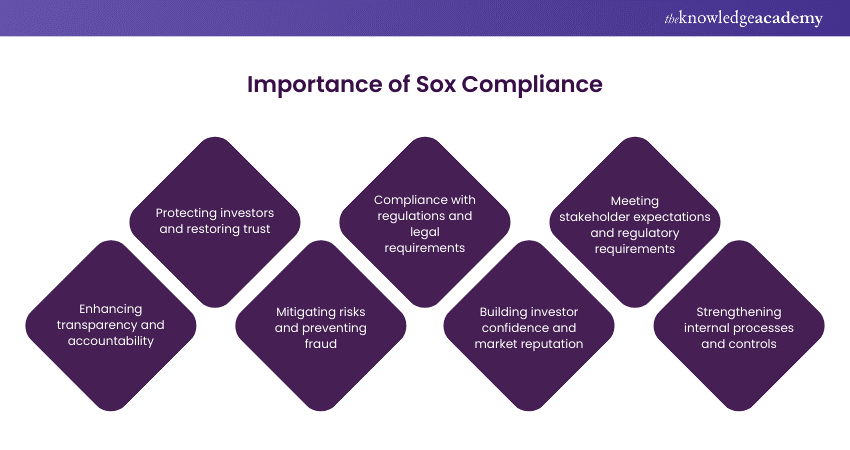

Why is SOX Compliance Important?

Now that we know SOX Compliance's meaning and its components, we will explore its importance. Let's explore the significance of SOX Compliance in greater detail as follows:

Enhancing Transparency and Accountability

SOX Compliance plays a crucial role in enhancing transparency and accountability within companies. By enforcing strict regulations and reporting requirements, it ensures that companies provide accurate and reliable financial information to stakeholders. Transparent financial reporting practices enable investors, regulators, and the public to have a clear understanding of a company's financial health and performance.

Protecting Investors and Restoring Trust

One of the primary objectives of SOX Compliance is to protect investors and restore trust in the financial markets. By holding corporate executives accountable for the accuracy and completeness of financial information, it helps safeguard the investments and interests of shareholders. This, in turn, fosters investor confidence and encourages capital inflow, supporting the growth and stability of companies and the overall economy.

Mitigating Risks and Preventing Fraud

SOX Compliance places a strong emphasis on implementing robust internal controls and risk management practices. By establishing effective internal controls, companies can mitigate the risk of errors, irregularities, and fraudulent activities in financial reporting. SOX Compliance encourages companies to identify and address potential risks, ensuring the reliability and integrity of financial information. By doing so, it minimises the likelihood of financial fraud and protects companies from reputational damage and financial losses.

Compliance with Regulations and Legal Requirements

SOX Compliance ensures that companies comply with relevant regulations and legal requirements. By adhering to the requirements of the Sarbanes-Oxley Act, companies demonstrate their commitment to ethical conduct, transparency, and accountability.

Compliance with SOX regulations helps companies stay on the right side of the law, avoiding legal and financial penalties that may arise from non-compliance. It also promotes a culture of compliance throughout the organisation, fostering responsible business practices.

Building Investor Confidence and Market Reputation

SOX Compliance plays a vital role in building investor confidence and enhancing a company's market reputation. Investors are more likely to trust companies that comply with SOX regulations, as it demonstrates a commitment to ethical behaviour, responsible financial management, and the protection of stakeholders' interests. Compliance with SOX standards enhances a company's credibility and reputation in the market, attracting potential investors, business partners, and customers.

Meeting Stakeholder Expectations and Regulatory Requirements

In an era where corporate governance and accountability are in the spotlight, SOX Compliance helps companies meet the expectations of various stakeholders, including shareholders, employees, regulators, and the public. It ensures that companies operate with integrity, transparency, and adherence to the best practices in financial reporting and corporate governance. SOX Compliance helps companies fulfil their obligations and responsibilities to stakeholders and comply with regulatory requirements, thereby maintaining trust and confidence.

Strengthening Internal Processes and Controls

SOX Compliance encourages companies to assess and strengthen their internal processes and controls. It promotes the implementation of effective internal controls, risk management frameworks, and ethical conduct throughout the organisation. This results in improved operational efficiency, reduced risks, and enhanced decision-making capabilities, benefiting the long-term sustainability and success of the company.

Master the art of security with our industry-leading Security Governance and Compliance Training Course. Join today and safeguard your organisation!

The SOX Compliance Process

The SOX Compliance process is a systematic approach that companies follow to ensure adherence to the guidelines and regulations set forth by the Sarbanes-Oxley Act (SOX). Let's delve deeper into the steps involved in the SOX Compliance process and their significance:

Identifying Applicable Regulations

The first step in the Sox Compliance process is to identify the regulations that apply to the company. This requires a comprehensive understanding of the business operations, industry-specific requirements, and any regulatory changes.

Identifying the applicable regulations helps companies determine the scope of their compliance efforts and establish a clear roadmap. It ensures that companies focus their resources and efforts on addressing the relevant regulatory requirements.

Establishing Internal Controls

Once the applicable regulations are identified, companies need to establish effective internal controls. Internal controls are the policies, procedures, and mechanisms put in place to ensure accurate financial reporting, prevent fraud, and safeguard company assets.

Companies must design and implement control activities such as segregation of duties, access controls, and regular reviews to mitigate the risk of errors, irregularities, and fraudulent activities. Strong internal controls provide assurance that financial information is reliable, accurate, and compliant with SOX regulations.

Assessing Compliance

Regular assessments are conducted to evaluate the company's compliance with SOX regulations. This involves conducting internal audits, reviewing financial statements, and performing testing to identify any areas of non-compliance or weaknesses in internal controls.

Compliance assessments provide insights into the effectiveness of internal controls, identify gaps or deficiencies, and highlight areas for improvement. By conducting thorough assessments, companies can take corrective actions to address any identified issues and enhance their Sox Compliance efforts.

Reporting and Disclosure

Sox Compliance requires companies to disclose their financial information accurately and in a timely manner. This includes filing periodic reports with regulatory authorities, such as the Securities and Exchange Commission (SEC), and making public disclosures as mandated by SOX regulations.

Companies must ensure that their financial statements and disclosures are transparent, complete, and in compliance with SOX guidelines. Accurate reporting and timely disclosure of financial information promote transparency, enable stakeholders to make informed decisions, and maintain trust in the company's financial reporting practices.

Continuous Monitoring

Achieving SOX Compliance is not a one-time event but an ongoing process. Continuous monitoring is crucial to ensure that companies maintain compliance with SOX regulations over time. This involves regular reviews, internal audits, and assessments to monitor the effectiveness of internal controls, identify changes in regulations, and assess any evolving risks.

Continuous monitoring allows companies to promptly address any gaps or changes in the regulatory landscape, ensuring that their SOX Compliance efforts remain up to date and effective.

Challenges in achieving Sox Compliance

While SOX Compliance is crucial for ensuring financial transparency and accountability, companies often face several challenges in achieving full compliance with the guidelines and regulations set forth by the Sarbanes-Oxley Act (SOX). Let's explore some of the common challenges encountered:

Complexity of Regulations

Sox Compliance involves navigating through a complex web of regulations and guidelines. The provisions of the Sarbanes-Oxley Act can be intricate, requiring a deep understanding of legal and accounting principles. Interpreting the regulations accurately and implementing them effectively can be a challenge, particularly for companies with limited resources or expertise in compliance matters.

Cost of Compliance

Implementing SOX Compliance measures can be costly for organisations, especially for Small and Medium-sized Enterprises (SMEs). Establishing and maintaining robust internal controls, conducting regular audits, and investing in compliance-related technologies and training can strain financial resources. Balancing the costs of compliance with the benefits and risks is a challenge that companies need to carefully manage.

Looking to expand your knowledge of the Compliance Management System? Sign up for our ISO 19600 Compliance Management Systems Training now!

Complex Organisational Structures

Companies with complex organisational structures, such as multinational corporations or conglomerates, face unique challenges in achieving SOX Compliance. Ensuring consistency and uniformity in compliance across various subsidiaries, business units, and geographical locations can be demanding. Coordinating efforts, streamlining processes, and harmonising reporting practices present significant challenges in such cases.

Resistance to Change

Implementing SOX Compliance often requires changes to existing processes, systems, and corporate culture. Resistance to change from employees, especially if they perceive compliance efforts as burdensome or disruptive, can hinder the smooth adoption of SOX Compliance measures. Overcoming resistance and fostering a culture that values transparency and accountability is a challenge that companies must address.

Integration of IT Controls

SOX Compliance places a strong emphasis on Information Technology (IT) controls, as technology plays a critical role in financial reporting processes. Integrating IT controls effectively and ensuring the security, integrity, and availability of digital systems and data can be challenging. Companies need to invest in robust IT infrastructure, data protection measures, and cybersecurity practices to meet SOX Compliance requirements.

Evolution of Regulatory Landscape

The regulatory landscape is dynamic, and changes in laws, regulations, and accounting standards can pose challenges for SOX Compliance. Staying up to date with regulatory changes, understanding their implications, and adapting internal controls and reporting practices accordingly requires ongoing effort and vigilance. Companies need to remain proactive and continuously monitor and update their SOX Compliance efforts to align with the evolving regulatory environment.

Resource Constraints

Achieving Sox Compliance requires dedicated resources, including skilled personnel, compliance tools, and financial investments. Smaller companies or those with limited resources may struggle to allocate the necessary time and expertise for Sox Compliance. Limited access to specialised professionals, training, and technological support can impede their ability to meet compliance requirements effectively.

Equip yourself with our Effective Compliance Training Course for sustainable business success. Join today!

Best Practices for SOX Compliance

Achieving and maintaining SOX Compliance requires a proactive and well-structured approach. To effectively navigate the complexities of the Sarbanes-Oxley Act (SOX) regulations, companies should consider implementing the following best practices:

Strong Tone at the Top

Establishing a strong tone at the top is critical for SOX Compliance. Senior management should demonstrate a commitment to ethical conduct, transparency, and compliance with regulatory requirements. By setting a positive example, leaders create a culture of compliance and instil accountability throughout the organisation.

Clear Roles and Responsibilities

Clearly defining roles and responsibilities related to Sox Compliance is essential. Designate individuals or teams responsible for overseeing compliance efforts, monitoring internal controls, and coordinating compliance activities. This ensures accountability, promotes effective communication, and avoids gaps or overlaps in responsibilities.

Robust Internal Controls

Implementing robust internal controls is a cornerstone of SOX Compliance. Evaluate existing controls, identify gaps, and establish comprehensive controls that mitigate risks, prevent fraud, and ensure accurate financial reporting. Regularly review and update internal controls to adapt to changing business environments, emerging risks, and evolving regulations.

Risk Assessment and Management

Conduct comprehensive risk assessments to identify potential risks and vulnerabilities in financial reporting processes. Implement a risk management framework that includes periodic risk assessments, internal audits, and ongoing monitoring. This helps proactively manage risks, prioritise control activities, and ensure that SOX Compliance efforts are focused on areas of highest risk.

Continuous Monitoring and Testing

Establish a system for continuous monitoring and testing of internal controls. Regularly review and evaluate the effectiveness of controls through internal audits, testing, and self-assessments. Monitor changes in business processes, systems, and regulations to identify any gaps or weaknesses that may impact SOX Compliance. Timely detection and remediation of control deficiencies are essential for maintaining compliance.

Training and Awareness

Provide comprehensive training and awareness programs to employees regarding SOX Compliance. Ensure that employees understand their roles, responsibilities, and the importance of compliance. Training should cover topics such as ethical conduct, internal controls, financial reporting requirements, and whistleblower procedures. Ongoing communication and reinforcement of expectations help embed compliance practices within the organisational culture.

Effective Documentation and Record-keeping

Maintain accurate and detailed documentation of Sox Compliance activities. Document policies, procedures, control activities, testing results, and any changes made to internal controls. Proper documentation provides evidence of compliance, facilitates audits, and ensures consistency in Sox Compliance efforts.

External Expertise and Independent Reviews

Engage external experts, such as auditors or consultants, to provide independent reviews and assessments of SOX Compliance. External expertise can offer valuable insights, identify potential blind spots, and ensure compliance with regulatory requirements. Independent reviews provide an objective evaluation of controls and help validate the effectiveness of SOX Compliance efforts.

Continuous Improvement and Adaptability

Promote a culture of continuous improvement and adaptability in SOX Compliance. Regularly review and assess the effectiveness of SOX Compliance measures, learn from past experiences, and implement enhancements where necessary. Stay abreast of regulatory updates, industry best practices, and emerging trends to adapt SOX Compliance efforts to evolving requirements.

Conclusion

Not only do you now understand What is SOX Compliance is, but you also see its importance in maintaining strong corporate governance and transparent financial reporting. By adhering to the Sarbanes-Oxley Act, companies enhance transparency, protect investors, and manage risks effectively. Embracing SOX Compliance ultimately builds trust and ensures a stable, secure business environment.

Enhance your compliance expertise with our industry-leading Corporate Governance Training. Sign up now!

Frequently Asked Questions

Enforced by the U.S. Securities and Exchange Commission (SEC), SOX is a mandatory government standard. At the same time, SOC is a voluntary form of security self-regulation, which is enforced and overseen by non-government entities.

To be SOX compliant, public companies must implement internal controls to shield financial data from tampering and pass an annual independent audit of their financial controls and statements.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Sarbanes-Oxley Training, including the Sarbanes-Oxley Certified Professional, Effective Compliance Training, and Consumer Protection Training. These courses cater to different skill levels, providing comprehensive insights into What is Compliance.

Our ISO & Compliance Blogs cover a range of topics related to Compliance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your ISO & Compliance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

PCI DSS Implementer

PCI DSS Implementer

Thu 16th Jan 2025

Thu 6th Mar 2025

Thu 22nd May 2025

Thu 24th Jul 2025

Thu 25th Sep 2025

Thu 20th Nov 2025

Thu 11th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please