We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Managing Payroll can be an extremely challenging and time-consuming task, leading to errors, compliance issues, and wasted resources. With the help of Payroll Software, you can effectively overcome these challenges as well as automate tedious tasks.

According to a Survey conducted by EY, one in six companies experienced litigation issues due to Payroll errors. By using proper Payroll applications, you can prevent such issues. In this blog, you will learn about the best Payroll Software, their features, as well as their pros and cons. So, let's dive deeper and learn more!

Table of Contents

1) What is a Payroll Software?

2) Top software for Payroll

a) Paylocity

b) Gusto

c) Paychex Flex

d) Xero

3) Conclusion

What is Payroll Software?

Payroll Software is a tool used by businesses to automate and simplify the management of employee compensation. It eliminates manual calculations, streamlines Payroll tasks, ensures accurate payments, and maintains compliance with tax laws and regulations.

From small businesses to large enterprises, Payroll application plays a crucial role in effectively managing and maintaining Payroll operations. They help save time, reduce errors, enhance efficiency in Payroll processing and offer many features such as:

a) Direct deposit

b) Tax filing

Top software for Payroll

When it comes to selecting a Payroll application for your business, it's crucial to choose a reliable and feature-rich solution that meets your needs. Here are the top four Payroll Software that has gained popularity among businesses:

Paylocity

Paylocity is a comprehensive Payroll application solution that offers a range of features to streamline Payroll Management for businesses of all sizes. It provides a wide array of features designed to simplify Payroll processing and enhance efficiency. Some key features include:

a) Payroll processing: Paylocity simplifies Payroll processing with automated calculations, tax deductions, and direct deposit capabilities. It ensures accurate and timely payment to employees.

b) Tax Management: The software handles tax-related tasks such as tax form preparation and filing, including year-end tax forms like W-2s and 1099s. It helps businesses stay compliant with tax regulations.

c) Reporting and analytics: Paylocity provides robust reporting features, allowing businesses to generate customised reports and analyse Payroll data to gain valuable insights.

d) Employee self-service: Paylocity offers a user-friendly online portal where employees can access information like pay stubs, tax documents, and personal information. This self-service functionality reduces administrative tasks for HR teams.

e) Time and attendance tracking: Paylocity integrates with time tracking systems, enabling businesses to accurately track employee attendance, manage Paid Time Off (PTO), and calculate hours worked.

Pricing:

The cost of Paylocity may be higher compared to some other Payroll application options. However, the pricing is customised based on the specific needs of each business.

Pros:

a) User-friendly interface: Paylocity's intuitive interface makes it easy for businesses to navigate and manage Payroll tasks efficiently.

b) Customisation options: The software allows businesses to customise various aspects, including earnings and deductions, to align with specific Payroll policies.

c) Customer support: Paylocity provides reliable customer support to assist businesses with any questions or issues that may arise during Payroll processing.

d) Scalability: Paylocity can accommodate businesses of different sizes, making it suitable for both small businesses and larger enterprises.

e) Integration capabilities: Paylocity integrates with other HR systems, accounting software, and time-tracking tools, allowing for seamless data flow and reducing manual data entry.

Cons:

a) Learning curve: While Paylocity is user-friendly, there might be a slight learning curve for beginners and new users who are unfamiliar with the software.

b) Expensive: Despite the features it offers, Paylocity is a bit more expensive than others, so not everyone can afford it.

Master the fundamentals of Payroll Management and boost your financial expertise with our comprehensive Introduction To Payroll Course – Sign up today!

Gusto

Gusto is a popular Payroll application option that offers a range of features to simplify and streamline Payroll Management for businesses. Let's take a closer look at Gusto's cost, features, as well as its pros and cons:

Features:

Gusto provides a comprehensive set of features designed to automate Payroll processes and support HR tasks. Some key features of Gusto include:

a) Payroll processing: Gusto simplifies Payroll processing by automating calculations, tax deductions, and direct deposits. It ensures accurate and timely payments to employees.

b) Tax filing: The software handles tax-related tasks, such as preparing and filing Payroll taxes, including year-end tax forms like W-2s and 1099s. Gusto helps businesses stay compliant with tax regulations.

c) Employee self-service: Gusto offers a user-friendly self-service web portal where employees can gain access to their pay stubs, tax forms, and personal information. This feature reduces the administrative burden on HR teams.

d) Time tracking: Gusto integrates with time tracking tools, allowing businesses to track employee hours, manage overtime, and calculate accurate pay.

e) Benefits administration: Gusto facilitates benefits management by enabling businesses to set up and administer employee benefits, including health insurance, retirement plans, and more.

f) Compliance support: Gusto helps businesses stay compliant with employment laws by providing automated compliance features, such as new hire reporting and document management.

Pricing:

Gusto offers different pricing plans based on the specific needs and requirements of businesses. The pricing is typically determined by factors such as the number of employees and the level of functionality required.

Pros:

Gusto offers several advantages that make it a popular choice among businesses:

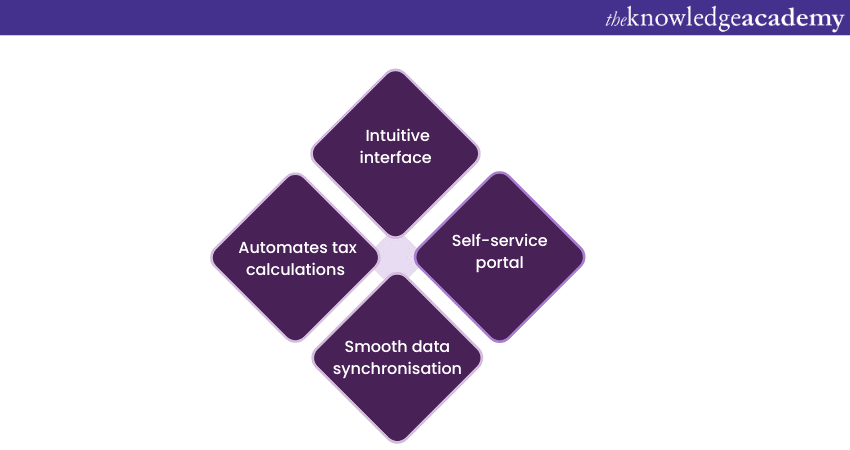

a) User-friendly interface: Gusto is known for its intuitive and easy-to-navigate interface, making it accessible for users with varying levels of technical expertise.

b) Automated tax Filing: The software automates tax calculations and filings, saving businesses time and ensuring accuracy in tax-related processes.

c) Integrations: Gusto seamlessly integrates with a wide range of other business tools, such as accounting software and time-tracking systems, enabling smooth data synchronisation.

d) Employee experience: Gusto's self-service portal empowers employees to access their Payroll and benefits information conveniently, reducing HR involvement.

e) Customer support: Gusto provides reliable customer support through various channels to assist businesses with any questions or concerns.

Cons:

While Gusto offers numerous benefits, there are a few considerations to keep in mind:

a) Limited international availability: Gusto's services are primarily designed for businesses operating within the United States, and its international availability is limited.

b) Pricing: The cost of Gusto's Payroll application may be higher compared to some other options, especially for businesses with a larger number of employees.

Paychex Flex

Paychex Flex is a comprehensive Payroll Software solution that offers many features to streamline Payroll management for businesses. Let's delve into Paychex Flex's cost, features, as well as its pros and cons:

Features:

Paychex Flex provides a robust set of features designed to simplify Payroll processes and support HR tasks. Here are some key features of Paychex Flex:

a) Payroll processing: Paychex Flex helps automate Payroll Processing tasks like Payroll calculations, tax deductions, and direct deposits. It helps ensure accurate and timely payments to employees.

b) Tax compliance: The software handles various tax-related tasks, including tax form preparation, tax filing, and compliance with federal, state, and local tax regulations.

c) Employee self-service: Paychex Flex offers an intuitive self-service portal where employees can access their tax documents, and personal information, reducing administrative burdens.

d) Time and attendance: Paychex Flex integrates with time tracking systems, enabling businesses to effectively track employee hours, manage time off, and process accurate pay.

e) Benefits administration: The software streamlines benefits management, allowing businesses to manage employee benefits like health insurance, retirement plans, and more.

f) Reporting and analytics: Paychex Flex provides reporting tools to generate customised reports and analyse Payroll data, offering valuable insights to businesses.

Pricing:

Paychex Flex offers customised pricing plans tailored to the specific needs and requirements of each business. Factors such as the number of employees, the level of functionality required, and additional services chosen impact the pricing.

Pros:

Paychex Flex offers several advantages that make it a preferred choice for businesses:

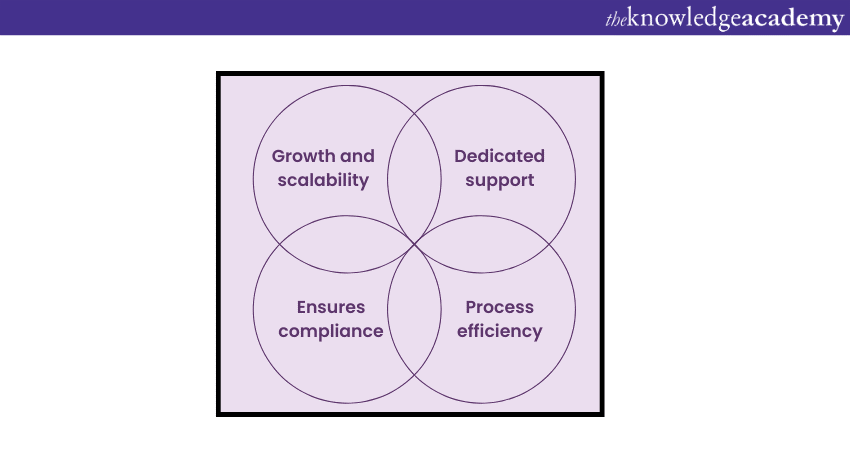

a) Scalability: Paychex Flex accommodates businesses of varying sizes, from small startups to large enterprises, allowing for seamless growth and scalability.

b) Comprehensive support: Paychex Flex provides dedicated customer support and resources to assist businesses in managing Payroll and navigating any challenges that arise.

c) Regulatory compliance: The software ensures compliance with tax regulations, labour laws, and other Payroll-related legal requirements, reducing the risk of penalties or errors.

d) Integration capabilities: Paychex Flex integrates with other business tools, such as accounting software and human resource management systems, facilitating data synchronisation and process efficiency.

Cons:

While Paychex Flex offers numerous benefits, there are a few considerations to be aware of:

a) Pricing: The cost of Paychex Flex may be higher compared to some other applications, especially for businesses with a larger number of employees.

b) Learning curve: As with any comprehensive software solution, there might be a learning curve for new users to fully navigate and utilise all the features offered by Paychex Flex.

Xero

Xero is a leading cloud-based accounting software that also offers Payroll functionality to businesses. Let's explore the features, cost, as well as pros and cons of using Xero for Payroll management:

Features:

Xero provides a range of features to streamline Payroll processes and integrate them with accounting tasks. Here are some key features of Xero's Payroll module:

a) Payroll processing: Xero simplifies Payroll processing with automated calculations, tax deductions, and direct deposit capabilities. It ensures accurate and timely payment to employees.

b) Tax compliance: The software handles tax-related tasks, such as calculating and filing Payroll taxes, generating year-end tax forms like W-2s and 1099s, and staying compliant with tax regulations.

c) Employee self-service: Xero offers an employee self-service portal where you can access pay stubs, tax documents, and personal information, reducing administrative workload for HR teams.

d) Time tracking integration: Xero integrates with time tracking systems, enabling businesses to track employee hours, manage leave requests, and accurately calculate pay based on time worked.

e) Reporting and analytics: Xero provides reporting features to generate customised Payroll reports and analyse Payroll data, allowing businesses to gain insights and make informed decisions.

f) Mobile accessibility: Xero offers a mobile app that allows employers and employees to manage Payroll tasks on the go, providing flexibility and convenience.

Pricing:

Xero's pricing for Payroll functionality varies based on the specific needs and requirements of businesses. It typically involves a base subscription fee for the accounting software and an additional cost for the Payroll module.

Pros:

Using Xero for Payroll Management offers several benefits, and let’s look at some of them below:

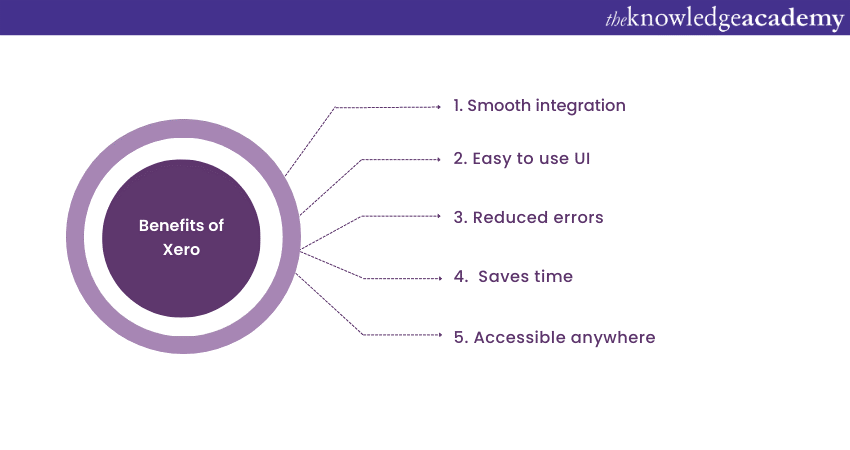

a) Seamless integration: Xero's Payroll module seamlessly integrates with its accounting software, ensuring smooth synchronisation of financial data and simplifying overall business processes.

b) User-friendly interface: Xero's intuitive interface makes it easy for businesses to navigate and manage Payroll tasks efficiently, even for users with limited accounting or Payroll experience.

c) Automation and efficiency: Xero automates many Payroll processes, reducing manual errors and saving time for HR teams.

d) Access anytime and anywhere: Xero is a cloud-based solution allowing employers and employees to access Payroll information and perform tasks from any device with internet connectivity.

Cons:

While Xero offers numerous advantages, it's important to consider a couple of potential limitations:

a) Advanced Features: Some advanced Payroll features, such as complex Payroll calculations for specific industries, may require additional integrations with third-party apps.

b) Learning Curve for Beginners: Users who are new to accounting software might require a learning curve to become familiar with Xero's interface and functionalities.

Enhance your Payroll Management skills with our specialised Xero Payroll Training for efficient financial operations – Sign up now!

Conclusion

We hope you read and understood everything about Payroll Software. Choosing the right Payroll application is crucial for efficient Payroll Management. The software mentioned above offer a multitude of features and benefits to streamline payroll procedures efficiently. Consider the requirements of your business and make an informed decision to streamline your Payroll operations effectively.

Take control of your financial future and unlock your potential with our expert-led Accounting & Finance Training Courses – Sign up today!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 17th Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 18th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please