We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Mortgage Deed is a key player when you are buying a home. It’s not just any document; it’s the deal-maker between you and your lender. This legal instrument delineates the conditions under which you borrow funds to acquire your property, with the property itself serving as collateral. It is your promise that gives the lender the right to step in if things don’t go as planned, protecting both of you.

Signing this deed is a big moment, as it marks your agreement with the Mortgage terms. It is the official stamp that locks in your duties and the lender’s rights, making it super important to get those house keys. Understanding “What is a Mortgage Deed?” is a must for a worry-free home purchase. So wait, no more; let's dive in!

Table of Contents

1) Definition of a Mortgage Deed

2) Components of a Mortgage Deed

3) Recording and registration of a Mortgage Deed

4) Importance of a Mortgage Deed

5) How to sign a Mortgage Deed?

6) Conclusion

Definition of a Mortgage Deed

A Mortgage Deed, also known as a deed of trust or security instrument, is a legal document formalising the lending agreement between a borrower and a lender. It’s also utilised to guarantee a loan on a piece of property, which is mostly real estate. Mortgage Deed helps the lenders to protect themselves for having the power to reclaim the property through the help of the court if the borrower cannot pay their dues.

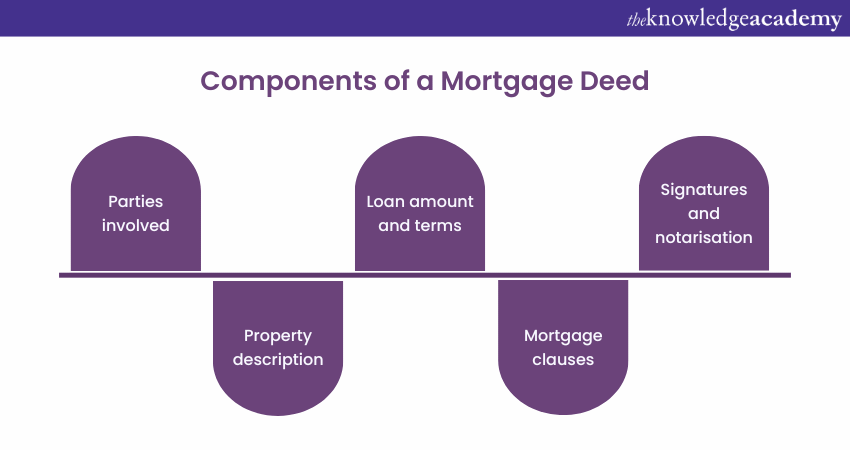

Components of a Mortgage Deed

The Mortgage Deed has several vital features that define the agreement made between the lender and the borrower. Let's explore each component in detail:

1) Parties involved:

The Mortgage Deed also seeks to establish parties to the contract: the giver of the Mortgage (the Mortgagor) and the recipient of the Mortgage (the Mortgagee). It gives their names, physical addresses, and more information, including their legal status/ entity type.

2) Property description:

This document usually accompanies the description of the property that the borrower is offering as a security for his or her loan. This usually contain the physical location of the property, the coordinates, and legal description of the property.

3) Loan amount and terms:

The Mortgage Deed also notes down the specific sum of money that the borrower is to pay to the lender as a loan. It also gives details on how repayment is to be done, the rate of interest and the terms of payment, whether daily, weekly, monthly or quarterly among others.

Some of the terms and conditions may consist of fines for late payments, extra payments before the due date, or variable percentage interest rates based on the agreement.

4) Mortgage clauses:

Other Mortgage clauses which may be incorporated in the deed to clarify the relations and responsibilities of the parties are- For example:

a) Acceleration clause: With this provision, the lender could demand the repayment of the entire outstanding loan if the borrower is noncompliant with the terms or has breached the agreement in some manner.

b) Due-on-sale clause: This one specifically focuses on redeeming the loan in the event of the sale or transfer of the property. It safeguards the interests of the lender and guarantees that the borrower does not take control over subsequent reimbursement.

c) Insurance and taxes clause: Through the Mortgage Deed the borrower may be required to keep the property insured and incur the cost of property taxes for the protection of the Mortgage lender’s security.

5) Signatures and notarisation:

The legal transfer of the property from the borrower to the lender can only occur when the Mortgage Deed has been signed by both the borrower and the lender. The signatures show that the parties have consented to all the provisions under the deed. In many jurisdictions, it is necessary to attach the notary’s seal or to have the signature of a notary public or another legal official.

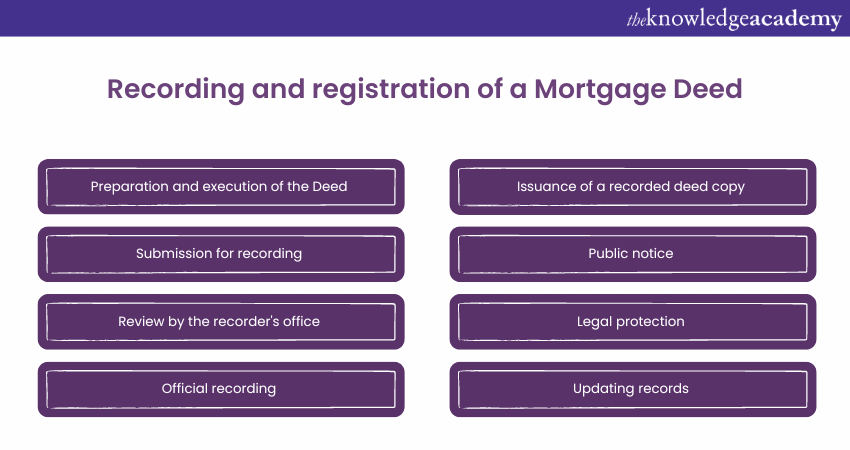

Recording and registration of a Mortgage Deed

Recording and registration of a Mortgage Deed is a crucial process that legally documents the Mortgage agreement with the appropriate government office. Here are the steps for recording and registration:

1) Preparation and execution of the Deed: Draft the Mortgage Deed with all necessary details, including the parties involved, property description, loan amount, terms, and Mortgage clauses. Both the borrower (Mortgagor) and lender (Mortgagee) must sign the Mortgage Deed.

2) Submission for recording: Submit the executed deed to the local government office responsible for property records, typically the county recorder or land registry office. Pay any required recording fees.

3) Review by the recorder's office: The recorder's office reviews the submitted Deed for completeness and accuracy. Any discrepancies or missing information must be corrected before the deed can be recorded.

4) Official recording: Once approved, the recorder's office officially records the Mortgage Deed in the public records. The document is assigned a unique recording number and date.

5) Issuance of a recorded deed copy: A copy of the recorded Mortgage Deed, stamped with the recording details, is issued to both the borrower and lender.

6) Public notice: Recording the deed publicly announces the lender's interest in the property. It helps protect the lender's rights and ensures transparency in property ownership.

7) Legal protection: The recorded deed is now a part of the official public record, offering legal protection against fraudulent claims and ensuring the lender's priority in the event of foreclosure.

8) Updating records: Any subsequent changes to the Mortgage, such as refinancing or loan payoff, should also be recorded to keep the public records current and accurate.

Gain in-depth knowledge about the key components of financial systems with our Diploma for Financial Advisers DipFA – join today!

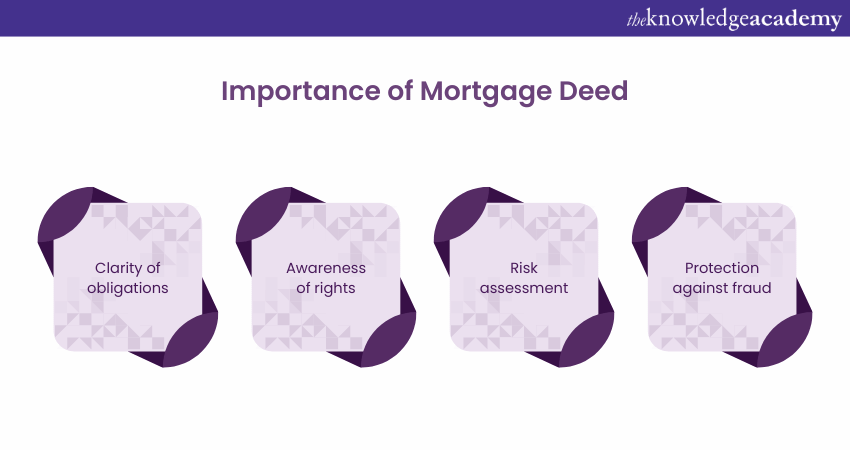

Importance of Mortgage Deed

Mortgage Deed is a valid legal document that defines the rights and responsibilities of the borrowers. Here are a few reasons why understanding the Mortgage Deed is crucial:

1) Clarity of obligations:

Understanding the Mortgage Deed helps the borrower stick to the agreed obligations and ensure they do not violate any of them within the stipulated legal contract. This involves paying the money as agreed, responsibly observing the time schedule, and meeting any other conditions stated in the deed.

Knowing such requirements allows borrowers to pay attention to their loan obligations so that they cannot face legal repercussions.

2) Awareness of rights:

The Mortgage Deed defines the rights of the borrower in addition to imposing certain conditions on them. Knowledge of these rights will assist borrowers to guard themselves against any unfair treatment that may happen to them during the Mortgage term.

These may include the right to pay off the loan in advance, the right to contest any error or omission in the servicing of the loan, or the right to receive paperwork associated with the loan.

3) Risk assessment:

The Mortgage Deed provides an informative insight into the agreement as it reveals the risks that borrowers are willing to take on in regard to the Mortgage agreement. It involves the assessment of the implications of repaying the loan, the effects of interest rate fluctuations (where relevant), and the possibility of any other fines that may be payable.

This knowledge helps the borrowers to make a suitable plan in case of any occurrence during their Mortgage term.

4) Protection against fraud:

Mortgage Deed allows borrowers to be safeguarded against fraud or misrepresentation by helping them to understand what is written in the document. They can check and confirm the clarification given by the deed and whether it meets the intended terms and conditions.

They use it this way in order to be able to notice any kind of frauds or decisions they do that may threaten their rights or their money.

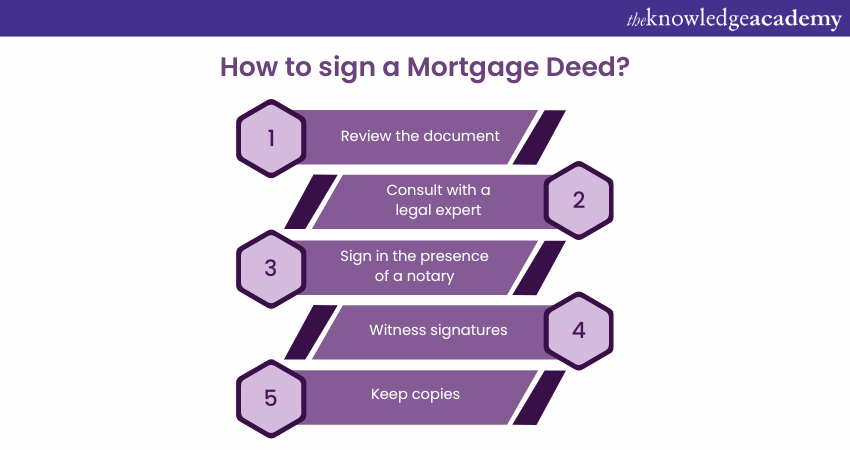

How to sign a Mortgage Deed?

Signing a Mortgage Deed is a significant legal step in the home-buying process. Here's how to do it:

1) Review the document: Carefully read through the Mortgage Deed to ensure you understand all the terms and conditions. Pay special attention to the loan amount, interest rate, repayment schedule, and any clauses that may impact your responsibilities or rights as a borrower.

2) Consult with a legal expert: It is advisable to consult with a real estate attorney or legal expert to clarify any doubts or concerns you might have. They can help interpret complex legal language and ensure that your interests are protected.

3) Sign in the presence of a notary: Both the borrower (Mortgagor) and the lender (Mortgagee) should sign the Deed in the presence of a notary public. The notary's role is to verify the identities of the signatories and to ensure that the signing is done voluntarily and without coercion.

4) Witness signatures: In some jurisdictions, additional witness signatures may be required. Ensure all necessary parties, such as impartial third-party witnesses, are present to sign the document. Witnesses verify that the signing parties are who they say they are and that the document was signed willingly.

5) Keep copies: After signing, make sure to keep multiple copies of the Mortgage Deed for your records. This includes a notarised copy and any copies given to witnesses. Having these on hand can be crucial for future reference or if any disputes arise.

Improve your understanding of Mortgage advice, practice and markets with our CeMAP Course (Level 1,2 And 3) - join today!

How to choose a Mortgage Deed witness?

Choosing the right witness for a Mortgage Deed involves:

1) Legal eligibility: Ensure the witness is legally eligible, typically over 18 and not a party to the Mortgage. They should not have any personal interest in the transaction to avoid any conflict of interest.

2) Credibility: Select a credible and trustworthy individual, preferably someone with a professional background, such as a lawyer, accountant, or a long-time community member. Their credibility can be important if any legal questions arise regarding the signing.

3) Availability: Ensure the witness is available at the time and place of signing to avoid any delays. Coordinate schedules in advance to ensure all parties are present at the same time.

4) Jurisdiction requirements: Check if there are specific requirements in the jurisdiction regarding who can act as a witness. Some areas may have stringent rules about who qualifies as a witness, such as disallowing family members or those with a financial interest in the transaction.

Conclusion

Understanding "What is a Mortgage Deed?" is crucial for anyone buying a home. A Mortgage Deed is a key legal document that protects the lender's interest in the property and outlines the borrower's responsibilities. It includes important details about the loan, property, and repayment terms, ensuring both parties are clear on their obligations. By knowing the basics of a Mortgage Deed, you can handle property transactions more confidently and securely.

Learn how to analyse financial statements with our Financial Management Course – join today!

Frequently Asked Questions

Registering a Mortgage Deed takes a few days to a few weeks, depending on the local government office's processing times. Delays can occur if there are errors or missing information in the submitted documents.

Yes, a Mortgage Deed can be amended after it is signed, but both the borrower and lender must agree upon any changes. The amended deed must also be re-recorded with the appropriate government office to ensure the changes are legally recognised.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 And 3), Financial Management Course, and Diploma for Financial Advisers DipFA. These courses cater to different skill levels, providing comprehensive insights into What is a Mortgage?

Our Business Skills Blogs cover a range of topics related to Mortgages, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage knowledge, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 10th Feb 2025

Mon 12th May 2025

Mon 7th Jul 2025

Mon 15th Sep 2025

Mon 3rd Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please