We may not have the course you’re looking for. If you enquire or give us a call on +800 312616 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Setting up Payroll is critical to running a business, ensuring that employees receive accurate and timely payments. This comprehensive guide will provide you with a step-by-step process on How to Set up Payroll effectively. From understanding your Payroll needs to complying with regulations, this guide will equip you with the knowledge and tools to streamline your Payroll operations.

According to Statista, Payroll software were the second largest segment of the human resources application market, making a revenue of 3.70 billion GBP. Read this blog to learn How to Set Up Payroll and use it to effectively manage the employees' Payrolls.

Table of Contents

1) How to Set up Payroll?

a) Determine your Payroll needs

b) Choose the right Payroll software

c) Set up your company information

d) Configure employee details

e) Define employee compensation and benefits

f) Set up Payroll taxes

g) Establish a Payroll Schedule

h) Process Payroll

i) Generate Payroll reports

j) Stay compliant with Payroll regulations

2) Conclusion

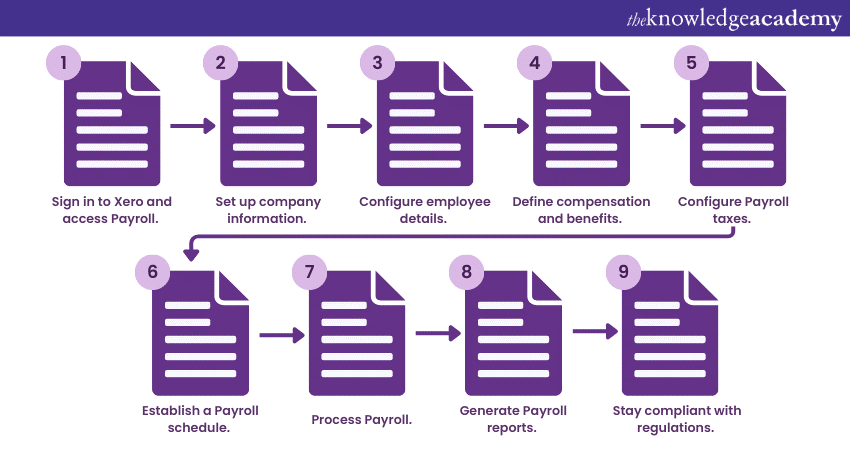

How to Set up Payroll?

Setting up Payroll for your business requires careful planning and execution. Here are some steps to walk you through setting up Payroll, from determining your needs to staying compliant with regulations. Follow these steps to streamline your Payroll operations effectively.

Fascinated by numbers and data? Try our Accounting & Finance Training course today!

Determine your Payroll needs

The first step in setting up Payroll is to assess your specific needs. Start by considering factors such as the number of employees in your organisation, the frequency of pay periods (weekly, bi-weekly, monthly), and the types of compensation you provide (hourly, salary, commissions). Understanding these aspects will help you choose a Payroll system that aligns with your business requirements.

Evaluate whether you need additional features such as automatic tax calculations, direct deposit capabilities, or employee self-service portals. Assess if you have any unique Payroll requirements, such as managing different departments or handling multiple locations.

Choose the right Payroll software

Once you have determined your Payroll needs, the next step is to select the right Payroll Software for your business. Choosing the appropriate software is crucial for efficient Payroll Management.

When evaluating Payroll software options, consider features such as automated calculations, which can streamline the process and reduce the risk of errors. Look for software that offers tax filing assistance, as it can help ensure compliance with tax regulations and save you time and effort. Direct deposit functionality is also important, as it simplifies the payment process for your employees.

Additionally, consider whether the software provides employee self-service portals. These portals allow employees to access their pay stubs, tax forms, and other relevant information, reducing the administrative burden on your HR or Payroll team.

Take the time to research and compare different Payroll software providers. Many reliable Payroll systems are available in the market for you to assess based on their features, pricing, user reviews, and customer support of each option to find the best fit for your small business. Xero is one option worth exploring, as it offers comprehensive Payroll functionality. Follow the below steps to set up Payroll in Xero:

Interested in the Xero software? Try our Xero Intermediate Training course today!

Set up your company information

You should enter accurate and detailed information about your company into the Payroll Software to start the Payroll setup process. This step ensures smooth tax filings and seamless employee payments. Begin by providing essential company details, including your business name, physical address, and contact information. Verify that all the information is up to date and correctly entered.

Next, input your federal and state tax identification numbers, which are crucial for tax reporting and compliance. Double-check the accuracy of these numbers to avoid any potential issues down the line.

Additionally, enter your company's bank account details. This allows Payroll software to facilitate direct deposits and other financial transactions smoothly. Ensure you provide the correct routing and account numbers for accurate and timely employee payments.

Configure employee details

Once your company information is set up, it's time to input comprehensive details about your employees into the Payroll system. Accurate and up-to-date employee records are essential for seamless Payroll processing.

Enter employees' basic information, including their full name, age, address, and social security numbers. Double-check the accuracy of these details to avoid any discrepancies in tax filings or employee payments.

Include additional employment-related information, such as their employment status (full-time, part-time, contractor) and hire dates. This information helps determine eligibility for benefits, tax withholding, and other Payroll-related calculations.

If your business has different departments or cost centres, consider setting up those designations in the Payroll system. This allows you to accurately allocate expenses and track costs associated with specific areas of your organisation.

Regularly update employee records as necessary. Any changes in personal information, such as address or marital status, should be promptly reflected in the Payroll system to ensure accurate Payroll processing.

Wish to learn more about the Payroll system? Try our Introduction to Payroll course!

Define employee compensation and benefits

Wondering what it takes to be a successful payroll manager? Our Payroll Manager Job Description outlines the essential skills and responsibilities.

To ensure a fair and transparent Payroll Process, it's essential to establish a clear compensation structure for your employees. Defining pay rates, overtime rates, and other variables based on your Payroll policies helps maintain consistency and accuracy.

Start by determining the pay rates for different positions or job roles within your organisation. Consider factors like experience, qualifications, and market rates to set competitive wages. Communicate these pay rates to your employees to avoid any confusion.

In addition to regular wages, establish guidelines for overtime rates, if applicable. Determine how overtime hours will be calculated and the corresponding rate of pay. This ensures that employees are compensated appropriately for any additional hours worked.

Configure employee benefits within the Payroll system. This includes health insurance, retirement plans, and other applicable benefits. Deductions, such as 401(k) contributions or garnishments, should also be defined and accurately reflected in employee paychecks.

Remember that compliance with labour laws and regulations is crucial when defining compensation and Payrolling Benefits. Ensure your Payroll policies align with federal and local laws to avoid legal issues.

Set up Payroll taxes

Understanding How to Set up Payroll Taxes is a crucial component of setting up Payroll. Understanding your business's specific tax obligations and ensuring you are complying with tax laws and regulations is essential. Consulting a tax professional or referring to relevant tax authorities can provide valuable guidance.

Begin by identifying the tax requirements for your business at the federal, state, and local levels. Understand the different types of taxes that need to be withheld from employee wages, such as federal income tax, state income tax, Social Security tax, and Medicare tax.

Configure the tax settings in your Payroll software to accurately calculate and withhold these taxes. Most Payroll software systems have built-in tax calculators that can simplify this process. Ensure your software is updated regularly to reflect any changes in tax rates or regulations.

In addition to employee tax withholdings, be aware of employer Payroll taxes, such as Federal Unemployment Tax Act (FUTA) and state unemployment taxes. Understand these taxes' reporting and payment requirements and set up the necessary processes to stay compliant.

Regularly review and reconcile Payroll tax reports to ensure accuracy and promptly address discrepancies. File tax forms and make tax payments on time to avoid penalties and interest charges.

Understand the impact of debt with our Introduction to Credit Control course!

Establish a Payroll schedule

Establishing a Payroll schedule is essential for ensuring timely and consistent employee payment. When determining a Payroll schedule, consider payment frequency and cut-off dates for submitting timecards or other relevant information.

Choose a pay frequency that aligns with your business needs and the preferences of your employees. Common options include weekly, bi-weekly, or monthly pay periods. Ensure that the selected frequency provides ample time for processing Payroll and making necessary adjustments. Set clear cut-off dates for employees to submit their timecards or any other required documentation. This allows sufficient time for Payroll processing and minimises delays or errors.

Communicate the established Payroll schedule to your employees to maintain clarity and transparency. Ensure they know the specific dates on which they can expect to receive their pay. Consistency in the Payroll schedule helps employees plan their finances effectively and fosters a sense of trust and reliability within the organisation.

Process Payroll

Once you have gathered all the required information and completed the necessary configurations, it's time to process Payroll. Utilise your chosen Payroll software to calculate employee wages accurately, including regular pay, overtime, and any applicable deductions or withholdings.

Start by importing or inputting the employee attendance or timecard data into the Payroll system. Ensure that all hours, including regular and overtime, are accurately recorded. Next, apply the appropriate pay rates and calculations based on your compensation structure and Payroll policies. Consider any adjustments for bonuses, commissions, or other variable components.

Verify the accuracy of the Payroll data before finalising and approving it. Double-check that all the information, such as hours worked, rates, and deductions, is correct. Pay special attention to any updates or changes in employee status, benefits, or tax withholding.

Once you are confident that the Payroll data is accurate, generate your employees' paychecks or direct deposit files. Review the summary of each employee's earnings and deductions to ensure completeness and correctness.

Learn financial analysis with our Finance For Non Financial Managers course today!

Generate Payroll reports

Generating Payroll reports using your Payroll software is crucial in effectively managing your business finances. These reports provide valuable insights into employee earnings, tax withholdings, and other Payroll-related information. They serve various purposes, including financial planning, budgeting, and record-keeping.

Utilise your Payroll software's reporting functionality to generate comprehensive reports summarising Payroll data. Common reports include employee earnings statements, tax reports, and Payroll summaries.

Employee earnings statements provide a detailed breakdown of each employee's earnings for the pay period, including regular wages, overtime, bonuses, and any deductions or withholdings. These statements help employees understand their total compensation and provide transparency in the Payroll process.

Tax reports summarise the taxes withheld from employee wages, such as federal income tax, state income tax, Social Security tax, and Medicare tax. These reports assist in fulfilling tax obligations and simplifying tax filing processes.

Payroll summaries provide an overview of the total Payroll expenses for a given period, including gross wages, employer taxes, and any additional costs related to employee benefits or deductions. These summaries assist in financial planning, budgeting, and evaluating overall labour costs.

Stay compliant with Payroll regulations

Staying compliant with Payroll regulations is essential to maintain legal and ethical practices within your business. It is crucial to stay informed about Payroll regulations and remain updated on any changes in tax laws at the federal, state, and local levels. By doing so, you can ensure accurate tax withholdings, timely filings, and proper documentation.

Regularly monitor updates from tax authorities, labour departments, and regulatory agencies to stay informed about any changes that may impact your Payroll processes. Consult reputable sources such as government websites or seek guidance from qualified tax professionals to stay current with the latest regulations.

Review your Payroll processes and systems regularly to ensure they align with the current regulations. Verify that tax calculations, deductions, and withholdings are accurate and up to date. Implement any necessary adjustments promptly to avoid compliance issues, potential penalties, and the occurrence of avoidable Payroll Queries. Maintaining accurate and organised Payroll records is crucial. Keep thorough employee data, tax forms, and Payroll reports securely stored and readily accessible for auditing or compliance purposes.

Adhere to filing and payment deadlines for taxes, such as income tax withholding, Social Security, Medicare, and unemployment taxes. Failure to comply with these deadlines may result in penalties and interest charges. Stay aware of the specific deadlines and ensure timely submissions to avoid legal repercussions.

Conclusion

In conclusion, learning How to Set up a Payroll system for your business requires careful consideration and adherence to the necessary steps. By determining your Payroll needs, choosing the right software, configuring company and employee details, and staying compliant with regulations, you can ensure smooth and efficient Payroll management for your small business.

Understand how to prepare a sole trader and a company’s financial statements with our comprehensive Accounting Masterclass course.

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 28th Feb 2025

Fri 30th May 2025

Fri 15th Aug 2025

Fri 26th Sep 2025

Fri 31st Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please