We may not have the course you’re looking for. If you enquire or give us a call on +800 312616 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Assets are everything a business owns, and they come in two main types: Tangible and Intangible Assets. Both are essential for a company's success. Tangible Assets are the physical things you can see and touch, like buildings and equipment. Intangible Assets, on the other hand, are valuable but not physical, like patents and trademarks.

If your workplace requires various types of assets, knowing the differences between Tangible and Intangible Assets can be helpful for you. In this blog, we'll break down Tangible and Intangible Assets, explain their features, and give examples to show why they matter. Let's dive in and explore what makes these assets so crucial!

Table of Contents

1) What are Tangible Assets?

2) What are Intangible Assets?

3) Tangible and Intangible Assets: A Detailed Comparison

a) Methods of Calculation

b) Liquidity Potential

c) Asset Proportion

d) Associated Risk Factors

e) Long-term Advantages

f) Valuation Approaches

4) Conclusion

What are Tangible Assets?

Tangible Assets are physical objects that can be seen, touched, and measured. They are used for long-term purposes and are utilised for daily operations. The company mainly uses Tangible Assets to produce goods and services and for rental or administrative purposes. The benefit of using Tangible Assets is that some assets have the potential to be appreciated in the long run, resulting in high asset prices. This leads to generating wealth for investors and individuals.

Key Characteristics of Tangible Assets

Some of the key features of Tangible Assets are:

a) Physical Presence: These assets can be measured and felt and have a distinct form. Because of their physical nature, they can be purchased, sold, or traded. The physical traits give the owner a sense of security and make them easy to manage.

b) Value Appreciation: Some of the Tangible Assets have the potential for value appreciation in the long term. If more demand for that particular asset or scarcity increases, the price of assets like real estate or collectables may also rise. However, depending on market demand and other factors can influence their value.

c) Utility: Some Tangible Assets, like a house and car, provide direct utility and convenience to the individual. Their practical application is one of the main characteristics of Tangible Assets. Additionally, these assets are used in the manufacturing of goods and services, which leads to operational processes and creates revenue.

d) Collateral: These assets are used as collateral for loans and finance purposes. Often, banks take assets like property or vehicles as collateral before providing capital. This minimises the risk for lenders, ultimately lowering interest rates for borrowers.

Common Examples of Tangible Assets

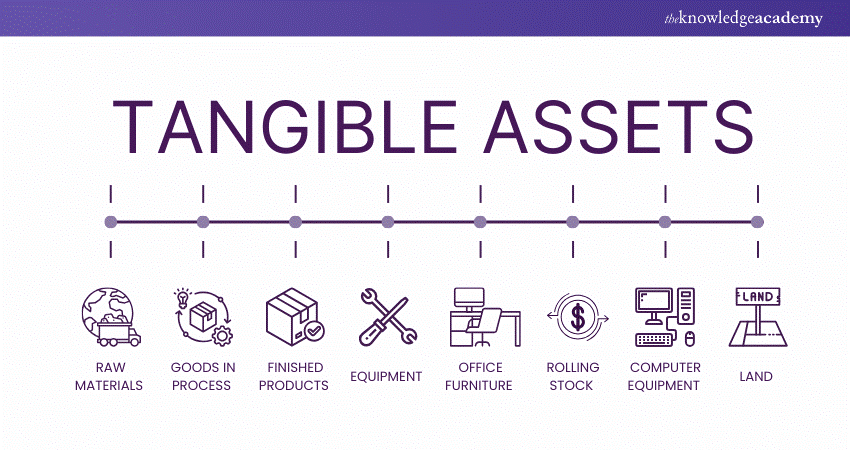

Tangible Assets are of two types: inventory and fixed assets. Here are a few examples of it:

Inventory assets include:

a) Raw materials

b) Goods in process

c) Finished products

Fixed assets include:

a) Equipment

b) Office furniture

c) Rolling stock

d) Computer equipment

e) Land

f) Building

g) Leasehold improvements

Gain insights into modern Investment strategies with our Investment Management Course – Join today!

What are Intangible Assets?

Intangible Assets do not have a physical nature and cannot be touched, felt, or measured. They show their value from legal or intellectual property rights, which represent revenue for a company or individual. Generally, Intangible Assets come from investments in innovation, creativity, and research and development.

Key Characteristics of Intangible Assets

Some of the key features of Intangible Assets are:

a) Non-physical substance: Intangible Assets do not have a physical presence; they exist in legal or intellectual form. Strategies like market research and cost approaches are used to calculate their value.

b) Intellectual Property Rights: Intangible Assets often include patents, trademarks, and copyrights. Intellectual property rights deal with legal protections for new ideas, inventions, and creativity that can ultimately grant exclusive rights and generate revenue for the owner.

c) Brand Value: Assets like brand names and logos contribute to brand value. A good brand can lead to customer satisfaction, loyalty, and trust. Well-known brands can charge premium pricing and differentiate from other brands.

d) Competitive Advantage: Intangible Assets offer a competitive edge over other competitors. Since they are not easily duplicated, rivals find it difficult to replicate them, which leads to increased market share and profitability.

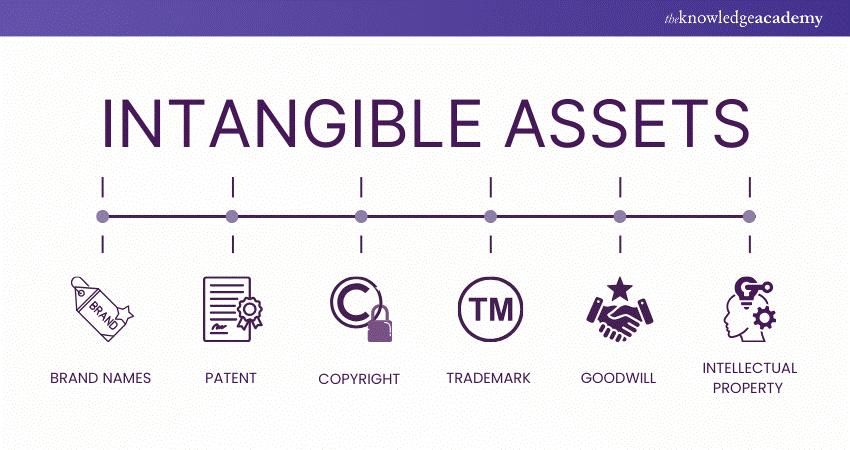

Common Examples of Intangible Assets

Some of the examples of Intangible Assets are:

a) Brand Names

b) Patent

c) Copyright

d) Trademark

e) Goodwill

f) Intellectual Property

Learn to track inventory with our Inventory Accounting and Costing Course – Join today!

Tangible and Intangible Assets: A Detailed Comparison

Here are the key differences of it:

1) Methods of Calculation

There are different calculation methods for finding the valuation of Tangible and Intangible Assets. For Tangible Assets, subtracts the Intangible Assets amount from Tangible Assets. Next, total liabilities will be deducted from the Tangible Assets. Now, you have the total value of Tangible Assets.

On the other hand, to determine the value of an Intangible Asset, one must determine the amount of revenue that each asset provides its owner.

2) Liquidity Potential

Liquidity means how easily a company or owner can distribute its assets. Tangible assets are easy to liquidate because they are physically present. So the owner can convert them into cash whenever they want. On the other hand, it is a little harder to liquidate Intangible Assets. This is because they are difficult to value and change frequently.

3) Asset Proportion

An owner can have a higher proportion of Intangible or Tangible Assets based on the industry. The industries with the highest number of Tangible Assets are Manufacturing, Oil, and Technology. These industries' assets include equipment, tools, technology, warehouses or factories, oil rigs, drilling equipment, and electronic devices.

On the other hand, the industries with more Intangible Assets are entertainment, automotive, and healthcare. Assets included from these industries are songs, television shows, movies, advertisements, and trademarks of their brand's name.

4) Associated Risk Factors

There are several risks associated with assets that affect their owners' finances. For Tangible Assets, physical damage can lead to depreciation in value. This depreciation may not accurately reflect an asset's economic value. Sometimes, complex assets are difficult to record on the balance sheet.

On the other hand, owners of Intangible Assets find it difficult to prove their own intellectual property. Data breaches can lead to the loss or theft of sensitive information. Sometimes, they can violate intellectual property to create their own property.

5) Long-term Advantages

Intangible Assets often have more long-term value than Tangible Assets. This is because companies can receive revenue from Intangible Assets for decades. However, Tangible Assets can lose their value once they are sold or transferred. For example, the owner receives money for Intangible Assets like patents for decades or as long as they are in use. Meanwhile, Tangible Assets like products can lose their value after they are sold or receive money.

6) Valuation Approaches

For Tangible Assets, the assets depreciate at a high speed because it has a physical presence, and their condition can be damaged over time. On the other hand, Intangible Assets go through a process called amortisation instead of depreciating value. This is when an Intangible Asset's value expands over a certain period of time. The aim of amortising assets is to get back as much money as it costs to buy the asset in the first place.

Conclusion

We hope you have understood the difference between Tangible and Intangible Assets. It is important for the owner or the company to have both Intangible and Tangible Assets to run their operations. However, both have different roles and advantages, which makes them useful for the company in the long term.

Learn essential asset management skills with our Fixed Assets Accounting and Management Course – Join today!

Frequently Asked Questions

A bank account is an Intangible Asset because it has a financial value, not a physical nature.

Yes, goodwill is an Intangible Asset. It shows company’s reputation, brand customer relationships and cannot be touched.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including the Fixed Assets Accounting and Management Course, Inventory Accounting and Costing Course, and Cash Cycle Management Training. These courses cater to different skill levels, providing comprehensive insights into What is Credit Management?

Our Accounting and Finance Blogs cover a range of topics related to fixed assets, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Tangible and Intangible Assets knowledge, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Book Keeping Course

Book Keeping Course

Fri 7th Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 1st Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please