We may not have the course you’re looking for. If you enquire or give us a call on +800 312616 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

A Trader is an individual who engages in the buying and selling of assets in any financial market. It can be either for themself or on behalf of another person or organisation. The main difference between a Trader and an investor is the duration for which the person holds the asset. Investors tend to have a longer-term time horizon, while Traders tend to hold assets for much shorter periods to capitalise on short-term trends. Read this blog about what a Trader does and the various factors affecting the Trader's salary.

Table of Contents

1) What does a Trader do?

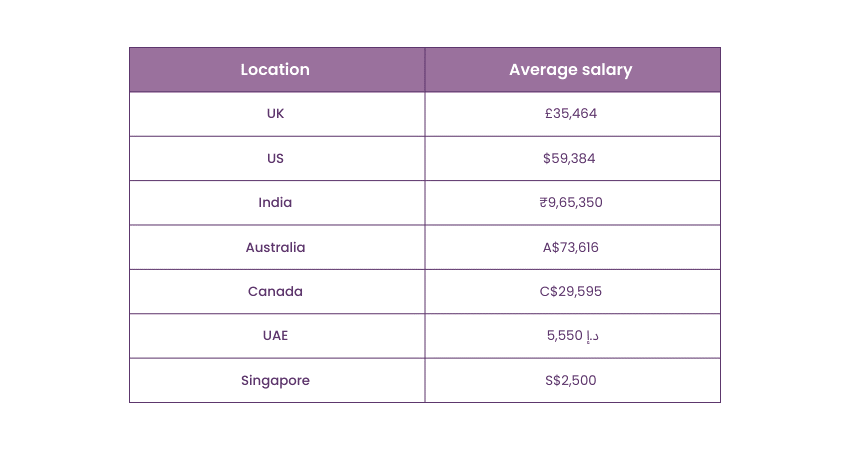

2) Average salary of Traders

a) Trader Salary based on location

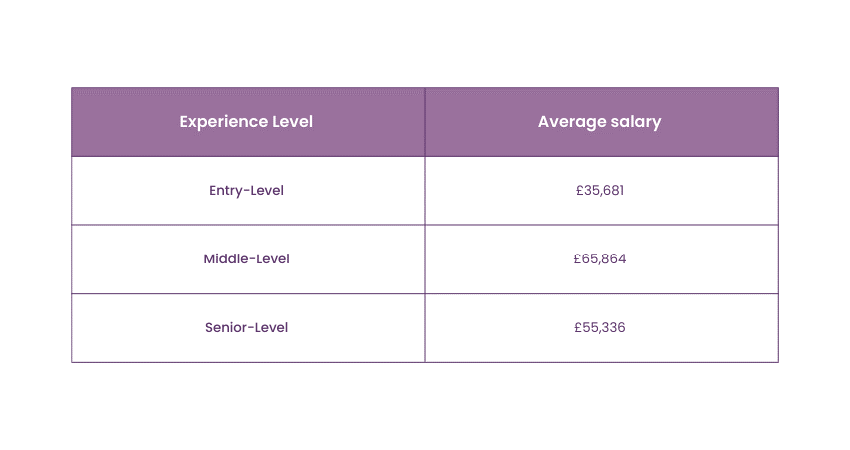

b) Trader Salary based on experience

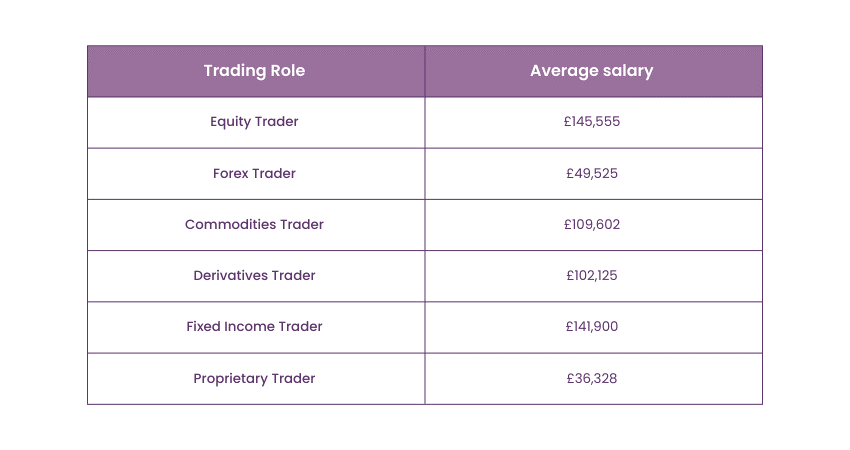

c) Trader Salary based on job roles

3) What are the career paths for a Trader?

4) Conclusion

What does a Trader do?

The main goal of a Trader is to generate profits by buying at a low price and selling at a higher price. They trade financial assets like stocks, bonds, currencies, and commodities. Profit generation is achieved through various approaches, such as fundamental, technical, and quantitative analyses, which help identify market trends and opportunities.

Traders use their market knowledge and analytical skills to make informed decisions and generate profits. This career requires staying updated on market trends and economic indicators, making it both challenging and rewarding. Trader Salaries can vary widely based on experience, location, and performance, with successful Traders often earning substantial incomes through commissions and bonuses.

Average salary of Traders

Trading is a vast profession and it's hard to put a limit on a good Trader's salary. Following are the Trader Salary based on the various location, experience and job role in Tabular format:

Source: Glassdoor

Trader Salary based on experience

Let’s look at the average compensation figures for individuals at different stages of their careers. Here’s a breakdown of what each level typically means in the UK in tabular format:

Source: Glassdoor

Trader Salary based on job roles

Trader Salary can also vary according to their job roles. Let’s look at the average Trader Salary in UK based on job roles in tabular format:

Source: Glassdoor

Become familiar with all important aspects of Investing and Trading with our Investment and Trading Training – Join now!

What are the career paths for a Trader?

Traders have diverse career paths, including roles in investment banks, hedge funds, and asset management firms. They can specialise in equities, forex, commodities, or derivatives Trading. Career progression often leads to Senior Trader, Portfolio Manager, or Risk Manager positions.

Some Traders move into roles in Financial Analysis, Market Research, or Sales and Trading. Others may start their own Trading firms or become independent Traders. Advanced education and certifications, such as CFA or FRM, can enhance career prospects. Networking and staying updated with market trends are crucial for long-term success in Trading.

Unlock the Future of Finance! Enroll in Cryptocurrency Trading Training Today and Master the Skills to Profit in the Digital Currency Market!

Conclusion

A Trader Salary varies widely based on location, experience, and job role, reflecting the dynamic nature of the profession. While the job can be stressful and demanding, the potential for substantial income and diverse career opportunities makes Trading a compelling career choice. Professionals passionate about financial markets stand to ear high salaries by following their calling.

Get familiar with the stalking trade to find promising and profitable opportunities with our Stock Trading Course – Register today!

Frequently Asked Questions

How many hours do Traders work?

Traders typically work 50-70 hours per week, often starting early to align with market openings and staying late to monitor global market developments and manage positions.

Is Trader a stressful job?

Yes, Trading is a stressful job due to the high stakes, fast-paced environment, and constant pressure to make profitable decisions. Market volatility and the need for quick, accurate analyses add to the intensity of the profession.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Courses, including the Cryptocurrency Trading Training, Day Trading Course, and Stock Trading Course. These courses cater to different skill levels, providing comprehensive insights into the Types of Investments

Our Business Skills Blogs cover a range of topics related to Investment and Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Trading skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please