We may not have the course you’re looking for. If you enquire or give us a call on +352 8002-6867 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Facing Cash Flow challenges can really hold back your business’s growth and stability. But don’t worry—there are powerful Cash Flow strategies that can transform your Financial Management and boost liquidity.

Imagine a consistent Cash Flow that empowers your business to thrive, invest, and expand without the stress of financial constraints. Check out our blog for 15 actionable Cash Flow Strategies that can set your business on the path to financial success. Dive in and discover how to improve your Cash Flow today!

Table of Contents

1) 15 Effective Strategies to Improve Cash Flow

a) Provide Discounts for Early Payments

b) Perform Credit Checks on Customers

c) Opt for Leasing Instead of Buying

d) Join a Buying Cooperative

e) Enhance Your Inventory Management

f) Minimise External Hiring

g) Implement Electronic Payment Methods

h) Negotiate Terms with Suppliers

i) Issue Invoices Promptly

j) Collaborate with an Accountant

2) Conclusion

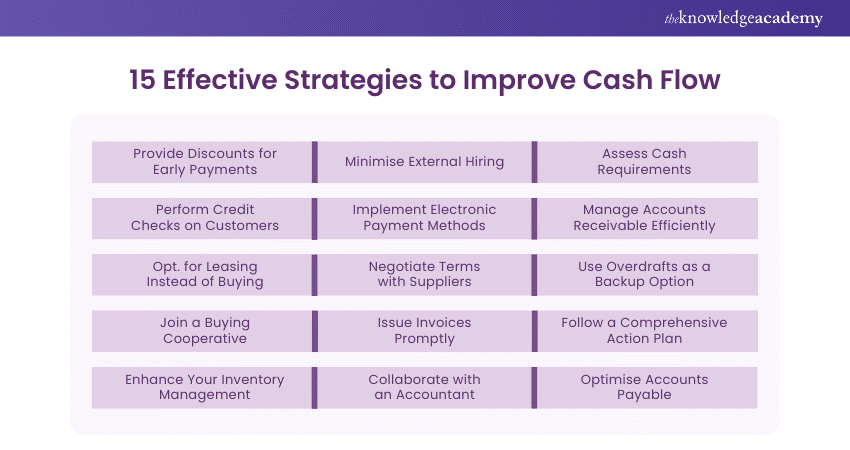

15 Effective Strategies to Improve Cash Flow

Maintaining a robust Cash Flow is important for the sustainability and growth of any business. Efficient Cash Flow Management ensures that you have enough liquidity to meet your obligations, invest in opportunities, and weather financial challenges. Below are 15 effective strategies to improve Cash Flow and keep your business on a solid financial footing.

1) Provide Discounts for Early Payments

Offering discounts for early payments is a powerful strategy to encourage customers to pay their invoices sooner. By providing a financial incentive, you can accelerate cash inflows, reducing the waiting period for payments. This strategy improves your Cash Flow and strengthens customer relationships by rewarding prompt payment.

2) Perform Credit Checks on Customers

If a customer prefers not to pay in cash, ensure you conduct a credit check before finalising the sale. A poor credit rating may indicate a higher risk of late payments, which can negatively impact your business's Cash Flow. If you choose to proceed with the sale despite these risks, consider implementing a higher interest rate to mitigate potential financial strain.

3) Opt. for Leasing Instead of Buying

Leasing equipment or assets rather than purchasing them outright can greatly improve Cash Flow. Leasing requires lower upfront costs and preserves your cash reserves, allowing you to allocate funds to other critical areas of your business. This approach helps manage expenses more effectively and keeps Cash Flow positive.

4) Join a Buying Cooperative

Joining a buying cooperative allows you to benefit from collective purchasing power. By pooling resources with other businesses, you can negotiate better terms and discounts from suppliers. This reduces costs and improves your Cash Flow by lowering the amount you need to spend on inventory and supplies.

5) Enhance Your Inventory Management

Conduct an inventory review to identify products that aren't selling as quickly as others. These slow-moving items can tie up significant cash and impact your Cash Flow. Instead of continuing to stock unsellable goods, consider selling them off, even at a discount. While it may be difficult to part with products you're emotionally attached to, maintaining objectivity is crucial for healthy Cash Flow.

Transform your career with expert training in Accounting and Financial Statement Analysis Training - Join now!

6) Minimise External Hiring

Reducing reliance on external hiring can help control payroll costs and improve Cash Flow. Instead of hiring temporary or freelance workers, consider training existing employees to take on additional responsibilities. This approach can reduce expenses and stabilise your Cash Flow by lowering variable labour costs.

7) Implement Electronic Payment Methods

Adopting electronic payment methods can streamline transactions and accelerate cash inflows. Electronic payments are faster and more efficient than traditional methods, reducing the time it takes to receive and process payments. This improves Cash Flow by ensuring quicker access to funds and minimising delays in payment processing.

8) Negotiate Terms with Suppliers

Negotiate favourable payment terms with your suppliers to extend your payment deadlines and improve Cash Flow. By securing longer payment terms, you can better manage your cash reserves and reduce the pressure on your finances. This strategy provides more flexibility in managing expenses and maintaining a positive Cash Flow.

9) Issue Invoices Promptly

Timely invoicing is crucial for maintaining healthy Cash Flow. Ensure that invoices are issued as soon as goods or services are delivered and follow up promptly on overdue invoices. This practice accelerates the collection process and reduces the risk of delayed payments affecting your Cash Flow.

10) Collaborate with an Accountant

Partnering with a skilled accountant can provide valuable insights into managing your Cash Flow more effectively. An accountant can help you develop financial forecasts, track Cash Flow trends, and implement strategies to optimise liquidity. Their expertise ensures that you make informed financial decisions and maintain a healthy Cash Flow.

11) Assess Cash Requirements

Regularly assess your cash requirements to ensure that you have sufficient funds to cover operational expenses and unexpected costs. By forecasting your cash needs and planning accordingly, you can avoid cash shortages and maintain a positive Cash Flow. This proactive approach helps you manage your finances more effectively.

12) Manage Accounts Receivable Efficiently

Efficient management of accounts receivable is essential for improving Cash Flow. Implement strategies such as setting clear payment terms, sending reminders for overdue invoices, and offering discounts for early payments. By keeping a close eye on receivables, you can reduce delays and ensure timely collections, enhancing your Cash Flow.

13) Use Overdrafts as a Backup Option

Having an overdraft facility in place provides a safety net for managing short-term Cash Flow issues. An overdraft allows you to access additional funds when needed, ensuring that you can cover unexpected expenses or temporary cash shortfalls. Use this option judiciously to avoid high-interest costs and maintain a positive Cash Flow.

14) Follow a Comprehensive Action Plan

Developing and following an action plan for Cash Flow Management helps you stay on track with your financial goals. Include strategies for budgeting, forecasting, and monitoring Cash Flow in your plan. Regularly review and update the plan to adapt to changing business conditions and ensure effective Cash Flow Management.

15) Optimise Accounts Payable

Improving accounts payable means effectively handling your unpaid bills to sustain a strong Cash Flow. Negotiate beneficial conditions with suppliers, prioritise payments according to deadlines, and make use of any available discounts. Strategically handling payables can enhance Cash Flow and lessen financial pressures on your business.

Utilising these tactics can improve your management of Cash Flow. It can offer you the necessary funds for expansion and manage financial obstacles. Frequently evaluate and modify your Cash Flow tactics to match your business requirements and maintain continual financial well-being.

Enhance your career with our expert-led Accounting Courses – Register now and take control of your financial future!

Conclusion

Managing Cash Flow effectively is crucial for the growth and stability of your business. By implementing these 15 actionable Cash Flow Strategies, you can ensure a steady stream of cash that allows your business to thrive, invest, and expand without financial stress. Remember, proactive financial management is key to unlocking your business’s full potential. Start applying these strategies today and set your business on the path to long-term financial success.

Boost your Financial Management Skills with our Cash Flow Training - Sign up now to secure your business’s growth!

Frequently Asked Questions

To manage Cash Flow during seasonal fluctuations, plan ahead with accurate forecasting, build a cash reserve, and adjust expenses based on anticipated sales patterns. Implement strategies like securing lines of credit and adjusting inventory levels to maintain liquidity throughout peak and off-peak periods.

Technology helps in Cash Flow Management by providing real-time financial insights, automating invoicing and payment processes, and facilitating budget tracking. Tools like accounting software and Cash Flow forecasting apps streamline financial tasks, improve accuracy, and enhance decision-making efficiency.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including Cash Flow Training, Inventory Accounting and Costing Course and Accounting and Financial Statement Analysis Course. These courses cater to different skill levels, providing comprehensive insights into Corporate Finance.

Our Accounting and Finance Resources cover a range of topics related to Accounting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 13th Dec 2024

Fri 21st Feb 2025

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please