We may not have the course you’re looking for. If you enquire or give us a call on +352 8002-6867 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Beginning a career as a Mortgage Loan Officer (MLO) can be rewarding and fulfilling. This job offers a stable career path and helps people buy place that they can call home. To enter this field, you need education, skills, and licensing. Many beginners ask, "How to become a Mortgage Loan Officer?" If you want to learn more, this blog is for you. You will learn the steps to become a Mortgage Loan Officer and the skills you need for the job. Additionally, we will provide an overview of their responsibilities and what they do.

Table of Contents

1) Who is a Mortgage Loan Officer?

2) What does a Mortgage Loan Officer do?

3) What are the steps to become a Mortgage Loan Officer?

4) Skills required to become a Mortgage Loan Officer

5) Average salary of a Mortgage Loan Officer

6) Conclusion

Who is a Mortgage Loan Officer?

A Mortgage Loan Officer (MLO) is a specialist dedicated to assisting individuals in securing their ideal home. They guide prospective homeowners through the process of determining their qualification for a Mortgage Loan. Primarily employed by banks and Mortgage lending institutions, MLOs provide a range of financial services. Additionally, they furnish clients with details on interest rates and the assortment of available loan options.

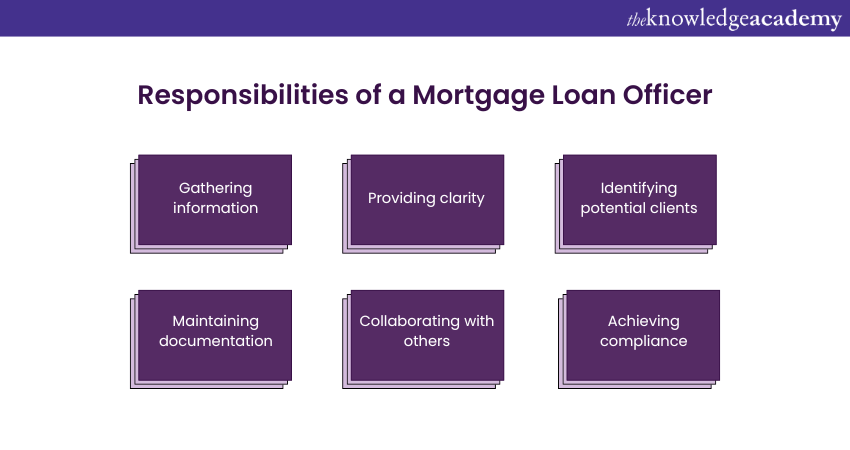

What does a Mortgage Loan Officer do?

From providing loan-related information, to maintaining documentation, a Mortgage Loan Officer has many responsibilities and performs many tasks. Let’s take a look at some of them below:

1) Gathering information: MLOs collect all information related to the borrowers’ finances and other related spheres such as taxes and tax returns.

2) Providing clarity: They provide much-needed clarity to the borrowers and their clients, and also suggest the best loan choices for them.

3) Identifying potential clients: One of their primary responsibilities is to identify potential clients and borrowers via various mediums like ads, seminars, etc.

4) Maintaining documentation: MLOs are responsible for documenting accurate information and maintaining documentation for all transactions.

5) Collaborating with others: MLOs collaborate and coordinate with other professionals like underwriters, promoters, insurance analysts, Risk Management professionals and real estate professionals.

6) Achieving compliance: They are responsible for complying with privacy laws and achieving compliance for the Mortgage applications on behalf of their clients.

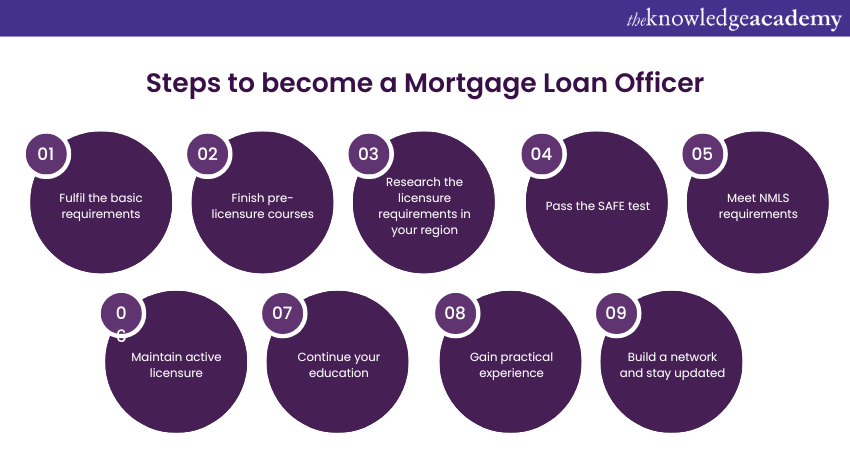

What are the steps to become a Mortgage Loan Officer?

Becoming a Mortgage Loan Officer takes a lot of work because of many requirements. Registering with the National Mortgage Registry and completing the necessary training are essential. These requirements can be broken down into several steps. Let's look at the steps to become a Mortgage Loan Officer:

1) Fulfil the basic requirements

One of the basic steps to becoming a Mortgage Loan Officer is to complete your schooling and some foundational courses. Knowledge in finance and mathematics can greatly improve the skills needed for this role. Additionally, you must be at least 18 years old.

2) Finish pre-licensure courses

Completing pre-licensure courses is a crucial step in becoming an MLO. These courses, which usually take about 20 hours, cover laws, regulations, fair lending, consumer protection, and ethics. They provide clarity and insight into the MLO’s job.

3) Research the licensure requirements in your region

Licensure requirements for Mortgage Loan Officers vary by location. For example, in Scotland, MLOs must register with the Scottish Financial Services Authority (SFSA). In the UK, the licensure requirements for Mortgage Loan Officers are specific to the region and the type of advice provided. For instance, MLOs advising on properties in Scotland must be registered with the Scottish Financial Services Authority (SFSA).

Across the UK, those wishing to engage in mortgage brokering activities need to be authorised by the Financial Conduct Authority (FCA). The authorisation process involves demonstrating the ability to deliver positive outcomes for consumers and includes steps such as submitting a detailed business plan and undergoing a thorough application review.

4) Pass the SAFE test

To become a Mortgage Loan Officer, you must clear the Secure and Fair Enforcement (SAFE) test with at least a 75% score. This test evaluates your knowledge of state and federal lending laws. If you don’t pass on the first try, you can retake it after 30 days. After three attempts, you must wait 180 days to retake it.

5) Meet NMLS requirements

The next step is to meet the Nationwide Multistate Licensing System (NMLS) requirements. This ensures that your employer can easily sponsor and supervise your duties as a Mortgage Loan Officer. Your sponsorship must also be approved by your state's regulatory body. Obtaining an NMLS Unique Identifier, a permanent number for officers and Real Estate organisations will help track your licenses and make sponsorship and supervision easier.

6) Maintain active licensure

Many people assume that everything is done after getting their license, but it’s far from done, as you should make sure that you fulfil the latest requirements. Moreover, you should ensure that you keep your information updated with the NMLS.

7) Continue your education

Despite obtaining a license, learning must be an everyday focus, as continuous learning is the key factor behind success in the long term. You can also use it to renew your license. Additionally, you have to have at least eight hours of coursework each year in order to be considered eligible to renew your license. Emphasise the understanding of laws, regulations, ethics, lending policies, and Mortgage origination services.

8) Gain practical experience

After completing your education and obtaining your license, gaining practical experience is crucial. You can start in an entry-level role or through internships. Working in an established institution can provide valuable industry insights. Here are some steps to gain practical experience:

1) Seek entry-level positions: Start with entry-level roles such as Loan Processor, Loan Officer Assistant, or Mortgage Underwriter in banks, credit unions, or Mortgage lending companies. These positions help you learn from seasoned professionals and understand the Mortgage industry.

2) Shadow experienced Loan Officers: Once in an entry-level position, seek opportunities to shadow experienced Loan Officers. Observing their daily activities and learning from their expertise provides practical knowledge and real-world experience.

9) Build a network and stay updated

Creating a professional network and staying informed about industry trends is crucial for success as a Mortgage Loan Officer. Here are some key steps to help you connect with others and stay informed:

1) Attend industry events: Participate in conferences, seminars, and networking events to connect with other professionals, lenders, and Real Estate Agents. Interacts and follow up with contacts to build relationships.

2) Join professional associations: Become a member of Mortgage and finance-related associations and organisations. These groups provide networking opportunities, industry resources, and educational events, allowing you to stay updated and gain valuable insights.

3) Collaborate with real estate professionals: Build relationships with Real Estate Agents, Mortgage Brokers, and industry professionals. Partnering with them can lead to referrals and a larger client base. Attend real estate events, offer educational seminars, and engage in cooperative marketing efforts.

4) Utilise online platforms: Connect with industry professionals using social media, professional networks, and online forums. Participate in discussions, share insights, and showcase your expertise to reach an audience and build connections beyond your local area.

5) Stay updated with industry news: Keep up with industry news, market trends, and regulatory changes. Subscribe to industry publications, follow reputable financial news sources, and join online communities. Attend webinars and workshops to stay informed about Mortgage guidelines, loan programs, and best practices.

Attain the knowledge of how to analyse financial statements with our CeMAP Training – join today!

Skills required to become a Mortgage Loan Officer

To become a successful Mortgage Loan Officer, having the right education is essential, but developing specific skills is equally important. Here are the key skills to focus on:

Strong interpersonal and communication skills

As a Mortgage Loan Officer, you will face different parties daily, such as clients, Real Estate agents, and other professionals. Establishing the relationship, active listening, and clearly talking about difficult financial terms are the main factors that give trust and clarity throughout the Mortgage process.

The ability to communicate in such a manner that enables clients to understand various loan options, terms, and conditions helps clients make informed decisions and forge positive relationships.

Analytical and critical thinking abilities

The objective of Mortgage Loan Officers is to check financial documents, like credit reports, income statements and tax returns. Analytical and critical thinking skills are vital when it comes to evaluating the financial standing of borrowers and, in turn, making informed lending decisions, including those that identify possible risks or opportunities. The credit analysis capability allows for the assessment of the creditworthiness of loan applications as well as the establishment of mutual benefits for the lenders and the borrowers.

Detail-oriented mindset

Precision and the ability to be attentive to detail are a fundamental components of Mortgage businesses. From documents’ preparation to setting compliance to regulations, detail-oriented approach is vital as it allows for professionalism, preventing costly mistakes at the same time. A vigilant and detail-oriented mindset makes it possible to manage each step during the loan process, from application to closing, correctly and without any interruption. It gives the lenders the chance to do their assessments appropriately and eliminate any future legal or financial issues.

Sales and marketing skills

Finding clients and creating leads are important tips for being a successful Mortgage Loan Officer. Strong sales and marketing skills are a critical part of what they can use to create a network and establish their credibility, which may lead to the borrowers reaching out to them. Marketing strategies that are well crafted, whether through the internet, networking events or community involvements, garner your brand more awareness and generate the desired amount of business. Business development, which involves sales skills, increases the conversion of leads into clients by listening to their needs and presenting loan products that would best serve their needs.

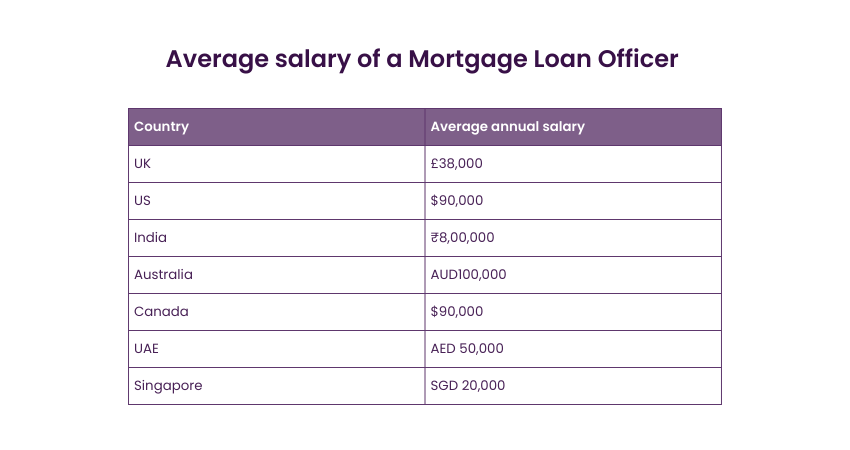

Average salary of a Mortgage Loan Officer

Below is a table showing the average salaries of Mortgage Loan Officer in the specified countries:

Source: Glassdoor

Please note that these data can vary based on factors, such as experience, location, and company.

Conclusion

We hope this blog has answered your question on “How to Become a Mortgage Loan Officer” by providing all the crucial information. Becoming a Mortgage Loan Officer requires a mix of education, skills, practical experience, licensing, and networking. By understanding the role and obtaining the necessary requirements, you can build yourself as a competent and trusted professional in the Mortgage industry.

Gain knowledge about the key components of financial systems with our CeMAP Course (Level 1, 2 And 3) – join today!

Frequently Asked Questions

A Loan Officer works for a bank or lending institution and offers loan products from their employer, while a Mortgage Broker acts as an intermediary who shops around for the best loan products from different lenders on behalf of the borrower.

Compensation for Loan Officers can vary widely, but some of the highest-paying companies include Wells Fargo, Quicken Loans, and JPMorgan Chase, depending on location and experience.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 And 3), Financial Management Course, and Diploma for Financial Advisers DipFA. These courses cater to different skill levels, providing comprehensive insights into What is a Mortgage?

Our Business Skills Blogs cover a range of topics related to Mortgages, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Mortgage Loan Officer skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 3rd Feb 2025

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please