We may not have the course you’re looking for. If you enquire or give us a call on +352 8002-6867 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Did you know with RPA (Robotic Process Automation), organisations can automate financial tasks such as financial statements and accounts reconciliation? RPA in Finance helps financial institutions move beyond routine data crunching and participate in high-value, forward-thinking business decisions. Finance teams use Robotic Process Automation to enhance speed, proficiency, and accuracy in particular tasks.

According to a report by McKinsey, RPA can completely automate 42% of financial tasks. By incorporating scripts into applications, Robotic Process Automation software enables businesses to use technology to carry out monotonous tasks like data entry. RPA provides many organisations with the chance to reallocate resources while enhancing data quality and process effectiveness through the use of technology. In this blog, you will learn about Robotic Process Automation in Finance, which enables organisations to utilise technology to undertake repetitive financial tasks.

Table of Contents

1) What is RPA in Finance?

2) Why do we need RPA in the finance industry?

3) RPA's advantages and their use cases in finance

4) How do financial institutions use RPA?

5) Conclusion

What is RPA in Finance?

Robotic accounting, sometimes called Accounting Process Automation (APA), uses tools like Blue Prism and UiPath to reduce the human labour required to handle accounting and finance department activities. The majority of the work is spent on routine data entering, and no matter what step of the business process data capture occurs, it takes time and produces problems that need to be fixed.

RPA in Finance helps in gaining the most valuable resource of all time. Everyone from the C-suite to sales needs structured financial data and insights to help them make timely business decisions. Yet, financial departments are overloaded in terms of both time and resources.

Robotic Process Automation (RPA), used in various industries, uses low-code software "bots" to complete time-consuming, repetitive tasks that human workers would otherwise handle. Such tasks include processing invoices, data entry and compliance reporting, etc.

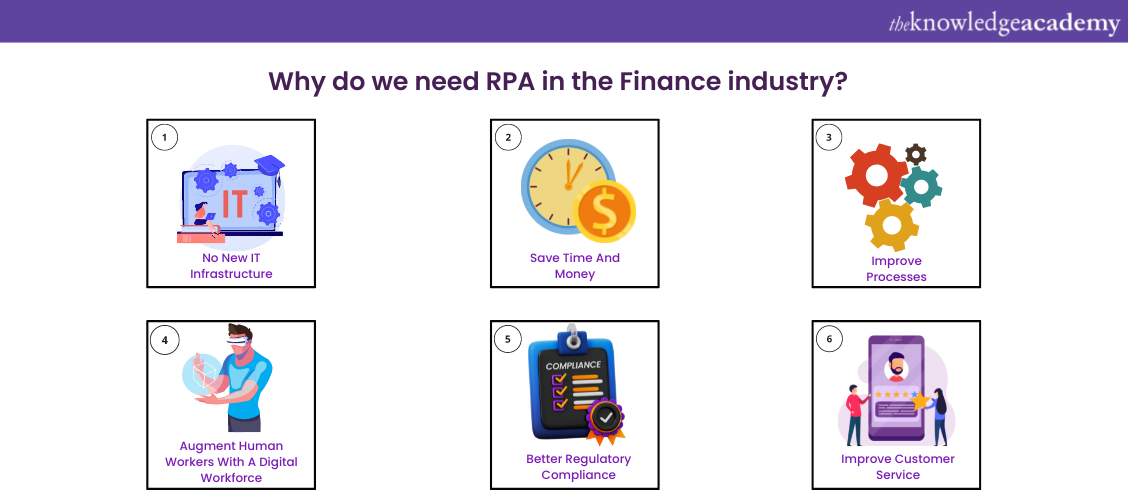

Why do we need RPA in the finance industry?

Factors considered in developing a business case:

a) Process efficiency improvement

b) Lowering data capture error rates and enhancing the quality of the data

c) Allowing employees to work on other projects.

The Breadth-First Search (BFS) industry struggles to remain relevant and competitive in a changing financial automation market. By automating manual activities and reducing errors with advanced RPA software, businesses may enhance operational effectiveness, cut costs, raise accuracy, and adhere to regulatory requirements.

Accounting allows financial and accounting operations workers to manage work more efficiently by reducing data transfer work. RPA can be used smartly as part of a broader process improvement initiative or appropriately to automate existing processes. RPA offers a good return on investment, improved accuracy, and efficient management of heavy workloads.

Benefits of RPA in the finance industry:

1) Helps in Computerising and managing processes

2) Avoiding mistakes in managing tasks

3) Computerising documentation and standardisation

4) Improving efficiency and returns

Learning the fundamentals will help you explore the realm of Robotic Process Automation. Register right away for our training on Robotic Process Automation using UiPath!

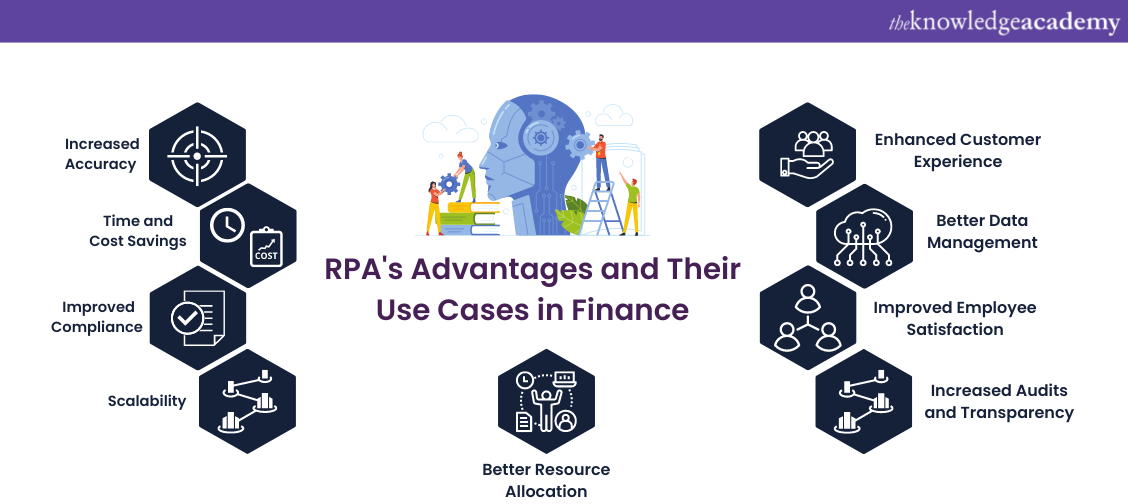

RPA's advantages and their use cases in finance

All the process changes come with their own set of benefits and risks. Let’s take a look at the advantages of RPA and its application in finance:

a) Increased accuracy: RPA can execute repetitive tasks without making errors, reducing the risk of human errors and increasing accuracy in financial processes such as data entry, account reconciliations, and financial reporting.

b) Time and cost saving: RPA can perform tasks much faster than humans, significantly reducing processing time, increasing efficiency and reducing costs associated with manual processing. This can free up employees to work on more strategic tasks.

c) Improved compliance: RPA can enforce compliance by adhering to defined business rules, policies, and procedures and ensuring that all transactions are executed according to legal and regulatory requirements.

d) Scalability: RPA can be scaled up or down as the workload changes, enabling organisations to adapt quickly to changing business needs.

e) Enhanced customer experience: RPA can automate routine tasks such as account opening, loan processing, and customer queries, which can help organisations to respond faster to customer needs and improve the overall customer experience.

f) Better data management: RPA can integrate with multiple data sources, providing real-time insights and enabling financial departments to make informed decisions.

g) Improved employee satisfaction: RPA can take on the repetitive and mundane tasks that employees might find boring, allowing them to focus on more complex and rewarding tasks. This can lead to improved employee satisfaction and retention.

h) Increased audits and transparency: RPA can provide a complete audit trail of all actions taken, providing transparency into the financial processes and ensuring that all actions can be traced back to their source.

i) Better resource allocation: RPA can analyse data and identify areas where resources are being underutilised or where there is excess capacity. This can help financial departments to better allocate resources to areas where they are needed most, maximising efficiency and reducing waste.

Discover the creation of web-integrated Open Span solutions. Sign up for our OpenSpan RPA Training!

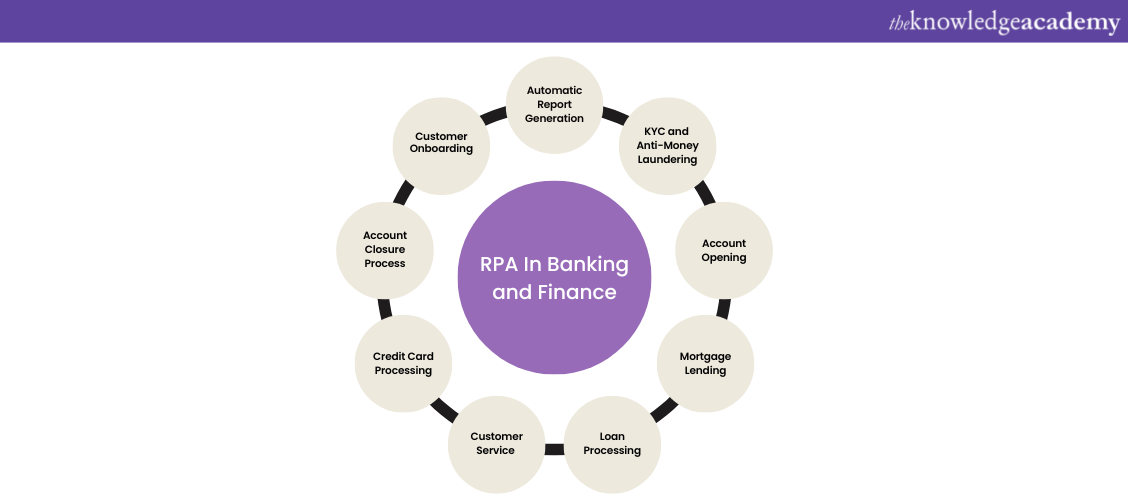

How do financial institutions use RPA?

Financial institutions increasingly use Robotic Process Automation (RPA) to automate repetitive tasks and streamline operations. Here are some of the ways how financial institutions use RPA:

a) Account opening and management: Financial institutions can use RPA to automate the account opening process, including data entry, verification, and document processing. RPA can also automate Account Management tasks, such as updating customer information and sending account statements.

b) Compliance and risk management: Financial institutions are subject to strict compliance and Risk Management regulations, and RPA can help automate compliance checks, fraud detection, and other Risk Management activities. RPA can also help ensure all compliance requirements are met and reduce the risk of human error.

c) Loan processing: RPA can help automate the loan processing workflow, including data collection, credit checks, underwriting, and document processing. This can help financial institutions speed up the loan approval process and improve customer service.

d) Customer service: Financial institutions can use RPA to automate customer service tasks, such as responding to inquiries, processing requests, and resolving issues. This can help improve customer satisfaction and reduce the workload of customer service agents.

e) Accounting and finance: RPA can help automate accounting and finance tasks, such as accounts payable and receivable, general ledger entries, and financial reporting. This can help reduce the risk of errors and improve the accuracy and speed of financial operations.

f) Reconciliation and settlement: Financial institutions use RPA to automate the process of reconciling and settling transactions between different systems and counterparties. This can help reduce the risk of errors, speed up the reconciliation process, and improve the accuracy of settlement data.

g) Data entry and processing: Financial institutions often have to process large volumes of data, such as customer information, transaction data, and market data. RPA can automate data entry and processing tasks, including data extraction, validation, and transformation.

h) Fraud detection and prevention: Financial institutions can use RPA to automate fraud detection and prevention activities, such as monitoring transactions for suspicious patterns or anomalies. RPA can also be used to flag suspicious transactions for further investigation automatically.

i) Trade processing: Financial institutions can use RPA to automate trade processing tasks, such as trade confirmation, settlement, and matching. This can help reduce manual errors and speed up the trade processing workflow.

j) Compliance reporting: Financial institutions must submit regular compliance reports to regulatory agencies, which can be time-consuming and complex. RPA can help automate the preparation and submission of compliance reports, including data extraction, formatting, and validation.

k) Human resources: Financial institutions can use RPA to automate human resources tasks, such as employee onboarding, payroll processing, and benefits administration. This can help reduce manual errors and free up HR staff to focus on more strategic initiatives.

Eager to learn more about Robotic Process Automation, refer to our blog on "RPA testing"

Conclusion

RPA can help financial institutions improve efficiency, reduce costs, and improve customer service while ensuring compliance with regulations and minimising the risk of human error. Hope this blog gives you enough insights about RPA in Finance, its uses, and some of its advantages in the finance industry.

Become an expert in picture visualisation and ROS node debugging. Join our Robot Framework Training right away!

Frequently Asked Questions

Upcoming Advanced Technology Resources Batches & Dates

Date

Robotic Process Automation using UiPath

Robotic Process Automation using UiPath

Thu 12th Dec 2024

Thu 13th Feb 2025

Thu 10th Apr 2025

Thu 12th Jun 2025

Thu 14th Aug 2025

Thu 9th Oct 2025

Thu 11th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please