We may not have the course you’re looking for. If you enquire or give us a call on +352 8002-6867 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Embark on a journey into the future of Financial Management with a comprehensive exploration of the transformative power of Xero Features. There are dynamic capabilities that set Xero apart, unveiling a suite of tools designed to redefine how businesses navigate their financial landscapes.

From user-friendly interfaces to advanced security measures and seamless integrations, Xero Features promises a revolutionary approach to accounting, empowering users with unparalleled efficiency and innovation. In this blog, you will gain insight into the Xero Features and learn about the attributes that make Xero a favourite among its users.

Table of Contents

1) Key features of Xero

a) Cloud-powered efficiency

b) User-friendly design

c) Reporting versatility

d) Robust security measures

e) Online file storage

f) Intuitive interface

g) Multi-currency support

h) Streamlined online payroll management

I) Anywhere access to data

j) Automated bank feeds

2) Conclusion

Key features of Xero

Xero, a cutting-edge accounting software, boasts a user-friendly interface for seamless navigation. It excels in automated bank reconciliation, simplified invoicing with reminders, and efficient expense tracking.

Moreover, offering multi-currency support and robust inventory management, Xero integrates with third-party apps, ensures payroll accuracy, and provides customisable reports for insightful financial analysis.

Here is a list highlighting the various Xero features:

1) Cloud-powered efficiency

Xero, a trailblazer in accounting, epitomises the efficiency of cloud-based solutions. By harnessing the power of the cloud, Xero transforms financial management into a seamless, accessible experience.

Additionally, the dynamic nature of cloud technology enables real-time collaboration and data access from any location, breaking down traditional barriers. With automated updates, users benefit from the latest features effortlessly, eliminating the need for manual interventions.

Furthermore, cloud-powered bank reconciliation ensures accuracy with live data feeds, and secure, encrypted cloud storage guarantees the safety of vital financial information. Xero's commitment to the cloud not only enhances operational efficiency but also future-proofs businesses by providing a scalable and adaptable platform.

Moreover, Embracing Xero means embracing a new era of agile, responsive, and collaborative financial management in the ever-evolving landscape of modern business.

2) User-friendly design

Xero's user-friendly design is a beacon of simplicity and efficiency in the complex realm of accounting software. With an intuitive interface, it empowers users of all skill levels to navigate effortlessly through its robust features.

From seamless onboarding to day-to-day operations, Xero prioritises accessibility, ensuring that users can easily grasp and utilise its powerful tools. The dashboard presents a clear snapshot of financial data, and the software's logical layout guides users through tasks with minimal learning curve.

Customisable templates for invoicing and reports further enhance the user experience, tailoring the platform to individual business needs. Xero's commitment to user-friendly design extends beyond aesthetics, fostering an environment where users can focus on strategic financial decisions rather than grappling with complex software.

Moreover, Xero's user-friendly design is a testament to its dedication to making sophisticated financial tools approachable and usable for everyone.

3) Reporting versatility

Xero sets itself apart with unparalleled reporting versatility, offering a robust suite of tools that transcend traditional financial reporting. Its customisable reporting feature empowers users to tailor reports to their specific business needs, providing a granular view of financial data.

Whether generating profit and loss statements, balance sheets, or custom reports, Xero's flexibility ensures that businesses can extract precise insights. With real-time data updates and dynamic filtering options, users can swiftly analyse financial trends, key performance indicators, and critical metrics.

Furthermore, Xero's reporting versatility extends to collaborative features, allowing multiple stakeholders to access and collaborate on reports simultaneously. This adaptability not only enhances decision-making but also ensures that businesses can effortlessly navigate the evolving landscape of financial analysis, making Xero a dynamic ally for those seeking a comprehensive and customisable reporting solution.

4) Robust security measures

Xero stands as a fortress of financial data with its robust security measures, ensuring the utmost protection for sensitive information. Employing state-of-the-art encryption protocols, Xero safeguards user data during transmission and storage, meeting the highest industry standards for security.

Furthermore, continuous monitoring and regular security audits fortify the platform against potential threats, providing users with peace of mind. With secure, permission-based access controls, businesses can regulate data access according to roles, limiting exposure to unauthorised personnel.

Additionally, Xero's commitment to compliance with global data protection regulations, such as GDPR, underscores its dedication to maintaining the privacy and integrity of user data. Trust in Xero extends beyond its intuitive features to a comprehensive security infrastructure, making it a reliable choice for businesses seeking a fortified defence against cyber threats in the digital age.

5) Online file storage

Xero redefines convenience with its online file storage, seamlessly integrating document management into its comprehensive suite of financial tools. Users can effortlessly upload, store, and organise essential files in the cloud, ensuring accessibility from any location.

Furthermore, this secure, centralised repository simplifies collaboration, allowing multiple stakeholders to access and share documents in real-time. With version history tracking, users can revert to previous iterations, promoting accountability and transparency.

Moreover, the online file storage in Xero complements its accounting features, facilitating the attachment of documents directly to transactions for comprehensive record-keeping. This intuitive system not only enhances workflow efficiency but also eliminates the need for disparate storage solutions, making Xero a holistic platform for both financial and document management needs.

6) Intuitive interface

Xero's intuitive interface is a cornerstone of its user-centric design, seamlessly blending sophistication with user-friendliness. Navigating the platform is a fluid experience, making complex financial tasks accessible to users with varying levels of expertise.

Additionally, the well-organised dashboard provides an instant snapshot of key financial metrics, ensuring users stay informed at a glance. With logically arranged menus and straightforward icons, Xero minimises the learning curve, allowing users to effortlessly execute tasks such as invoicing, expense tracking, and report generation.

Moreover, the platform's intuitiveness extends to its responsive design, catering to users on various devices. Xero's commitment to an intuitive interface not only enhances user satisfaction but also amplifies the efficiency of financial management, empowering businesses to focus on growth rather than grappling with complex software.

7) Multi-currency support

Xero's multi-currency support is a financial boon for businesses engaged in global transactions. Seamlessly managing multiple currencies, this feature ensures accurate and real-time currency conversion, minimising complexities in international trade.

With automated exchange rate updates, businesses can confidently conduct transactions in different currencies, while comprehensive reporting tools provide insights into the financial impact of currency fluctuations.

Moreover, Xero's multi-currency support streamlines financial processes, offering unparalleled flexibility for businesses navigating the diverse landscape of international markets, making it an indispensable tool for enterprises with a global footprint.

8) Streamlined online payroll management

Xero transforms payroll management into a streamlined, efficient process with its online payroll features. Automating salary calculations, tax deductions, and compliance tasks, Xero ensures accurate and timely payroll processing.

Additionally, the platform simplifies employee onboarding, allowing seamless integration of HR and payroll functions. With direct deposit options and automated tax filing, Xero minimises administrative burdens, freeing up time for strategic business activities.

Real-time reporting provides insights into labour costs, aiding informed decision-making. Xero's online payroll management not only ensures compliance with tax regulations but also elevates the payroll experience, making it an indispensable tool for businesses aiming for precision and efficiency in their financial operations.

Gain the knowledge of tax codes and statutory rights by signing up for our Introduction to Payroll Course now!

9) Anywhere access to data

Xero offers unparalleled access to crucial financial data, liberating users from the confines of traditional office settings. Harnessing the power of the cloud, Xero enables real-time access to financial information from any location, fostering flexibility and collaboration.

Whether in the office, at home, or on the go, users can effortlessly manage invoices, reconcile accounts, and monitor cash flow. This dynamic accessibility ensures that business decisions are not bound by physical constraints, empowering users to stay connected and in control of their financial affairs anytime, anywhere. Xero's commitment to anywhere access exemplifies a new era of agile, on-the-go financial management.

10) Automated bank feeds

Xero's automated bank feeds revolutionise financial management by seamlessly connecting to your bank accounts. This feature eliminates manual data entry, ensuring that transactions are automatically imported into the system.

Now, with real-time updates, users gain an accurate, up-to-the-minute view of their financial position. Automated bank feeds not only save time but also reduce the risk of errors, promoting data integrity.

More importantly, Xero's commitment to efficiency through automated bank feeds transforms the reconciliation process, allowing businesses to stay focused on strategic decisions rather than routine data entry, making it a cornerstone feature for a streamlined and error-free financial experience.

Streamline test processes and optimise efficiency by signing up for our Software Testing Automation Course now!

11) Streamlined invoicing and billing

Xero revolutionises invoicing and billing with a streamlined, user-friendly approach. Its intuitive interface allows users to create professional invoices effortlessly, customising templates to reflect their brand.

Additionally, automated features ensure timely invoicing and eliminate the hassle of manual reminders. Xero's platform enables secure online payments, accelerating cash flow. With real-time tracking, users can monitor invoice statuses, promoting transparency.

Recurring invoicing is simplified, saving time for businesses with subscription-based models. From creation to payment, Xero's invoicing tools optimise the billing process, making it an indispensable asset for businesses seeking efficiency and professionalism in their financial operations.

12) Instant quotes

Xero introduces instant quotes, a game-changing feature streamlining the quoting process for businesses. Users can swiftly generate professional quotes within the platform, tailoring them to client needs with customisable templates.

With real-time editing and collaborative capabilities, teams can refine quotes seamlessly, enhancing communication and reducing turnaround times. Integrated with invoicing, the transition from quote to payment is frictionless, ensuring a smooth client experience.

Moreover, Xero's instant quotes not only accelerate the quoting cycle but also reinforce the platform's commitment to efficiency and user-friendly functionality, making it an essential tool for businesses looking to elevate their quoting and invoicing processes.

13) Customisable invoice templates

Xero empowers businesses with customisable invoice templates, offering a professional and personalised touch to financial transactions. Users can tailor the appearance of their invoices to reflect the branding and style of their business, reinforcing a cohesive and professional image.

With easy-to-use customisation tools, elements such as logos, colours, and fonts can be effortlessly adjusted. This feature not only enhances the visual appeal of invoices but also ensures consistency across all financial communications.

Moreover, Xero's commitment to providing customisable invoice templates caters to businesses seeking a tailored, branded approach to invoicing, contributing to a polished and professional representation in the marketplace.

14) Account watchlist feature

Xero introduces the Account Watchlist feature, a strategic tool for businesses seeking financial vigilance. This feature allows users to monitor specific accounts with precision, providing a focused view of critical financial metrics.

By highlighting key accounts, businesses can proactively track performance, identify trends, and make informed decisions. The Account Watchlist feature ensures that users stay ahead of financial developments, promoting strategic planning and timely interventions.

With this dynamic tool, Xero reinforces its commitment to empowering businesses with the insights needed to navigate the complexities of financial management, offering a proactive approach to success.

15) HubDoc integration

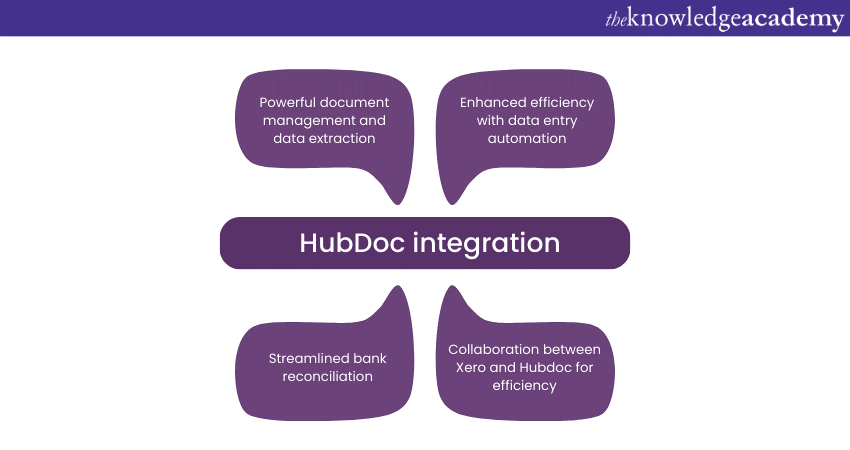

Xero seamlessly integrates with Hubdoc, a powerful document management and data extraction platform. This integration enhances efficiency by automating the data entry process. Hubdoc collects financial documents, extracts relevant data, and syncs seamlessly with Xero, reducing manual input and minimising errors.

Users benefit from streamlined bank reconciliation, simplified expense tracking, and improved accuracy in financial reporting. This collaboration between Xero and Hubdoc exemplifies a commitment to automation, ensuring that businesses have access to cutting-edge solutions that optimise document management and elevate the overall efficiency of financial processes. The Hubdoc integration cements Xero's position as a leader in innovative, user-friendly accounting solutions.

16) Seamless integrations with other tools

Xero stands out with its seamless integration capabilities, effortlessly connecting with a myriad of third-party tools. From CRM systems to e-commerce platforms, these integrations enhance Xero's functionality, allowing businesses to tailor their accounting ecosystem to their specific needs.

The cohesive integration streamlines data flow, reduces manual input, and ensures real-time collaboration across multiple applications. Xero's commitment to an open ecosystem empowers users to build a tech stack that suits their unique business requirements, promoting efficiency, accuracy, and adaptability in financial management.

With seamless integrations, Xero continues to redefine the boundaries of collaborative and connected accounting solutions.

Acquire the knowledge to manage your bills and reports by signing up for our Xero Introduction Training now!

Conclusion

In conclusion, the array of Xero features showcased in this exploration underscores its position as a transformative force in modern financial management. From the intuitive interface to the robust security measures and seamless integrations, Xero Features collectively redefine efficiency, accessibility, and innovation in the realm of accounting solutions.

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Xero Introduction Training

Xero Introduction Training

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please