We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Planning for retirement is crucial, and the Provident Fund (PF) plays a vital role in securing your financial future. The Employees’ Provident Fund (EPF) scheme is a collaborative effort, with employers and Employees contributing to a substantial savings pool over time. In this blog, we’ll dive into the essentials of EPF and guide you through the PF Calculation Formula with a clear, step-by-step approach. Let’s get started on your journey to financial stability!

Table of Contents

1) What is EPF?

2) What is the PF calculation formula?

3) Steps to Calculate EPF

4) Advantages of Using an EPF Calculator

5) Important things to consider for EPF

6) Conclusion

What is EPF?

The Employees' Provident Fund (EPF) is a government-mandated savings program designed to help employees save a portion of their income for retirement. Both the employer and employee contribute 12% of the employee’s basic salary and Dearness Allowance (DA) to the EPF account each month. These contributions grow with interest over time, creating a substantial fund that employees can access upon retirement or during specific circumstances like job changes, medical emergencies, or crises.

Key Features of EPF:

a) Employee and Employer Contributions: Both contribute 12% of the employee’s basic salary and DA.

b) Interest Rate: Determined annually by the government.

c) Withdrawal: Available upon retirement or under specific conditions such as unemployment or medical emergencies.

The EPF serves as a crucial financial tool, offering tax benefits, a secure retirement corpus, and a safety net for unforeseen circumstances, ensuring financial stability in the future.

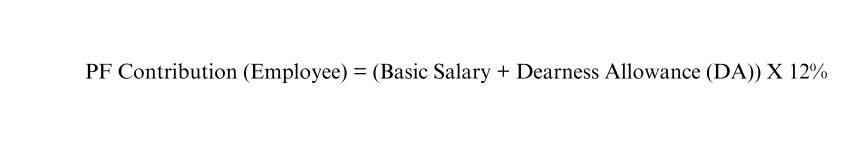

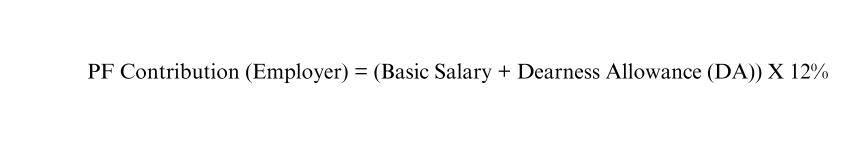

What is the PF Calculation Formula?

The PF Calculation Formula is essential for determining the monthly contributions made by both the employee and the employer towards the employee's retirement savings. This formula ensures a systematic approach to saving, setting aside a portion of the employee's earnings for future financial security.

1) Employee’s Contribution:

Basic Formula: 12% of the employee’s basic salary and DA.

Similarly, the employer's contribution is calculated using the same base:

2) Employer’s Contribution:

Basic Formula: 12% of the employee’s basic salary and DA.

a) 8.33% goes to the Employee Pension Scheme (EPS).

b) 3.67% goes directly to the EPF account.

These contributions, along with the interest determined annually by the government, accumulate over time to form the employee’s total Provident Fund balance, which can be accessed upon retirement or under specific circumstances.

Elevate your HR strategies with our HR Analytics Course. Join now!

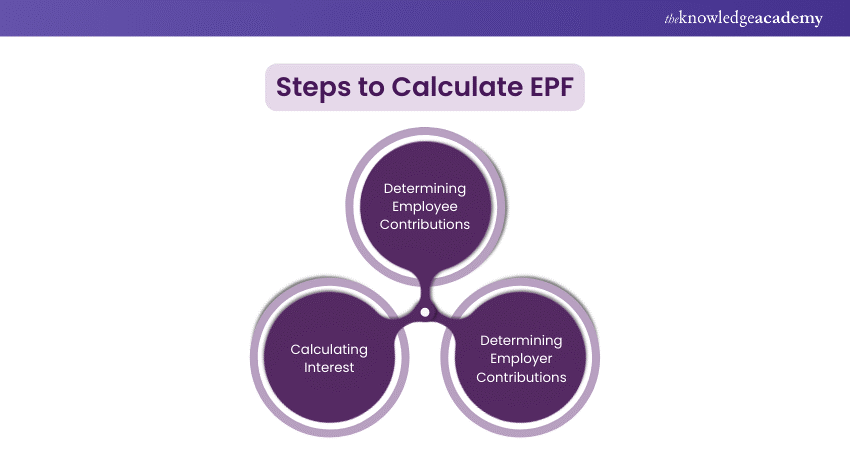

Steps to Calculate EPF

To accurately calculate your EPF, follow these three essential steps:

1) Determining Employee Contributions

The first step in calculating EPF is determining the employee’s contribution.

Basic Calculation: The employee’s contribution is straightforward. It is 12% of the employee’s basic salary and dearness allowance (DA).

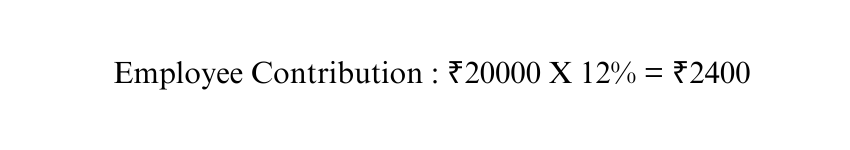

Example: If an employee’s basic salary plus DA is ₹20,000, then the monthly EPF contribution would be:

This regular deduction and contribution to the EPF account is crucial for building a substantial retirement corpus over time. The simplicity of the calculation ensures that both employees and employers can easily track contributions, making the process transparent and straightforward.

Over the years, as the contributions accumulate along with the interest earned, employees can secure a significant fund that provides financial security in retirement or during other qualifying circumstances.

2) Determining Employer Contributions

Next, calculate the employer’s contribution.

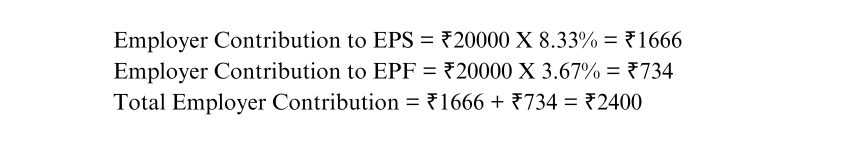

Split Contributions: The employer’s contribution is 12% of the employee’s basic salary and DA. However, this is divided between EPF (3.67%) and EPS (8.33%).

Example: Using the same salary example:

The employer’s contribution matches the employee’s but is allocated differently.

3) Calculating Interest

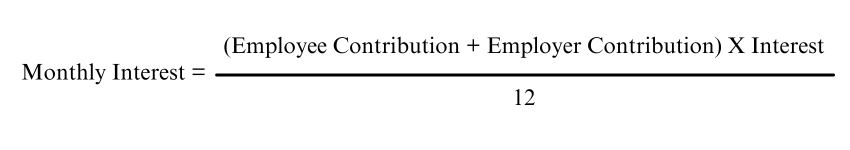

The final step is calculating the interest accrued on the contributions.

Interest Rate: The government sets the EPF interest rate annually. For this example, let’s assume it is 8.5% per annum.

Interest Calculation: Interest is calculated monthly but credited to the account annually. To calculate the monthly interest:

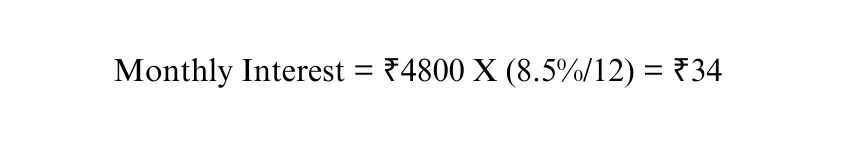

Example: For an employee and employer contribution totalling ₹4,800

This interest continues to accumulate, increasing the total EPF balance over time.

Advantages of Using an EPF Calculator

An EPF Calculator simplifies the often complex task of determining your Provident Fund balance. Here's why it's a valuable tool:

a) Precision: EPF Calculators deliver accurate results, factoring in all relevant variables, including salary adjustments and interest rates.

b) Efficiency: Instead of manually calculating contributions and interest, an EPF Calculator provides instant and reliable results, saving you time.

c) Strategic Financial Planning: With an EPF Calculator, you can estimate your retirement corpus, enabling better financial planning and informed decisions about additional savings or investments.

d) Up-to-date Information: Most EPF Calculators are regularly updated to reflect the latest government-mandated interest rates, ensuring your calculations are always current and accurate.

Incorporating an EPF Calculator into your financial routine helps you effortlessly track your savings and ensures you're on the right path to building a secure retirement fund.

Become a leader in human resources with our HR Management Course. Join now!

Important Things to Consider for EPF

When managing your EPF, it's essential to keep the following key factors in mind:

a) Voluntary Provident Fund (VPF): Employees have the option to contribute more than the mandatory 12% through VPF, which accrues the same interest rate, allowing for increased savings.

b) Tax Advantages: EPF contributions qualify for tax deductions under Section 80C of the Income Tax Act, making it a tax-efficient savings method.

c) Withdrawal Guidelines: While EPF withdrawals are typically made at retirement, partial withdrawals are permitted under specific conditions, such as purchasing a home, funding education, or covering medical emergencies.

d) Account Portability: EPF accounts are fully portable, allowing you to transfer your account when changing jobs, ensuring continuous growth of your savings without disruption.

By keeping these considerations in mind, you can optimise your EPF, maximising its benefits for a secure financial future.

Conclusion

Grasping the PF Calculation Formula is crucial for both employees and employers. It not only helps in tracking contributions but also plays a key role in retirement financial planning. Each step, from determining contributions to calculating accrued interest, is vital for securing your financial future. By mastering this formula, you can ensure your Provident Fund grows steadily, giving you peace of mind for the years ahead.

Achieve excellence in human resources with our Certified HR Manager Course. Join now!

Frequently Asked Questions

Yes, partial withdrawals are allowed before retirement for particular purposes, such as purchasing a home, paying for education, or medical emergencies. However, certain conditions must be met, and withdrawal amounts are typically limited.

The government reviews and announces the EPF interest rate annually. This rate is applied to your EPF balance for the financial year, and interest is credited to your account at the end of the year.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various HR Leadership Courses, including the HR Course, HR Analytics Course and HR Strategy Training. These courses cater to different skill levels and provide comprehensive insights into Diversity in the Workplace.

Our Human Resources Blogs cover a range of topics related to HR Leadership, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your HR Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please