We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Financial prosperity is a cornerstone of fulfilling life in the modern era. With global consumption on the rise, the pursuit of financial security and prosperity has never been more critical. So, where does one start on the path to financial health? The gateway is simple – Investment. But What is Investment?

Think of it as an asset or item purchased for immediate gratification apart from a means to generate income or grow in value over time. For instance, buying a piece of art isn’t just about owning a beautiful object; it’s about investing in a potential source of wealth for years to come. Willing to unravel the mysteries of Investment?

Dive into this blog to grasp the What is Investment, its essentials and learn how it can be the key to enhancing your financial narrative.

Table of Contents

1) What is Investment?

2) How Does Investment Work?

3) Types of Investments

4) What are the Benefits of Investing?

5) How to Start Investing?

6) Calculating Return on Investment (ROI)

7) What are the Differences Between Saving and Investing?

8) Conclusion

What is Investment?

Whenever you perform a transaction that gives you better monetary returns over a period of time, that is called an Investment. In a general sense, Investment is the process of using a commodity to purchase an asset. With the passage of time, the said asset will help increase the value of the commodity you’ve used to initiate the transaction.

It also lays the groundwork with time, effort, money or an asset, which helps in build your wealth for the future. Therefore, an Investment Process can also be referred to as one of the ways to generate income even when you are not working.

There are several forms of financial Investments, and they focus on increasing the value of the money that you have Invested. Let's explore some of them below:

a) Mutual funds

b) Endowment plans

c) Investment plans

d) Stocks

e) Bonds

How Does Investment Work?

Investment is a powerful tool for expanding your wealth, which can be utilised to achieve your long-term financial objectives. By investing, you stand to earn returns, which may be either fixed or variable, based on the investment avenue you choose. Fixed returns offer a predetermined amount known at the outset of your investment journey. On the other hand, variable returns allow you to venture into the realms of equity and debt markets.

While equity markets offer the possibility of substantial returns, they also come with greater risk. Conversely, debt markets are synonymous with lower risk and provide consistent returns. Compounding indicates that longer investments typically yield higher returns. These gains can supplement your income, helping you achieve your financial goals.

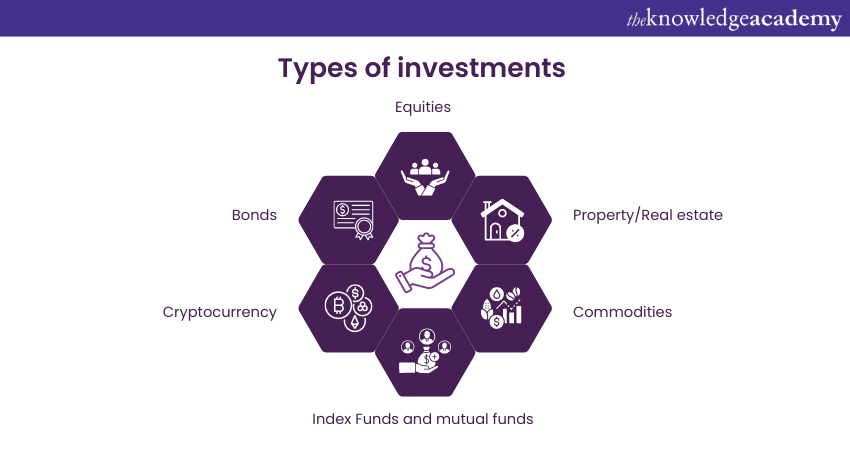

Types of Investments

Understanding investment begins with a clear definition of your financial goals, which shape your investment strategy. Be it opting for tangible assets or delving into financial markets with equity and debt, your objectives are key. The investment process is also influenced by the multiple acquisition methods. Let’s talk about the Types of Investment in detail:

Equities

When an Investor purchases a share or an ownership unit in a company’s stock, it is called equity. As an Investor, you possess not only a set of stocks in a company but also a share of the company itself. The ownership of an organisation is divided among Investors whenever they purchase a stock. The better an organisation performs, the more valuable its stocks become. Hence, more value is generated for the Investor.

At times, equity holders also possess the right to vote in major companies. They can vote to establish or change the board of directors. They can also receive dividends if the organisation makes a profit and decides to share it with the Investors. Organisations can also give Investors bonus shares at times, but that isn’t frequent.

Understand the intricacies of long-term Capital Management with our Investment Management Courses.

b) Bonds

Bonds are a common method for entities like governments, corporations, and municipalities to secure funding. They represent a debt investment, where investors lend funds to an issuer in exchange for periodic interest payments. Here’s how bonds function:

a) Issuers release bonds to gather capital for various purposes, including infrastructure, business expansion, or operational funding.

b) Each bond has a face value, the future worth of the bond, which is more of a pledge than a guarantee.

c) Bonds carry a coupon rate, the yearly interest rate paid to investors.

d) The maturity date marks the bond’s conclusion, at which point the issuer repays the face value to the bondholder.

e) Typically, issuers must pay this face value at maturity, with no interest payments due beyond this date.

c) Property/Real estate

As the name suggests, Investing in a property allows you to hold either a piece of land or a combination of the plot and the accommodation constructed over it. This includes houses, bungalows, apartments, apartment buildings and complexes, and much more. You can not only purchase a piece of property and wait for time to increase its value, but you can also purchase and rent the property out to people or organisations.

This way, you’ll be able to generate a stream of income through rent and the price of the establishment itself. A number of business tycoons often buy pieces of property and then rent them out to organisations, people, and other parties.

Dissect the risks associated with Real Estate Investment with our Real Estate Risk Management Training - book your spot now!

d) Commodities

Commodities are things that can be divided into two categories: frequent usage-regular value and infrequent usage-high value. The former are the things commonly used in everyday life, while the latter are items that are not used as often but hold a higher value.

They can also be split into soft and hard types. The “soft” side of commodities includes edible items such as coffee beans, soybeans, wheat, and grains. The “hard” side of commodities includes inedible items such as fossil fuels, minerals, metals, etc.

Gold and silver are famous commodities that are traded quite frequently in the markets worldwide. While people do hold some amount of physical gold and silver, they’re more popular in commodity markets and are frequently traded for. Organisations also release bonds on commodities to help people Invest and take part in resource gathering and management.

e) Index Funds and Mutual Funds

Index Funds and Mutual Funds are both collective investment schemes, but they differ in their management and objectives.

a) Index Funds point to mirror the performance of a market index and are passively managed, resulting in lower costs due to reduced transaction fees and management expenses.

b) Mutual Funds, conversely, are actively managed with the goal of outperforming the market, which often leads to higher costs from frequent trading and strategic asset allocation.

In essence, Index Funds offer a cost-effective, low-maintenance investment option that tracks market indices, while Mutual Funds provide a more hands-on approach with the potential for higher returns at a greater cost.

f) Cryptocurrency

Cryptocurrency is one of the most popular Investment methods. Its recent popularity has made it a lucrative opportunity for Investors. Cryptocurrency is a Blockchain-based currency used to transact or hold digital value. Cryptocurrency organisations issue coins or tokens whose value may be appreciated. These tokens can then be used for transactions or can be utilised for transactions only in specific networks.

Cryptocurrencies use different cryptographic techniques that secure transactions and control the creation of any new units. This level of security makes them immune to counterfeiting. The best part of Investing in Cryptocurrencies is that they can be used anywhere in the world at any time.

This accounts for lower transaction fees when compared to any other traditional banking and financial systems. Also, the value of cryptocurrencies is highly volatile, and they are subject to rapid changes according to market demand, Investor sentiment, and other factors.

Drive success and learn cutting-edge revenue strategies - join our Revenue Management Training now!

What are the Benefits of Investing?

Let’s take a look at the following to understand the Investment advantages:

1) Wealth Accumulation and Generation: The first and foremost reason why a person Invests is to generate income and expand their pool of wealth. Obviously, the more wealth you possess, the more accessible solutions become for you. With the passage of time, you can not only increase your initial Investment amount but also diversify it.

2) Enhanced Financial Objectives: When you commence Investing in assets, it helps you establish your financial goals. With enough time, you can strengthen your financial goals and establish objectives to meet them.

3) Compounding: Compounding refers to an increment that happens at an exponential rate against the commodity Invested. Making 2X or 4X on initial Investment is what it usually boils down to. The more you Invest with time, the better your chances become of making significant profit margins. 4) Creating an Inflation Shield: With time, the power of the money you hold decreases, which makes it imperative to multiply it for the unforeseeable future. With Investments, you can ensure that you’ll be equipped with the right amount of money to help you through the rough phases.

5) Retirement Planning: A well-rounded investment portfolio addresses immediate financial requirements by securing your future reserves. Achieving a comfortable retirement is a common goal, yet it demands diligence and thorough research. Investing in diverse assets generates a stream of income for you and provides financial security for your loved ones. With prudent investments over time, you can ensure their well-being.

How to Start Investing?

If you are still wondering how to start Investing, follow the below-mentioned steps, which will explain to you more in detail about how to create an Investment portfolio:

a) Research: It should be your first step before you start Investing in assets. A sound knowledge of the concept of Investment, types of Investment, assets that you can Invest in, risk factors, etc., is necessary for you to know. Before buying a single share of a company, understand the company's future and then buy the share.

b) Plan your spending: Decide why you are putting your money away and how to ensure that monthly expenses do not interfere with your emergency fund. Before Investing, make sure that it does not interfere with your lifestyle.

c) Study about liquidity restrictions: Some Investments may be locked in for quite some time and cannot be liquidated, that is, sold at any time you want. Before you Invest, learn if they can be sold or bought at any time.

d) Taxes: are the most important part of your financial journey. It would be best if you always researched tax implications. You need to formulate strategies that can extend beyond what the product can hold and the tax vehicle they Invest in.

e) Risk: Decide on how much you are ready to risk. You need to be comfortable with how your financial power will allow you to take risks. Strategies are ways in which you can reduce risks and explore ways to mitigate any risks.

Unlock the secrets of cryptocurrency trading – join our Cryptocurrency Trading Training today and transform your future!

Calculating Return on Investment (ROI)

The most common method to assess an investment’s performance is by calculating its Return on Investment (ROI). This metric is computed using the formula:

|

ROI=(Current Value of Investment-Original Value of Investment)/Original Value of Investment |

What are the Differences Between Saving and Investing?

Comprehending the distinction between saving and investing is crucial for effective financial planning. Let's explore the key differences between these two financial strategies:

|

Aspect |

Saving |

Investing |

|

Purpose |

Setting aside money for short-term goals or emergencies |

Growing wealth over the long-term |

|

Risk and Return |

Generally considered low risk, with minimal interest in savings accounts |

Higher risk but also potential for higher returns |

|

Time Horizon |

Usually for near-future needs like a holiday or a new appliance |

Geared towards long-term goals, that include retirement or a child's education |

|

Inflation Impact |

Value can be eroded over time due to inflation |

Investing in assets that outpace inflation can help maintain or grow purchasing power |

| Available Options | Typically stored in bank accounts |

Offers a range of options, including bonds, stocks, mutual funds, and real estate, each with its own level of risk and potential return |

Conclusion

We hope that from this blog, you have understood What is Investment and why it is important for your financial journey. In this blog, we also discussed some of the important types, benefits and steps that you can take to start Investing, especially if you are a beginner in this domain. Having the right mindset, confidence and clarity on Investments will help you build a successful financial future.

Transform your future with our Forex Trading Course – register today and trade like a pro!

Frequently Asked Questions

You can begin Investing with limited funds by focusing on low-cost Investment options. You can further consider opening a high-yield savings account, Investing in fractional shares of stocks or ETFs, contributing to a Roth IRA, or using tools that allow you to Invest small amounts regularly.

Investing risks include market volatility, liquidity issues, inflation, and individual asset risk. You can mitigate these by diversifying your portfolio across various asset classes, regularly reviewing and adjusting your Investments, and adopting a long-term perspective to ride out market fluctuations.

The Knowledge Academy offers various Investment and Trading Training, including Investment Banking Training, Cryptocurrency Trading Training and Investment Management Masterclass. These courses cater to different skill levels, providing comprehensive insights into Capital Investment.

Our Business Skills Blogs cover a range of topics related to Investment and Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please