We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The Sarbanes-Oxley Act (SOX) has made big changes in the corporate world since it was introduced. Created to stop financial misconduct and corporate scandals, the Benefits of Sarbanes-Oxley go beyond just following rules. This law ensures financial transparency and strengthens internal controls.

SOX also improves corporate governance. It helps prevent fraud and unethical practices by encouraging accountability and restoring investor confidence. In this blog, we will explore the many Benefits of Sarbanes Oxley and how it promotes ethical business practices and secures financial markets.

Table of Contents

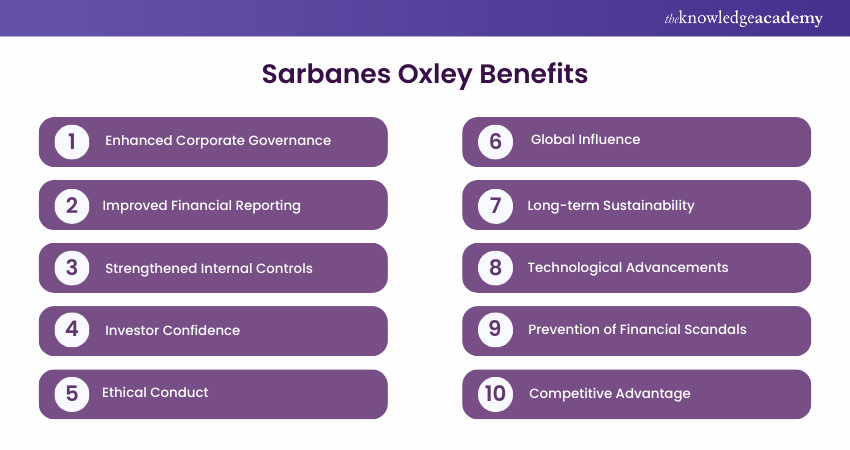

1) Sarbanes Oxley Benefits

a) Enhanced Corporate Governance

b) Improved Financial Reporting

c) Strengthened Internal Controls

d) Investor Confidence

e) Ethical Conduct

f) Global Influence

g) Long-term Sustainability

h) Technological Advancements

i) Prevention of Financial Scandals

2) Conclusion

Sarbanes Oxley Benefits

The Sarbanes Oxley Act (SOX) enhances corporate governance by establishing stricter regulations for public companies, requiring executive accountability and transparency. It mandates that CEOs and CFOs certify the accuracy of financial statements, ensuring they are personally liable for any inaccuracies. This fosters a culture of responsibility and integrity at the top management level, promoting ethical decision-making and corporate accountability.

Enhanced Corporate Governance

Enhanced corporate governance, a cornerstone of the Sarbanes-Oxley Act, brings forth a robust framework that safeguards shareholder interests and promotes ethical conduct. The requirement for independent audit committees ensures objective oversight, mitigating potential conflicts of interest and ensuring transparency. By separating management from oversight, organisations promote a culture of diligence and responsible decision-making.

This mechanism of checks and balances not only prevents unethical practices but also instils investor confidence in the integrity of business operations. Enhanced corporate governance establishes a foundation for long-term success, where transparency, accountability, and ethical behaviour take centre stage, shaping a resilient business environment that benefits stakeholders, employees, and the broader economy.

Improved financial reporting

The Sarbanes-Oxley Act ushered in a new era of financial reporting, marked by heightened accuracy and transparency. By requiring CEOs and CFOs to personally certify the accuracy of financial statements, the act reinforces the commitment to trustworthy reporting.

This mandate instills a sense of ownership and accountability at the highest levels of leadership, deterring unethical practices and misrepresentation. As a result, organisations invest in robust internal control assessments, diligent audits, and rigorous reporting processes.

This commitment to accurate financial reporting not only reassures investors and stakeholders but also contributes to a more informed decision-making process. Improved financial reporting underpins the foundation of Sarbanes-Oxley's objectives, promoting a business environment where financial integrity is paramount, and trust is rebuilt in the realm of corporate finance.

Strengthened Internal Controls

At the core of the Sarbanes-Oxley Act's benefits lies the reinforcement of internal controls. By mandating comprehensive assessments, the act compels organisations to fortify their risk management strategies. Strengthened internal controls not only ensure the accuracy of financial reporting but also mitigate the potential for fraudulent activities. This proactive approach empowers companies to identify vulnerabilities, prevent mishandling of assets, and maintain the integrity of their operations. As a result, organisations gain a heightened awareness of potential risks and opportunities for improvement. Strengthened internal controls not only safeguard against financial losses but also contribute to a culture of responsible governance and sustainable growth.

Investor Confidence

Investor confidence stands as a cornerstone of a thriving financial ecosystem. When investors trust that the information they receive is accurate and transparent, they make informed decisions that drive market stability. Measures such as the Sarbanes-Oxley Act play a pivotal role in boosting investor confidence by enforcing stringent reporting standards and accountability measures. Investors are more likely to invest in companies that uphold ethical practices and provide reliable financial disclosures. This trust not only benefits individual investors but also contributes to the overall health of the economy. By fostering an environment where investors can confidently allocate their resources, businesses can access capital, spur innovation, and contribute to sustainable economic growth.

Stay ahead with Sarbanes-Oxley Training – Begin your path to regulatory expertise today!

Ethical Conduct

The Sarbanes-Oxley Act has a great influence on promoting ethical conduct within organisations. By mandating transparent reporting of executive compensation, conflicts of interest, and potential ethical concerns, the act has promoted a culture of integrity. Executives and employees are encouraged to uphold ethical values, knowing that their actions are subject to scrutiny.

This focus on ethical behaviour not only enhances the reputation of organisations but also contributes to long-term sustainability. Sarbanes-Oxley's impact on ethical conduct extends beyond regulatory compliance, guiding companies to prioritise honesty, fairness, and responsible decision-making. As a result, businesses cultivate a reputation for ethical leadership, gaining the trust of stakeholders and solidifying their commitment to responsible business practices.

Global Influence

The impact of the Sarbanes-Oxley Act transcends national borders, exerting a profound influence on global business practices. This legislation's emphasis on transparency, accountability, and ethical conduct has resonated across continents, shaping corporate governance standards internationally.

Countries around the world recognised the value of implementing similar principles within their regulatory frameworks. Many jurisdictions, particularly in the European Union, adopted regulations that aligned with Sarbanes-Oxley's spirit, encouraging a harmonised approach to corporate governance and financial reporting.

The act's global influence extends beyond compliance; it contributes to a more consistent and transparent business environment. By embracing Sarbanes-Oxley's principles, countries strengthen investor trust, enhance market stability, and create a framework that encourages responsible business practices on a global scale. As a result, the Sarbanes-Oxley Act stands not only as a domestic response to financial scandals but also as a catalyst for elevating business standards worldwide.

Long-term Sustainability

Long-term sustainability, a key benefit of the Sarbanes-Oxley Act, encompasses more than just financial stability. By promoting transparency, accountability, and ethical behaviour, organisations can fortify their resilience in the face of challenges. This sustainability extends beyond profit margins, encompassing environmental, social, and governance factors. Companies that prioritise long-term sustainability are better equipped to navigate crises, adapt to changing markets, and maintain their reputation over time. Moreover, they attract socially conscious investors and customers who value ethical practices. By boosting a culture of responsibility and foresight, long-term sustainability ensures that organisations thrive not only in the present but also in the evolving business landscape of the future.

Technological Advancements

The impact of the Sarbanes-Oxley Act isn't confined to corporate governance alone; it's also catalysed technological advancements. To comply with the Act's stringent reporting and internal control requirements, organisations turned to technology for streamlined solutions. Automated systems emerged, revolutionising financial reporting, risk assessment, and compliance management. Software tools that facilitate real-time data collection, analysis, and reporting have become essential in meeting Sarbanes-Oxley's demands efficiently.

These technological strides not only enhance accuracy and transparency but also empower organisations to adapt to changing regulations and market dynamics swiftly. The Sarbanes-Oxley Act, by fostering a tech-driven compliance landscape, showcases the symbiotic relationship between legislation and innovation, ultimately elevating the efficiency and effectiveness of corporate operations in an increasingly complex business world.

Prevention of Financial Scandals

The stringent requirements of Sarbanes-Oxley act as a deterrent to fraudulent activities. The act's provisions make it more difficult for companies to engage in deceptive practices, reducing the likelihood of financial scandals that can damage both the company's reputation and the broader financial system. The prevention of financial scandals stands as a paramount imperative in today's corporate landscape. By implementing robust regulatory frameworks, transparent reporting practices, and stringent internal controls, organisations can effectively thwart unethical activities that undermine trust and integrity.

Maintaining a culture of ethics and accountability, coupled with diligent oversight by independent audit committees, serves as a bulwark against fraudulent practices. Through continuous education and training, employees are empowered to identify and report suspicious activities, reinforcing a united front against malfeasance. By adhering to these practices and embracing a commitment to ethical conduct, businesses can forge a path toward long-term success, safeguarding their reputation and contributing to a healthier financial ecosystem.

Competitive Advantage

The Sarbanes-Oxley Act doesn't just promote regulatory compliance; it offers a unique avenue for organisations to gain a competitive edge. By adhering to its principles of transparency, accountability, and ethical conduct, companies can distinguish themselves in the market. Demonstrating a commitment to sound financial reporting and governance practices enhances the organisation's reputation, attracting investors, customers, and partners who value integrity.

The act's emphasis on accurate financial disclosures and robust internal controls cultivates an environment of trustworthiness. This reputation for ethical behaviour sets companies apart from their competitors, positioning them as reliable and responsible entities. In an era where stakeholders prioritise ethical business practices, leveraging the competitive advantage offered by Sarbanes-Oxley compliance can translate into long-term success, stronger relationships, and sustained growth.

Elevate your expertise with our Sarbanes-Oxley Certified Professional Course for enhanced governance and compliance

Conclusion

The Benefits of Sarbanes-Oxley reach far beyond the initial compliance requirements. This legislation has revolutionised corporate practices, instilling a culture of transparency, ethics, and accountability. While the initial apprehension may have focused on the perceived burdens of compliance, the enduring advantages have reshaped the corporate landscape. These benefits promote trust, stability, and ethical business conduct.

Unlock advanced banking insights with Introduction to Basel IV Training – Start mastering regulatory standards today!

Frequently Asked Questions

The Sarbanes-Oxley Act benefits public companies by enhancing financial transparency, strengthening internal controls, and improving investor confidence. It helps prevent fraud, reduces financial misstatements, and promotes accountability, leading to stronger corporate governance and stability.

SOX contributes to global financial stability by enforcing strict financial reporting standards, reducing fraud, and increasing transparency. It builds investor trust and confidence, which helps prevent market volatility and supports sustainable economic growth, promoting a stable financial environment.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Sarbanes-Oxley Training, including Sarbanes-Oxley Certified Professional Course, Integrated Management System Training and the Certified Internal Auditor Training. These courses cater to different skill levels, providing comprehensive insights into SOX methodologies.

Our ISO & Compliance Blogs cover a range of topics related to IT infrastructure, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your IT and Networking skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

Sarbanes-Oxley Certified Professional

Sarbanes-Oxley Certified Professional

Mon 6th Jan 2025

Mon 3rd Mar 2025

Mon 19th May 2025

Mon 21st Jul 2025

Mon 8th Sep 2025

Mon 10th Nov 2025

Mon 24th Nov 2025

Mon 8th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please