We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you or someone you know living with a long-term health condition or disability that impacts daily life? Personal Independence Payment (PIP) is a crucial welfare benefit in the UK designed to provide financial support for those with physical or mental health challenges.

With PIP, you can receive help covering the extra costs of daily living or mobility needs. This support offers peace of mind and greater independence. In this blog, we will discuss your eligibility for PIP and how it can provide financial support. You will also learn how PIP Payments help manage the additional costs of living with a health condition.

Table of Contents

1) What is Personal Independence Payment (PIP)?

2) Eligibility for PIP

3) The PIP Assessment Process

4) How to Apply for Personal Independence Payment?

5) How the DWP Makes Decisions on PIP Claims?

6) How Your Abilities Are Scored?

7) What You’ll Receive from PIP?

8) PIP amounts

9) Conclusion

What is Personal Independence Payment (PIP)?

Personal Independence Payment (PIP) is a state benefit designed to assist individuals with the additional costs arising from long-term illnesses or disabilities. Introduced in 2013, it replaced the Disability Living Allowance (DLA).

PIP can provide financial support if you meet the following criteria:

a) You experience a long-term physical or mental health condition or disability.

b) You face challenges in performing everyday tasks or moving around due to your condition.

You may be eligible for PIP regardless of your employment status, savings, or receipt of most other benefits.

Eligibility for PIP

You could get a Personal Independence Payment if you fulfill the following conditions:

1) Age Requirement:

You are 16 years or older.

2) Health Condition:

You have a physical or mental ailment or a disability that will probably last for 12 months or more.

3) Daily Activities and Mobility:

You have difficulty in mobility on a daily basis meaning that your normal daily life is affected a lot.

4) Duration of Difficulties:

These impediments have persisted for at least three months and the program requires at least another three months to complete.

5) Residency:

Either you are a citizen of Great Britain or Northern Ireland or it can also be said that you have lived in this area in the last 03 years more than two years.

6) State Pension Age:

However, if you have claimed State Pension age or above, there is another benefit that you can apply for that is called Attendance Allowance.

In case you earlier qualified for PIP and continue to meet the qualifying conditions that applied the year before you attained the State Pension age, then you may still receive PIP.

7) Living Abroad:

If you are residing in another country besides a European state you may be able to claim benefits in accordance with specific treaties that exist between your country of residence and the UK.

8) Immigration Status:

Although the PIP is available for British or Irish citizens who have made permanent move to the UK, if you are an asylum seeker or you are not normally resident in the United Kingdom, you may qualify depending with the immigration statute and the habitual residence test.

The PIP Assessment Process

Here’s how the PIP assessment process works:

1) Review by DWP:

Once the Department for Work and Pensions (DWP) reviews your form, you will have an assessment.

2) Assessment Methods:

Conducted in person at an assessment centre.

Can also be done over the phone or through a home visit.

3) Adjustments:

If you need any adjustments to attend your assessment, contact the DWP in advance.

4) Accessibility:

If you receive a letter for an assessment that is not accessible to you, reach out to the organisation that arranged it (Capita or Independent Assessment Services (IAS)).

5) Answering Questions:

The assessor will ask questions similar to those in your application form.

You will need to discuss your condition and how it affects your daily life.

6) Support:

You can bring someone with you to the PIP assessment if you think it would be helpful.

How to Apply for Personal Independence Payment?

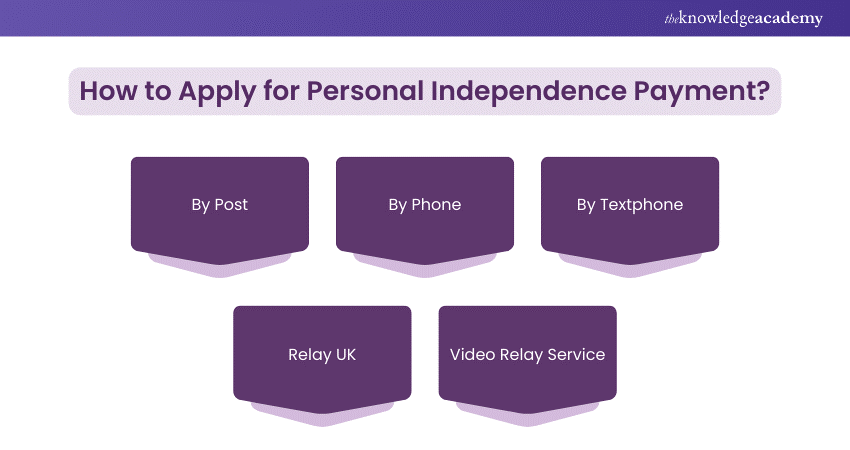

To apply for Personal Independence Payment (PIP), you need to contact DWP. Here are the ways you can do this:

a) By Post: Send a letter to Freepost DWP PIP 1

b) By Phone: Call 0800 917 2222

c) By Textphone: Use 0800 917 7777

d) d) Relay UK: Dial 18001, then 0800 917 2222

e) Video Relay Service: Available for British Sign Language (BSL) users

The PIP process can take several months and involves the following steps:

a) Contacting the DWP to start your claim

b) Filling in your PIP claim form and providing supporting evidence

c) Attending an assessment if required

d) Receiving the outcome of your claim

e) If you didn’t receive a reply from the DWP, it’s a good idea to contact them to check on the progress of your claim.

Take control of your financial future – Join our Financial Management Course and enhance your professional skills.

How the DWP Makes Decisions on PIP Claims?

During the assessment for PIP Payments, a healthcare provider will assess your capability to carry out different daily living and mobility tasks. They evaluate how your health condition or disability affects your capacity to carry out daily tasks. They also assess how much help you need to handle these responsibilities.

The health professional proceeds to draft a report for the DWP. A DWP decision maker uses this report to assess your eligibility for PIP, your payment rate, and the length of time the payments will be made.

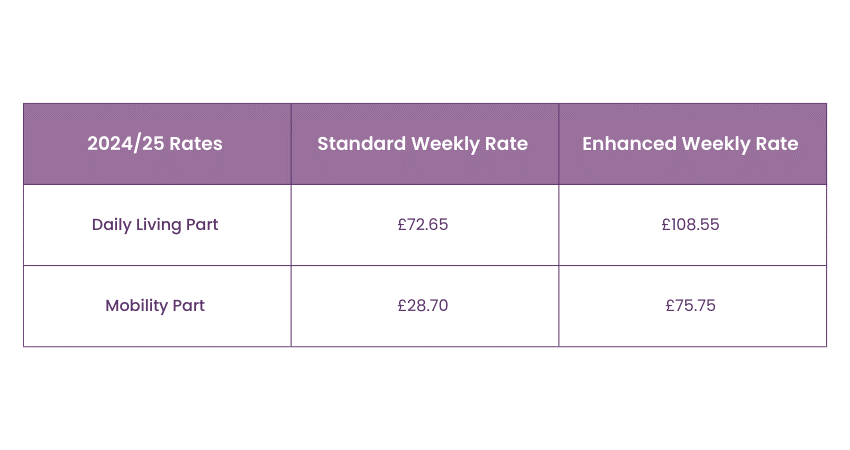

PIP is divided into two parts. They include the daily living component and the mobility component. Each component has two payment rates, which are the standard rate and the enhanced rate.

a) Standard Rate: Given if your ability to perform activities is limited.

b) Enhanced Rate: Given if your ability to perform activities is severely limited.

The Daily Living Activities

To qualify for the daily living component of PIP, you must have a physical or mental condition that affects your ability to perform some or all of the following activities:

a) Preparing food

b) Eating and drinking

c) Managing your treatments

d) Washing and bathing

e) Managing toilet needs or incontinence

f) Dressing and undressing

g) Communicating verbally

h) Reading and understanding written information

i) Socialising with others

j) Making decisions about money

The Mobility Activities

To qualify for the mobility component of PIP, you must have a physical or mental condition that affects your ability to:

a) Plan and follow journeys

b) Move around

Enhance your career with our Certified Pension Administration Training – Join now and secure your future!

How Your Abilities Are Scored?

DWP will total your points from all the daily living and mobility activities to determine your PIP eligibility and rate.

Check What the Daily Living Scores Mean

a) 8 to 11 points: Standard rate

b) 12 points or more: Enhanced rate

Check What the Mobility Scores Mean

a) 8 to 11 points: Standard rate

b) 12 points or more: Enhanced rate

Example:

Jacob can walk up to 50 meters with a walking stick but cannot repeat this due to exhaustion and pain. He can, however, walk up to 20 meters multiple times a day. Based on this, Descriptor (e) applies to him, scoring him 12 points. This score qualifies him for the enhanced rate of the mobility component.

What You’ll Receive from PIP?

As we mentioned above, PIP consists of two main components: the Daily Living Component and the Mobility Component. Each component has two rates: the Standard Rate and the Enhanced Rate. Read ahead to explore them.

PIP Amounts

PIP is tax-free and paid every four weeks. Your income or savings do not affect the amount you receive, and you can claim it whether you are employed or not.

Notify the Department for Communities (DfC) immediately if there are any changes in your personal circumstances or how your condition affects you.

Boost your financial skills and unlock new opportunities with our expert-led Finance Courses. Start today!

Conclusion

Personal Independence Payment provides essential financial support to individuals with long-term health conditions or disabilities. This assistance helps them manage daily living and mobility needs. By offering both Standard and Enhanced Rates for its components, PIP Payments ensures that recipients receive the appropriate level of assistance. This assistance is tailored based on their specific circumstances.

Learn essential pension management skills and build a confident retirement plan with our Retirement and Pensions Training - Register now!

Frequently Asked Questions

Avoid saying you can do tasks easily if you struggle with them. Be honest about your difficulties and how they impact your daily life. Downplaying your condition can lead to an inaccurate assessment.

Yes, PIP may contact your GP or other healthcare professionals for additional information about your condition. This helps them make a more accurate assessment of your needs and eligibility for support.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Finance Courses, including Retirement and Pensions Training, Financial Management Course and Financial Modelling Course. These courses cater to different skill levels, providing comprehensive insights into Benefits of Corporate Finance for Organisations.

Our Accounting and Finance Blogs cover a range of topics related to Retirement and Pensions, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Finance Skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Retirement and Pensions Training Course

Retirement and Pensions Training Course

Fri 20th Dec 2024

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please