We may not have the course you’re looking for. If you enquire or give us a call on + 800 908601 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The emergence of Neobanks and Fintech has become a focal point, revolutionising traditional banking. Understanding the Difference Between Neobanks and Fintech is crucial, as these terms often intermingle but represent distinct facets of financial innovation. Neobanks is a digital banking service subset within fintech, a broader term containing various technologies that transform various aspects of the financial industry.

Table of Contents

1) What is a Neobank?

2) What is Fintech?

3) Difference between Fintech and Neobank

4) Conclusion

What is a Neobank?

Neobanks, a recent entrant into the financial arena, distinguish themselves by their absence of physical branches and lack of legacy systems, a departure from the conventional banking model. Instead of relying on in-person visits to bank branches, Neobank clients manage their accounts through user-friendly mobile apps and online interfaces.

Moreover, the absence of costly overheads related to maintaining physical locations and the substantial IT investments required by traditional banks positions Neobanks as cost-efficient alternatives. Consequently, they often provide more competitive rates on financial products, including loans and credit cards.

Such an allure makes Neobanks particularly appealing to small businesses seeking economical financial solutions. As these digital institutions continue redefining the banking landscape, their agility and cost-effectiveness reshape the financial industry paradigm.

Now, Neobanks, as digital disruptors, distinguish themselves with innovative features. Operating exclusively online, they eschew physical branches for a fully digital experience. Neobanks provides 24/7 accessibility, real-time transaction tracking, and user-friendly mobile apps. Cost-effective due to the absence of brick-and-mortar overheads, they often offer competitive rates on loans and credit cards. Some specialise in personalised financial management tools, creating a seamless and tailored banking experience. Neobanks also frequently collaborate with third-party fintech providers, fostering a dynamic financial services ecosystem.

What is Fintech?

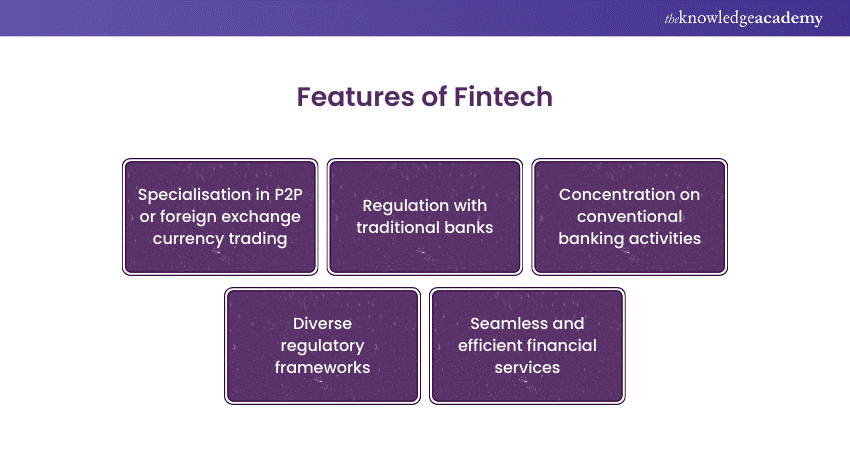

Fintechs, short for financial technology companies, encompass a diverse array of digital services, ranging from payment processing to investment and lending. Many Fintechs specialise in specific niches like peer-to-peer (P2P) lending or foreign exchange currency trading.

Further, by often regulating traditional banks or neobanks, Fintechs extend their services and products to a broader audience. Despite the shared objective of providing financial convenience, Neobanks and Fintechs diverge in their strategic focus. Neobanks primarily concentrate on conventional banking activities, such as deposits and loans.

In contrast, Fintechs frequently push boundaries by introducing innovative products like peer-to-peer payment systems or cryptocurrency investments. Additionally, Neobanks typically necessitate a full retail banking license, while Fintechs may operate under diverse regulatory frameworks, contingent on their geographical location globally. This dynamic interplay between Neobanks and Fintechs underscores the evolving financial services landscape.

Fintechs, at the forefront of financial innovation, showcase diverse and cutting-edge features. These tech-driven companies revolutionise financial services, offering seamless and efficient solutions. From payment processing to investment, lending, and insurance, fintechs cover a broad spectrum. They often collaborate with traditional banks to enhance existing services or independently introduce groundbreaking products.

Fintechs leverage advanced technologies like blockchain and AI, prioritising speed, accessibility, and cost-effectiveness. Their user-centric approach fosters financial inclusion, transforming the industry by providing innovative solutions, disrupting conventional models, and shaping a more dynamic and accessible financial landscape.

Grow your career with vital knowledge about Finance by signing up for our Accounting & Finance Training now!

Difference between Fintech and Neobank

The financial sector perceives Fintech and Neobank as related yet distinct concepts. While Neobanks are ‘digital-only', Fintechs encompass a broad range of tech-centric financial services. Have a look at their distinctions:

|

Aspect |

Fintech |

Neobank |

|

Definition |

Encompasses tech-driven financial services, leveraging technology for enhanced financial processes across various sectors such as payment, investment, lending, insurance, and financial planning. |

A subset of fintech, Neobanks specifically refer to online-only, digital banks operating exclusively in the digital space without physical branches. |

|

Focus |

Addresses a broad spectrum of financial services and may collaborate with established banks to enhance existing offerings or develop new financial solutions. |

Specialises in providing digital banking services, including checking, savings, and payments, with a focus on a mobile-centric, user-friendly experience. Some may collaborate with fintech companies to expand their services. |

|

Industry presence |

Operates across diverse financial sectors beyond banking, including payment processing, investment, lending, insurance, and financial planning. |

Concentrates solely on the banking industry, offering digital banking services without the need for physical branches. Part of the broader fintech landscape. |

|

Physical presence |

May or may not have physical branches and can collaborate with traditional banks that do have physical locations. |

Exclusively operates in the digital realm, devoid of physical branches, providing services through mobile apps and online platforms. |

|

Collaboration |

Frequently collaborates with established banks and financial institutions to enhance or complement existing services. |

May collaborate with fintech companies to expand service offerings, enhancing the overall digital banking experience. |

|

Service offering |

Offers a diverse range of tech-driven financial services beyond banking, catering to various customer needs. |

Primarily focuses on digital banking services, including checking, savings, and payments, with an emphasis on a seamless, user-friendly experience. |

|

Innovation |

Introduces innovative solutions across multiple financial sectors, disrupting traditional banking models. |

Disrupts traditional banking by providing innovative, digital-only solutions, challenging conventional banking practices. |

|

Regulatory requirements |

Operates under various regulatory frameworks depending on the specific financial services provided and regional regulations. |

Generally requires a full retail banking license due to its exclusive focus on banking services within the digital realm. |

|

Impact on the Financial Industry |

Influences the financial industry by introducing technological advancements, improving customer experiences, and challenging traditional banking norms. |

Shapes the financial industry by revolutionising banking practices, offering cost-effective digital solutions, and redefining the customer-bank relationship. |

Master the concept of Fintech and learn its latest advancements by signing up for our FinTech Course today!

Conclusion

In conclusion, the transformative forces of financial innovation are reshaping the industry landscape. The Difference Between Neobanks and Fintech is evident in their distinct approaches, where Fintech is a broad spectrum of tech-driven financial services, and Neobanks is a digital-only bank revolutionising traditional banking. Together, they redefine the future of finance, offering diverse and customer-centric solutions.

Frequently Asked Questions

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Courses, including Payroll Courses, Finance for Non-Financial Managers, Financial Management Courses and more. These courses cater to different skill levels, providing comprehensive insights into What is Credit Risk.

Our Business Skills Blogs cover a range of topics related to Fintech, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting & Finance skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

FinTech Course

FinTech Course

Fri 29th Nov 2024

Fri 6th Dec 2024

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please