We may not have the course you’re looking for. If you enquire or give us a call on + 800 908601 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Finance is a complex and vital part of every business and organisation. To start your journey with finance, you first need to understand What is Financial Accounting? The definition of Financial Accounting states that it is a process of recording, summarising, and reporting a company's financial transactions in a structured manner.

According to Fortune Business Insights, the global accounting software market is expected to reach $20 billion by 2026. In this blog, we will learn – What is Financial Accounting? The concepts of Financial Accounting and why it is important for businesses.

Table of Contents

1) What is Financial Accounting?

2) Components of Financial Accounting

3) Importance of Financial Accounting

4) Role of Financial Accounting in business

5) Challenges in Financial Accounting

6) Conclusion

What is Financial Accounting?

Financial Accounting is the process of documenting, evaluating, and reporting every corporate transaction. It is to represent their financial achievements to the promoters and users. The primary objective of accounting is to provide an accurate and comprehensive outlook of a business's financial performance and position.

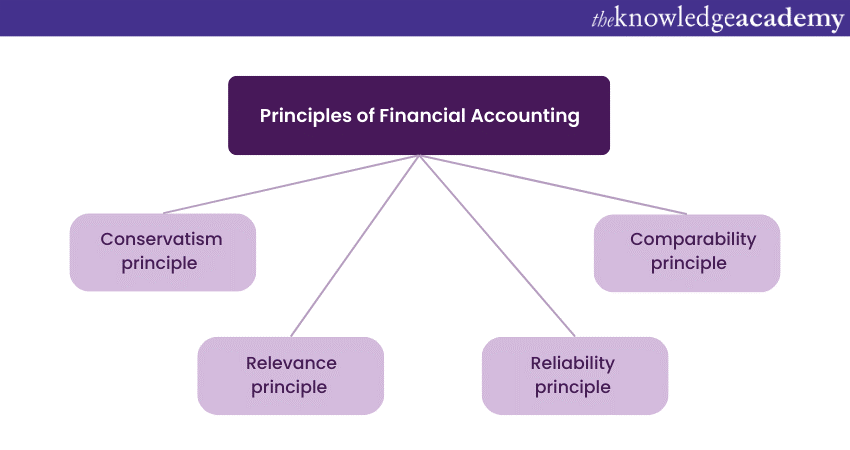

Financial accounting is built upon a set of fundamental principles that guide the process. These principles play a crucial role in ensuring the accuracy, transparency, and relevance of financial statements. Some of these fundamental principles are as follows:

Conservatism principle

The conservatism principle, also known as the principle of prudence, encourages accountants to exercise caution and avoid being overly optimistic when making financial judgments. This principle acknowledges that uncertainties exist in business, and it advises accountants to focus on the side of understating rather than overstating assets and revenues.

By adopting a conservative approach to accounting, companies can avoid potential overvaluation and present a more realistic picture of their financial position.

Relevance principle

The relevance principle dictates that financial information should be relevant to the decision-making needs of various users, such as investors, creditors, and management. This principle emphasises that the information included in financial statements should have the capacity to impact users' decisions. Irrelevant or immaterial information can clutter financial reports and distract users from making informed choices.

It, therefore, holds accountants accountable for selecting and presenting information that is meaningful and directly contributes to stakeholders' understanding of the business's financial performance and position.

Reliability principle

Reliability is a fundamental principle of accounting. This principle underscores the importance of accurate, unbiased, and trustworthy financial reporting. Information presented in financial statements should be free from error, bias, or manipulation.

By ensuring the reliability of financial data, businesses maintain the credibility of their reporting, which, in turn, fosters trust among stakeholders. Reliable financial information is a cornerstone for making informed decisions, whether it's for investing, lending, or strategic planning.

Comparability principle

The comparability principle enables stakeholders to compare financial information across different periods and companies. It emphasises the need for consistency in accounting methods and reporting formats. When financial statements are presented in a consistent manner over time, users can identify trends, assess performance changes, and draw meaningful comparisons. This principle not only promotes transparency but also allows stakeholders to evaluate a company's financial health relative to industry peers, aiding in more informed decision-making.

Components of Financial Accounting

The components of Financial Accounting are the pillars that make the accounting reports accurate and trustworthy. The components can be much more complex based on various factors like the size of the data and the nature of the organisation. Although some of the most fundamental and important components of Financial Accounting are as follows:

Financial statements

Financial statements are the final outcomes of the accounting process, and its three basic components include balance sheets, income statements, and cash-flow statements.

Balance sheet: It is also known as the statement of financial position. The balance sheet includes the details of the organisation's assets, liabilities, and shareholders' equity at a specific point in time. It illustrates the company's financial standing and its ability to meet short-term and long-term obligations.

Income statement: Income statements, also called profit and loss statements, showcase a company's revenues, expenses, and resulting net income or loss over a defined period. It provides insights into a company's operational performance and its ability to generate profits.

Cash flow statement: These statements detail the movement of cash in and out of a company over a specific period. It categorises cash flows into operating, investing, and financing activities, helping stakeholders understand how a company manages its cash resources.

Recording transactions

Accounting is a process of recording accurate and relevant data about the company’s year-on-year transactions and other financial decisions both internally and externally. Every financial transaction, whether it involves revenue, expenses, assets, or liabilities, is carefully documented.

Recording these transactions and data is typically done using the double-entry accounting system, where every transaction affects at least two accounts, ensuring that the accounting equation remains balanced (Assets = Liabilities + Equity). This method not only prevents errors but also allows for accurate tracking of financial changes.

Learn everything about financial recording and bookkeeping; register for our Book Keeping Training!

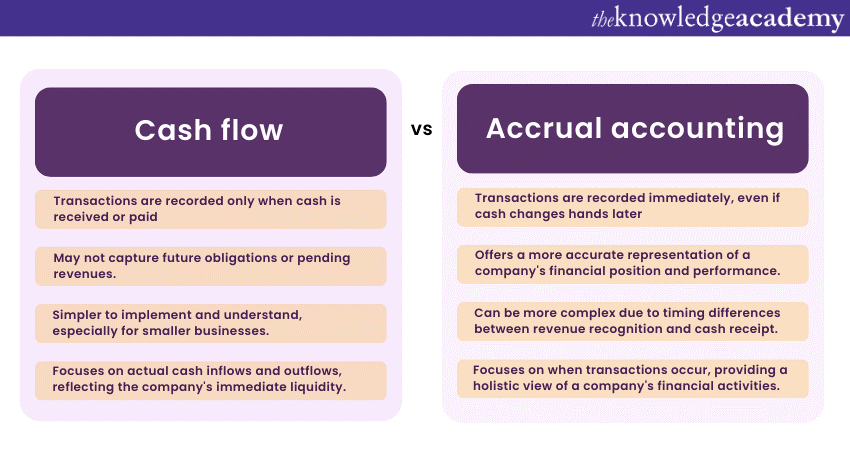

Accrual vs cash basis accounting

Financial Accounting often operates on an accrual basis, where transactions are recognised when they occur, regardless of when cash changes hands. This method provides an accurate representation of a company's financial activities and performance.

On the other hand, the cash basis accounting includes transactions when cash is received or paid. It is a simple form of accounting, although it might not provide a comprehensive view of a company's financial health since it doesn't capture future obligations or pending revenues.

Importance of Financial Accounting

Financial Accounting serves as a system that enables businesses to make business operations transparent and informed, playing a pivotal role in facilitating communication, decision-making, compliance, and confidence among various stakeholders. Some of the main importance of accounting are as follows:

Decision-making for stakeholders

One of the primary reasons Financial Accounting holds immense importance is its role in aiding decision-making for stakeholders. Business owners and management teams rely on accurate and up-to-date financial information to make strategic choices. Financial statements provide insights into revenue streams, cost structures, profitability, and operational efficiency.

These insights guide resource allocation, investment decisions, and long-term planning. Investors also use financial statements to assess the health and potential of a company, determining whether it aligns with their objectives and risk tolerance.

Regulatory compliance

Financial Accounting operates within a framework of standards and regulations set by authoritative bodies like the International Financial Reporting Standards (IFRS). Adhering to these standards ensures that financial statements are accurate, consistent, and comparable. Compliance with these standards is not only ethically essential but often legally mandated.

Businesses must provide transparent and accurate financial information to regulatory agencies, shareholders, and the public. Proper Financial Accounting practices safeguard against fraud, misrepresentation, and unethical reporting.

Investor confidence

Investor confidence is a cornerstone of healthy financial markets and successful businesses. Accurate Financial Accounting fosters investor confidence by providing transparency and insights into a company's financial health.

When investors have access to reliable financial information, they can make informed decisions about buying, holding, or selling securities. A company that consistently reports accurate and transparent financial data is more likely to attract investment and retain shareholder trust over the long term.

Business performance evaluation

Financial Accounting allows businesses to evaluate their performance objectively. By analysing financial statements over different periods, businesses can identify trends, strengths, and weaknesses.

This analysis aids in refining strategies, adapting to market changes, and seizing opportunities for improvement. Accurate Financial Accounting also supports effective budgeting and forecasting, enabling management to allocate resources efficiently and set achievable financial goals.

Transparency and accountability

Transparency in financial reporting is integral to building and maintaining relationships with stakeholders. Accurate financial statements demonstrate a company's commitment to transparency and accountability, fostering positive relationships with customers, employees, suppliers, and investors. Open communication about a company's financial health builds trust and helps stakeholders make informed decisions that align with their interests.

Role of Financial Accounting in business

Financial Accounting plays a multidisciplinary role in the world of business. It serves as the backbone of transparent and effective business operations by providing a structured framework for recording, summarising, and communicating financial information.

This information is crucial not only for internal decision-making but also for building trust, complying with regulations, and facilitating external communication with various stakeholders. Mentioned below are some of the significant roles of accounting in businesses:

Internal management

Financial Accounting serves as a vital tool for internal management within a business. It provides the management team with insights into the company's financial performance and position. By accounting and analysing the financial statements, balance sheets, income statements, and cash flow statements, managers can understand the company's revenue sources, cost structures, and overall profitability.

This information forms the basis for making informed decisions regarding resource allocation, budgeting, and setting strategic goals. Financial Accounting also aids in evaluating the efficiency of different business units, identifying areas of improvement, and aligning strategies with market trends.

It empowers managers to assess the impact of different scenarios, optimise operations, and allocate resources effectively, thereby contributing to the overall growth and sustainability of the business.

Register for our Financial Management Training to unlock your business potential through finance and take your business to the next level!

External communication

Accounting's role in a business is beyond its internal applications, and Financial Accounting serves as a language of communication with external stakeholders, including investors, creditors, regulatory bodies, and the public. External parties like partnerships or investment firms often lack direct insight into a company's operations, making accurate and transparent financial information crucial for building trust and credibility.

Creditors, such as banks and lenders, also utilise financial information to evaluate a company's creditworthiness. Accurate financial reporting enables creditors to assess the risk associated with lending money to the business.

Regulatory bodies require businesses to adhere to specific accounting standards and reporting requirements to ensure transparency and fair practices. Failing to comply with the regulations might lead to legal consequences, highlighting the importance of accurate accounting in maintaining legal and ethical standards.

Register for our Accounting Masterclass and elevate your financial skills!

Challenges in Financial Accounting

If you are to understand What is Financial Accounting and what is its importance, you must know the challenges of the process of accounting. Navigating the challenges is essential to ensure accurate, transparent, and reliable financial reporting. Some of the common challenges in Financial Accounting are as follows:

Complex transactions: Modern business operations often involve intricate transactions that pose challenges to accurate financial reporting. Mergers, acquisitions, complex financial instruments, and revenue recognition are examples of transactions that can be convoluted in the Market in Financial Instruments Directive context.

Data security and integrity: In times when cybercrimes and data breaches are common, maintaining the security and integrity of financial data is paramount. Financial records are vulnerable to hacking, unauthorised access, or corruption, which can have severe consequences for both businesses and stakeholders.

Accuracy: Accuracy is the foundation of Financial Accounting. Minor errors in accounting can have significant implications on financial statements and, subsequently, on business decisions. Ensuring that each transaction is recorded correctly, entries are categorised accurately, and financial statements are free from errors is a constant challenge.

Regulations and compliance: The concept of accounting operates within a framework of rules and regulations set by authoritative bodies. However, these regulations are not static; they evolve in response to changing economic environments and emerging business practices.

Start Trading Smarter Today! Enroll in Our Cryptocurrency Trading Training Now!

Conclusion

Financial Accounting is the driving tool towards the success of a business or organisation. Companies and professionals need to understand - What is Financial Accounting? Its concepts and its importance to the business model. Additionally, being well-versed in Financial Modelling Interview Questions can help professionals showcase their expertise in financial analysis and decision-making. To gain deeper insights and practical knowledge, referring to an SAP Financial Accounting PDF can be immensely beneficial. We hope this blog will help you understand everything you need to know about accounting and its core fundamentals.

To explore the world of finance and accounting and elevate your skills, Register for our Accounting & Finance Training!

Frequently Asked Questions

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Accounting Course

Accounting Course

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please