We may not have the course you’re looking for. If you enquire or give us a call on +60 1800812339 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Picture this- a small business owner starts accepting Cryptocurrencies and suddenly sees a surge in international customers. This scenario highlights the transformative power of digital assets. Considering this, are you curious about the latest developments in the digital currencies world? If so, our blog on “Top Cryptocurrency Trends” can help you explore the most significant shifts shaping the future of finance.

Moreover, a 2023 Statista report, states that the Cryptocurrency market is projected to reach about 31.17 billion GBP. The same report reveals that the volume of users is expected to cross 950 million by 2027. Given this context, let’s dive into the ultimate blog and explore the Cryptocurrency Trends in detail!

Table of Contents

1) Exploring the top Cryptocurrency Trends

2) Importance of Understanding Current Crypto Trends

3) Long-term vs Short-term Market Trends

4) Role of Cryptocurrency in Future Economies

5) Conclusion

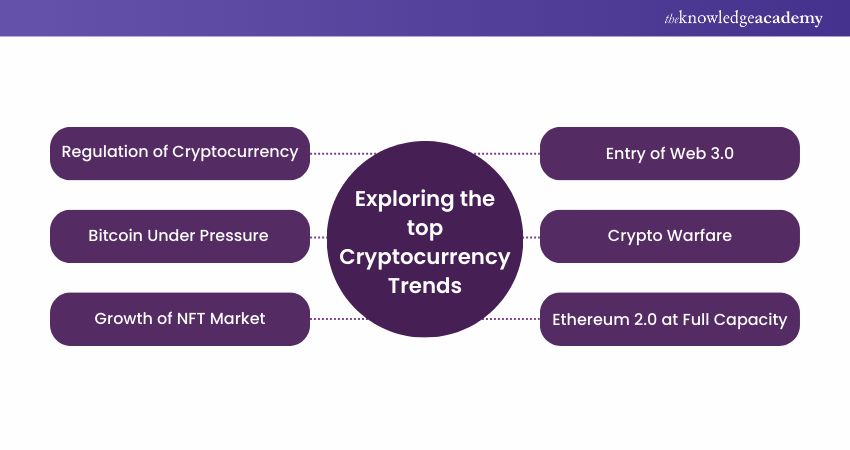

Exploring the top Cryptocurrency Trends

Cryptocurrency is basically digital or virtual currency underpinned by cryptography, providing enhanced levels of security. Unlike traditional money, cryptocurrencies are decentralised, operating on technology known as blockchain.

Now, this technology creates a distributed ledger enforced by a network of computers or 'nodes'. Bitcoin, the first and most well-known cryptocurrency, has paved the way for over 6,000 other variants, known as altcoins.

Despite their volatility, cryptocurrencies are gaining acceptance worldwide for their potential to provide fast, secure, and low-cost transactions, reshaping the financial landscape. Here are the 10 top Cryptocurrency Trends described in detail as follows:

Regulation of Cryptocurrency

The regulation of Cryptocurrency comprises legal frameworks and guidelines instituted by either governments or regulatory bodies. The regulations are instituted to help them oversee the utilisation, trade, and taxation practices of Cryptocurrencies.

More importantly, they aim to prevent illicit activities, protect consumers, and maintain the markets’ stability and the security of digital assets. Here are the many facets associated with the regulation of Cryptocurrencies:

a) Global Disparity: The laws governing digital currencies differ in different countries because some of them support new technologies while others restrict them. For example, Bitcoin is accepted as a mode of payment in Japan; however, China has restricted the use of such currencies.

b) Legal Framework: Global governments are trying to come up with laws by which the usage of Cryptocurrencies can be controlled. These can be such things as obtaining licenses for Cryptocurrency trading platforms also known as exchanges or regulation of Initial Coin Offerings (ICO).

c) Anti-money Laundering (AML): Correspondingly, the supervisory authorities may try to protect Cryptocurrencies from being involved in illicit operations, including money laundering or financing of terrorism. Some of these measures are advocating for Know Your Customer (KYC) regulation on crypto exchanges.

d) Taxation: Tax authorities of the countries are increasingly integrating Cryptocurrency transactions into taxes. In many nations, Cryptocurrencies are considered for tax purposes as properties hence liable for capital gains tax.

e) Security Standards: Regulations are being put in place to ensure that exchanges and other Cryptocurrency service providers meet certain security standards to protect consumers and their digital assets.

f) Consumer Protection: Regulatory bodies strive to safeguard the rights of consumers in the crypto market, providing protection against fraud, misinformation, and market manipulation. This is a crucial area of regulation to maintain trust and stability within the Cryptocurrency market.

Approval of Crypto Exchange Traded Fund (ETF)

The Exchange Traded Fund (ETF) is a sort of investment fund and exchange-traded product that tracks an index, sector, commodity, or asset. ETF shares are typically traded on public stock exchanges. Here are some key aspects of an ETF’s approval, described as follows:

a) Market Exposure: The approval of a crypto ETF allows investors to gain exposure to Cryptocurrencies without the necessity to directly buy, store, or manage them.

b) Liquidity: Crypto ETFs are traded on traditional stock exchanges and might be purchased and sold on the trading day at market prices, providing investors with increased liquidity.

c) Diversification: Crypto ETFs often track multiple cryptocurrencies, providing investors with the opportunity to make their portfolio diverse within the crypto market.

d) Regulatory Oversight: ETFs are subject to regulations by financial authorities. This oversight can provide a layer of protection for investors, enhancing trust in the crypto market.

e) Increased Adoption: Approval of a crypto ETF can signal regulatory acceptance, potentially leading to increased adoption of cryptocurrencies by traditional investors and institutions.

f) Risk Management: Crypto ETFs allow investors to access the potential returns of the volatile crypto market, while mitigating some of the associated risks with direct crypto ownership.

Bitcoin Under Pressure

Bitcoin is the first and globally well-reputed Cryptocurrency launched in 2009. It is basically a decentralised digital currency without a centralised bank system or an administrator. Here are the key reasons describing the pressure on Bitcoin in the coming years:

a) Regulatory Scrutiny: With its rising popularity, Bitcoin is facing increasing scrutiny from regulators worldwide. The regulatory changes can significantly impact its value and acceptance.

b) Scalability Issues: Bitcoin's current technology has scalability concerns. Its block size and processing time for transactions can limit its growth and functionality.

c) Environmental Concerns: Bitcoin mining consumes a significant amount of energy, leading to environmental concerns. These concerns may influence its acceptance and value in an increasingly eco-conscious world.

d) Competition: The rise of other cryptocurrencies, particularly those that offer improved technologies or functionalities, poses a challenge to Bitcoin's dominance.

e) Volatility: Bitcoin's price is extremely volatile, influenced by many factors such as market demand, investor sentiment, regulatory news, and macroeconomic trends. This volatility can deter potential users or investors.

f) Security Threats: Despite its cryptographic security, Bitcoin is a prime target for cybercriminals. Any security breaches can undermine confidence in Bitcoin and negatively affect its value.

Acquire the skills to excel in rapidly growing Blockchain industry – join our Blockchain Trainings and become a certified expert!

Growth of NFT Market

Non-Fungible Tokens (NFTs) are digital assets representing ownership or being a proof of authenticity of a distinct item or piece of content, using Blockchain Technology. Here are the various aspects of the NFT market’s growth, listed as shown below:

a) Digital art Boom: The NFT market has seen substantial growth with the boom in digital art. High-profile sales, such as Beeple's artwork selling for 65 million GBP, have drawn significant attention to the space.

b) Broadening Scope: NFTs are expanding beyond digital art into other areas like music, real estate, and even tweets. This broadening scope is contributing to market growth.

c) Crypto Wealth: With the rise of cryptocurrency wealth, many investors are actively looking for new ways to diversify their portfolios, driving demand for NFTs.

d) Blockchain Adoption: As understanding and adoption of blockchain technology grow, so does the NFT market.

e) Celebrity and Brand Engagement: Many celebrities and brands have entered the NFT market by creating and trading their NFTs, which not only boosts market visibility but also adds credibility and attracts new investors.

f) User Engagement: NFTs offer a unique way for content creators to connect with their audiences, driving higher adoption rates and market expansion.

Entry of Web 3.0

Web 3.0, also called the ‘semantic web’, represents the next generation of internet technology. It is expected to deliver intelligent, personalised experiences and encourage efficient information exchange. Here are the many facets surrounding the entry of Web 3.0:

a) Artificial Intelligence: Web 3.0 leverages AI and Machine Learning to interpret content, understand context, and deliver more personalised user experiences.

b) Semantic web: By structuring data in a way that machines can understand, Web 3.0 facilitates more accurate and targeted content retrieval, enhancing user interaction with the web.

c) 3D Graphics: Enhanced visualisation tools and 3D graphics are a significant part of Web 3.0, offering users a more immersive and engaging browsing experience.

d) Ubiquitous Connectivity: Web 3.0 aims for constant, seamless connectivity, integrating multiple platforms and devices for a smoother user experience.

e) Blockchain Integration: Web 3.0 integrates blockchain technology for better privacy, security, and decentralisation, empowering users to own and control their data.

f) Interoperability: Web 3.0 enhances interoperability between different web services, making the internet more collaborative and promoting the sharing and combination of services.

Register for our expert-led Investment and Trading Training and navigate the markets like a pro!

Crypto warfare

Cyber warfare refers to the usage of technology and the internet to conduct or counter warfare in cyberspace. It involves actions by a nation-state or international organisation to penetrate another nation's computer systems or networks with the agenda of causing damage or disruption.

a) Weaponisation of Cryptocurrencies: Cryptocurrencies, due to their anonymous and decentralised nature, can be used for illicit activities, including financing of terrorism and cyber warfare operations.

b) Crypto-jacking: This involves hackers using a victim's computer processing power to mine cryptocurrencies without their knowledge, a method which could be employed on a larger scale during cyber warfare.

c) Ransomware Attacks: In these attacks, hackers encrypt a victim's data and demand ransom in cryptocurrency to unlock it. Such tactics could be used as a form of economic warfare.

d) Disruption of Crypto Infrastructure: In the event of conflict, attacks could target cryptocurrency exchanges or blockchain infrastructure, aiming to disrupt financial systems and cause economic instability.

e) Use of Privacy Coins: Privacy-focused cryptocurrencies can be used to conduct covert operations, hiding the transactions from surveillance.

f) Cryptocurrency as a Financial Weapon: In a global economy, countries might use cryptocurrencies to bypass sanctions, manipulate economic stability, or exert economic influence.

Acquire a solid understanding of how to trade Cryptocurrency by signing up for the Cryptocurrency Trading Training now!

Enhanced Features of Crypto

Cryptocurrencies offer a variety of enhanced features over traditional forms of money, leading to numerous unique use cases. Here is a list of the features and use cases of crypto:

a) Decentralisation: Cryptocurrencies operate on decentralised networks using Blockchain Technology, removing the requirement for a central authority or intermediary. This feature is beneficial for reducing transaction costs and increasing financial inclusivity.

b) Security: The use of cryptographic protocols in cryptocurrencies ensures secure transactions and protects against fraud, making them ideal for online transactions and digital economies.

c) Transparency: All of the Cryptocurrency transactions are recorded on the Blockchain, giving transparency and traceability. The transaction records can be particularly useful in areas such as supply chain management.

d) Speed and Accessibility: Cryptocurrencies enable quick, global transactions, making them ideal for international transfers. They are also accessible to anyone having an internet connection, offering financial services to unbanked populations.

e) Programmability: Cryptocurrencies can be programmed to produce smart contracts that automatically get executed when certain conditions are met. This functionality is driving innovations in fields like Decentralised Finance (DeFi) and the creation of Decentralised Autonomous Organisations (DAOs).

f) Asset Tokenisation: Cryptocurrencies allow for the tokenisation of assets - both tangible, like real estate, and intangible, like intellectual property. This can democratise investment.

Master the skills to build and deploy smart contracts – sign up for our Ethereum Developer Training now!

Ethereum 2.0 at full Capacity

Ethereum 2.0, also known as Eth2 or Serenity, is the upcoming an upgrade to the Ethereum blockchain. The crypto upgrade aims to improve the scalability, security, and sustainability of the Ethereum network.

a) Proof of Stake (PoS): Ethereum 2.0 will switch from a Proof of Work (PoW) to a PoS consensus mechanism, which is more energy-efficient and can process transactions faster.

b) Sharding: To improve scalability, Ethereum 2.0 will introduce sharding. Shards are smaller chains that process their transactions and smart contracts, significantly increasing the network's capacity.

c) Crosslinks: Crosslinks are references to shard chains in the Ethereum 2.0 Beacon Chain. This system will ensure all shards are synced with the main chain, ensuring network security and integrity.

d) Ethereum Virtual Machine (EVM): The EVM, which enables the execution of smart contracts, will be optimised in Ethereum 2.0 to improve its efficiency and capabilities.

e) eWASM: An acronym for ‘Ethereum WebAssembly’, eWASM will replace EVM, allowing developers to execute code faster, support more programming languages, and improve the developer experience on the platform.

f) Sustainability: By using PoS and sharding, Ethereum 2.0 aims to significantly reduce energy consumption, addressing one of the major crucial criticisms of blockchain technology and cryptocurrencies.

Join our expert-led Bitcoin And Cryptocurrency Course and explore the intricacies of digital currencies!

Increase in Layer 2 Smart Contracts

Layer 2 (L2) smart contracts are gaining momentum, with experts predicting a lasting trend. Bitcoin and Ethereum, for instance, belong to the category of "Layer 1" cryptocurrencies, serving as their settlement layer.

Nevertheless, Layer 1 blockchain networks face scalability challenges. As a solution, the development of an alternative framework, such as Layer 2 smart contracts, has been deemed essential to achieve enhanced scalability. This underscores the significance of L2 smart contracts in driving mainstream cryptocurrency adoption by enabling limitless scaling possibilities.

Crypto to Continue Driving the Adoption of Green Energy

Cryptocurrencies have faced criticism for their environmental impact, particularly concerning Bitcoin mining, which is estimated to generate huge amount of carbon emissions in the United Kingdom alone.

Given the substantial carbon footprint associated with Proof of Work (POW) consensus mechanisms, which rely on fossil fuel-generated energy, there is a growing shift. Emerging blockchain networks are increasingly adopting more environmentally friendly consensus mechanisms to address these concerns.

11) Central Bank Digital Currencies (CBDCs)

An increasing number of central banks are considering the issuance of digital currencies. This innovation could transform our use and perception of money, making transactions quicker, more affordable, and more secure.

Moreover, digital currencies could improve financial inclusion by giving access to banking services for unbanked populations. As central banks explore this frontier, the regulatory landscape will need to adapt to ensure stability and security in the financial system.

12) Decentralised Finance (DeFi)

DeFi, or decentralised finance, involves creating financial systems by utilising Blockchain Technology without the need for intermediaries like banks. This rapidly growing trend offers greater financial freedom, transparency, and accessibility.

By eliminating intermediaries, DeFi reduces costs and increases efficiency in financial transactions. As this ecosystem evolves, it promises to democratise finance, making it more inclusive and innovative.

Importance of Understanding Current Crypto Trends

In the ever-evolving Cryptocurrency world, staying informed about current trends is crucial. Let’s explore the necessity of comprehending these trends:

a) Recognising Market Trends: Analysing charts and historical data allows us to understand crypto market trends, whether they are moving upwards, downwards, or sideways. This insight enables informed decisions on when to buy or sell a Cryptocurrency.

b) Establishing Support and Resistance Levels: Technical analysis helps identify critical support and resistance levels, indicating points where demand or supply could halt price movements. Recognising these levels aids in strategic trading decisions.

c) Utilising Technical Indicators: Various technical indicators offer insights into trend strength, price momentum, and potential trend reversals. Familiarity with these indicators empowers traders to make well-informed decisions.

d) Interpreting Market Sentiment: Technical analysis helps gauge market participants’ sentiment, which significantly influences price movements. For instance, a bullish sentiment among traders can drive up the price of a particular Cryptocurrency.

e) Long-term Investment Strategy: Even for those not actively trading, understanding technical analysis informs long-term investment decisions. Observing a strong uptrend in a Cryptocurrency may signal a favourable opportunity for long-term investment.

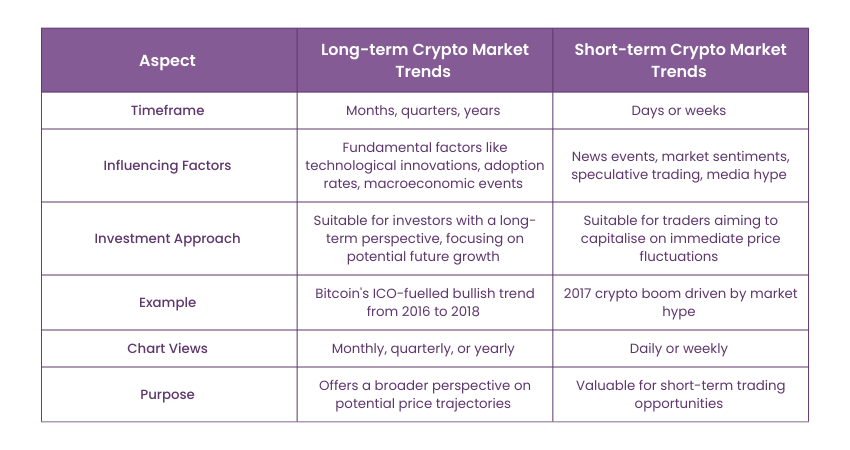

Long-term vs Short-term Market Trends

Comprehending market trends is vital for making informed investment decisions. Here’s a comparison of long-term vs short-term market trends:

Role of Cryptocurrency in Future Economies

The Types of Cryptocurrency are poised to perform a transformative role in future economies. Let’s explore their role in detail:

a) Decentralisation: Cryptocurrencies offer a decentralised alternative to traditional financial systems, reducing reliance on central banks and intermediaries.

b) Financial Inclusion: They have the potential to enhance financial inclusion, particularly in regions where traditional banking services are scarce.

c) Efficiency: Cryptocurrencies facilitate faster and cheaper cross-border transactions, eliminating the need for costly intermediaries and lengthy processing times.

d) Transparency and Security: Blockchain technology enhances trust in financial transactions by providing transparency and security, reducing fraud and corruption.

e) Economic Growth: The rise of Decentralised Finance (DeFi) platforms creates new opportunities for lending, borrowing, and investing without traditional financial institutions, driving economic growth and diversification.

f) Global Trade: Enhanced efficiency in transactions can boost global trade and economic integration.

g) Innovation: Cryptocurrencies and Blockchain Technology foster innovation in financial services, resulting in new business models and economic opportunities.

Conclusion

In conclusion, the dynamic world of Cryptocurrency is continuously evolving, presenting both opportunities and challenges. Staying updated about the latest Cryptocurrency Trends is crucial for navigating this fast-paced landscape. So, keep exploring, stay curious, and embrace the future of finance!

Discover the secrets of successful currency trading by investing in our Foreign Exchange Training – join us now!

Frequently Asked Questions

Regulatory uncertainty creates volatility in Cryptocurrency Trends, as unclear or evolving regulations can lead to rapid price fluctuations. Investors may hesitate or withdraw due to fears of potential legal repercussions, while the market remains highly sensitive, influencing both short-term and long-term trends

Blockchain enhances the security of Cryptocurrencies by creating a decentralised, immutable ledger that records all transactions. This ensures transparency, prevents fraud, and protects against unauthorised modifications, safeguarding the integrity of Cryptocurrencies.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Training, including Cryptocurrency Trading Training, Foreign Exchange Training etc. These courses cater to different skill levels, providing comprehensive insights into Pros and Cons of Cryptocurrency.

Our Business Skills blogs covers a range of topics related to Cryptocurrency Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Advanced Technology Resources Batches & Dates

Date

Cryptocurrency Trading Training

Cryptocurrency Trading Training

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please