We may not have the course you’re looking for. If you enquire or give us a call on +60 1800812339 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Double Entry Accounting is more than just a method; it’s the backbone of accurate Financial Reporting for businesses of all sizes. Have you ever wondered how companies maintain balanced books, track profits, and prevent errors? This powerful system records transactions in two accounts, ensuring financial clarity and transparency. Let’s dive into the world of Double Entry Accounting!

Table of Contents

1) What is Double Entry Accounting?

2) How Double Entry Accounting Works?

3) Types of Accounting Used in Double Entry Accounting

4) Debits and Credits

5) Double Entry Accounting Examples

6) Double Entry Accounting Education Requirements

7) Double Entry Accounting Skills

8) Double Entry Accounting Advantages

9) Double Entry Accounting Disadvantages

10) Double Entry Accounting Softwares

11) Conclusion

What is Double Entry Accounting?

Double Entry Accounting accounts each transaction in dual aspects as the name suggests. The two aspects namely debit and credit dictate the nature of the transaction. This system of accounting ensures accuracy and overall balance. Some of the elements of trial balances include tallying debit and credit balances whilst minimising the element of risk.

Investing in Accounting Software is recommended to implement Double Entry Accounting efficiently. AI-powered Accounting Software can be especially beneficial, using algorithms to analyse data, automate data collection from various sources, and provide insights into Financial Health. Thus, it is a powerful tool for accuracy and Strategic Financial Management.

How Double Entry Accounting Works?

Double Entry Accounting operates on the principle that every transaction impacts at least two accounts, with one entry as a debit and the other as a credit. This ensures that the accounting equation: Assets = Liabilities + Equity remains balanced.

For example, if a business purchases equipment for £1,000 in cash, the equipment (asset) account is debited £1,000, while the cash (asset) account is credited £1,000. This method maintains accuracy, offering a clear, balanced view of Financial Activities.

Types of Accounting Used in Double Entry Accounting

Double Entry Accounting ensures that every Financial Transaction has two corresponding entries: a credit and a debit. Below are the key types of Double Entry Accounting:

1) Financial Accounting

a) Purpose: Prepares Financial Statements for external stakeholders (investors, creditors, regulators).

b) Role: Records Financial Transactions using debit and credit entries to maintain accurate Financial Reports.

2) Managerial Accounting

a) Purpose: Provides Financial Data for internal decision-making (budgeting, forecasting).

b) Role: Uses Double Entry to track internal transactions, ensuring balanced records.

3) Cost Accounting

a) Purpose: Determines production or service costs.

b) Role: Tracks raw materials, labour, and overhead costs through debit and credit entries.

4) Tax Accounting

a) Purpose: Focuses on Tax Compliance and planning.

b) Role: Records tax-related transactions using Double Entry, such as tax expenses and liabilities.

5) Forensic Accounting

a) Purpose: Investigate Financial Discrepancies, often related to fraud.

b) Role: Relies on Double Entry to trace discrepancies and identify anomalies.

6) Auditing

a) Purpose: Reviews Financial Records for accuracy and compliance.

b) Role: Examines Double Entry records to verify transaction accuracy and reliability.

Master the art of financial project management—join our Project Accounting Course today!

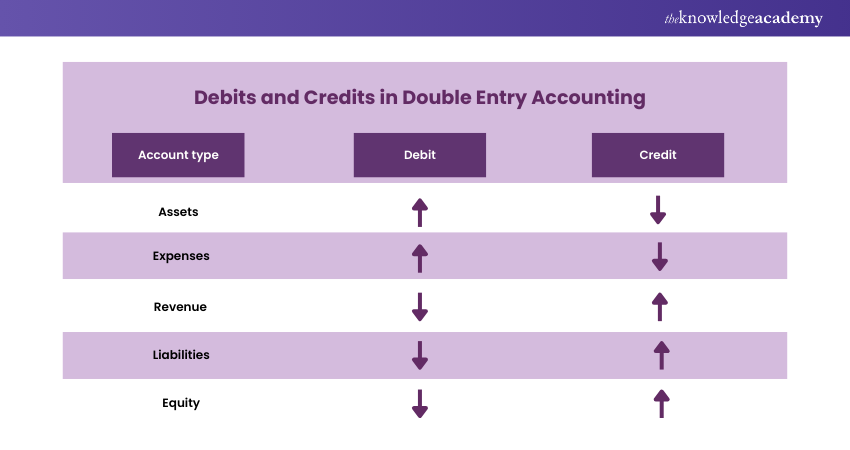

Debits and Credits

In Double Entry Accounting, debits and credits form the basis of every Financial Transaction. A debit represents an increase in asset or expense accounts and a decrease in liability or equity accounts. Conversely, a credit increases liability, equity, or revenue accounts and decreases assets or expenses. Every transaction must have minimum one debit and one credit entry, ensuring the total debits always equal total credits.

This creates a balanced financial record, maintaining the accuracy of the Accounting System. By adhering to this method, businesses can effectively track the flow of money, prevent errors, and maintain Financial Transparency. It is important for precise Financial Reporting and helps ensure that all transactions are correctly recorded and reflected in the Financial Statements.

Double Entry Accounting Examples

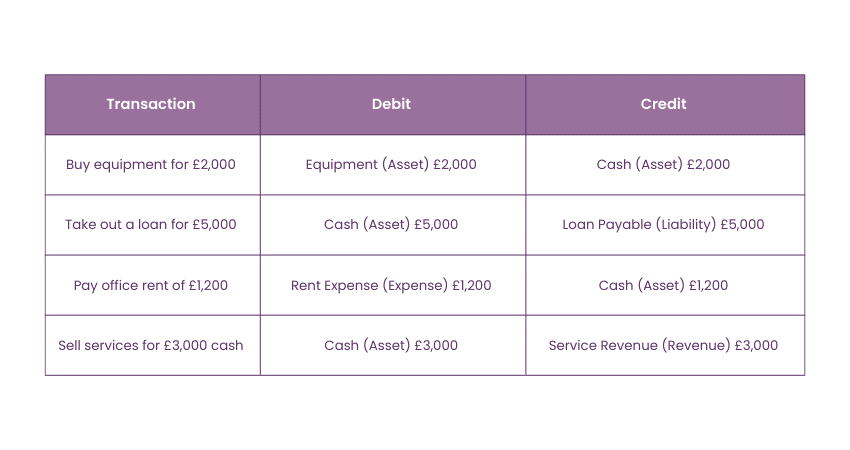

Every transaction in Double Entry Accounting affects at least two accounts—one as a debit and one as a credit. Here's how it works in practice:

Example 1: Purchasing Equipment with Cash

A business buys equipment for £2,000 in cash. The transaction affects the cash and equipment accounts.

a) Debit: Equipment (Asset) £2,000

b) Credit: Cash (Asset) £2,000

Example 2: Taking Out a Loan

A business takes out a loan of £5,000.

a) Debit: Cash (Asset) £5,000

b) Credit: Loan Payable (Liability) £5,000

Example 3: Paying for Office Rent

The business pays £1,200 for office rent.

a) Debit: Rent Expense (Expense) £1,200

b) Credit: Cash (Asset) £1,200

Example 4: Selling Services for Cash

A business provides services worth £3,000 and receives cash.

a) Debit: Cash (Asset) £3,000

b) Credit: Service Revenue (Revenue) £3,000

Double Entry Accounting Education Requirements

To pursue a career in Double Entry Accounting, you typically need to meet specific educational requirements. Here are the key steps:

a) achelor’s Degree: Most employers require a bachelor’s degree in accounting or a related field. This takes about four years to complete and entails around 120 credits.

b) Additional Credits for CPA: To become a Certified Public Accountant (CPA), you’ll need 150 college-level credits. This might require taking additional courses.

c) Certification: Certification like the CPA or Certified Bookkeeper (CB) can enhance your qualifications. For the CB certification, you need at least 3,000 hours of experience or two years of Bookkeeping or Accounting experience.

d) Continuing Education: Persisting education is often needed to maintain certifications. For example, CBs must fulfil 60 continuing education credits every three years.

Double Entry Accounting Skills

To become an accountant, you must be proficient in managing Financial Records and generating reports. Whether you’re handling accounts for your own business or working in an Accounting department, you’ll need to understand:

1) Accounting Software

2) Accounting Practices

3) Financial Statements

4) Basic Bookkeeping

5) Accounting Legal Requirements

To ensure accuracy and avoid errors, it’s essential to develop the following skills:

1) Basic Spreadsheet Skills

2) Analytical Skills

3) Attention to Detail

4) Organisational Skills

Double Entry Accounting Advantages

Double Entry Accounting offers several significant advantages, including:

a) Providing a clear representation of a business's Financial Position

b) Quickly detecting errors and fraud

c) Offering valuable insights for decision-making

d) Assessing the Financial Health of a company

This system is also instrumental in creating Financial Statements, like revenue statements and balance sheets, which offer a comprehensive view of a company’s overall performance and health.

Double Entry Accounting Disadvantages

While having significant advantages, Double Entry Accounting has its downsides too. Here are the primary disadvantages:

a) The Double Entry Accounting system is more complex than Single Entry Accounting.

b) It requires two entries (debit and credit) for each transaction.

c) The system demands that debits and credits always balance mathematically.

d) This complexity can lead to time-consuming processes and higher costs.

e) Despite the complexity, Double Entry Accounting is more beneficial for businesses in the long run than Single Entry Accounting.

Enhance your financial expertise—join our Accounting and Financial Statement Analysis Training today!

Double Entry Accounting Softwares

Cutting-edge Accounting Software has streamlined Bookkeeping and Accounting operations by automating data reconciliation and other tasks. Double Entry Accounting software aids in tracking financial transactions and generally includes necessary features like a general ledger, accounts receivable/payable, and a trial balance.

These programs can determine revenue and expenses, calculate profits and losses, and automatically execute checks and balances, cautioning you if any issues arise.

Some popular Double Entry Accounting software in the market today include:

a) QuickBooks

b) FreshBooks

c) Xero

These tools enhance accuracy and efficiency in managing a business’s financials.

Conclusion

Double Entry Accounting gives businesses a clear picture of their Financial Activities by noting the money coming in and going out for each transaction. Even though it's a bit more complicated than Single Entry Accounting, it's more accurate, reduces the chance of mistakes, and clarifies Financial Information, which is essential for managing money well.

Build a strong financial foundation—join our Accounting and Finance Policies Course today!

Frequently Asked Questions

The four golden rules of Double Entry Bookkeeping are:

1) Debit the receiver, credit the giver.

2) Debit: what comes in. Credit: what goes out.

3) Debit expenses and losses.

4) Credit income and gains.

These ensure balanced transactions.

The principles of Double Entry Accounting state that every Financial Transaction has two sides: a debit and a credit. Each transaction must affect at least two accounts, ensuring that the total debit is equal to the total credit and maintaining the balance of Financial Records.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including the Book Keeping Course, Treasury Management Training Course, and Inventory Accounting And Costing Course. These courses cater to different skill levels, providing comprehensive insights into 15 Cash Flow Strategies to Improve Capital Management.

Our Accounting and Finance Blogs cover a range of topics related to Financial Management and reporting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Financial Analysis skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Book Keeping Course

Book Keeping Course

Fri 20th Dec 2024

Fri 10th Jan 2025

Fri 24th Jan 2025

Fri 14th Feb 2025

Fri 28th Feb 2025

Fri 14th Mar 2025

Fri 21st Mar 2025

Fri 4th Apr 2025

Fri 2nd May 2025

Fri 16th May 2025

Fri 6th Jun 2025

Fri 13th Jun 2025

Fri 27th Jun 2025

Fri 11th Jul 2025

Fri 25th Jul 2025

Fri 15th Aug 2025

Fri 29th Aug 2025

Fri 19th Sep 2025

Fri 3rd Oct 2025

Fri 17th Oct 2025

Fri 7th Nov 2025

Fri 21st Nov 2025

Fri 5th Dec 2025

Fri 19th Dec 2025

Fri 26th Dec 2025

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please