We may not have the course you’re looking for. If you enquire or give us a call on +60 1800812339 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Commercial Real Estate is a diverse field comprising various properties, markets, and opportunities. Whether you are an investor, developer, broker, tenant, or owner, it can offer you impressive returns. However, it also requires specialised knowledge, careful analysis, and constant adaptation to the changing trends and demands of the industry.

This blog will provide you with the latest insights, updates, and tips on everything related to Commercial Real Estate. Let’s dive in to learn more!

Table of contents

1) Understanding Commercial Real Estate

2) Importance of Commercial Real Estate

3) Types of Commercial Real Estate properties

4) Commercial leases

5) Why is it important to invest in Commercial Real Estate?

6) Key players in Commercial Real Estate

7) Benefits and challenges in Commercial Real Estate

8) Conclusion

Understanding Commerical Real Estate

Commercial Real Estate is a property where companies of all sizes can set up offices to carry out their business operations. There are several other types of Commercial Real Estate, including large warehouses.

Importance of Commercial Real Estate

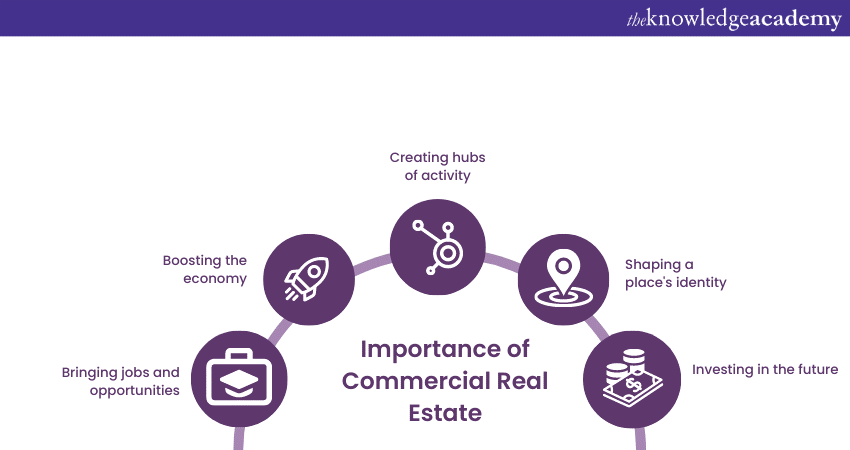

Image Description: Commercial Real Estate’s significance.

Commercial Real Estate is important for the following reasons:

4) Key Players in Commercial Real Estate

5) Commercial Real Estate and COVID-19

6) Benefits and challenges in Commercial Real Estate

7) Conclusion

Understanding Commerical Real Estate

Commercial Real Estate is not about buildings; it is where all sorts of businesses shop. From significant office buildings where, companies work to smaller shops where we buy things, from large warehouses where stuff gets made and shipped to cosy apartments where people live – it is all part of this kind of real estate.

Importance of Commercial Real Estate

Commercial Real Estate is important for the following reasons:

Commercial Real Estate is like the most colourful, exciting pieces of that puzzle, and here is why they matter so much:

a) Bringing jobs and opportunities: When new businesses open in these special places, they need people to work for them. That means more jobs for the people in the area. Imagine a bakery setting up shop – they need bakers, cashiers, and managers. So, people living nearby can find jobs and earn money.

b) Boosting the economy: When businesses do well, they make money, which flows into the local economy. People spend their earnings on food, clothes, and entertainment, helping other companies grow. This cycle keeps the town's or city's economy healthy and growing.

c) Creating hubs of activity: Think of your favourite hangout spots – a mall, a coffee shop, or a park. These places are part of Commercial Real Estate. They become meeting points where friends gather, families spend time, and exciting events occur. They are like the heart of a community, bringing people together.

d) Shaping a place's identity: Have you ever seen a famous building or a popular street in your town? These iconic places often fall under Commercial Real Estate. They give a place its unique character and identity. When you think of your town, you might think of that special store or that big office building – they become symbols of where you live.

e) Investing in the future: People who buy Commercial Real Estate are not just buying a building but investing in the future. When they make these places better, they make the whole area better. This improvement can inspire growth and development, making the town or city an even more exciting place to live and work.

Elevate your Real Estate expertise and success with our transformative Real Estate Agent Masterclass.

Types of Commercial Real Estate properties

Commercial Real Estate comprises properties that serve distinct business, commerce, and community development purposes. Each property type contributes uniquely to our surroundings' economic and social fabric. Let us explore each of these types in more detail:

Office spaces

Office spaces in Commercial Real Estate are essential hubs where businesses plan, innovate, and execute strategies. Corporate headquarters, often located in impressive skyscrapers, host teams collaborating on projects, conducting meetings, and managing administrative tasks. On the other hand, co-working spaces offer flexible setups for freelancers, startups, and remote workers, encouraging collaboration and networking. Here are some examples of office spaces:

a) A modern downtown skyscraper housing the headquarters of a multinational technology company. The building features open-concept office spaces, collaborative meeting rooms, and innovative technology infrastructure.

b) A co-working space located in a historic building, providing flexible workstations for freelancers, startups, and remote professionals. The space offers shared amenities, networking events, and a vibrant community atmosphere.

Retail spaces

In Commercial Real Estate, retail properties are the face of consumerism, providing spaces where people shop for various goods and services. Retailers carefully design their spaces to enhance customer experiences, employing visual merchandising and strategic layout planning techniques to entice shoppers. These properties are vital for commerce and creating vibrant commercial districts that draw people together. Here are some examples:

a) A shopping mall has a variety of stores, from high-end fashion boutiques to popular electronics outlets. The mall is designed with spacious corridors, attractive storefronts, and entertainment areas to create an engaging shopping experience.

b) A local bookstore nestled in a vibrant neighbourhood. The store offers a cosy ambience, book readings, and a cafe, making it a beloved gathering spot for book enthusiasts and the community.

Industrial properties

In Commercial Real Estate, industrial properties are the engines of production and distribution, powering supply chains and economic growth. Manufacturing facilities house machinery and workers that produce goods on a large scale, while warehouses store and organise products before they reach their final destinations. In the digital age, these properties have become important as e-commerce fulfilment centres, facilitating the rapid delivery of online orders. Here are a few examples of industrial properties:

a) A manufacturing plant producing automobiles. The facility houses state-of-the-art assembly lines, robotics, and quality control processes to ensure efficient production and high-quality vehicles.

b) A large distribution centre for an e-commerce giant. The centre features automated sorting systems, advanced inventory management technology, and a massive storage capacity to fulfil online orders quickly and accurately.

Multifamily properties

Multifamily properties in Commercial Real Estate address the essential need for housing, offering diverse living arrangements for individuals and families. These properties provide shelter and a sense of community through shared amenities and common spaces. Residents can interact, socialise, and build relationships, creating a supportive environment. Here are a few examples of multifamily properties:

a) Various units and amenities are offered by a modern apartment complex, including a fitness centre, swimming pool, and communal lounge areas. This setup promotes a sense of community and provides residents with convenient urban living.

b) A suburban townhouse community where families live in close-knit neighbourhoods. The properties feature front yards, shared green spaces, and playgrounds, creating a family-friendly environment.

Empower your Real Estate success with our Real Estate Risk Management Training!

Commercial leases

a) Most companies and organisations lease out spaces in commercial buildings. These buildings are generally owned by different investors, owners, or single owners who collect rent from these companies. Commercial lease rates depend on the time they occupy these buildings and the space.

b) Commercial leases generally have one year to ten years or more. However, the lease length can be regulated per the organisation’s needs or requirements. Let’s discuss the four primary types of commercial property leases:

c) A single net lease means the tenant is solely responsible for paying the property taxes.

d) A double net lease means the tenant is solely responsible for paying the property taxes and insurance.

e) A triple net lease means the tenant must pay for the property taxes, insurance, and maintenance.

f) A gross lease means that the tenant pays only the rent, and the landlord, on the other hand, pays for the building’s property taxes, insurance, and maintenance.

Why is it important to invest in Commercial Real Estate?

Investing in Commercial Real Estate is essential for several reasons:

a) Stable income: Commercial properties often offer higher rental yields than residential properties, providing investors with a stable and attractive income stream.

b) Long-term leases: Commercial leases are typically longer than residential ones, which means less tenant turnover and more consistent income.

c) Capital appreciation: Over time, Commercial Real Estate tends to increase in value, offering investors the potential for capital gains and income.

d) Hedge against inflation: Real Estate often acts as a good pillar against inflation, as property values and rents tend to increase with inflation.

e) Portfolio diversification: Adding Commercial Real Estate to an investment portfolio can reduce risk through diversification, as Real Estate markets often move independently of stock markets.

f) Tax benefits: Investors can benefit from various tax advantages, including deductions for depreciation, mortgage interest, and other property-related expenses.

g) Leverage: Real Estate allows for leverage, meaning investors can control a significant asset with a relatively small amount of capital, potentially increasing their return on investment.

h) Tangible asset: As a physical asset, Commercial Real Estate can provide more robust control and security than other investments.

i) Opportunity for value addition: Investors can increase commercial properties' value and income potential through strategic improvements and management efficiencies.

j) Economic impact: Investing in Commercial Real Estate contributes to economic development, supporting businesses, creating jobs, and enhancing community infrastructure.

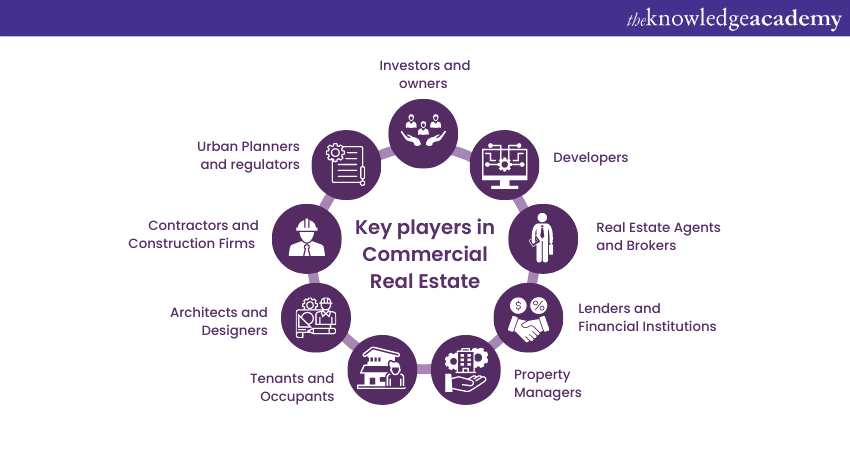

Key players in Commercial Real Estate

Commercial Real Estate is driven by a various key players who contribute their expertise, resources, and vision to shape the landscape of properties and opportunities. Here are some essential actors and their roles in this domain:

Investors and owners

Investors and owners form the financial foundation of Commercial Real Estate. They provide the necessary capital for property acquisition, development, and maintenance. These individuals or entities carefully assess market trends, conduct due diligence, and make strategic decisions that impact the types of properties that thrive within a given region.

Developers

Developers oversee the entire lifecycle of a project, from conceptualisation and design to construction and leasing. Developers who collaborate with architects, engineers, and contractors bring innovative concepts to life, ensuring that properties meet market demands while adhering to urban planning guidelines.

Real Estate agents and brokers

Agents and brokers facilitate connections between buyers and sellers, serving as transaction intermediaries. These professionals play a vital role in negotiating deals, drafting contracts, and providing insights into property values and market trends. Assisting clients in navigating through the complexities of the market, they ensure informed decisions are aligned with their goals.

Lenders and financial institutions

Lenders and financial institutions are vital in Commercial Real Estate, offering essential funding. They evaluate borrower potential, scrutinise risk, and allocate funds wisely for sound growth. Their ongoing monitoring ensures proper financial management throughout projects.

Property managers

Property Managers oversee commercial properties, ensuring compliance, maintenance, and tenant satisfaction. Acting as intermediaries between owners and tenants, they handle operations, rent collection, repairs, and tenant needs, creating a harmonious environment benefiting all stakeholders.

Tenants and occupants

Tenants bring vitality to commercial spaces, converting emptiness into bustling hubs. Leasing and occupancy bolster property owners financially while energising local economies. Tenants integrate into the community by establishing offices, stores, or restaurants, drawing foot traffic, revenue, and neighbourhood identity.

Unlock your Real Estate investment potential with our comprehensive Real Estate Financial Modelling Training. Elevate your skills and make strategic financial decisions confidently.

Benefits and challenges in Commercial Real Estate

Engaging in Commercial Real Estate offers several benefits but has its own challenges. Let us explore both aspects to gain a comprehensive understanding of this dynamic industry:

Benefits of Commercial Real Estate

Discussed below are some of the benefits of Commercial Real Estate:

a) Potential for high returns: Commercial Real Estate investments can yield substantial returns, especially in prime locations and thriving markets. Rental income and property appreciation contribute to long-term wealth accumulation.

b) Diversification: Commercial properties diversify investment portfolios, reducing risk through exposure to different asset classes. This balance can help mitigate the impact of market fluctuations.

c) Stable income: Lease agreements with tenants provide a reliable income stream. Long-term leases and established businesses enhance income stability for property owners.

d) Appreciation: Well-located properties tend to appreciate over time, allowing investors to capitalise on capital gains when selling.

e) Tax advantages: Commercial Real Estate provides a range of tax advantages, such as deductions for mortgage interest, depreciation, and operational costs, contributing to optimising tax obligations.

f) Control over value: Investors can actively enhance property value through renovations, improvements, and strategic management, directly impacting potential returns.

Challenges of Commercial Real Estate

Discussed below are some of the challenges of Commercial Real Estate:

a) High initial costs: Acquiring and developing commercial properties often involves significant upfront expenses, including down payments, construction costs, and legal fees.

b) Market volatility: Economic downturns and market fluctuations can impact property demand, occupancy rates, and rental income, affecting investor returns.

c) Property management: Effective property management requires time, expertise, and resources to ensure tenant satisfaction, maintenance, and compliance.

d) Tenant turnover: Vacancies between tenants can lead to income gaps and increased management efforts to secure new occupants.

e) Regulatory complexity: Commercial properties are subject to complex zoning laws, building codes, and regulations, necessitating thorough due diligence and compliance.

f) Financing challenges: Securing financing for commercial properties can be challenging, with lenders assessing various risk factors and demanding substantial down payments.

g) Competition: Saturated markets can result in heightened competition for tenants, potentially impacting rental rates and lease negotiations.

Conclusion

Commercial Real Estate encompasses a realm of diverse properties, offering both promising rewards and intricate challenges. From bustling offices to vibrant retail spaces, understanding what is Commercial Real Estate is, this blog reveals a dynamic landscape where strategic investments can yield substantial returns, but prudent navigation is critical to success.

Unlock your potential with our comprehensive Investment and Trading Training. Seize opportunities, mitigate risks, and master the art of financial success.

Frequently Asked Questions

Businesses can leverage Commercial Real Estate for branding and visibility by choosing strategically located properties, designing distinctive and branded physical spaces, and utilising building signage and architecture as marketing tools.

Owning Commercial Real Estate properties involves potential risks such as market volatility, tenant turnover, unforeseen maintenance and repair costs, property management challenges, liquidity constraints, regulatory and zoning changes, environmental liabilities, interest rate fluctuations, and the impact of economic downturns.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Investment and Trading Courses, including Real Estate Financial Modelling Training, Real Estate Risk Management Training, and Real Estate Agent Masterclass. These courses cater to different skill levels, providing comprehensive insights into Digital Real Estate methodologies.

Our Business Skills Blogs cover a range of topics related to Investment and Trading, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Investment skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Real Estate Agent Course

Real Estate Agent Course

Fri 24th Jan 2025

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please