We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The implementation of the Sarbanes-Oxley Act (SOX) in 2002 was a reaction to significant corporate scandals. The goal was to regain confidence in financial reporting and corporate governance among the public. It required more stringent internal controls and financial disclosures. The legislation greatly decreased instances of financial wrongdoing and deceit. So, SOX implemented strict rules. The Impact of Sarbanes-Oxley Act was improved transparency and accountability. It also increased investor trust by guaranteeing more accurate financial reports.

Outside the United Kingdom, SOX influenced International Financial Reporting Standards. Several countries adopted comparable rules aligned with SOX’s stringent guidelines. This had a positive effect on corporate governance worldwide, including in the US. The Act remains a fundamental aspect of corporate governance reforms.

In this blog, we explore the global Impact of Sarbanes-Oxley Act (SOX) in detail.

Table of Contents

1) Impacts of Sarbanes-Oxley

a) Revolutionising Corporate Governance

b) Fortifying Financial Reporting

c) Boosting Investor Confidence

d) Shaping Global Business Practices

2) Challenges and Continuous Improvement

3) Conclusion

Impacts of Sarbanes Oxley

Below are the Impact Sarbanes Oxley has had on various businesses and sectors of the financial domain.

a) Revolutionising Corporate Governance

The introduction of the Sarbanes Oxley Act heralded a revolutionary transformation in the realm of corporate governance. This landmark legislation aimed to rebuild trust and accountability within organisations by redefining the relationship between management, directors, and shareholders.

Central to this transformation was the mandate for companies to establish independent audit committees. Comprising board members not directly affiliated with management, these committees served as guardians of ethical conduct and financial transparency. This separation of oversight from day-to-day operations minimised conflicts of interest, ensuring unbiased decision-making that prioritised shareholder interests.

This shift in corporate governance had a profound impact on organisational dynamics. It challenged the traditional hierarchical structures, empowering directors to exert more influence over strategic decisions. The era of unchecked executive authority was replaced by a system of checks and balances that promoted ethical stewardship.

Furthermore, the emphasis on transparency and accountability cascaded through the corporate culture. Companies, recognising the importance of responsible governance, began embracing open communication, ethical decision-making, and increased disclosure. As a result, the revolution in corporate governance propelled organisations towards a new era of integrity, laying the foundation for sustained trust and responsible management practices.

b) Fortifying Financial Reporting

Sarbanes Oxley brought about a transformation in financial reporting practices. The act mandated CEOs and CFOs to personally certify the accuracy of financial statements, rendering them legally responsible for their veracity. This certification process held executives accountable for the numbers presented to investors, deterring them from inflating figures or manipulating financial information.

Furthermore, the act introduced internal control assessments. Public companies were required to analyse and report on the functionality of their internal controls over financial reporting. This requirement aimed to prevent fraudulent activities, improve accuracy, and provide greater confidence in the integrity of financial statements.

The impact of these provisions was evident as organisations invested in robust reporting mechanisms. Audits became more rigorous, internal control systems were enhanced, and companies established risk assessment procedures to identify vulnerabilities. The result was a higher level of scrutiny and a commitment to accuracy.

c) Boosting Investor Confidence

Boosting investor confidence was one of the paramount objectives achieved by the Sarbanes Oxley Act. This monumental legislation instilled a renewed sense of trust and reassurance in the minds of investors. By requiring CEOs and CFOs to personally vouch for the accuracy of financial statements, the act brought a heightened level of accountability to corporate financial reporting. Investors could now rest assured that the figures presented were backed by the personal integrity and liability of top executives.

Moreover, the emphasis on transparent and comprehensive financial reporting resonated deeply with investors. The act's provisions compelled companies to disclose not only their financial numbers but also executive compensation, potential conflicts of interest, and other material information. This level of transparency empowered investors to make more informed decisions, safeguarding them against potentially hidden risks or unethical practices.

In essence, the Sarbanes Oxley Act acted as a guardian of investor interests. It transformed financial reporting from a potentially opaque realm to a realm of clarity and accountability. This transformation went beyond numbers; it extended to the principles of ethical conduct and responsible governance, fostering an environment where investors could confidently allocate their resources, knowing that their interests were protected by a robust regulatory framework.

Enhance compliance skills with Sarbanes-Oxley Training – Start mastering regulations today!

d) Shaping Global Business Practices

The Sarbanes-Oxley Act radiated its influence far beyond U.S. borders, leaving an indelible mark on global business practices and regulatory frameworks. Its principles, aimed at bolstering corporate accountability and transparency, spurred a wave of reforms in international jurisdictions.

European Union countries, in particular, were receptive to the act's principles. These countries introduced directives and regulations that mirrored the transparency standards set by Sarbanes-Oxley, acknowledging the need for robust corporate governance and investor protection. This alignment promoted a more cohesive and harmonised approach to corporate governance worldwide.

Sarbanes-Oxley's impact also resonated in emerging economies seeking to attract foreign investments. Recognising that strong corporate governance mechanisms inspire investor confidence; many countries adopted their best practices to create a favourable business environment. This adoption not only bolstered investor trust but also contributed to economic growth by promoting ethical conduct and accountability.

Advance your career with our Sarbanes-Oxley Certified Professional Course – Sign up today!

Challenges and Continuous Improvement

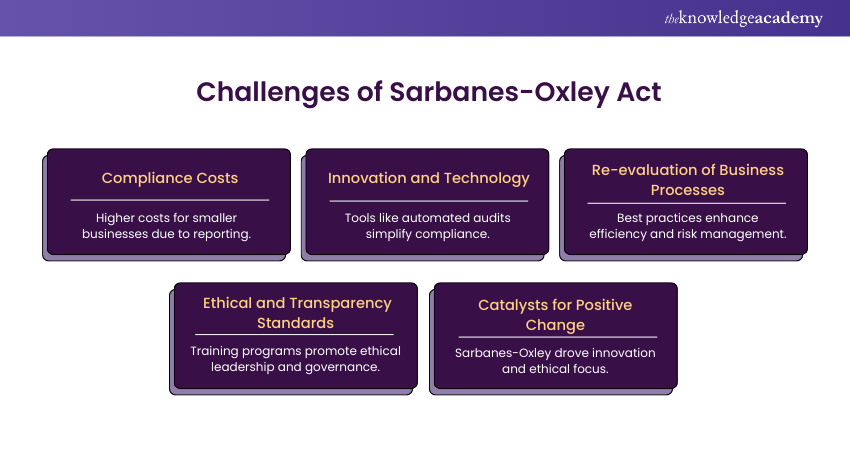

While the Sarbanes Oxley Act introduced vital reforms to the corporate landscape, it also presented challenges that spurred innovation and continuous improvement. Compliance costs, particularly for smaller businesses, escalated due to the rigorous reporting and control requirements mandated by the act. This financial burden raised concerns about hindering the growth of emerging enterprises.

However, these challenges catalysed a wave of innovation aimed at mitigating the complexities of compliance. Technology solutions emerged to streamline reporting processes, enhance internal controls, and reduce costs. Automated audit tools, software for risk assessment, and cloud-based reporting systems empowered organisations to navigate regulatory demands more efficiently.

Furthermore, the challenges prompted a re-evaluation of business processes. Companies adopted best practices not only to meet regulatory requirements but also to enhance operational efficiency and risk management. The act's influence extended beyond compliance to shaping smarter, more resilient business strategies.

Sarbanes Oxley's introduction of ethical and transparency standards also inspired the establishment of ethical leadership and governance training programs. Organisations began to prioritise ethics education to foster a culture of integrity and responsibility.

In essence, the challenges posed by Sarbanes Oxley acted as catalysts for positive change. They triggered a wave of innovation that empowered businesses to embrace technology, refine processes, and cultivate a culture of ethics. These adaptations not only enabled compliance but also set the stage for more robust and accountable business practices.

Conclusion

As we reflect on the Impact of Sarbanes Oxley, it's clear that this legislation has left an indelible mark on corporate governance, financial reporting, and investor confidence. It transformed how organisations approach transparency, accountability, and ethical conduct. The act's enduring legacy is a corporate landscape that prioritises integrity, embraces responsible governance, and seeks to instil confidence in stakeholders.

Get started with Basel IV concepts with our Introduction To Basel IV Training today!

Frequently Asked Questions

The Sarbanes-Oxley Act enhanced corporate governance by boosting transparency, increasing accountability, and enforcing stricter internal controls. This significantly reduced financial fraud and bolstered investor confidence in publicly traded companies.

The Sarbanes-Oxley Act indirectly influenced International Financial Reporting Standards by encouraging global adoption of stricter financial reporting, transparency, and accountability measures. This alignment brought International practices in line with the rigorous standards set by SOX.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Sarbanes-Oxley Training, including the Sarbanes-Oxley Certified Professional, Introduction To Basel III, and Introduction To Basel IV Training. These courses cater to different skill levels, providing comprehensive insights into Benefits of Sarbanes-Oxley.

Our ISO & Compliance Blogs cover a range of topics related to Sarbanes-Oxley, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your ISO & Compliance skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming ISO & Compliance Resources Batches & Dates

Date

Sarbanes-Oxley Certified Professional

Sarbanes-Oxley Certified Professional

Mon 10th Mar 2025

Mon 2nd Jun 2025

Mon 8th Sep 2025

Mon 3rd Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please