We may not have the course you’re looking for. If you enquire or give us a call on +47 80010068 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine you're a business owner, and an ocean of numbers, finance reports, and data surrounds you. It's overwhelming, isn't it? This is where the Management Accountant enters the picture. But what exactly does a Management Accountant do, and what makes them crucial in today's corporate landscape? They are like the ship's captains, navigating your business through the tumultuous sea of financial data.

Have you ever wondered about the intricate details behind a business's financial health and strategies? Worry not! We have you covered! Continue reading this blog to learn about the role of Management Accountants in detail. Also, explore how can they provide insights into the success of a business.

Table of Contents

1) Who is a Management Accountant?

2) What Does a Management Accountant do?

3) How to Become a Management Accountant?

4) Chartered Management Accountant

5) The Importance of Management Accounting in Business

6) The Future of Management Accounting

7) Is Management Accounting Better Than Financial Accounting?

8) Is Management Accountant a Stressful Job?

9) Conclusion

Who is a Management Accountant?

Management accounting involves preparing internal financial reports and analysis to aid management in decision-making and achieving business goals. It focuses on providing detailed financial and statistical information that helps managers make informed decisions to achieve business goals.

Unlike financial accounting, which targets external stakeholders, management accounting emphasises future planning, budgeting, performance evaluation, and cost management. Techniques include variance analysis, forecasting, and trend analysis, all aimed at improving operational efficiency and strategic planning within the organisation.

What Does a Management Accountant do?

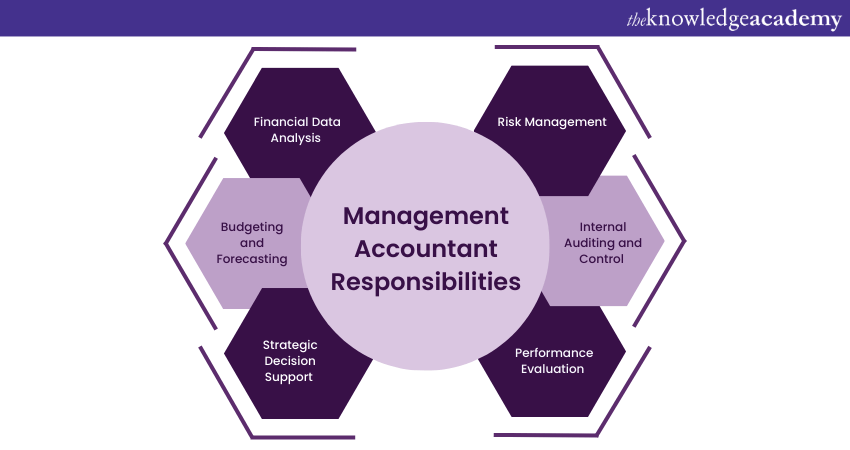

Management Accountants are the basis of an organisation's financial stability and strategic success. Their responsibilities extend above basic accounting; they also serve as financial strategists, risk analysts, and planning experts. Let's look at the various responsibilities a Management Accountant takes up:

Financial Data Analysis

The role of a Management Accountant in financial data analysis is similar to that of an investigator. They sift through financial statements, inspecting every item and every number to understand the company's financial status. This involves analysing balance sheets, income statements, cash flow statements, and other financial documents.

They also dissect operational costs, revenue streams, and investments to understand their impact on the business's bottom line. The Management Accountant then condenses this complex financial data into easily digestible reports.

Budgeting and Forecasting

Management Accountants analyse income and expenses for the upcoming period using past data, market trends, and business plans. After the budget is approved, they regularly compare actual income and expenses against it, highlighting any significant differences and suggesting improvements.

In addition to budgeting, Management Accountants forecast future financial trends, which helps the company prepare for future opportunities or challenges. They also anticipate market dynamics, predict revenue trends, and forecast future costs. As a result, they provide a roadmap for the company's financial future.

Strategic Decision Support

In the arena of strategic decision-making, Management Accountants act as advisors to the top management. They use their financial expertise to assess the financial implications of strategic initiatives.

For example, if a company is considering a new product launch, the Management Accountant will analyse the expected costs, projected revenue, and potential profitability. Based on their analysis, they may recommend proceeding with the launch. They may also modify the product design to reduce costs or even scrap the initiative if it seems financially unsound.

Risk Management

The role of a Management Accountant in risk management is also critical. They continually monitor various risk factors – from market volatility and operational inefficiencies to regulatory changes and cybersecurity threats. They evaluate the potential impact of these risks on the company's financial health and devise strategies to mitigate them.

For example, if a company operates in an industry with fluctuating raw material prices, the Management Accountant may suggest strategies. It may involve entering long-term contracts at fixed prices or diversifying suppliers to manage this risk.

Internal Auditing and Control

Internal audits are a key function of a Management Accountant. They review the company's financial records for accuracy and inspect internal control systems for effectiveness. They also ensure adherence to financial regulations and standards.

Doing so, help prevent fraud, minimise financial errors, and protect the company's assets. If an audit uncovers issues, the accountant recommends improvements to enhance financial accuracy and operational efficiency.

Performance Evaluation

Management Accountants serve as performance evaluators. They measure the company's financial performance against set targets and industry benchmarks. They use financial ratios and Key Performance Indicators (KPIs) to assess aspects like profitability, liquidity, and operational efficiency. If they identify areas where the company is underperforming, they suggest corrective measures and strategies to improve performance.

Learn to manage teams with our Management Course – Join today!

How to Become a Management Accountant?

To become a Management Accountant, one requirement follow experts' education, skill development, and professional certification. Here's an easy procedure for becoming a Management Accountant:

Education

At a minimum, aspiring Management Accountants need to have a bachelor’s degree in finance, accounting, or a related field. This forms the foundation of knowledge in areas such as cost accounting, financial management, and auditing.

However, the world of finance is intricate and constantly evolving, so many professionals opt to further their knowledge base. They often pursue advanced degrees such as a Master of Business Administration (MBA) or a Master's in Accounting.

Skills Needed

Alongside formal education and certification, Management Accountants need to possess a set of skills that enable them to excel in their role. Here's a detailed list of skills that these professionals need to possess:

1) Problem-solving Skills: Management Accountants commonly fulfil difficult financial situations that demand innovative approaches. As a result, they must be excellent problem solvers, capable of thinking analytically and making educated choices under pressure.

2) Attention to Detail: Precision is essential in accounting. Management Accountants must have an excellent sense for detail to ensure the accuracy of financial records and reporting. This ability is necessary to identifying inequalities, understanding financial patterns, and creating accurate forecasts.

3) Communication Skills: Despite working mainly with numbers, Management Accountants require strong verbal and written communication skills. They must be able communicate complex financial facts to stakeholders. Also, to present their results and ideas to company stakeholders, they must communicate effectively and clearly.

4) Analytical Skills: Management Accountants need to be able to analyse large amounts of financial data and discern patterns, trends, and insights. This involves not just understanding numbers but also understanding the story they tell about the company's financial health and performance.

Learn team performance management with our Senior Management Training – Join today!

Chartered Management Accountant

A Chartered Management Accountant (CMA) is a certified Management Accountant. These professionals focus in providing financial data and analysis to help companies make educated decisions about their operations and goals.

CMAs learn to analyse financial data, set budgets, manage expenditures, and evaluate the financial impact of corporate choices. They play an important role in strategy planning, performance evaluation, and risk management in organisations.

To become a CMA, persons should commonly finish an intense coursework and examination process established by a professional accounting group, such as the Chartered Institute of Management Accountants (CIMA). This certification validates their understanding of Management Accounting principles and procedures.

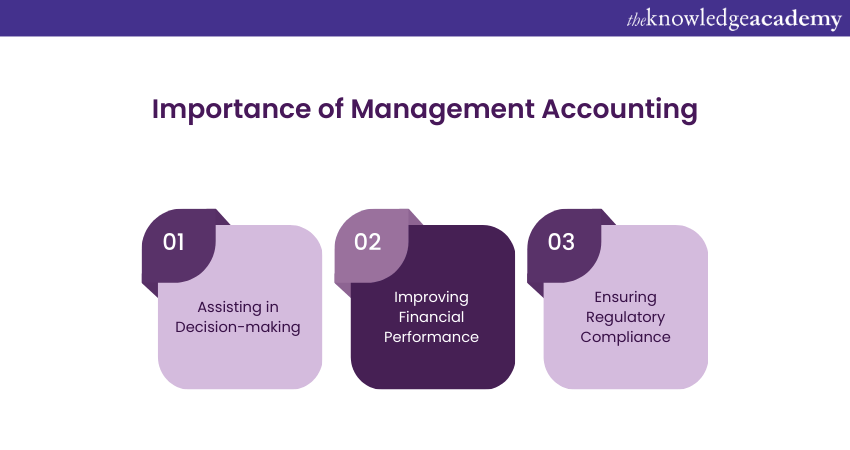

The Importance of Management Accounting in Business

Management Accounting holds a position of paramount importance in the realm of business, acting as a compass, fitness coach, and regulatory watchdog. Here's how:

Assisting in Decision-making

Just as a ship requires a compass to navigate the vast ocean, businesses need the analytical insights provided by Management Accounting for effective decision-making. Management Accountants dissect and interpret complex financial data, transforming it into actionable information. This enables business leaders to make well-informed strategic decisions, enhancing the probability of achieving desired outcomes.

Improving Financial Performance

Management Accountants play a significant role in bolstering a business's financial health. They prepare budgets, control costs, and analyse the profitability of different business activities. Much like a fitness coach devises workout plans to improve an athlete's performance, these accountant implements financial strategies to optimise a company's financial health.

Moreover, they identify areas for financial improvement, suggest cost-saving measures, and highlight profitable opportunities. All of this collectively contributes to better financial performance.

Ensuring Regulatory Compliance

Every business operates within a specific legal and regulatory framework that requires strict adherence. The role of Management Accounting extends to ensuring that the company complies with these regulatory standards.

They keep abreast of the latest financial laws and regulations, conduct internal audits, and ensure accurate financial reporting. This helps minimise legal risks and avoid potential financial penalties. It also safeguards the company's reputation and financial integrity.

Learn how to choose correct organisational structure with our Event Management Course – Join today!

The Future of Management Accounting

The area of Management Accounting is not immune to the fast developments in technology and changing business environments that define the 21st century. With technology changing traditional roles and and with ever-changing business financial acumen, the future of Management Accounting looks both thrilling and hopeful. Let's explore these trends in more detail:

Technology's Impact on Management Accounting

Technological advancements are dramatically reshaping the Management Accounting profession. Some of the key technologies influencing this field are as follows:

1) Artificial Intelligence (AI): AI is revolutionising various aspects of Management Accounting. It can accelerate the process of collecting vast amounts of finances. As a result, it can help Management Accountants to analyse complex data sets more efficiently. AI can also perform repetitive tasks such as invoice processing and data entry, freeing up time for accountants to focus on strategic tasks.

2) Automation: Automated accounting systems can handle routine tasks such as record keeping, payroll, and tax preparation. This not only reduces the risk of human error but also allows Management Accountants to concentrate on more critical. As a result, it adds value to tasks such as financial planning and analysis.

3) Data Analytics: In today's data-driven business environment, the ability to analyse and interpret a large collection of data is invaluable. Advanced data analytics tools give Management Accountants deeper insights into financial data, enabling them to uncover hidden patterns, identify opportunities, and make data-backed decisions.

Increasing Demand for Management Accountants

In our increasingly complex business environment, the role of Management Accountants has never been more critical. Companies are dealing with a myriad of challenges, from navigating financial uncertainties and regulatory changes to managing risks and exploring growth opportunities. To overcome these challenges, businesses need professionals who understand financial data, can plan strategically, and make informed decisions.

Management Accountants, with their ability to translate financial data into actionable business strategies, are perfectly suited to help businesses navigate these complexities. As such, the demand for accountants is on the rise.

Moreover, as businesses become more global, the role of the Management Accountant is expanding beyond traditional financial management to include areas like sustainability accounting and international business strategy. This widening of scope means more opportunities for accountants.

Is Management Accounting Better Than Financial Accounting?

Management Accounting helps managers make decisions by providing detailed reports on costs and operations. Financial accounting focuses on creating financial statements for external use, like investors and regulators. Both are important, but they serve different purposes

Is Management Accountant a Stressful Job?

Being a Management Accountant can be stressful because it involves meeting deadlines and handling complex data. They often work long hours, especially during busy periods. However, it can also be rewarding and offer good career opportunities.

Conclusion

In essence, Management Accountants are crucial navigators in the complex world of business finance. Their role transcends traditional accounting duties, as they leverage their expertise to drive strategic decision-making and business growth. By understanding the Functions of Management Accounting, they provide valuable data that shapes business strategies and improves overall performance. In the face of technological advancements and evolving business landscapes, the profession is adapting and flourishing, making it an exciting career path for aspiring accountants.

Learn to empower team members with our Management Training for New Managers Course – Join today!

Frequently Asked Questions

What is the Difference Between Management Accounting and Financial Accounting?

Management Accounting focuses on giving financial information to internal stakeholders so that they can make choices. On the other hand, Financial Accounting deals with reporting financial information to external stakeholders to meet regulations and maintain transparency.

What Tools and Techniques do Management Accountants use?

Management Accountants use different tools and strategies. These include budgeting, variance evaluation, cost-volume-profit analysis, activity-based costing, balancing scorecards, performance dashboards, and strategic financial modelling.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is the The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Management Courses, including Introduction To Management Course, Management Training For New Managers Course, and Performance Management Training. These courses cater to different skill levels, providing comprehensive insights into Objectives of Entrepreneurship.

Our Business Skills Blogs cover a range of topics related to Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Management Training for New Managers

Management Training for New Managers

Fri 16th May 2025

Fri 25th Jul 2025

Fri 29th Aug 2025

Fri 10th Oct 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please