We may not have the course you’re looking for. If you enquire or give us a call on +64 98874342 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you struggling to distinguish between Financial Report vs Management Report? Discover how each type serves a unique purpose within your organisation. While a Financial Report provides a snapshot of your company's financial health, the Management Report delivers insights tailored for strategic decisions.

Read this blog on Financial Report vs Management Report to learn how using both can enhance your corporate governance and decision-making processes. Unlock the full potential of these essential tools and drive better business outcomes.

Table of Contents

1) Understanding Financial Reporting

a) Significance of Financial Reports

b) Goals of Financial Reports

2) Understanding Management Reporting

a) Significance of Management Reports

b) Goals of Management Reports

3) Financial Report vs Management Report: Contrasting Elements

4) Conclusion

Understanding Financial Reporting

Financial Reporting and Analysis are essential for all businesses and are primarily used for external purposes. These reports include:

1) Profit and loss statement

2) Income statement

3) Balance sheet

4) Accounts payable

5) Accounts receivable

6) Statement of cash flows

These reports are essential for banks, investors, and regulators to approve loans, extend credit, and ensure compliance with accounting standards. Financial Reporting reflects a business's financial position at the time of reporting but does not predict the future or provide detailed insights.

Significance of Financial Reports

Financial reports are crucial for regulatory compliance and ensuring accurate financial data and cash flow management. While some businesses view Management Reports as an additional expense, they are invaluable for making informed decisions. Management Reports can help prevent costly mistakes and save money by guiding better business decisions.

Goals of Financial Reports

Financial reports are essential for maintaining transparency and supporting strategic business decisions. Here's a breakdown of their key aspects:

1) GAAP Compliance: Adhere to Generally Accepted Accounting Principles (GAAP), providing a standardised approach for transparent and organised financial statements.

2) Support for Management: Assist in planning, analysis, and decision-making by offering structured financial data.

3) Informed Decisions: Enable investors, creditors, and stakeholders to make well-informed decisions regarding credit, investment, and other financial matters.

4) Economic Insights: Provide information on an organisation’s economic resources, their usage, and changes in claims over time.

5) Statutory Audits: Offer critical data for statutory audits, ensuring compliance and accuracy.

6) Stakeholder Communication: Keep stakeholders informed about the company’s fiscal responsibilities and overall performance.

7) Social Welfare: Address the interests of employees, trade unions, and the government, contributing to enhanced social welfare.

Understanding Management Reporting

Management Reporting is optional and serves internal business needs. It provides a detailed analysis of company financials, offering insights that support informed decision-making. Reports include:

1) Profit and loss by category (team, job, department)

2) Inventory reports

3) Sales reports

4) Utilisation reports

By focusing on specific business areas, Management Reports help identify strengths and opportunities for improvement. For instance, evaluating the sales department's performance before deciding to expand can be crucial. This type of reporting supports CEOs in making data-driven decisions, allowing them to pinpoint issues if profits fall short of expectations.

Significance of Management Reports

Management Reporting is essential for making informed leadership decisions. It enables data-driven decision-making, allowing business owners to lead strategically with reliable financial insights rather than reacting impulsively.

Some business owners might focus solely on financial reports, citing concerns like cost, time constraints, or doubts about the value of Management Reports. However, neglecting Management Reports means missing out on crucial insights that can drive growth and prevent costly, ineffective initiatives. By leveraging Management Reports, you can strengthen your business, enhance profitability, and avoid wasting resources.

Build your workplace decision-making and problem-solving skills with our CMI Level 4 Training – Sign up today!

Goals of Management Reports

Management Reports offer valuable insights and serve multiple purposes within a business. Here’s how they function:

1) Flexibility in Reporting: Management Reports are not bound by Generally Accepted Accounting Principles (GAAP) and can be customised based on company needs.

2) Upward Communication: They are used for upward communication, providing specific information needed by department managers for their managerial functions.

3) Record-keeping: Serve as important records for future reference and sometimes meet legal requirements.

4) Stakeholder Interest: Relevant to top management, government agencies, shareholders, creditors, customers, and the general public.

5) Public Relations: General progress reports and resource usage summaries are presented to enhance goodwill and develop public relations.

6) Performance Measurement: Used to evaluate the performance of individuals, teams, or departments and is crucial for decisions on promotions, incentives, and bonuses.

7) Actionable Insights: Provide the basis for taking action and issuing instructions to improve performance and address specific issues.

Become familiar with how to assume human nature and managerial behaviour with our CMI Level 4 Certificate in Management and Leadership Training.

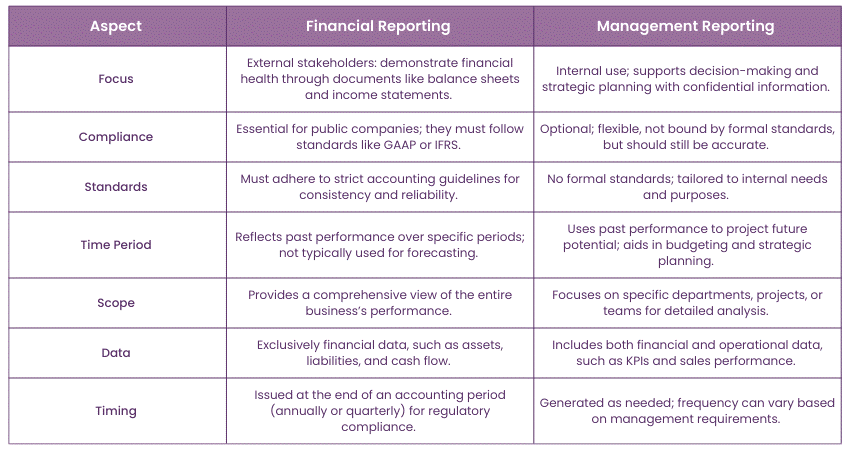

Financial Report vs Management Report: Contrasting Elements

Understanding the differences between financial reports and Management Reports is crucial for effective business operations. While both play essential roles in business decision-making, they serve distinct purposes and adhere to different standards. Here's a breakdown of their contrasting elements:

1) Emphasis

Financial Reporting focuses on external purposes, providing transparency to stakeholders like investors and regulators. In contrast, Management Reporting is for internal use, aiding in decision-making and strategic planning by offering insights into specific areas of the business.

2) Coverage

Financial reports assess the overall performance of a business, presenting a comprehensive view. Management Reports delve into detailed segments, such as departments or specific projects, to analyse performance and identify areas for improvement.

3) Information Content

Financial reports use financial data, including balance sheets, income statements, and cash flow statements, to reflect the company's past performance. Management Reports incorporate both financial and operational data, including Key Performance Indicators (KPIs), to support future planning and performance evaluation.

4) Reporting Period

Financial Reporting typically covers specific periods, such as fiscal years or quarters, to present historical performance. Management Reporting, however, can be created as needed, focusing on current data and future forecasts to guide decision-making.

5) Regulatory Requirements

Financial reports must adhere to established accounting standards like GAAP or IFRS, ensuring accuracy and consistency. Management Reports are not bound by these regulations, allowing companies to customise their content based on internal needs.

6) Frameworks

Financial reports follow rigorous frameworks and standards to ensure uniformity and comparability. Management Reports, on the other hand, are flexible and tailored to the needs of the business without essential frameworks.

7) Timeliness

Financial Reporting is scheduled at the end of accounting periods to comply with regulatory requirements. Management Reporting can be produced on a flexible timeline, allowing for frequent updates to reflect the most current data and support ongoing business decisions.

Here's a table comparing financial and Management Reporting, highlighting their distinct features and purposes:

Master accounting and finance skills with our expert-led Accounting & Finance Training – sign up now!

Conclusion

We hope you read and grasp the distinctions between Financial Reports and Management Reports, as this knowledge is vital for effective business management. Financial Reports provide a standardised, historical view of a company’s financial health for external stakeholders and compliance purposes. On the other hand, Management Reports offer flexible, detailed insights for internal decision-making and strategic planning. Utilising both types of reports ensures compliance, optimises performance, and supports well-informed decisions.

Register for our CMI Level 4 Award in Management and Leadership and learn about the internal and external factors influencing organisational culture.

Frequently Asked Questions

Financial Reports ensure transparency and regulatory compliance, providing an objective view of a company’s financial status for external stakeholders. Management Reports aid internal governance by offering detailed insights and performance metrics to guide strategic decisions and operational improvements.

Financial Reports are typically prepared quarterly or annually to meet regulatory requirements and provide a snapshot of financial health. Management Reports are often generated more frequently, such as monthly or weekly, to support ongoing internal decision-making and monitor performance in real-time.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various CMI Level 4 Training, including CMI Level 4 Award in Management and Leadership Training and Health and CMI Level 4 Certificate in Management and Leadership Training. These courses cater to different skill levels, providing comprehensive insights into the Leadership and Management Skills.

Our ILM, CMI Leadership & Management Blogs cover a range of topics related to CMI Level 4, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Leadership Skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming ILM, CMI Leadership & Management Resources Batches & Dates

Date

International Financial Reporting Standards Training Course

International Financial Reporting Standards Training Course

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please