We may not have the course you’re looking for. If you enquire or give us a call on +64 98874342 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

A Payroll Manager plays a crucial role in any organisation. They ensure that employees are paid correctly and on time. By effectively handling Payroll processing, tax calculations, and compliance, they help maintain accurate financial records and ensure employee satisfaction.

According to Glassdoor, a Payroll Manager's average salary in the UK is 43,232 GBP annually and could go higher based on experience and skill set. In this blog, you will learn about Payroll Managers, their roles and responsibilities, and the qualifications and skill required to become one.

Table of Contents

1) Payroll Manager: A quick overview

2) Qualifications and skills required

3) Roles and responsibilities of a Payroll Manager

4) How to Become a Payroll Manager?

5) Conclusion

Payroll Manager: A quick overview

A Payroll Manager is responsible for overseeing all aspects of the Payroll Process within an organisation. They handle employee compensation, tax withholding, benefits administration, and compliance with relevant laws and regulations.

Average Salary

The average salary of a Payroll Manager can vary based on many criteria, such as location, industry, company size, and level of experience. However, the average salary range for a Payroll Manager falls between £30,000 and £63,000 per year in the UK. As for the US, the average salary is US$65,021, and in India, it is 1,000,000 INR.

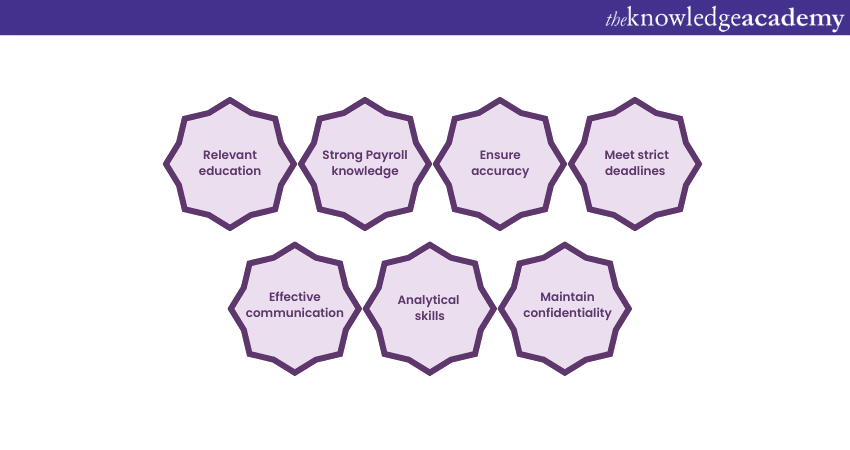

Qualifications and skills required

In order to excel as a Payroll Manager, you must possess certain qualifications and skills per the Payroll job description. Some of them are listed below:

a) Education: A bachelor's degree in accounting, finance, or a related field is often preferred for a Payroll Manager position. It provides a solid foundation in financial principles and ensures a comprehensive understanding of Payroll processes.

b) Payroll knowledge: A Payroll Manager should possess a strong knowledge of Payroll processing, tax regulations, and employment laws. They should be well-versed in Payroll Software and systems and stay updated on industry trends and best practices.

c) Attention to detail: Excellent attention to detail and accuracy are crucial for a Payroll Manager. They must be meticulous when working with large amounts of numerical data and ensure precision in calculating salaries, deductions, and taxes.

d) Organisational and time management skills: In Payroll jobs, Managers often have to meet strict Payroll deadlines. Strong organisational and time management skills enable them to efficiently handle multiple tasks, prioritise work, and ensure timely Payroll processing.

e) Communication skills: Effective communication is crucial for these professionals to interact with employees, management, and external stakeholders. They should be able to explain Payroll processes and resolve inquiries or issues related to Payroll clearly and professionally.

f) Analytical mindset: An analytical mindset is valuable for a Payroll Manager. They should be able to analyse Payroll data, identify discrepancies, and proactively resolve any issues that may arise.

g) Confidentiality: Payroll Managers handle sensitive employee information, including personal and financial data. They must maintain confidentiality and handle such information with the utmost integrity and discretion.

By possessing these qualifications and skills, a Payroll Manager can effectively perform their role and contribute to the success of the organisation's Payroll operations.

Master the essentials of Payroll management and pave the way to a successful career with our Introduction To Payroll Training - Sign up now!

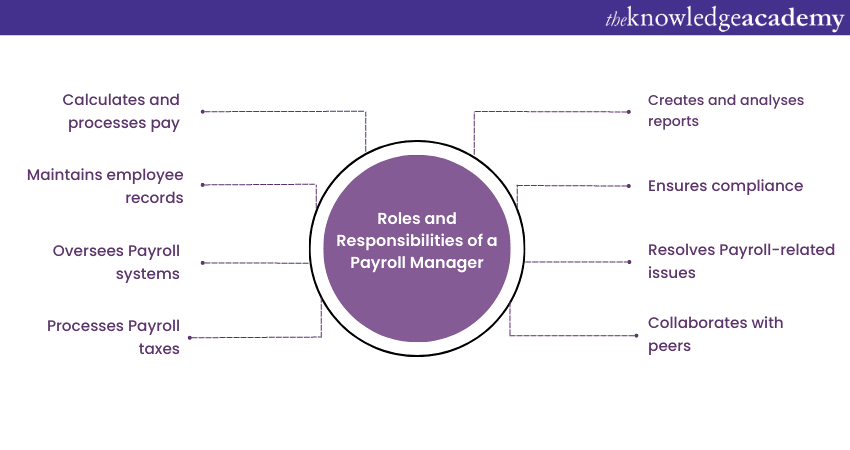

Roles and responsibilities of a Payroll Manager

A Payroll Manager holds various key responsibilities within an organisation. These responsibilities include:

a) Processing Payroll: A Payroll Manager's primary responsibility is accurately processing Payroll for employees. This involves calculating salaries, bonuses, and deductions and ensuring timely employee payment.

b) Employee record management: Payroll Managers are responsible for maintaining and updating employee records. This includes managing tax information, personal details, and any changes in employment status.

c) Payroll system management: A Payroll Manager must oversee and manage the Payroll software and systems used by the organisation. They should be proficient in troubleshooting system issues, ensuring data integrity, and maintaining the security of Payroll information.

d) Payroll tax calculation: A Payroll Manager is responsible for calculating and processing Payroll taxes. This includes income tax, social security contributions, and other applicable deductions.

e) Generating Payroll Reports: Payroll Managers should generate and analyse Payroll reports to ensure accuracy and compliance. They must reconcile any discrepancies and provide clear and comprehensive reports to management.

f) Compliance with regulations: A Payroll Manager must stay current with relevant Payroll laws and regulations. They should ensure that the organisation complies with statutory requirements and handle any Payroll-related audits or inquiries.

g) Employee support: Payroll Managers address employee inquiries and resolve Payroll-related issues in a timely and professional manner. They should have effective communication skills to assist and guide employees regarding their Payroll.

h) Collaboration with HR and Finance: Payroll Managers work closely with the HR and finance departments to ensure the seamless integration of Payroll data with other systems. This collaboration helps maintain accurate financial records and employee data.

Unlock the secrets to effective financial management and take control of your organisation's success with our Financial Management Training.

How to Become a Payroll Manager

Becoming a Payroll Manager requires education, experience, and specialised skills. Follow these steps to pursue a career in Payroll Management:

a) Earn a bachelor's degree in accounting, finance, or a related field

b) Gain practical experience in Payroll administration or related roles

c) Continuously build your Payroll knowledge and stay updated on industry trends

d) Consider obtaining certifications such as CPP or FPC to enhance your credentials

e) Broaden your expertise in HR, finance, or compliance to complement Payroll management.

f) Showcase leadership abilities by taking on supervisory roles or leading teams.

g) Network with professionals in the field and seek mentorship from experienced Payroll Managers.

h) Stay informed about changes in Payroll laws, tax regulations, and compliance requirements.

i) Adapt to new technologies and software systems for efficient Payroll processing.

j) Monitor job boards and tailor your resume to highlight relevant experience and certifications.

Conclusion

We hope you read and understood everything about the Payroll Manager job description. These professionals are essential in ensuring smooth Payroll operations within an organisation. By understanding the responsibilities, qualifications, and skills required for this position, you can effectively pursue a career in Payroll management.

Elevate your accounting and finance skills to new heights with our comprehensive Accounting & Finance Training Courses – Sign up now!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 3rd Jan 2025

Fri 17th Jan 2025

Fri 7th Feb 2025

Fri 21st Feb 2025

Fri 7th Mar 2025

Fri 28th Mar 2025

Fri 11th Apr 2025

Fri 9th May 2025

Fri 23rd May 2025

Fri 20th Jun 2025

Fri 4th Jul 2025

Fri 18th Jul 2025

Fri 8th Aug 2025

Fri 22nd Aug 2025

Fri 5th Sep 2025

Fri 12th Sep 2025

Fri 26th Sep 2025

Fri 10th Oct 2025

Fri 24th Oct 2025

Fri 14th Nov 2025

Fri 28th Nov 2025

Fri 12th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please