We may not have the course you’re looking for. If you enquire or give us a call on +64 98874342 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Whether you are an individual client, run a company or oversee an institution, the road to achieving long-term financial objectives will be paved with challenges. The biggest of them involves curating a dynamic mix of investments that balance risk and reward with finesse. This challenge can be overcome through the use of modern Portfolio Management Software.

Portfolio Management Software is like a custom organiser for your investment information, easing the process of evaluating your net worth, gains, and losses while viewing the overall diversification of your assets. This blog dives into the benefits, examples, and challenges associated with these software. Read on and learn how to navigate your business goals with cutting-edge digital flair.

Table of Contents

1) What is a Portfolio Management Software?

2) Benefits of using Portfolio Management Software

3) Top Investment Portfolio Management Software on the market

4) Compare the Best Portfolio Management Software Tools

5) Challenges with Investment Portfolio

6) Conclusion

What is Portfolio Management Software?

A Portfolio Management Software is a valuable tool designed to assist individuals and organisations in efficiently managing their investment portfolios. It offers various functionalities and features that help users track, analyse, and optimise their investments.

This software has become increasingly popular among investors, financial advisors, and asset managers. This is due to its ability to streamline Portfolio Management processes and enhance decision-making capabilities.

Additionally, Portfolio Management Software plays a vital role in simplifying and enhancing Investment Management. Its comprehensive features and functionalities enable users to consolidate investment data, analyse performance, automate tasks, manage risk, and collaborate effectively.

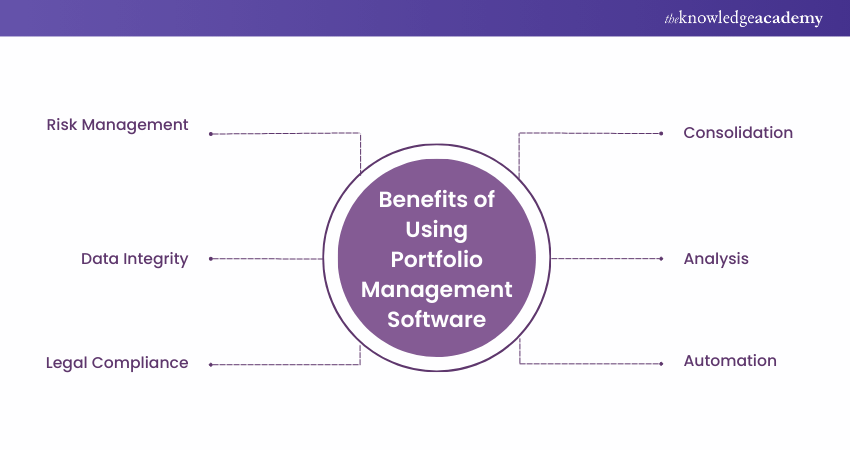

Benefits of Using Portfolio Management Software

Portfolio Management Software offers several benefits to individuals and enterprises involved in managing investment portfolios. Here are six key advantages of using them:

a) Consolidation of Investment Information: One of the primary benefits of Portfolio Management Software is the ability to consolidate all investment-related data into a single platform. Users can import and sync data from various sources, such as brokerage accounts, retirement funds, and other financial assets. It is due

b) Enhanced Portfolio Analysis: Portfolio Management Software provides robust analytical tools to evaluate the performance of investments. Users can access customisable dashboards, charts, and reports that display key performance metrics, asset allocation, risk indicators, and benchmark comparisons. These tools enable users to gain valuable insights into their portfolio's performance, identify trends, and assess the effectiveness of investment strategies.

c) Time-saving Automation: Automation is a significant advantage of Portfolio Management Software. Users can automate routine tasks such as data updates, portfolio rebalancing, and event notifications. Instead of manually tracking and adjusting portfolios, software tools can automatically synchronise data, execute trades, and provide alerts for important events. This automation saves time, reduces manual errors, and ensures portfolios remain aligned with investment objectives.

d) Efficient Risk Management: Effective Risk Management is crucial in Portfolio Management. The software offers various risk assessment capabilities to evaluate and mitigate risks. Users can perform scenario analysis, stress testing, and risk simulations to assess the potential impact of market fluctuations. Additionally, some software solutions integrate advanced risk models and provide risk-adjusted performance metrics, enabling users to measure risk exposures and optimise portfolios accordingly.

e) Security and Data Integrity: Security is a paramount concern when handling financial data. Reputable Portfolio Management Software providers prioritise data security by implementing robust encryption protocols, secure data storage, and user authentication mechanisms. Using software from trusted providers that comply with industry standards and regulations, users can ensure the privacy and integrity of their investment data.

f) Reporting and Compliance: The Portfolio Management Tools offers comprehensive reporting capabilities to generate customised reports, statements, and tax documents. These reports can be tailored to meet specific regulatory requirements or client preferences. By automating the reporting process, users can save time, reduce manual errors, and ensure compliance with regulatory obligations.

Top Investment Portfolio Management Software on the Market

Portfolio Management Software can streamline your financial life with their ability to provide an aggregate view of multiple accounts. However, there are differences among the platforms. While some are focused exclusively on Investment Management and tracking, others account for saving, debt, budgeting, and spending along with Investment Management and analysis. Here, we explore the 11 best software for Portfolio Management. Let's dive in:

1) Empower

This is a powerful Portfolio Management Tool that enables users to consolidate and analyse their investment data in a single platform. It provides intuitive tools and advanced analytics to track performance, manage risk, and optimise investment strategies. With its user-friendly interface and robust features, Empower offers agency to its users to make informed decisions and achieve their financial objectives. It offers the following features:

a) Portfolio Consolidation: Import and sync data from various investment accounts for a consolidated view.

b) Performance Tracking: Monitor portfolio returns, asset allocation, and benchmark comparisons.

c) Automation: Automate data updates, portfolio rebalancing, and event notifications.

d) Risk Management: Perform scenario analysis, stress testing, and risk simulations.

e) Collaboration and Communication: Facilitate real-time cooperation and idea sharing.

f) Security and Compliance: Ensure data security and regulatory compliance.

g) Reporting and Analysis: Generate custom reports, statements, and tax documents.

Looking to broaden the scope and objectives of Portfolio Management? Sign up for our Management of Portfolios (MoP®) Foundation Exam Resit Course now!

2) Bloomberg Terminal

Bloomberg Terminal is a comprehensive financial information and analytics platform widely used by financial professionals worldwide. It provides real-time market data, news, analysis tools, and trading capabilities. The Bloomberg Terminal is renowned for its extensive coverage of financial markets and its ability to deliver critical information for making informed investment decisions. It offers the following features:

a) Real-time market data: Up-to-the-minute information on stocks, bonds, commodities, currencies, etc.

b) News and research: Access to a wide range of news articles, research reports, and analysis.

c) Analytics and charting tools: Powerful tools for in-depth market analysis and charting.

d) Bloomberg intelligence: Industry-specific research and analysis.

e) Trading and execution: Direct access to trading venues and efficient trade execution.

f) Portfolio management: Tracking, performance measurement, and risk analysis of investment portfolios.

g) Economic data and analytics: Extensive economic data, indicators, and forecasting tools.

3) Morningstar Direct

Morningstar Direct is a powerful investment analysis and research platform financial professionals used as a great Portfolio Management Software to make informed investment decisions. It provides comprehensive data, analytics, and tools for Portfolio Management, asset allocation, and performance evaluation. It offers the following features:

a) Investment Data and Research: Extensive data and research on mutual funds, ETFs, stocks, and more.

b) Portfolio Analytics: Tools for risk assessment, performance evaluation, and asset allocation analysis.

c) Fund and Stock Screening: Ability to filter investments based on specific criteria.

d) Performance Evaluation: Tools to measure and compare fund and portfolio performance.

e) Research Reports and Ratings: Proprietary research reports and ratings for investment insights.

f) Data Visualisation and Reporting: Visual presentation of investment data and customisable reports.

g) Economic and Market Insights: Access to economic data, market trends, and expert commentary.

h) Data Integration and Customisation: Integration of proprietary data and customisation options.

4) Charles River IMS

Charles River IMS is a comprehensive front-to-back-office Portfolio Management Tool used by asset managers, wealth managers, and institutional investors. It offers extensive features and functionalities to streamline investment operations, automate workflows, and enhance decision-making capabilities. Charles River IMS is known for its scalability, flexibility, and integration capabilities, making it a popular choice for investment professionals globally.

It offers the following features:

a) Order and Execution Management: Efficient routing, execution, and monitoring of trades across asset classes and trading venues.

b) Compliance and Regulatory Reporting: Compliance checks, monitoring, and automated reporting capabilities.

c) Data and Analytics: Real-time market data, quantitative analysis, and risk models for informed decision-making.

d) Integration and Connectivity: Seamless integration with data providers, trading platforms, and custodians.

e) Performance Measurement and Reporting: Tools for measuring performance, attribution analysis, and generating custom reports.

f) Workflow Automation: Automation of manual workflows and Straight-Through Processing (STP).

g) Compliance Monitoring: Monitoring of regulatory compliance and identification of potential risks.

h) Client and Stakeholder Reporting: Customised reporting and communication tools for clients and stakeholders.

Unlock the full potential of Portfolio Management and enhance your skills with our Management Of Portfolios (MoP®) Foundation & Practitioner Training!

5) Quicken Premier

Quicken Premier is a personal finance management software designed to help individuals and households manage their finances, track investments, and plan for the future. It offers a range of tools and features to simplify budgeting, track spending, and optimise investment strategies. Quicken Premier is known for its user-friendly interface and comprehensive financial management capabilities.

It offers the following features:

a) Budgeting and Expense Tracking: Create budgets and track expenses.

b) Investment Tracking: Monitor investment portfolios and performance.

c) Retirement Planning: Plan for future retirement goals.

d) Tax Planning: Track deductions and estimate tax liabilities.

e) Bill Payment and Reminders: Manage bills and set payment reminders.

f) Debt Management: Track and manage loans and credit cards.

g) Mobile Access: Access finances and track spending on mobile devices.

h) Data Security: Secure storage and encryption of financial data.

6) Ziggma

Ziggma is an innovative Investment Management platform designed as a Portfolio Management Software to empower individual investors with powerful tools and insights for managing their portfolios. It offers a comprehensive suite of features to help users make informed investment decisions, monitor their portfolios, and optimise their investment strategies. Ziggma stands out for its user-friendly interface, advanced analytics, and ability to integrate with brokerage accounts. It offers the following features:

a) Investment Research: Access real-time market data and research.

b) Model Portfolios: Analyse pre-built investment portfolios.

c) Risk Analysis: Assess portfolio risk.

d) Performance Reporting: Generate comprehensive performance reports.

e) Investment Ideas and Alerts: Receive notifications and investment suggestions.

f) Integration with Brokerage Accounts: Sync portfolios with popular brokers.

g) Watchlists and Stock Screening: Monitor stocks and filter based on criteria.

h) Collaborative Features: Share insights and ideas with peers.

7) Kubera

Kubera is a comprehensive personal wealth management platform designed to assist individuals in managing and tracking their net worth, assets, and liabilities. It offers a range of features and tools to simplify financial tracking, asset organisation, and estate planning. Kubera aims to provide users with a holistic view of their financial health and empower them to make informed decisions about their wealth. It offers the following features:

a) Net Worth Tracking: Monitor overall financial health.

b) Asset Organisation: Categorise and track assets.

c) Liabilities Management: Track debts and repayment progress.

d) Investment Portfolio Tracking: Monitor investment performance and diversification.

e) Estate Planning: Manage estate assets and beneficiaries.

f) Document Storage: Securely store critical financial documents.

g) Collaborative Sharing: Share financial information with trusted individuals.

h) Performance Analytics: Analyse investment returns and portfolio growth.

i) Goal Tracking: Set and track financial goals.

Become a master planner of Portfolio Management Implementation with our Management Of Portfolios (MoP®) Practitioner Exam Resit Course - Sign up now!

8) Simplifi by Quicken

Simplifi by Quicken is a powerful personal finance management app designed to help individuals simplify and take control of their finances. It provides users with a clear and organised view of their financial picture

Thus, they can track their spending, manage budgets, and stay on top of their financial goals. Simplifi stands out for its user-friendly interface, real-time syncing across devices, and comprehensive financial management capabilities. It offers the following features:

a) Account Aggregation: Sync financial accounts in one place.

b) Budgeting and Expense Tracking: Manage budgets and track expenses.

c) Bill Management: Track due dates and make payments.

d) Goal Tracking: Set and monitor financial goals.

e) Customisable Dashboards: Personalise financial views.

f) Spending Analysis: Analyse spending patterns.

g) Financial Insights: Receive actionable recommendations.

h) Real-time Syncing: Access data across devices.

i) Data Security: Protect sensitive financial information.

Unlock advanced strategies and upgrade your skills to MOP Practitioner level with our Management Of Portfolios (MoP®) Practitioner Upgrade Training!

9) Nitrogen

Nitrogen is another key example of a Portfolio Management Software that transformed the growth strategies of financial advisors and Wealth Management companies when it introduced ‘Riskalyze’ in 2011. Presently, Nitrogen serves as the primary growth platform for these firms, aiding advisors in converting prospects into appointments, transforming these appointments into valuable clients, and ultimately turning these clients into enthusiastic referrers.

Additionally, the company pioneered the Risk Number®, based on a Nobel Prize-winning academic foundation, and leads the Fearless Investing Movement. This Movement has attracted thousands of financial advisors who are dedicated to Nitrogen's goal of inspiring global confidence in fearless investing.

With regards to its market segment, 90 per cent of it comprises small businesses, indicating a strong focus on this sector. The remaining 7 per cent represents mid-market companies, suggesting a more modest engagement with these larger, more established businesses, possibly due to differing needs or the targeted service offerings of the market player.

10) SigFig

SigFig provides a no-cost service for managing investment portfolios, which is part of its automated Investment Management offerings. You can start by creating an account, connect your financial accounts, manually add your assets, and utilise SigFig's investment analysis tools. Some important points to remember about SigFig are:

Sigfig also allows you to help shape your ideal investment portfolio, by letting you answer questions about your financial objectives and risk tolerance. This data is essential for evaluating your current investments.

The portfolio analysis report generated by SigFig suggests an appropriate portfolio ranging from conservative to aggressive, based on your quiz answers. This report includes analysis of various aspects like:

(a) Volatility

(b) Stock/bond distribution or asset allocation

(c) Expense ratio

(d) Geographical diversification

(e) Cash drag

(f) Concentration in individual stocks

(g) A recommended portfolio

c) It also provides an estimate of the long-term value of a portfolio. The Holdings screen presents details like performance, fundamentals, profits, losses, and other crucial investment metrics.

d) Users must note that the Sigfig reports offer limited customisation options. SigFig users do not have access to tools for tracking spending, saving, debts, and budgeting. However, given that SigFig is free, it serves as a useful tool for a quick overview of your portfolio and comparison with a suggested asset mix.

11) Fidelity Full View

The Fidelity Full View Portfolio Management Program is a personal finance organisation tool by eMoney Advisor, LLC. The program integrates your linked financial account data to analyse all your accounts within one system. The supported accounts include credit cards, loans, banks, investments, insurance, and mortgages. Once the financial accounts are linked, the information automatically updates daily.

The Fidelity Full View Dashboard shows net investments, worth, retirement analysis, spending, and insurance. The investments easily sync and showcase asset transaction and allocation views in addition to the summary. The available investment reports include the following:

a) Net worth history

b) Holdings detail

Some of the advantages of Fidelity Full View includes:

a) Clean interface

b) Access to Fidelity calculators and tools

c) Good portfolio syncing with outside accounts

d) Tracks many account types

Compare the Best Portfolio Management Software Tools

Here is a summarised comparison of the 11 best Portfolio Management Software Tools mentioned above:

|

Company |

Trackable Asset Classes |

Trackable Account Types |

|

Empower |

Stocks, bonds, ETFs, mutual funds, cash, real estate |

Retirement accounts, brokerage accounts, cash accounts |

|

Bloomberg Terminal |

Stocks, bonds, ETFs, mutual funds, commodities, derivatives, Forex |

Brokerage accounts, retirement accounts, custom portfolios |

|

Morningstar Direct |

Stocks, bonds, ETFs, mutual funds, alternatives |

Brokerage accounts, retirement accounts, institutional accounts |

|

Charles River IMS |

Stocks, bonds, ETFs, mutual funds, derivatives |

Institutional accounts, brokerage accounts, retirement accounts |

|

Quicken Premier |

Stocks, bonds, ETFs, mutual funds, real estate |

Brokerage accounts, retirement accounts, cash accounts, loans |

|

Ziggma |

Stocks, bonds, ETFs, mutual funds |

Brokerage accounts, retirement accounts, cash accounts |

|

Kubera |

Stocks, bonds, ETFs, mutual funds, real estate, Cryptocurrencies |

Brokerage accounts, retirement accounts, bank accounts, crypto wallets |

|

Simplifi by Quicken |

Stocks, bonds, ETFs, mutual funds |

Brokerage accounts, retirement accounts, cash accounts |

|

Nitrogen |

Stocks, bonds, ETFs, mutual funds, options |

Brokerage accounts, retirement accounts, custom portfolios |

|

SigFig |

Stocks, bonds, ETFs, mutual funds |

Brokerage accounts, retirement accounts |

|

Fidelity Full View |

Stocks, bonds, ETFs, mutual funds, real estate |

Brokerage accounts, retirement accounts, cash accounts |

Transform your financial future! Access the Portfolio Management PDF Guide and start managing your investments like a pro.

Challenges with Investment Portfolio Management Software

Every software solution has challenges, such as business, technological, and compliance requirements. Some challenges associated with investment Portfolio Management Software are:

1) Portfolio Overload: Many portfolios are overloaded with assets. Therefore, enhancing diversity amongst these assets leads to a lack of overtrading and monitoring. Consequently, this complicates software usage, negatively impacting most portfolio managers' learning curve.

2) Scalability and Integration: Some Portfolio Management Software cannot be scaled or unsuitable for managing large and complex portfolios. In addition, integrating the software into an existing platform is very hard, resulting in technological challenges such as glitches, downtime, and financial data aggregation across platforms.

3) Security: Data privacy is currently a significant problem in the technology sector. Without a complex security system that is compliant with regulatory rules and laws, it is tough to protect financially sensitive information. For many investors, their strategies, investment amounts, asset class types, and investment decisions are highly valued.

Get ahead in your interview process with our comprehensive Wealth Management Interview Questions. Start preparing now for success!

Conclusion

In conclusion, Portfolio Management Software plays a crucial role in helping individuals and businesses effectively manage their investments, track performance, and make informed financial decisions.These software solutions offer a wide range of features and capabilities, including portfolio tracking, Investment Analysis, Risk Assessment, performance reporting, and collaboration tools. We hope this blog serves as a beacon for optimisng your investment strategies, monitoring market trends, and achieving your financial goals.

Master the art of Portfolio Management, maximise strategic alignment, and achieve organisational excellence with our comprehensive Management of Portfolios (MoP) training courses!

Frequently Asked Questions

How Should you Choose Portfolio Management Software?

To choose Portfolio Management Software, consider the following:

a) Ensure the software aligns with your investment goals

b) Evaluate the user interface and ease of use

c) Look for features like real-time data updates, risk analysis, and tax reporting

d) Check for integration capabilities with financial institutions and your device

How can Proficiency in Portfolio Management Software Benefit my Career?

Numerous people depend on Portfolio Management services for supervising and administering their investment portfolios. These services minimise risk, optimise returns, and grow clients' investments. Learning Portfolio Management skills helps effectively manage your clients’ investments and helps them achieve their financial objectives.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are Related Portfolio Management Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers PMP Training, including courses such as Portfolio Management Professional (PgMP®), PMI Project Management Ready and more. These courses cater to different skill levels, providing comprehensive insights into Project Charters.

Our Project Management Blogs cover a range of topics related to Portfolio Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Portfolio Management skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Project Management Resources Batches & Dates

Date

Portfolio Management Green Belt Certification Course

Portfolio Management Green Belt Certification Course

Mon 19th May 2025

Mon 8th Sep 2025

Mon 8th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please