We may not have the course you’re looking for. If you enquire or give us a call on +971 8000311193 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In today’s rapidly changing world, organisations face several risks and uncertainties that can impact their operations and finances. Management of Risk (M_o_R) is crucial for identifying, assessing and mitigating these potential risks to ensure long-term success and sustenance.

Management of Risk (M_o_R) provides a structured risk management framework that helps organisations improve decision-making, reduce uncertainty and improve their overall performance. In this blog, we will discuss the M_o_R framework and its aspects in detail.

Table of Contents

1) How does M_o_R work?

a) M_o_R Principles

b) M_o_R Approach

c) M_o_R Processes

2) Conclusion

How does M_o_R work?

M_o_R is a roadmap for organisations to follow with regard to risk management. It brings together three core concepts - principles, approaches and processes to formulate a strategy that helps mitigate and avoid risks and improve overall performance.

Below is an explanation of all three aspects of a M_o_R framework:

a) M_o_R Principles

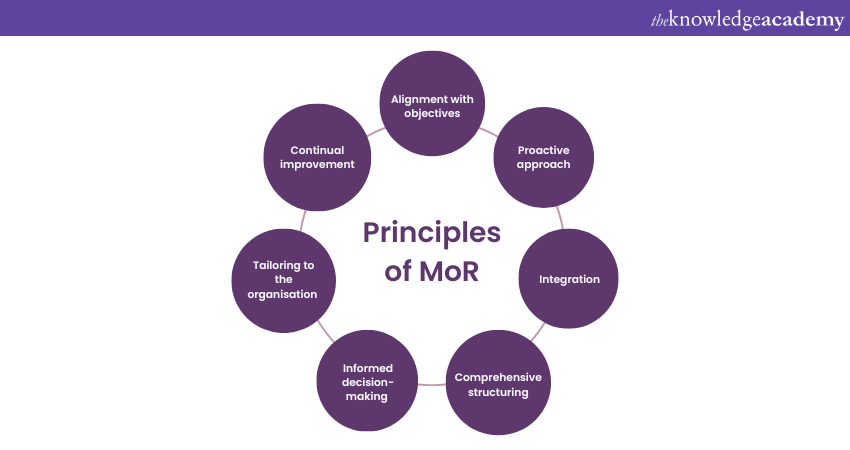

M_o_R principles refer to a set of guidelines that provide a framework for effective risk management within an organisation. M_o_R Practitioner will help in understanding real worlds scenarios and its method of implementation. These principles are designed to help an organisation identify, assess and manage risks in a timely and effective manner.

There are seven principles that need to be followed according to the M_o_R framework:

a) Alignment with objectives

b) Proactive approach

c) Integration

d) Comprehensive structuring

e) Informed decision-making

f) Tailoring to the organisation

g) Continual improvement

b) M_o_R Approach

An enterprise’s approach to the M_o_R principles depends on the industry, the revenue generation and the business strategies it has adopted. The organisation, while formulating the framework, will agree on the following documents:

a) Risk Management Policy

b) Process Guide

c) Strategy Document

d) Issue Log

e) Risk Registers

These documents will help the organisation formulate a solid and effective M_o_R strategy.

c) M_o_R Processes

The M_o_R framework defines four main processes:

1) Risk identification: This process involves identifying potential risks that may affect the achievement of the organisational objectives. The primary objective of this process is to create a comprehensive list of risks the organisation may face.

2) Risk assessment: This process involves analysing the identified risks to determine their likelihood and impact. The main objective of this process is to prioritise the risks listed based on their severity of impact.

3) Risk response planning: This process involves developing strategies and plans to mitigate the identified risks. The chief objective of this process is to identify appropriate risk responses and develop plans to implement them.

4) Risk monitoring and reporting: This process involves monitoring the effectiveness of the risk management strategies and reporting on the progress of all risk management activities undertaken. The prime objective of this process is to ensure that risk management remains a continuous process and that risks are managed effectively over time.

Conclusion

Summing up, the M_o_R framework consists of three primary aspects, principles, approach and processes and along with which challenges of management of risk comes up. These aspects will determine how effectively M_o_R will work in an organisation that chooses to adopt it.

Register for our MoR® 4 Practitioner Risk Management Certification course today and discover how to overcome and mitigate risks.

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

MoR® 4 Practitioner Risk Management Certification

MoR® 4 Practitioner Risk Management Certification

Mon 20th Jan 2025

Mon 17th Mar 2025

Tue 22nd Apr 2025

Mon 19th May 2025

Mon 16th Jun 2025

Mon 21st Jul 2025

Mon 18th Aug 2025

Mon 15th Sep 2025

Mon 20th Oct 2025

Mon 17th Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please