We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

In business and finance, the question- “What is Bookkeeping” stands as the cornerstone of organised Financial Management. It is a vital practice that every company, regardless of its size or industry, relies upon to keep its financial house in order.

Bookkeeping is not merely a tedious task; it is a fundamental component of maintaining financial stability, making informed decisions, complying with tax regulations, and conducting in-depth financial analysis. Still wondering What is Bookkeeping? Read this blog further to learn about Bookkeeping in detail.

Table of content

1) Understanding What is Bookkeeping

2) Importance of Bookkeeping

3) Types of Bookkeeping methods

4) Recording transactions in Bookkeeping

5) Steps to become a Bookkeeper

6) Conclusion

Understanding What is Bookkeeping

Bookkeeping is the systematic and methodical process of recording, organising, and maintaining a detailed record of a company's financial transactions. These financial transactions encompass a wide range of activities, including income, expenses, assets, liabilities, and equity. The primary objective of Bookkeeping is to create an accurate and up-to-date ledger of a company's financial activities. It ensures that the financial statements reflect a true and reliable representation of the company's financial status.

Thus, Bookkeeping involves documenting every monetary movement within a business. It serves as the financial foundation upon which businesses build their financial strategies, assess their financial health, and fulfil their regulatory obligations.

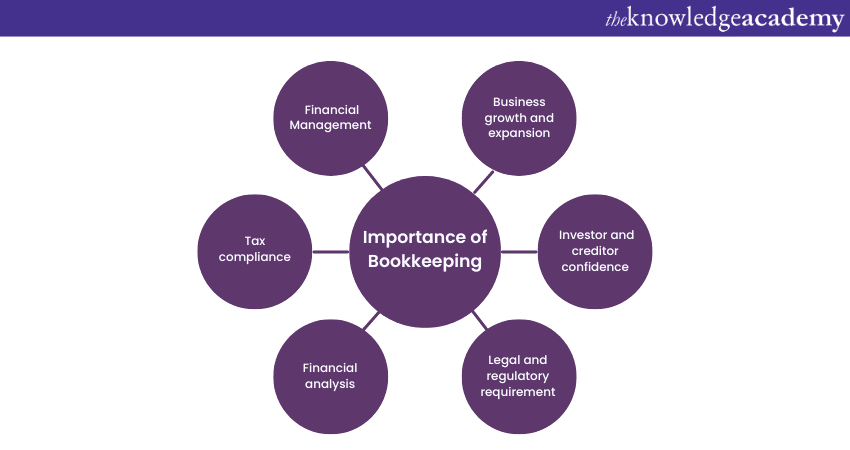

Importance of Bookkeeping

Bookkeeping is indispensable for businesses and individuals for a variety of crucial reasons. These are as follows:

1) Financial Management: Bookkeeping provides a clear, organised, and real-time overview of a company's financial position. This information empowers business owners, managers, and stakeholders to make informed decisions regarding budgeting, investment, and resource allocation.

2) Tax compliance: Businesses are required to report their financial transactions to tax authorities, and incomplete or inaccurate records can result in costly penalties and legal issues. Proper Bookkeeping ensures that all income, expenses, deductions, and credits are correctly documented. This makes the tax filing process smoother and reduces the risk of audits.

3) Financial analysis: Bookkeeping allows businesses to assess their profitability, liquidity, and overall financial health. Analysing financial records can uncover trends, identify areas of improvement, and highlight potential financial risks. This data-driven approach is invaluable for making strategic decisions. Thus, it helps set financial goals and plans.

4) Legal and regulatory requirement: Many countries have legal requirements mandating proper Bookkeeping. Failing to maintain accurate financial records can result in legal consequences, including fines and, in extreme cases, business closure. Adhering to these regulations not only keeps businesses in good standing but also fosters transparency and accountability.

5) Investor and creditor confidence: Investors and creditors often require access to a company's financial records to assess its creditworthiness and stability. Detailed and well-maintained Bookkeeping can instil confidence in potential investors and lenders. This, in turn, can make it easier for businesses to secure funding or attract investors.

6) Business growth and expansion: As businesses grow, so does the complexity of their financial operations. Proper Bookkeeping provides a solid foundation for expansion. It enables businesses to track performance, secure financing for growth, and navigate the challenges associated with scaling operations.

Ready to kickstart your career in Bookkeeping? Join our Book Keeping Training and become a skilled professional today!

Types of Bookkeeping methods

Bookkeeping can be performed using different methods, each tailored to suit specific business needs and complexities. The two primary types of Bookkeeping methods are as follows:

Single-entry Bookkeeping

Single-entry Bookkeeping is a simple method. It is typically used by small businesses and sole proprietors. In this system, only one entry is made for each financial transaction, usually in a simple ledger or spreadsheet.

It records basic information about income and expenses. Single-entry Bookkeeping is relatively easy to maintain, but it lacks the comprehensive detail provided by double-entry Bookkeeping. The key features of single-entry Bookkeeping include the following:

a) Suitable for small and uncomplicated businesses.

b) Transactions are recorded once, typically as a list of income and expenses.

c) Less comprehensive than double-entry Bookkeeping.

d) It doesn't track the dual effect of transactions on accounts.

Double-entry Bookkeeping

Double-entry Bookkeeping is the more advanced and widely used method. It is the standard for most businesses, especially those with multiple transactions and complex financial structures.

In this system, every financial transaction is recorded twice: once as a debit (an increase in one account) and once as a credit (a decrease in another account). This method maintains a balance between assets, liabilities, equity, income, and expenses. As a result, it ensures the accuracy and integrity of the financial records. The key features of double-entry Bookkeeping include the following:

1) Suitable for businesses of all sizes and complexities.

2) Provides a comprehensive and balanced view of a company's financial position.

3) Helps in identifying errors or inconsistencies in the accounting records.

Register for our Introduction To Credit Control Course to master the art of managing credit and boosting financial stability!

Process of recording transactions in Bookkeeping

Recording transactions in Bookkeeping involves several key steps, and the methods used can vary. The following are four common steps in the process of recording transactions:

Using cash registers

Cash registers are commonly used to record sales transactions in retail and service businesses. These machines automatically record sales amounts, calculate change, and generate receipts for customers. While cash registers are helpful for tracking cash sales, they are limited in their ability to record non-cash transactions, like credit card payments or expenses.

Utilising the journal

The journal is a chronological record of all financial transactions, whether they involve cash, credit, or other forms of payment. Each transaction is recorded in the journal with details such as date, description, accounts affected, and amounts. This chronological recording provides a complete transaction history.

Maintaining the ledger

The ledger is a more organised and structured record of financial transactions. It categorises transactions by account. Thus, it allows businesses to see the balance of each account at any given time. The ledger consists of individual accounts, such as cash, accounts receivable, accounts payable, and various income and expense accounts. Each transaction recorded in the journal is posted to the corresponding account in the ledger.

Creating a trial balance

A trial balance is a summary of all the accounts in the ledger and their respective balances. It serves as a preliminary check to ensure that debits and credits in the ledger are equal, helping identify errors and discrepancies. If the trial balance does not balance (i.e., the debits do not equal the credits), it indicates an issue that needs to be resolved before finalising financial statements.

Take control of your financial future by joining our Financial Management Training now!

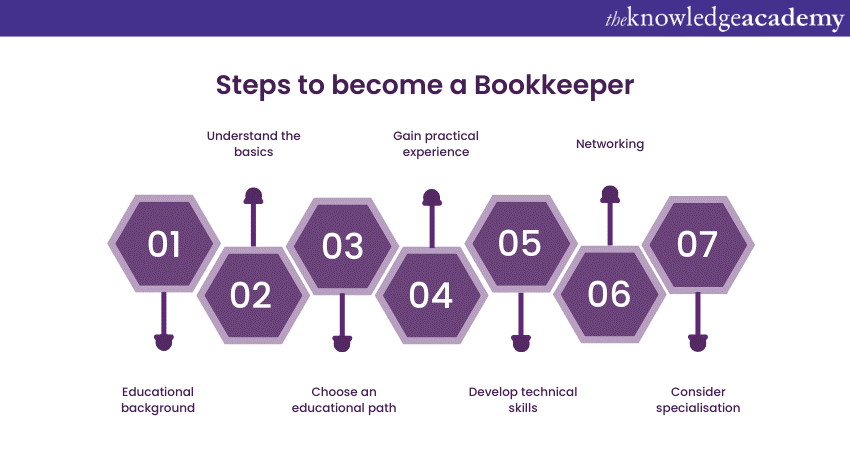

Steps to become a Bookkeeper

Becoming a Bookkeeper involves a combination of education, training, and practical experience. Here are the steps to pursue a career in Bookkeeping:

a) Educational background: Start by completing your high school education, as it provides the foundation for further studies and skills needed in Bookkeeping. You can go for a High School Diploma.

b) Understand the basics: Develop a strong understanding of basic arithmetic, mathematics, and numerical skills. Bookkeeping is heavily reliant on accuracy in calculations.

c) Choose an educational path: While a college degree is not always required, many Bookkeepers pursue relevant education to enhance their skills. Consider the following options:

d) Associate degree in accounting or Bookkeeping: This is a two-year program that provides a more comprehensive understanding of Bookkeeping principles.

e) Certification programs: Many organisations offer Bookkeeping certification programs, such as Certified Bookkeeper (CB) or Certified Public Bookkeeper (CPB). These programs can be completed in a shorter time frame than a degree.

f) Online courses: There are numerous online courses and tutorials that can help you learn Bookkeeping skills at your own pace.

g) Gain practical experience: Practical experience is crucial in Bookkeeping. Consider internships or part-time positions that allow you to apply your knowledge and gain real-world experience. You can work for small businesses, accounting firms, or as a freelance bookkeeper.

h) Develop technical skills: Familiarise yourself with Bookkeeping software and accounting tools. Proficiency in software like QuickBooks, Xero, or Sage can be a valuable asset in your career.

i) Networking: Join professional organisations and networks related to Bookkeeping and accounting. Building a strong professional network can lead to job opportunities and industry insights.

j) Consider specialisation: Bookkeeping can cover a broad range of industries and areas. You may choose to specialise in areas such as payroll, tax preparation, or forensic accounting, depending on your interests and career goals.

Join our Accounting & Finance Training and enhance your expertise for a brighter financial future!

Conclusion

we hope that after reading this blog you have understood What is Bookkeeping. It is the vital practice of recording, organising, and maintaining an accurate record of financial transactions. It serves as the backbone of financial management for businesses and individuals alike.

Level up your accounting skills with our Accounting Masterclass - join today!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 17th Jan 2025

Fri 21st Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 25th Jul 2025

Fri 7th Nov 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please