We may not have the course you’re looking for. If you enquire or give us a call on +61 1-800-150644 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Mastering Cash Flow Management is crucial for maintaining your business’s financial health. By adopting strategic practices, you can boost liquidity, cut costs, and ensure a steady revenue stream, paving the way for sustainable growth and stability.

Dive into this blog to discover effective techniques for improving cash flow. Learn How to Improve Cash Flow Management and take control of your finances, securing a prosperous future for your business with these proven Cash Flow Strategies.

Table of Contents

1) 8 Ways to Improve Cash Flow

a) Review Your Accounts Payable Terms

b) Negotiate Faster Payment Terms

c) Evaluate Your Spending

d) Offer Customer Incentives and Penalties

e) Accelerate the Collection of Receivables

f) Issue Invoices Promptly

g) Seek Professional Financial Advice

h) Analyse Your Cash Flow Patterns

2) Why Improving Cash Flow Can Be Challenging

3) Conclusion

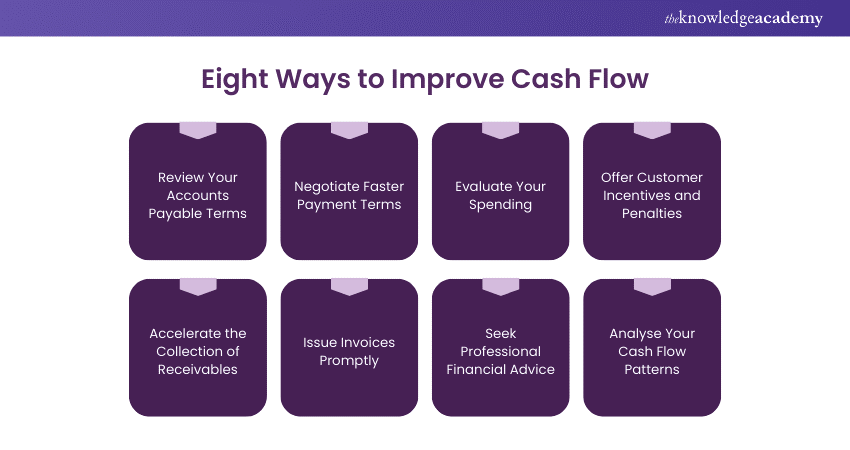

Eight Ways to Improve Cash Flow

Effectively managing Cash Flow is important for strengthening your business's long-term financial foundation. By implementing strategic practices, you can ensure steady liquidity, reduce expenses, and foster sustainable growth. Here are eight insider tips on How to Improve Cash Flow and provide your business with essential financial flexibility.

1) Review Your Accounts Payable Terms

One of the first steps in improving Cash Flow is to review the terms of your accounts payable. This includes understanding the payment schedules you’ve agreed upon with your suppliers. If possible, negotiate extended payment terms to keep cash in your business longer. By aligning your payment schedules with your cash inflows, you can avoid cash shortages and better manage your outflows.

2) Negotiate Faster Payment Terms

While extending your own payment terms can improve Cash Flow, it's equally important to negotiate faster payment terms with your clients. Encourage your customers to pay earlier by offering small discounts or incentives for early payment.

This strategy speeds up your cash inflow and ensure that funds are available more quickly. It also improves your overall liquidity, providing your business with greater flexibility in managing its finances.

3) Evaluate Your Spending

Regularly evaluating your spending is a key method to optimise your Cash Flow Management. Review all expenses and identify areas where you can cut costs without compromising the quality of your products or services.

Consider renegotiating contracts, finding alternative suppliers, or even eliminating unnecessary expenses. By keeping a close eye on your spending, you can free up cash that can be redirected to other areas of your business.

4) Offer Customer Incentives and Penalties

One effective tactic to encourage early payments is offering clients a discount, such as a 2% reduction on the invoice amount if payment is made within seven days. Additional incentives could include discounts on future orders, gift certificates, or merchandise. Clearly mention these offers on the invoice to motivate prompt action.

To minimise the risk of unpaid invoices, consider implementing late payment fees. Ensure the penalty is clearly outlined in the initial customer contract and reiterated when invoicing, specifying the fee and when it will be applied.

5) Accelerate the Collection of Receivables

Speeding up the collection of receivables is another effective way to improve Cash Flow. Implement a robust invoicing system that ensures invoices are sent out promptly and followed up on regularly.

Consider using automated reminders for overdue payments to ensure timely follow-ups and reduce payment delays. Additionally, it offers multiple payment options to make it easier for customers to settle their accounts quickly. The faster you collect your receivables, the sooner you can reinvest that cash back into your business.

Transform your career with expert training in Accounting and Financial Statement Analysis Training - Join now!

6. Issue Invoices Promptly

Timely invoicing is critical to maintaining a healthy Cash Flow. Ensure that invoices are issued immediately after a sale or service is completed. Delayed invoicing can lead to delayed payments, which in turn affects your Cash Flow.

By adopting a prompt invoicing system, you can ensure that cash is coming in as quickly as possible. This help to maintain steady Cash Flow and reducing the likelihood of cash shortages.

7. Seek Professional Financial Advice

At times, handling Cash Flow can become complicated, particularly as your business expands. Consulting a financial expert can offer valuable guidance on improving your financial management skills.

An advisor specialising in finance can assist you in recognising possible problems with Cash Flow. He has the ability to suggest tactics for enhancing liquidity and aid in long-term financial planning. Seeking expert guidance in finance can help you avoid costly mistakes and safeguard your company from economic difficulties in the long run.

8. Analyse Your Cash Flow Patterns

Consistently monitoring your Cash Flow patterns is crucial for identifying patterns and predicting potential Cash Flow issues. By examining your Cash Flow statements, you can pinpoint times of reduced cash coming in and prepare for them.

Having knowledge of how your Cash Flows behave can also assist in predicting upcoming cash requirements. This enables you to make well-informed choices regarding spending, investments, and savings. Maintaining regular analysis helps you proactively address Cash Flow problems and solidify a stable financial base for your business.

By following these eight methods, you can enhance the Cash Flow of your organisation and guarantee lasting stability and expansion. Proper Cash Flow Management can help sustain your business and set it up for success in the long run.

Why Improving Cash Flow Can Be Challenging

The primary cause of Cash Flow issues is insufficient turnover. While late and overdue payments might boost your sales figures, they don’t translate into immediate cash, often delaying actual income for several months. In some cases, you may even need to write off certain debtors as bad debts.

Rapid expansion combined with low sales margins can further strain your Cash Flow, making improvements challenging. Additionally, poor inventory management is another critical factor that can exacerbate Cash Flow problems.

Enhance your career with our expert-led Accounting Courses – Register now and take control of your financial future!

Conclusion

Understanding How to Improve Cash Flow is vital for the financial health and sustainability of your business. By implementing strategic practices like managing payment terms, optimising expenses, and improving inventory management, you can enhance liquidity and ensure steady growth. Taking control of your Cash Flow today will pave the way for a stronger, more resilient business tomorrow.

Boost your Financial Management Skills with our Cash Flow Training - Sign up now to secure your business’s growth!

Frequently Asked Questions

What is the Role of the Cash Flow?

Cash Flow plays an important role in maintaining a business's financial health by ensuring sufficient liquidity to cover operational expenses, debts, and investments. It reflects the inflow and outflow of cash, helping businesses manage day-to-day operations, plan for future growth, and avoid financial shortfalls.

What Increases or Decreases Cash Flow?

Cash Flow can be increased by speeding up receivables, cutting unnecessary expenses, and optimising inventory management. Conversely, it can decrease due to late payments, high operational costs, excessive debt, and poor financial planning, all of which strain a business's liquidity.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses, including Cash Flow Training, Inventory Accounting and Costing Course and Accounting and Financial Statement Analysis Course. These courses cater to different skill levels, providing comprehensive insights into Corporate Finance.

Our Accounting and Finance Resources cover a range of topics related to Accounting, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Accounting and Finance Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please