We may not have the course you’re looking for. If you enquire or give us a call on +61 1-800-150644 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Investment Banking is a competitive and fast-paced industry that demands a unique set of skills to succeed. Regardless of whether you're a fresh graduate aspiring to enter this field or a seasoned professional aiming to climb the corporate ladder, honing these specific Investment Skills is necessary for a successful career in Investment Banking. Through this blog, learn the key Investment Banking Skills that will give you an edge in the fast-paced and competitive financial sector. Discover how these skills can help you achieve your career goals.

Table of Contents

1) Who is an Investment Banker?

2) What skills do you need for Investment Banking?

3) Why are Investment Banking Skills important?

4) Developing efficient Investment Banking Skills

5) Conclusion

Who is an Investment Banker?

An Investment Banker is a Finance expert employed by a financial institution, assisting clients in securing funds for various objectives. Some of the tasks that an Investment Banker does are as follows:

a) Arranging financing by issuing bonds or stocks

b) Advising on mergers and acquisitions

c) Preparing and marketing Initial Public Offerings (IPOs)

d) Managing risks and complying with regulations

e) Innovating and adapting to changing markets

Investment Bankers need to have strong analytical, communication, interpersonal, and negotiation skills. They also need to work under tight deadlines and handle complex financial transactions. Investment Bankers are often well-paid but also face high stress and competition.

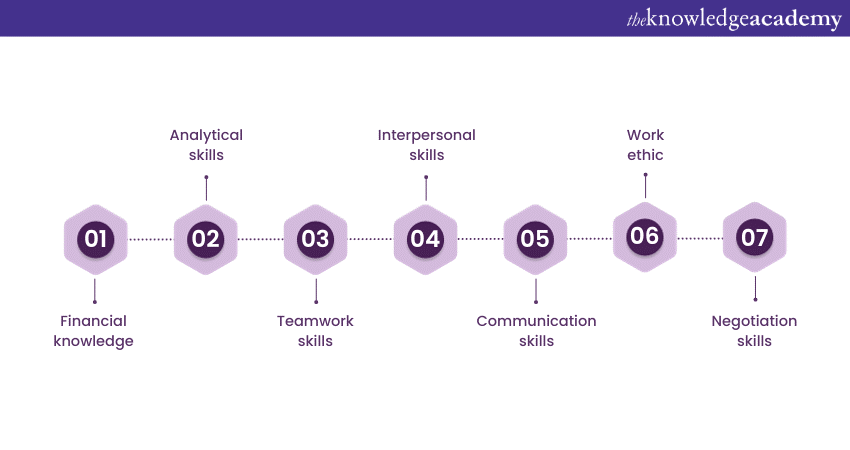

What skills do you need for Investment Banking?

Now, let’s have a closer look at various Investment Banking Skills that you need to possess:

Financial knowledge

A strong knowledge of market forces, asset depreciation, Portfolio Management and other Investment-related concepts is a must-have for an Investment Banker. This makes the Investment Banker a reliable source for organisations to consult about assets and Investment strategies. You can acquire this knowledge through academic programs or even with sound work experience.

Analytical skills

From the perspective of an Investment Banker, analytical thinking refers to analysing data for their clients and coming up with the best Investment strategy. Analytical thinking is at the core of Investment Banking Skills.

In smaller organisations, Investment Bankers have to do research on their own to analyse the client's data. However, in large and well-established organisations they have analysts to support them by collecting the required data. With these Investment Banking Skills in hand, you can easily identify problems and discover solutions, ensuring customer satisfaction.

Teamwork skills

Teamwork is a key Investment Banking Skill to possess. They work in close proximity with other Investment Bankers and need good communication skills to propagate their ideas and lead the team. If you are to lead a team of other Investment Bankers, you must master Leadership Qualities as well as hone efficient management skills.

Interpersonal skills

If you are an Investment Banker, you have to deal with a wide variety of people. These include clients, team members and analysts. The Finance sector certainly demands fast-paced outputs, and a lot of people who are anxious about the financial market may be difficult to deal with. Being able to handle difficult conversations regarding the financial market can facilitate Investment strategy planning.

Communication skills

As an Investment Banker, you must be adept at both verbal as well as non-verbal communication skills. A large part of your day will involve communicating with team members, clients as well as potential investors. Additionally, you must possess the ability to communicate by email and phone calls. This gives you the flexibility to establish good relationships with the clients. Having good persuasive skills can make your current clients plan long-term Investment strategies with you.

Work ethic

Regardless of your domain, you won't be able to achieve success in your career without the right work ethic – the domain of Investment Banking is no different. To develop a good reputation as an efficient Investment Banker, you might have to work after hours. Additionally, you have to work longer days than usual to build a strong base of clients. As the market is fickle in nature and is constantly changing, you have to make changes in the client's portfolio distribution at very short notice.

Negotiation skills

Being able to reach agreements which are of mutual benefit to both parties is very essential. This is a core skill you need to develop as well as you can to become a successful Investment Banker.

Learn how you can master Revenue Management by checking out our Revenue Management Training!

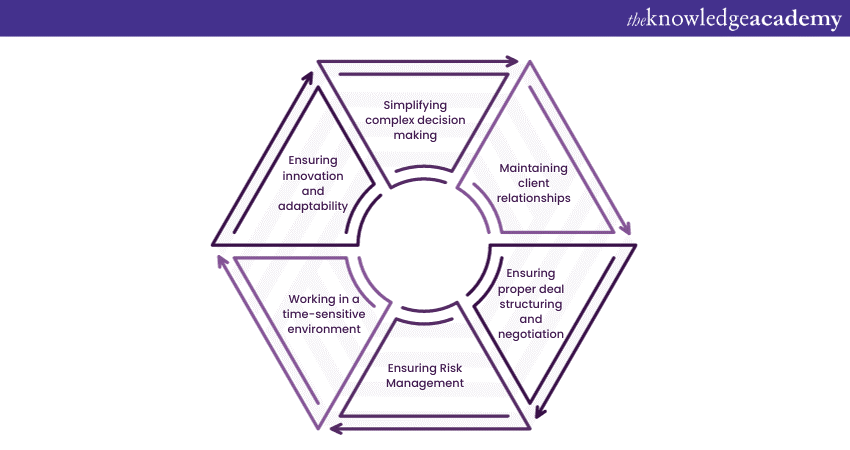

Why are Investment Banking Skills important?

Investment Banking Skills are essential for success in the financial world. Here are some reasons why:

a) Complex decision making: Investment Bankers need to understand financial data, evaluate risks, and anticipate market trends. Skills like financial analysis and modelling help them navigate the financial landscape.

b) Client relationships: Investment Bankers must communicate effectively, understand and address clients’ needs, and foster trust and satisfaction. Clients rely on Investment Bankers for their financial goals; strong interpersonal skills are important.

c) Deal structuring and negotiation: Investment Bankers must craft deals that benefit all parties. Skills like negotiation, creativity, and financial knowledge help them ensure that deals are profitable and sustainable.

d) Risk Management: Investment Bankers must assess and manage risks to protect their clients’ investments and assets. Skills like analytical thinking, market awareness, and attention to detail help them identify and mitigate potential risks.

e) Time Management: Investment Bankers need to work within strict timelines. Whether it’s closing a deal, preparing financial reports, or conducting market research, they must balance multiple tasks and meet deadlines. It ensures that opportunities are maximised, and client expectations are met promptly.

f) Innovation and adaptability: Investment Bankers need to remain at the forefront of the ever-changing financial environment. They must embrace new tools and methodologies and leverage emerging opportunities and challenges. Skills like innovation and adaptability help them do that.

Developing efficient Investment Banking Skills

While the Investment Banking industry demands a lifelong learning process, let's look at some of the ways to develop efficient Investment Banking Skills:

Education

Many Investment Bankers have degrees in Business Management and Finance. However, a lot of others come from a variety of educational backgrounds. The degree courses offer valuable knowledge of different types of Investment as well as basic Financial Management.

Based on the course that you may choose, you might as well get to learn about Project Management and analytical thinking skills. A four-year degree will include regular academic classes, which will help you ace your written communication and quantitative reasoning.

Certification Courses

If you want to represent the firm as an Investment Banker, most financial service firms prefer certified individuals. To earn a certification, you have to pass an exam that tests your Investment Banking skills and knowledge and Financial Management concepts, which includes legal statutes.

Work experience

Internships at financial institutions can be your first step to becoming an Investment Banker. You can complete these internships during or after the completion of your certification course. These courses teach future Investment Bankers how financial organisations operate.

This allows you to observe how experienced Investment Bankers, Fund Managers, and other finance professionals work. Based on the internship, you might learn about Investment opportunities and learn about researching funds. You can also be asked to assist a specific financial Investment Banker while working with their clients. This experience can provide valuable insights into various financial instruments and their applications, which might include understanding the differences between a Bank Guarantee vs Letter of Credit.

Want to know more about Investment? Join our Investment and Trading Training today!

Conclusion

By reading this blog, we hope you learned what it takes for becoming an Investment Banker and how to develop Investment Banking skills. With the right mindset, you can hone your skills and make your way up to the top slowly but surely. Remember that it is not an overnight process and requires patience and perseverance. Follow the roadmap discussed above, and you will be a step closer to securing your dream job!

Want to know more about Investment Management? Join our Investment Management Masterclass today!

Frequently Asked Questions

Which technical skills are highly sought-after in Investment Banking?

Some of the technical skills that are highly sought-after in the field of Investment Banking involve the following:

a) Financial analysis and modelling

b) Data interpretation and presentation

c) Risk and Credit Management

d) Knowledge of Investment products and markets

Which technical skills are highly sought-after in Investment Banking?

Improving your Investment Banking Skills can impact your earning potential in several ways, such as the following:

a) Enhancing your performance and productivity

b) Increasing your value and reputation

c) Expanding your opportunities and network

d) Developing your career and growth

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Trainings, including Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Investment and Trading methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills blogs to discover more insights!

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please