We may not have the course you’re looking for. If you enquire or give us a call on +61 1-800-150644 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Every step in the world of investment can feel like treading uncharted waters teeming with risks, ready to drag your financial dreams to the depths! But what if you could have trusty compasses to guide you through it all? Net Present Value (NPV) and Internal Rate of Return (IRR) are precisely that! These two powerful financial metrics help investors assess the profitability of projects by accurately comparing cash inflows and outflows with distinct perspectives.

The blog explores the critical differences between Net Present Value Vs Internal Rate of Return, highlighting everything from their formulas for calculation to reinvestment assumptions and preferences in decision-making. Read on and master the craft of making smarter, more rewarding investment decisions!

Table of Contents

1) Understanding Net Present Value (NPV)

2) Formula for Calculating NPV

3) How to Calculate NPV Using Excel?

4) Understanding of Internal Rate of Return (IRR)

5) Formula for Calculating (IRR)

6) How to Calculate IRR Using Excel?

7) Key Differences Between NPV and IRR

8) Conclusion

Understanding Net Present Value (NPV)

Net present value (NPV) is a method of discounting all cash flows back to their present value, utilising the cost of capital, and then adding the present values. The assumption underlying NPV is that all future cash flows shall be reinvested at the cost of capital rate. Essentially, the higher the NPV, the more attractive the project.

Formula for Calculating NPV

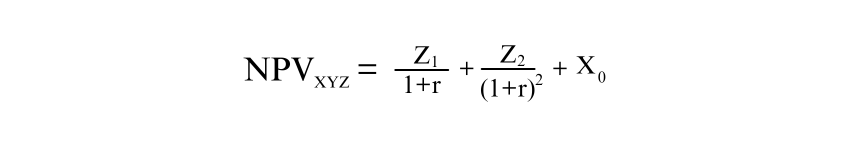

The formula for Net Present Value is:

Where:

Z1 = Cash flow in Time 1

Z2 = Cash flow in Time 2

R = Discount rate

X0 = Cash outflow in Time 0 (Initial investment)

How to Calculate NPV Using Excel?

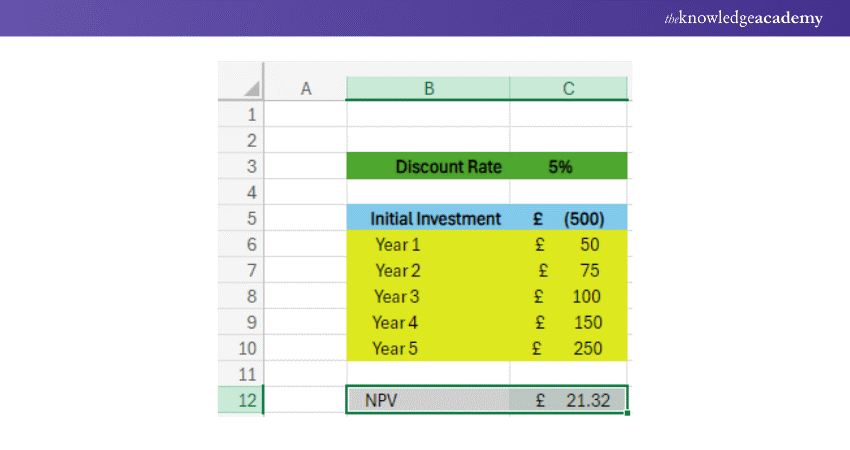

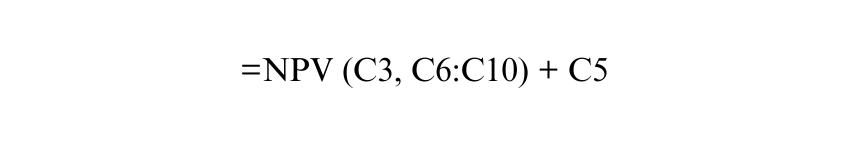

The NPV function is a common Excel tool in financial modelling and calculates the NPV of a series of cash flows. The full formula requirement for calculating NPV is as follows:

=NPV(discount rate, future cash flow) + Initial Investment

In this example, the formula put into the grey NPV cell is:

Understanding of Internal Rate of Return (IRR)

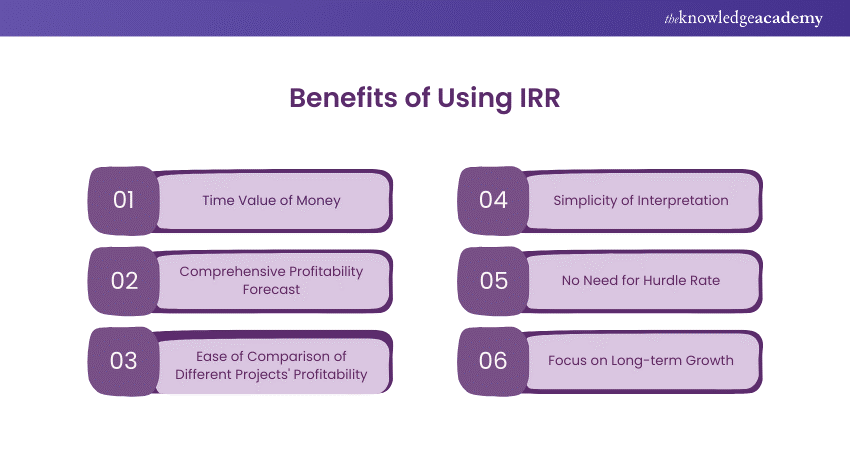

Internal rate of return (IRR) is the rate at which NPV equals zero. So, it's the rate at which discounted cash inflows equal the outflows. The IRR is analogous to the Yield to Maturity (YTM) when discussing bonds. The higher the IRR, the better the project.

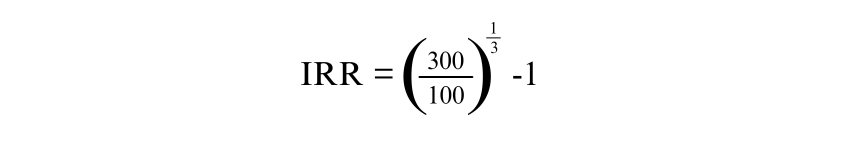

To demonstrate how IRR is utilised in a simple scenario, consider an initial investment of £100 and three years later, you receive £300. The IRR can be calculated as follows:

This calculation provides an IRR, indicating the investment's annual growth rate over the three years.

Equip yourself with the top pricing tactics and demand forecasting methods in our Revenue Management Training - Sign up now!

Formula for Calculating IRR

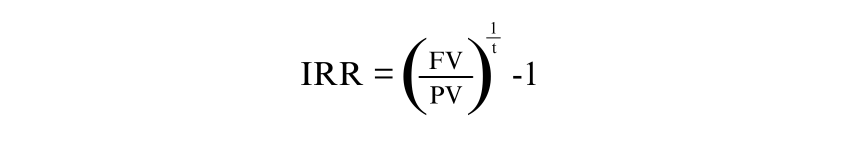

The formula for calculating IRR is as follows:

Where:

FV = Future value

PV = Present value

t = Time period

Want deeper insight into modern investment strategies? Sign up for our detailed Investment Management Course now!

How to Calculate IRR Using Excel?

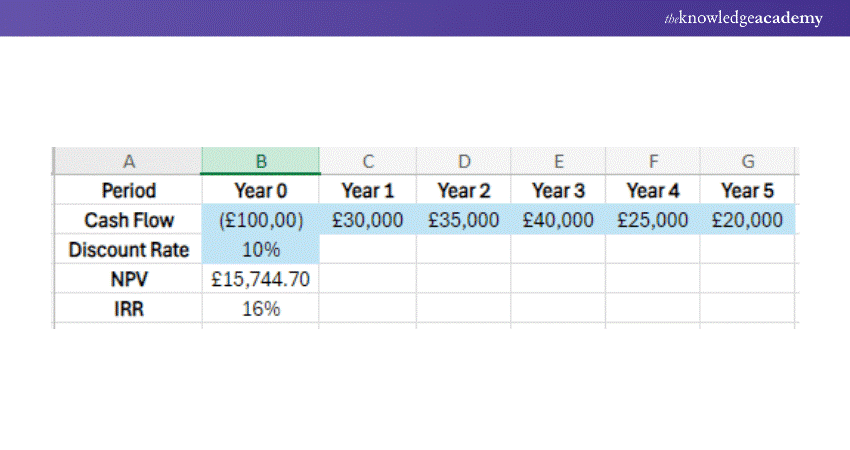

The syntax for IRR in Excel is =IRR(values,[guess]), where 'values' is the range of values and 'guess' is an optional guess at the IRR percentage. If an investment involves net costs in the future rather than mere net revenue, it may have multiple IRRs. Below, you can find an example of the basic IRR function. The formula in cell B5 = IRR(B2:G2)

Key Differences Between NPV and IRR

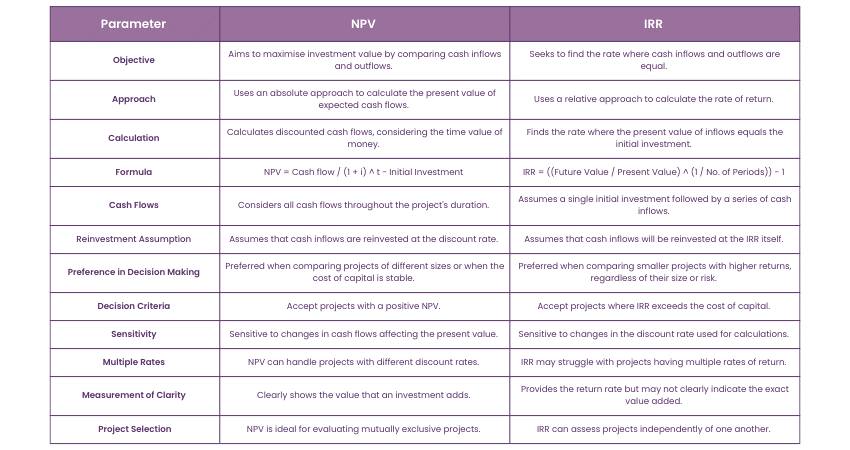

The main differences between IRR and NPV are summarised in the table below:

Conclusion

In conclusion, NPV and IRR are invaluable financial metrics for assessing the best investment opportunities. While NPV focuses on absolute value, IRR spotlights potential profitability. Understanding the differences between Net Present Value Vs Internal Rate of Return will help you make informed decisions, balance risk and optimise long-tern financial success.

Build advanced Business Analysis expertise through our up-to-date BCS Advanced International Diploma in Business Analysis – Sign up now!

Frequently Asked Questions

Net Present Value is considered more conservative than Internal Rate of Return for several reasons, including:

a) Lower and more realistic reinvestment rate assumption

b) Discount rate flexibility

c) Suited for multiple project size and duration

d) IRRs produce unreliable multiple values for project with non-conventional cash flows

Here are the steps to choose a project using NPV and IRR:

a) Calculate NPV and IRR for Each Project.

b) Compare NPV and IRR Values.

c) Consider the Time Frame and Cash Flow Patterns.

d) Evaluate the Risk and Discount Rate.

e) Make the Final Decision by choosing the project with highest positive NPV and IRR above the required RoR.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Business Analysis Courses, including BCS Practitioner Certificate in Modelling Business Processes Training and the BCS Foundation Certificate in Business Analysis Course. These courses cater to different skill levels, providing comprehensive insights into Business Analysis Services.

Our Business Analysis Blogs cover a range of topics related to business success, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Analysis Resources Batches & Dates

Date

BCS Certificate in Business Analysis Practice

BCS Certificate in Business Analysis Practice

Mon 18th Nov 2024

Mon 17th Mar 2025

Mon 26th May 2025

Mon 1st Sep 2025

Mon 15th Dec 2025

Halloween sale! Upto 40% off - 95 Vouchers Left

Halloween sale! Upto 40% off - 95 Vouchers Left

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please