We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

As organisations navigate an era of rapid technological advancement, traditional processes often fail to address modern challenges. The Better Business Case (BBC) 5 Case Model, introduced by the UK Treasury in 2013, has become a cornerstone of effective decision-making. As we fast forward, over 3,000 professionals had trained in this methodology by 2018, which has influenced 500+ business cases worldwide.

Continue diving into this blog to explore the model’s structure, its five critical components, real-world applications, and the value it delivers in optimising public sector investments.

Table of Contents

1) What is the Better Business Case 5 Case Model?

2) What is the Structure of Better Business Cases?

3) Benefits of Using the Five Case Model

4) Real-world Examples of the Five Case Model

5) Conclusion

What is the Better Business Case 5 Case Model?

The Better Business Case 5 Case Model is a core standard for developing business cases in the UK since its introduction by the UK Treasury in 2013. Since then, it has been widely recognised as a valuable framework for infrastructure project planning that has widely influenced global best practices, particularly in public sector investment.

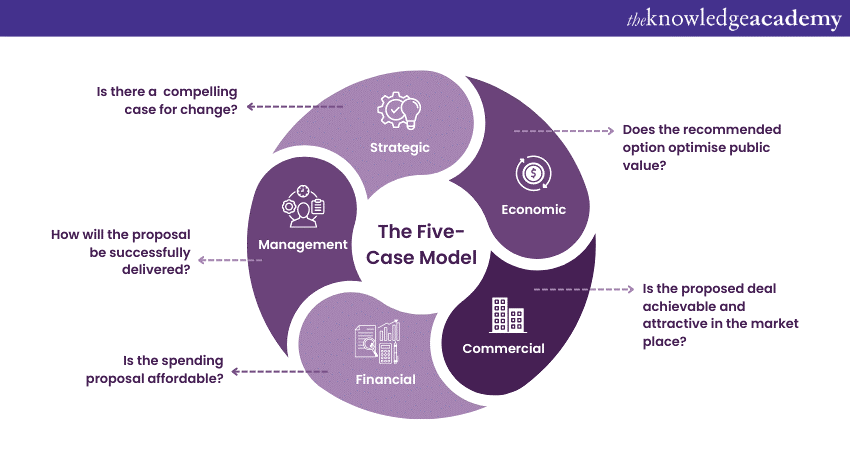

It should be ensured that each component of the 5 Case Model should be satisfied. The objective of the business case is to ensure that the programmes and projects live up to their intended objectives and deliver the expected benefits. The five cases that make up the organising framework for a Better Business are explained as follows:

1) The Strategic Case

The Strategic Case mainly answers the question, “why the project is needed?” It shows how it aligns with organisational goals and addresses key problems or opportunities. To show how the proposed initiative aligns with other projects and programs in the organisation, an updated business strategy should be included. This strategy should consider and reference relevant local, regional, and national policies and regulations.

To make a strong case for change, it is important to clearly understand why the change is needed and what drives it. The reasons behind the proposal should follow the SMART criteria. This means they need to be Specific, Measurable, Achievable, Relevant, and Time-bound. These criteria make it easier to evaluate the initiative's success once it is complete.

A good proposal starts with a clear understanding of the current situation. This includes examining the existing processes (business-as-usual), identifying problems and opportunities (business needs), defining the required capabilities (scope), and considering the potential benefits, risks, and limitations of the change.

One key challenge in creating a strategic case is explaining how the proposed change will improve the organisation’s ability to achieve better results and benefit stakeholders and customers. At the same time, it is crucial to identify the risks involved.

The proposal must be based on well-researched business needs. This includes considering service demand and planning for the organisation’s capacity to meet those demands. Another challenge is ensuring that initiatives align with the organisation’s overall strategy and fit into a clear portfolio of related programmes and projects.

2) The Economic Case

The Economic Case answers the question, 'What is the best option for delivering value to the public?” The Economic Case looks at the value for money by comparing different solutions. This includes costs, benefits, and risks over time. One can run these options through a cost-benefit analysis that consists of well-being.

The Socio-Economic dimension of a business case focuses on identifying the proposal that offers the most value to society, considering both social and environmental factors. To demonstrate this value, it is necessary to assess a broad range of possible options (the "long list") based on how well they align with the initiative's goals and key success factors. Afterwards, a smaller set of options (the "short list") must be thoroughly evaluated.

One challenge in the Economic Case is selecting the right options for scope, service delivery, solutions, funding, and implementation. If this is not done carefully, the chosen options may provide less-than-optimal value from the start.

Another challenge is justifying options with higher costs than maintaining the current state or doing the bare minimum. Additionally, it can be difficult to measure or assign a monetary value to the benefits and risks associated with the different options.

3) The Commercial Case

The Commercial Case answers the question, can we deliver it through partnerships?” The Commercial Case assesses the market and procurement strategies—how the project will be delivered and whether contracts or suppliers are feasible. It also demonstrates that the procurement approach is viable in the relevant marketplace.

The commercial case aims to show that the preferred option from the "short list" can result in a successful procurement and a structured agreement between the public sector and its service providers. To ensure this, it is essential to understand the market, assess what suppliers can realistically deliver, and explore procurement methods that will provide the best value for both parties.

A key challenge in the commercial case is acting as an "intelligent customer." This means anticipating how to secure the highest public value during the contract phase, even as organisational and operational requirements evolve over time.

Join our Better Business Cases Foundation & Practitioner Course to understand how business cases work- kickstart your career transformation now!

4) The Financial Case

The Financial Case answers the question, “can we afford it? If yes, how will we fund it?” In the Financial case, it evaluates the financial costs, funding sources, and affordability of the project.

The financial case aims to show that the preferred option is both fundable and affordable, with support from stakeholders and customers. To do this, it is essential to have a clear understanding of the capital, revenue, and costs involved in the proposed initiative. It is also essential to assess how the deal will affect the organisation's balance sheet, income, expenses, and pricing structure.

5) The Management Case

The Management Case answers the question, “How will it be done?” It defines how the project will be planned, managed, and evaluated to ensure successful delivery.

The management case ensures that proper arrangements are in place for delivering, monitoring, and evaluating the initiative. It also feeds back into the organisation's strategic planning process. To show that the preferred option can be delivered successfully, it is essential to provide evidence that the project will follow best practices and undergo independent assurance. Additionally, arrangements for contract management, benefit realisation, and risk management must be clearly demonstrated.

The management case comes with its own set of challenges. One challenge is managing risks during the initiative's design, build, funding, and operational phases while also having contingency plans ready. Another challenge is navigating inevitable organisational changes in a controlled manner to ensure objectives are achieved, outcomes are delivered, and benefits are evaluated effectively.

What is the Structure of Better Business Cases?

The Better Business Cases (BBC) guidance provides a clear and systematic approach to developing business cases. It ensures that proposals are evaluated thoroughly and aligned with organisational goals and public value.

1) Overview of Business Cases

The Better Business Cases guidance provides a structured framework for developing business cases. It divides business cases into two main aspects: the parts that make up the case (The 5 Case Model) and the approval processes required to move forward. This approach ensures clarity and consistency in decision-making.

2) Approval Processes

In the Better Business Cases (BBC) framework, some projects require two-stage approvals, while others need just one. Large and high-risk projects follow a three-stage process: the Strategic Outline Case (SOC), Outline Business Case (OBC), and Full Business Case (FBC). The SOC focuses mainly on the Strategic Case and less on the Economic and Financial Cases, with even less detail on the Commercial and Management Cases.

A single-stage business case is used for smaller, lower-risk projects. This combines the Indicative and Detailed Business Cases into one and provides less detail overall. Despite the simpler process, it still ensures key aspects are covered.

Both types of approval processes include an additional stage: the Implementation Business Case. This stage is used to get final approval for the chosen supplier and contracts and also reflect any changes made during earlier stages.

Benefits of Using the Five Case Model

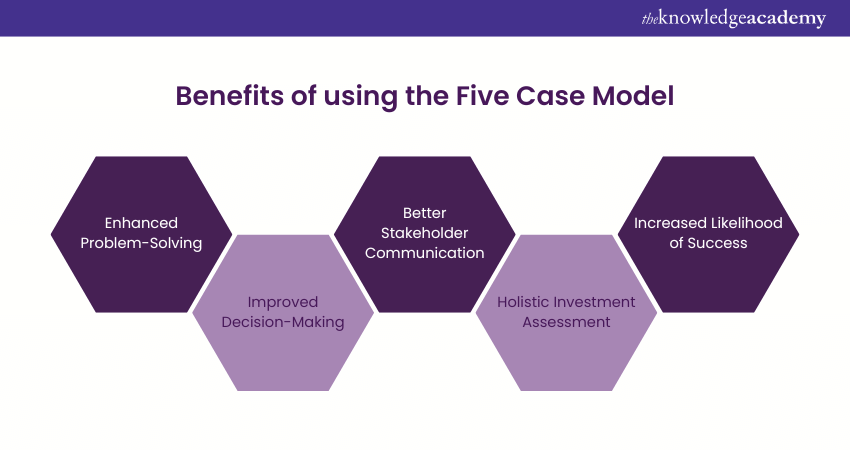

The Five Case Model provides a structured framework for developing business cases, ensuring thorough analysis and informed decision-making. By examining proposals through five distinct dimensions, this model offers a comprehensive view of potential investments, aiding in understanding the rationale behind proposals.

1) Enhanced Problem-Solving: The Five Case Model systematically addresses each dimension, allowing organisations to explore various aspects of a proposal in depth. This thorough exploration leads to more effective solutions by identifying potential challenges early and developing strategies to mitigate them.

2) Improved Decision-Making: By providing a clear and detailed evaluation of proposals, the model helps decision-makers gain insights into strategic alignment, economic viability, commercial feasibility, financial affordability, and management readiness. This comprehensive understanding enables more informed choices that align investments with organisational goals.

3) Better Stakeholder Communication: The Five Case Model's standardised approach ensures consistency in presenting information, making it easier for all stakeholders to understand and engage with the business case. This clarity reduces misunderstandings and promotes collaboration, facilitating smoother project progression and stakeholder buy-in.

4) Holistic Investment Assessment: The model’s examination of five distinct dimensions allows for a holistic view of potential investments. This thorough analysis aids in assessing the value for money of proposals, ensuring that all critical aspects are considered before making investment decisions.

5) Increased Likelihood of Success: By adopting the Five Case Model, organisations can ensure that all critical aspects of a proposal are thoroughly considered. This structured methodology increases the likelihood of successful project outcomes, ultimately delivering greater value to the organisation.

Drive success with Better Business Cases Practitioner- join our Better Business Cases™ Practitioner Course today!

Real-world Examples of the Five Case Model

The Five Case Model has proven to be a valuable tool across various sectors. It effectively addresses complex challenges and enhances decision-making processes. Its structured methodology allows organisations to conduct comprehensive analyses, leading to improved outcomes in diverse industries.

1) Healthcare Sector Applications: The Five Case Model has been utilised in healthcare to analyse and enhance patient care and hospital operations. By evaluating options to streamline discharge processes and reduce patient readmissions, healthcare organisations have achieved more efficient service delivery, ultimately improving patient outcomes.

2) Manufacturing Sector Optimisation: The model has also been instrumental in the manufacturing sector, where it helps optimise production and supply chain management. Manufacturers leverage this framework to assess strategies to minimise waste and increase production efficiency, enabling informed decisions that enhance operational performance and profitability.

3) Government Agency Utilisation: Government agencies have adopted the Five Case Model to address various issues, including policy development and infrastructure planning. By systematically evaluating the potential impacts and benefits of proposed initiatives, public sector organisations can allocate resources effectively to meet the community's needs.

4) Versatility Across Industries: These examples highlight the versatility of the Five Case Model in real-world scenarios. Its structured approach facilitates thorough analysis and informed decision-making, leading to improved outcomes across different sectors, from healthcare to manufacturing and government.

5) Enhanced Decision-Making Framework: Overall, the Five Case Model provides a robust framework for organisations to navigate complex challenges. By ensuring comprehensive evaluation and strategic alignment, it enhances the likelihood of project implementation and delivers significant value successfully.

Achieve excellence with Managing Benefits™ Foundation & Practitioner Training- start now!

Conclusion

We hope you got an overview of the Better Business Case 5 Case Model. The Better Business Case 5 Case Model is an integral component of Better Business Cases' performance. To extract the best public value from a project, one must ensure that every component of the 5 Case Model is satisfied. Projects are more likely to deliver their outputs and benefits if they are aligned with strategic objectives, well-scoped and planned, and include comprehensive financial, procurement, and risk analyses.

Master the fundamentals of benefits management – join our Managing Benefits™ Foundation Course today!

Frequently Asked Questions

To write a good business case, you must define the problem, outline objectives, and provide evidence supporting the need for change. You must also evaluate, assess risks, and highlight benefits. Ensure you meet organisational goals, present a financial plan, and include a strategy for implementation and monitoring.

The NHS uses the Better Business Case 5 Case Model to ensure strategic alignment, value for money, and effective delivery of healthcare projects. It further helps prioritise resources, manage risks, and maximise public value, ensuring better outcomes for patients and efficient use of public funds.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Better Business Cases Courses, including Better Business Cases™ Foundation & Practitioner, Better Business Cases™ Foundation, and Better Business Cases™ Practitioner. These courses cater to different skill levels, providing comprehensive insights into Everything to Know About Better Business Cases Exam.

Our Project Management Blogs cover a range of topics related to Earned Value Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Project Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Project Management Resources Batches & Dates

Date

Better Business Cases™ Foundation & Practitioner

Better Business Cases™ Foundation & Practitioner

Mon 17th Mar 2025

Mon 12th May 2025

Mon 7th Jul 2025

Mon 15th Sep 2025

Mon 3rd Nov 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please