We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Choosing between ACCA and CPA is like choosing your adventure in the world of accounting. Are you aiming for global versatility or mastering the gold standard of U.S. accounting? This blog dives deep into the ACCA vs CPA debate, helping you uncover which certification truly aligns with your career aspirations. Whether you dream of navigating international finance or dominating the American market, this journey will guide you to the perfect path to transforming your accounting future!

Table of Contents

1) What is ACCA?

2) What is CPA?

3) Difference Between ACCA and CPA

a) Eligibility

b) Course Duration

c) Recognition

d) Examination Dates

e) Focus on International Standards

f) Ongoing Learning and Development

g) ACCA vs CPA Salary

h) Course Structure

i) Job Profile

j) Exam Structure and Difficulty Level

k) Career Opportunities and Specialisations

l) Time Duration

4) Conclusion

What is ACCA?

The Association of Chartered Certified Accountants (ACCA) is an international membership body based in the UK that accredits professional accountants. It offers one of the top accountancy qualifications for finance professionals worldwide.

The ACCA qualification is a globally recognised certification in accounting and finance, with over 250,000 members and 500,000 students across 180+ countries. Whether you’re interested in audit, tax, financial management, or even corporate leadership, an ACCA Career can provide diverse opportunities for growth and success. ACCA Books are valuable resources to help candidates excel in audit, tax, financial management, and corporate leadership.

What is CPA?

The Certified Public Accountant (CPA) designation is given to licensed accounting professionals by the Board of Accountancy in each U.S. state. In many countries, like India, the Chartered Accountant (CA) designation is considered equivalent to the CPA.

The CPA (U.S.) curriculum covers financial accounting and reporting, auditing and attestation, business law and ethics, taxation, corporate governance, strategic planning, and financial and operations management. Students who complete the US CPA can also pursue the CPA Canada designation.

Difference Between ACCA and CPA

While both ACCA and CPA are accounting qualifications, they differ in several key aspects. Let’s compare ACCA and CPA based on eligibility, course duration, recognition and other such factors:

Eligibility

ACCA Eligibility Criteria:

ACCA eligibility criteria vary depending on the level that you are applying for. Here are the basic requirements to be eligible for ACCA:

1) Educational Qualifications:

a) For 18+: Minimum of three GCSEs (or equivalent) and 2 A-Levels (or equivalent) in five subjects, including Mathematics and English.

b) Graduates: Relevant degrees may qualify for exemptions from some ACCA exams.

c) No formal qualifications: Start with the ACCA Foundation in Accountancy (FIA) route.

2) English Proficiency: Strong understanding of English, as ACCA exams are conducted in English.

These criteria vary slightly by country, so check ACCA's official website for detailed information.

CPA Eligibility Criteria:

1) Prerequisites for the CPA Exam:

a) A bachelor’s or equivalent degree, preferably in accounting, finance, or business administration

b) 120 credits

c) Based on foreign academic credential evaluation

d) Decided by 55 State Boards of Accountancy

2) Eligibility for CPA License:

a) 150 credits

b) Two years of work experience

c) Fulfil the 4 Es: Examinations, Education, Experience, Ethics examination

d) License to be earned within three years of clearing all examinations

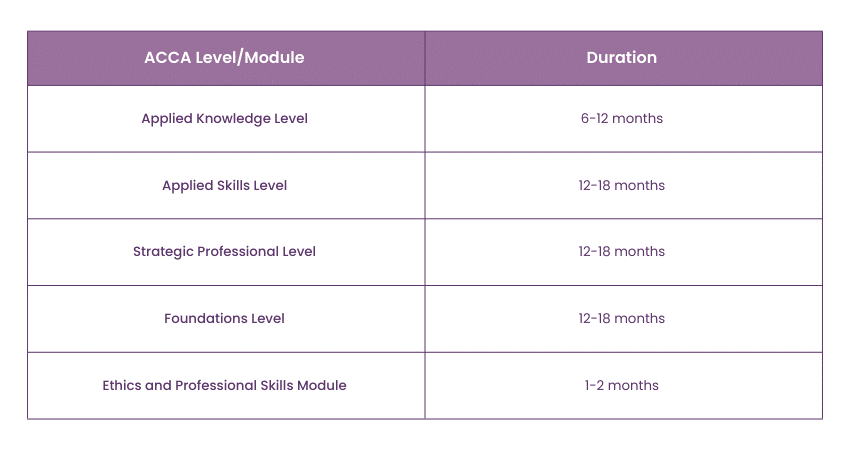

Course Duration

ACCA Programme Duration:

CPA Programme Duration:

Candidates typically take 12-18 months to clear all exams of the CPA programme.

Recognition

1) ACCA Recognition:

a) Global Accreditation: It is recognised in over 180 countries.

b) Mutual Recognition Agreements (MRAs): ACCA has MRAs with many professional accounting bodies worldwide, allowing members to fast-track their qualifications or gain exemptions in other countries.

2) CPA Recognition:

a) Wide Recognition: CPA is widely recognised, especially in the USA.

b) International Applicability: The CPA license's applicability outside the USA depends on the respective country’s requirements and regulations.

Examination Dates

1) ACCA Exam Schedule:

a) On-Demand CBEs: Can be taken at any time throughout the year.

b) Session CBEs: They are Held in March, June, September, and December. Candidates must book their exams ahead of each session's deadline.

2) CPA Exam Schedule:

a) On-Demand Exams: They are available in January, February, April, May, July, August, October, and November.

Focus on International Standards

1) ACCA Standards:

a) IFRS Focus: ACCA relies on International Financial Reporting Standards (IFRS), emphasising a deep understanding of global accounting practices.

2) CPA Standards:

b) GAAP Focus: The US CPA primarily focuses on Generally Accepted Accounting Principles (GAAP) and follows International Accounting Standards.

Ongoing Learning and Development

ACCA Continuing Professional Development (CPD):

1) CPD Requirement: Candidates must earn CPD units by participating annually in Continuing Professional Development (CPD) activities to maintain ACCA membership.

CPA Continuing Professional Education (CPE):

2) CPE Requirement: To maintain a CPA license, candidates must fulfil Continuing Professional Education (CPE) requirements, which generally involve completing a specific number of CPE hours within a stipulated time frame.

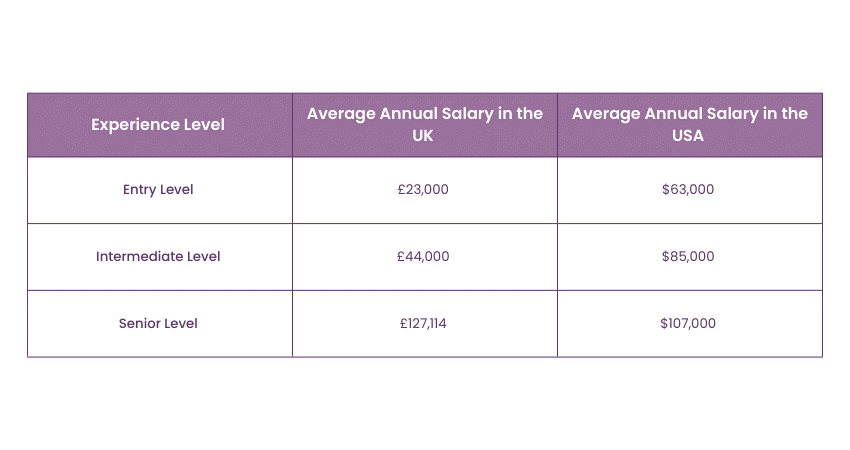

ACCA vs CPA Salary

ACCA: ACCA qualification provides opportunities for several job profiles, and their salaries vary depending on several factors, including experience and location. Here is an explanation of the average salary you can expect after you get your ACCA qualification in the UK and USA:

Source: Glassdoor

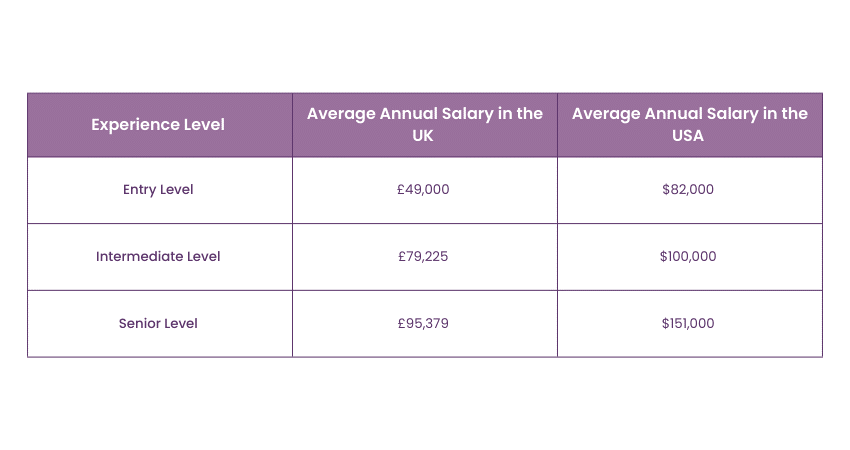

CPA: While CPA primarily targets the US market, qualified professionals can earn handsomely around the globe. Here’s an overview of the average salary of CPA-qualified professionals according to their experience level in the UK and USA:

Source: Glassdoor

Course Structure

ACCA:

The ACCA qualification comprises 13 exams across three levels:

1) Applied Knowledge

2) Applied Skills, and

3) Strategic Professionals

It covers a broad range of topics including Financial Accounting, Management Accounting, Taxation, Auditing, and Assurance.

CPA:

The CPA certification involves four exam sections:

1) Auditing and Attestation (AUD)

2) Business Environment and Concepts (BEC)

3) Financial Accounting and Reporting (FAR), and

4) Regulation (REG)

It primarily focuses on U.S. Generally Accepted Accounting Principles (GAAP) and U.S. taxation.

Job Profile

ACCA:

The ACCA qualification offers many career options, including financial accounting, management accounting, auditing, taxation, financial analysis, and consulting. ACCA members are wanted worldwide and can work in different areas, such as public accounting firms, big companies, banks, and government agencies.

CPA:

The CPA certification is well-regarded in the US and offers fantastic opportunities for people in public accounting, taxation, financial planning, corporate accounting, or forensic accounting. CPAs often work in public accounting firms, corporate finance departments, or government agencies, or they set up their own practices.

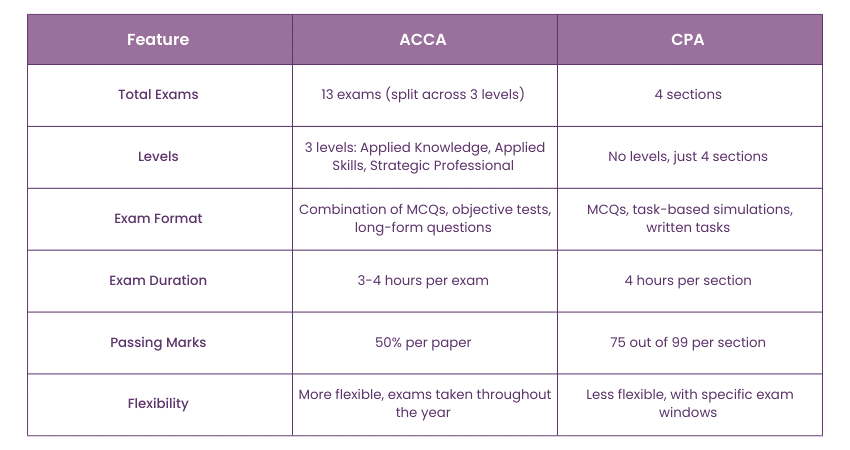

Exam Structure and Difficulty Level

The ACCA and CPA are both prestigious accounting qualifications but have different exam structures. Here's a detailed comparison:

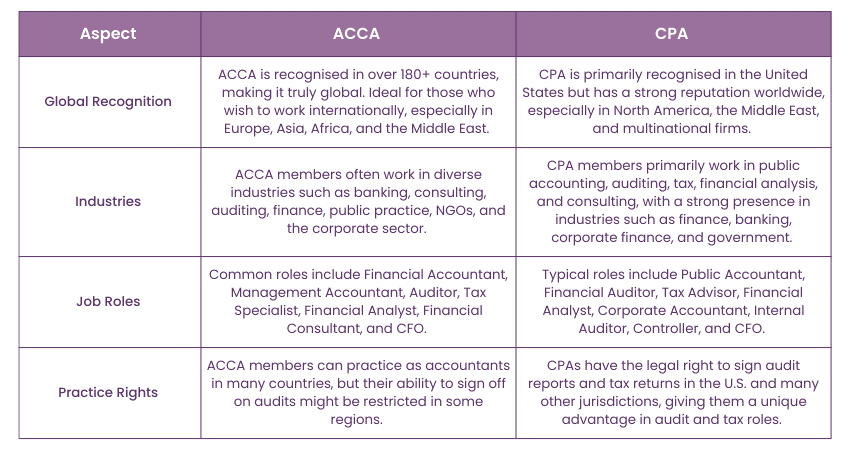

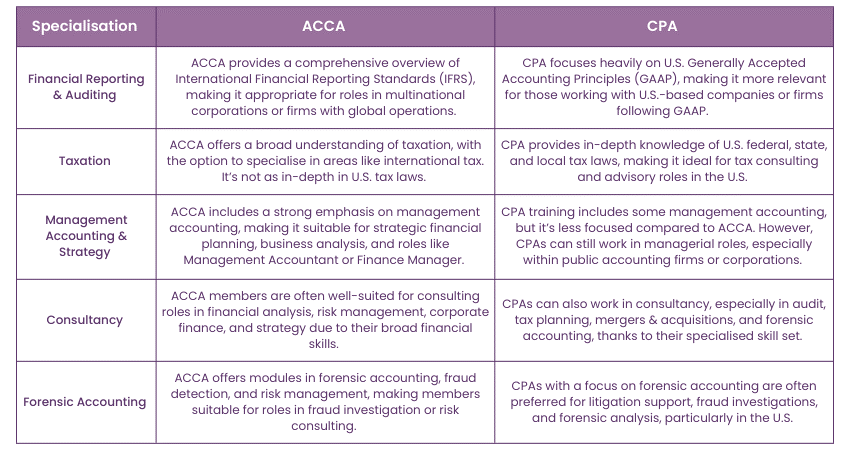

Career Opportunities and Specialisations

Both are highly respected in the accounting and finance industry, but they have unique pathways depending on the region, industry preferences, and the nature of their training. Here's a detailed comparison of career opportunities and specialisations:

Career Opportunities:

Specialisations:

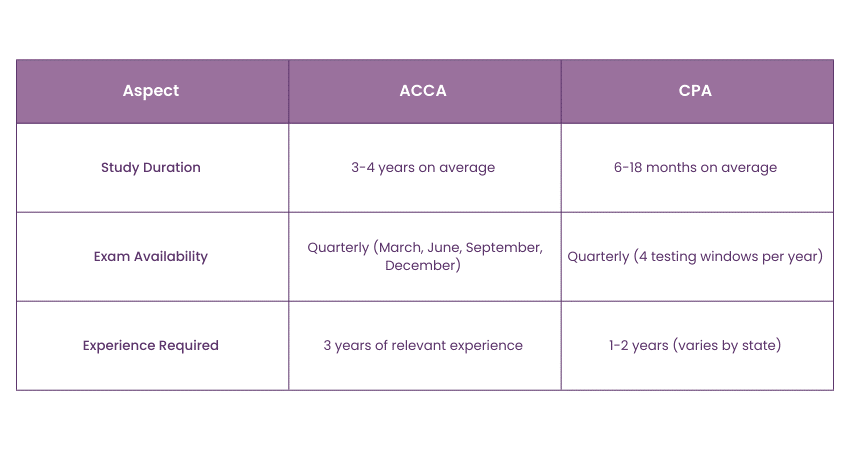

Time Duration

Here’s a concise comparison of ACCA vs CPA in terms of cost and time investment:

Conclusion

When choosing between ACCA vs CPA, consider your career goals, where you want to work, and your passion. ACCA is excellent if you're looking for global recognition and a wide range of skills for international opportunities. On the other hand, CPA is more focused on U.S. accounting standards, making it perfect if you're aiming for the American market. On the other hand, CPA is more focused on U.S. accounting standards, making it perfect if you're aiming for the American market. Similarly, understanding AAT vs ACCA can help you decide which qualification aligns best with your career aspirations. Consider what you want to achieve, how much time you can commit, and where you see yourself in the future to pick the proper certification for you!

Frequently Asked Questions

What are the Disadvantages of Doing ACCA?

ACCA has downsides, like taking a long time to complete (usually 3-4 years), being quite expensive, and needing to be better recognised in certain countries like the U.S. Also, depending on the job market, ACCA might face competition from other qualifications like CPA.

Is CPA More Difficult Than ACCA?

The CPA is often considered more challenging than the ACCA because it zeroes in on U.S. accounting standards, has stricter eligibility requirements, and has shorter exam timelines. On the other hand, the ACCA covers a broader range of topics, which means more exams and flexibility.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please