We may not have the course you’re looking for. If you enquire or give us a call on +40 316317743 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Just picture making money while you are asleep—seems like a dream, doesn't it? That is the strength of earning income passively. It's more than just making additional money; it's about establishing a safety cushion that provides financial independence and adaptability. Passive Income streams, whether from investments, rental properties, or digital products, can greatly increase your income without the need for a traditional 9-to-5 job. In a society that places growing importance on financial stability and independence, establishing Passive Income has become a crucial objective.

Passive Income provides many advantages whether you want to add to your income, build retirement savings, or attain financial independence. Are you prepared to tap into the possibilities of earning Passive Income? Let's discover the Benefits of Passive Income in this blog.

Table of Contents

1) What is Passive Income?

2) Difference Between Active and Passive Income

3) Need for Passive Income

4) Benefits of Passive Income

5) Tax Benefits

6) Difficulties in Earning Passive Income

7) Conclusion

What is Passive Income?

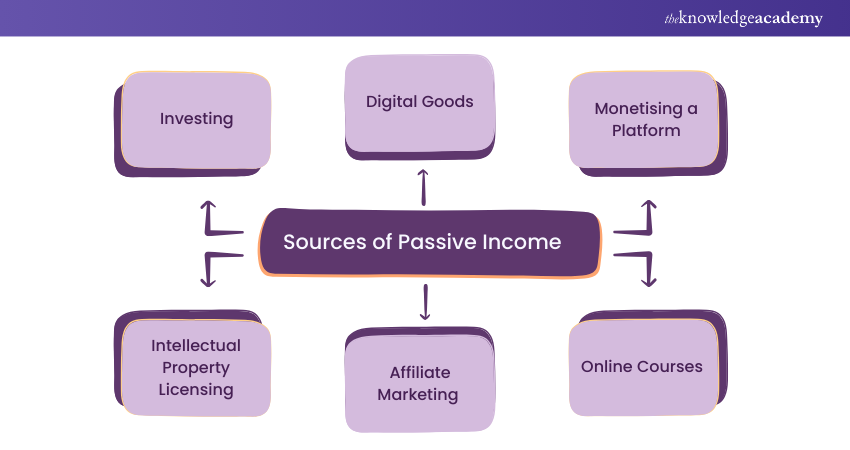

Passive Income is made without the need for active or continuous participation, enabling you to make money while concentrating on other tasks. It's the money that comes in without actively working, such as while you're asleep or engaging in personal interests. Numerous methods exist for generating Passive Income, such as:

a) Investments: Investments involve making money from investments in stocks, bonds, real estate, or other assets by receiving dividends, interest, rent, or capital gains.

b) Digital Products: Selling items like electronic books, podcasts, or software online is a form of Passive Income.

c) Content Monetisation: Monetising content involves creating income from blogs, websites, YouTube channels, or social media platforms by establishing a dedicated following.

d) Licensing Intellectual Property: Generating income through licensing patents, trademarks, or creative works such as music.

e) Affiliate Marketing: Affiliate Marketing involves promoting products or services created by others and receiving a commission for every sale.

f) Online Courses: Developing and marketing online educational content or courses that provide valuable skills or knowledge.

These are simply a few examples of Passive Income streams. The main thing is to concentrate on delivering value, which leads to earning money without needing to always put in constant effort.

Difference Between Active and Passive Income

Active Income is earned through personal effort, such as a salary, hourly wages, or freelance work. It requires your time, skills, and ongoing commitment. If you stop working, your income stops too. This type of income is directly linked to your working hours, often leading to limited freedom and increased stress.

In contrast, Passive Income flows with minimal ongoing effort once established. It comes from investments, rental properties, or digital products that generate continuous earnings. Passive Income offers greater flexibility and financial freedom, as it’s not tied to active working hours. It allows you to earn without constant effort, supporting long-term financial goals.

While Active Income demands your time, Passive Income builds wealth more effortlessly, enhancing your financial journey.

Need for Passive Income

The demand for Passive Income is increasing as individuals look for more financial stability. Depending only on the income that you actively work for can pose a risk. Passive Income acts as a financial safety net, offering stability in times of job loss or economic hardships.

It assists in handling increasing living expenses and enhances your capacity to save for future necessities. Having multiple sources of income decreases reliance on a single source, resulting in improved financial autonomy.

This extra money helps with future plans, such as setting aside funds for retirement, going on trips, or making investments. In the end, Passive Income is crucial for attaining long-term financial independence and tranquility, providing a more stable financial future.

Master the secrets of Marketing success with our Introduction To Marketing Training – Join now!

Benefits of Passive Income

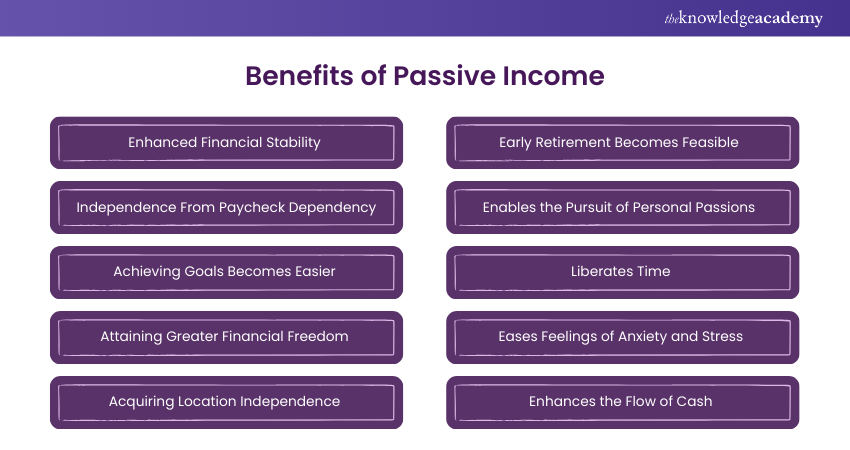

The numerous Benefits of Passive Income can enhance your lifestyle and contribute to the realisation of your objectives. Here are some of the Passive Income Benefits:

1) Enhanced Financial Stability

Passive Income adds another source of income, establishing a safety cushion and lowering financial insecurities.

2) Independence From Paycheck Dependency

Breaking free from paycheck dependency means less reliance on just one income source, providing financial security in the event of job loss or decreased work hours.

3) Achieving Goals Becomes Easier

Additional income can assist in saving for important goals such as purchasing a house, traveling, or investing.

4) Acquiring Location Independence

Generating Passive Income enables you to make decisions based on want rather than financial limitations, ultimately improving overall freedom.

5) Gaining Location Independence

Having Passive Income means you are not restricted to one place, giving you more freedom in choosing where to reside or visit.

6) Early Retirement Becomes Feasible

Generating Passive Income can make early retirement a possibility by supplementing or replacing your earned income.

7) Enables the Pursuit of Personal Passions

It offers the financial assistance required to pursue hobbies, interests, or new ventures without financial worry.

8) Liberates Time

Passive Income liberates time that would have been used for work, providing more chances for leisure or personal growth.

9) Eases Feelings of Anxiety and Stress

Having Passive Income for financial security lessens stress, providing reassurance in times of financial uncertainty.

10) Enhances the Flow of Cash

Boosts cash flow by providing additional funds for unexpected emergencies, investments, or opportunities, enhancing the flow of cash.

Elevate your Marketing game with our Business Marketing Strategies Training – Register now!

Tax Benefits

Passive Income in the UK provides various tax benefits that can assist individuals in maximising their earnings while minimising tax responsibilities. Income generated from interest, dividends, and rental income frequently receive special tax exemptions and reduced rates in comparison to standard income. Furthermore, initiatives such as the Rent-a-Room Scheme offer tax benefits to homeowners who rent out fully furnished rooms.

There are specific tax-free allowances for capital gains from selling investments or property that can greatly decrease the tax liability on these profits. By taking advantage of these tax advantages, people can make Passive Income a more effective and appealing choice for adding to their main sources of income.

Difficulties in Earning Passive Income

Though there are advantages to Passive Income, creating and managing these sources can be difficult. Transitioning from earning money through actively working to generating income passively necessitates thoughtful strategising, cautious choices, and frequently substantial initial investments. Below are certain challenges that people may face:

a) Initial Investment Requirements: Some Passive Income streams, such as real estate or stocks, need an initial investment, which may pose a challenge. Obtaining the required funds can be achieved through budgeting, financial planning, or exploring other financing options.

b) Strategic Planning and Knowledge: Strategic planning and knowledge are required to create Passive Income through financial literacy. It is crucial to comprehend your objectives, willingness to take risks, and the current market environment. Acquiring the expertise and understanding necessary to explore Passive Income possibilities is crucial for achieving lasting success.

c) Patience and Persistence: Being patient and persistent is crucial when trying to generate Passive Income as it is not achieved quickly, especially in the beginning. Remaining dedicated with a focus on the future is essential.

d) Market Volatility and Risks: Passive Income is still susceptible to market volatility and risks, such as fluctuations in real estate values or downturns in the stock market. Reducing risks with diversification and careful planning is crucial for long-term success.

Master the art of Passive Income with our Passive Income Course - join now!

Conclusion

Embracing Passive Income is a strong move towards attaining financial stability and independence. By utilising simple sources of income, you can create a secure future and have the freedom to live life on your own terms. Although the journey demands commitment and education, the benefits greatly surpass the hard work. Consistently seek out Passive Income opportunities to maintain financial stability in the long run. It gives a sense of calm and the opportunity to concentrate on important things, like being with family or following personal interests.

Craft your path to marketing mastery with our Marketing Courses today!

Frequently Asked Questions

Individuals pursue Passive Income to attain financial independence, diminish reliance on Active Income, and establish security in times of unpredictability. It provides the option to follow individual ambitions, invest in the future, and experience a more harmonious lifestyle.

Passive Income is highly advantageous as it allows for earnings with minimal labor, offering financial stability and freedom without the need for continuous effort. It permits you to vary revenue sources, lessen reliance on one source, and reach financial goals in the long run with ease.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Marketing Training, including the Passive Income Course, Strategic Marketing Course, and Introduction To Marketing Training These courses cater to different skill levels, providing comprehensive insights into YouTube Monetisation.

Our Digital Marketing Blogs cover a range of topics related to Marketing, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Digital Marketing skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Digital Marketing Resources Batches & Dates

Date

Passive Income Course

Passive Income Course

Fri 3rd Jan 2025

Fri 7th Mar 2025

Fri 2nd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 7th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please