We may not have the course you’re looking for. If you enquire or give us a call on +40 316317743 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you intrigued by the world of finance? Do you have a knack for numbers and a passion for dissecting market trends? If so, you might have considered a career as a Financial Analyst. In this guide, we'll dive into the exciting journey of How to Become a Financial Analyst and uncover the steps you need to take to succeed in this rewarding profession.

Table of Contents

1) Who is a Financial Analyst?

2) Educational requirements

3) Developing key skills

4) Gaining relevant experience

5) Job search and application

6) Conclusion

Who is a Financial Analyst?

In the vast finance landscape, a Financial Analyst is a meticulous investigator, a strategic thinker, and a data-driven advisor. Financial Analysts are professionals who possess the unique ability to decipher the intricate language of numbers and translate it into actionable insights. They interpret financial data, transforming raw figures into narratives that guide critical business decisions.

A Financial Analyst's primary role is comprehending and predicting market trends, investment opportunities, and potential risks. Experts in data analysis use advanced tools and techniques to sort through vast amounts of data, searching for patterns, correlations, and anomalies that could affect the financial stability of a company or an individual's investment portfolio. Stakeholders can make informed choices by distilling complex financial information into understandable reports.

These professionals don't merely crunch numbers; they bridge the gap between quantitative analysis and strategic planning. Their recommendations influence investment strategies, budget allocations, and long-term financial goals. Whether in Corporate Finance, Investment Banking, or Asset Management, Financial Analysts are the linchpin that connects financial theory with real-world decision-making.

Gain knowledge on how to analyse financial statement by signing up for our Financial Management Training now!

Educational requirements

Curious about How to Become a Financial Analyst? Embarking on becoming a Financial Analyst begins with a solid education foundation. A blend of academic knowledge and specialised training forms the cornerstone of a successful career in this field. Here are the key educational components that aspiring Financial Analysts should consider:

Bachelor's degree in Finance or related field

A bachelor's degree in Finance, Accounting, Economics, or a related field is often the first step towards a career as a Financial Analyst. These programs lay the groundwork by comprehensively understanding financial principles, investment strategies, and market dynamics. Courses in mathematics and statistics equip future analysts with the quantitative skills needed to interpret complex data.

Master's degree and certifications (CFA, CPA, etc.)

While a Bachelor's degree can open doors, a Master's degree can significantly enhance your competitiveness and earning potential. Pursuing a Master's in Finance, Business Administration (MBA), or a related discipline equips you with advanced knowledge and a broader skill set, such as leadership and strategic thinking.

Professional certifications also play a vital role in setting you apart. The CFA designation, which the CFA Institute offers, is greatly respected in the Financial Industry. It demonstrates expertise in Investment Management and Analysis. On the other hand, the Certified Public Accountant (CPA) credential can be valuable for Financial Analysts focused on Accounting and Audit roles.

Developing essential skills

Becoming a proficient Financial Analyst requires more than academic qualifications; it demands a robust skill set encompassing technical and interpersonal proficiencies. Here are the key skills you need to develop to excel in this dynamic role mentioned below:

Analytical skills

Analytical prowess lies at the heart of a Financial Analyst's toolkit. The ability to dissect complex data, identify trends, and draw meaningful conclusions is crucial. Analysts must possess a keen eye for detail while maintaining a big-picture perspective. Sharp analytical skills enable accurate decision-making when evaluating company performance or assessing investment opportunities.

Financial modelling and data analysis

Mastery of financial modelling is a cornerstone skill for Financial Analysts. Financial models allow analysts to simulate different scenarios, predict outcomes, and quantify risks. Proficiency in software like Microsoft Excel and specialised financial modelling tools is paramount. Data analysis skills go hand-in-hand, as analysts must be adept at cleaning, organising, and interpreting large datasets to extract valuable insights.

Communication skills

Effective communication is the bridge that connects analytical insights with decision-makers. Financial Analysts must convey complex information clearly and concisely, tailoring their message to suit technical and non-technical audiences. In written reports or verbal presentations, articulating findings and recommendations is crucial for influencing stakeholders.

Industry knowledge

Financial analysis is not a one-size-fits-all endeavour; it requires domain-specific knowledge. Developing a deep understanding of your industries enhances your ability to interpret financial data in context. From understanding sector-specific regulations to recognising industry trends, having an industry-focused perspective adds depth to your analyses.

Continuous learning and adaptability

The financial landscape is dynamic, constantly influenced by economic shifts, technological advancements, and regulatory changes. Successful Financial Analysts exhibit a commitment to continuous learning. Remaining open to acquiring new skills, staying informed about market developments, and adapting to industry changes ensures long-term relevance.

Gear up to take the first step towards becoming a Financial Analyst today! Sign up for our Accounting & Finance Training now!

Gaining relevant experience

Transitioning from academia to the practical world of Financial Analysis requires hands-on experience that complements your education and hones your skills. Aspiring Financial Analysts must proactively seek opportunities to apply their knowledge and build a robust career foundation. Here are key strategies for gaining the relevant experience necessary for success:

Internships and entry-level positions

Internships serve as invaluable entry points into the world of Financial Analysis. These opportunities provide a real-world glimpse into the daily responsibilities of a Financial Analyst and allow you to apply theoretical concepts in practical settings. Internships often occur in banks, investment firms, corporate finance departments, and consulting firms.

Entry-level positions, such as Financial Analyst associates or junior analysts, are also excellent ways to accumulate experience. These roles may involve data collection, financial modelling, and supporting senior analysts in decision-making. While the tasks may seem basic, they provide the exposure needed to understand the intricacies of the field.

Networking and professional organisations

Building a network within the finance industry can open doors to a plethora of opportunities. Joining professional organisations such as the CFA Institute or the Financial Management Association International provides access to resources and enhances your credibility within the field.

Networking isn't just about making connections; it's about cultivating relationships. Engage in conversations, seek advice, and be genuinely interested in others' experiences. Your network can inform you about job openings, recommend you for positions, and offer mentorship that accelerates your growth.

Taking initiative

Sometimes, the best way to gain experience is to take the initiative to work on personal projects or engage in self-directed learning. For instance, you could create a mock Financial Analysis report for a fictitious company, demonstrating your skills and thought process. Engage with financial news and conduct analyses to enhance your understanding of market trends.

Collaborate with peers on case studies, participate in online forums, or contribute articles to finance-related publications. These activities showcase your passion for Financial Analysis and allow you to receive feedback and refine your abilities.

Continuous skill development

In a field as dynamic as finance, staying relevant requires constant skill development. Consider enrolling in specialised courses or workshops on advanced financial modelling, data visualisation, or risk management. Online platforms offer many resources to help you expand your skill set.

Showcasing your experience

When pursuing roles as a Financial Analyst, it's crucial to effectively showcase your relevant experience on your resume and during interviews. Highlight internships, projects, and entry-level positions demonstrating your ability to analyse financial data, create models, and provide actionable insights.

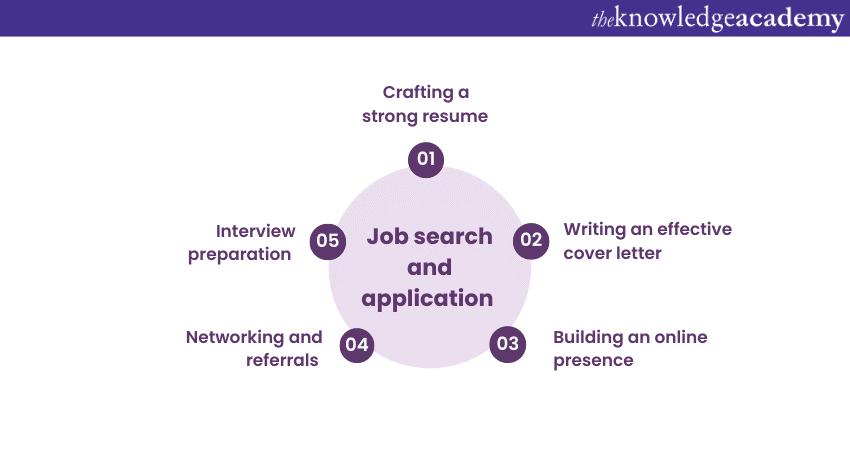

Job search and application

Navigating the job search process as an aspiring Financial Analyst requires a strategic approach that showcases your skills and sets you apart in a competitive field. Here are key steps to help you successfully land your dream role:

Crafting a strong resume

Your resume acts as a first impression on potential employers. Tailor it to emphasise your relevant skills, education, and experiences. Highlight your Financial Analysis coursework, internships, and any related projects. Use quantifiable achievements to demonstrate your impact, such as "Developed a financial model that improved forecasting accuracy by 15%."

Writing an effective cover letter

An intricate cover letter provides an opportunity to convey your passion and suitability for the role. Address the hiring manager by name, if possible, and explain why you're interested in the company and the position. Highlight your skills and experiences that directly relate to the requirements of the job. Share specific examples of how you've demonstrated key skills, such as financial modelling or data analysis.

Building an online presence

In today's digital age, having a professional online presence can enhance your job search efforts. Create or update your LinkedIn profile to showcase your academic achievements, skills, and experiences. Connect with professionals in the field and engage in discussions relevant to financial analysis. A strong online presence can attract recruiters and help you stay informed about job openings.

Networking and referrals

Networking remains a powerful tool in job searching. Leverage your connections to gain insights into potential job opportunities. Attend industry events, career fairs, and workshops to meet professionals who can provide advice and referrals. Employee referrals often carry weight in hiring decisions, so don't hesitate to reach out to individuals working in companies you're interested in.

Interview preparation

Preparing for interviews is crucial to making a positive impression. Research the company's financial performance, recent news, and the specific role you're applying for. Be ready to discuss your experiences, skills and how they align with the job requirements. Practice answering common interview questions, such as those related to financial analysis techniques and your ability to handle data-driven challenges.

Conclusion

Education, skills, experience, and strategic networking are crucial in the pursuit of becoming a Financial Analyst. This guide on "How to Become a Financial Analyst" equips you to navigate this dynamic field, unlocking a world of data-driven decision-making and meaningful impact in the financial domain.

Learn how to prepare a sole trader and a company’s financial statements by signing up for our Accounting Masterclass now!

Frequently Asked Questions

Upcoming Business Skills Resources Batches & Dates

Date

Financial Management Course

Financial Management Course

Fri 27th Dec 2024

Fri 24th Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please