We may not have the course you’re looking for. If you enquire or give us a call on +0800 780004 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Cash Flow is the lifeblood of any business, fueling its growth, sustaining its operations, and determining its financial health. Imagine a business as a complex machine—Cash Flow is is crucial resource that facilitates a smooth running of any organisation. Whether you're a startup or an established enterprise, understanding Cash Flow is key to navigating the intricate world of business finance.

Table of Contents

1) What is Cash Flow?

2) Different Types of Cash Flow

3) Cash Flow Example

4) Why is Managing Cash Flow so Important?

5) How to Manage Your Cash Flow

6) Impact of Poor Cash Flow Management

7) Difference Between Cash Flow and Profit

8) Conclusion

What is Cash Flow?

Cash Flow is the net movement of cash and cash equivalents in and out of a business over a specific period. It indicates a company’s ability to generate enough money to meet its financial obligations, such as paying off debts, covering operating expenses, and funding future growth initiatives.

Cash Flow is a vital indicator of a business’s economic health and sustainability. It is categorised into three main types: operating, investing, and financing Cash Flows. Operating Cash Flow pertains to the cash generated from core business activities, investing Cash Flow involves cash spent on or generated from investments, and financing Cash Flow covers cash movements related to funding the business. Each type provides critical insights into a company's financial performance.

Different Types of Cash Flow

Understanding the different Cash Flow types is crucial to understanding a complete picture of a business's financial health. Each type highlights specific areas of a company's operations, investments, and financing.

Cash Flows from Operations

Cash Flows from Operations (CFO) are the cash generated or consumed by a company's core business activities. This includes cash receipts from sales of goods and services and cash payments to suppliers and employees. CFO is often seen as the most important type of Cash Flow because it shows whether a company can generate enough positive Cash Flow to maintain and grow its operations without external financing.

Cash Flows from Investing

Cash Flows from Investing (CFI) reflect the cash used for investing in assets that will benefit the company in the long term, such as purchasing property, plant, and equipment (PPE) or acquiring other businesses. This category can also include cash generated from the sale of these assets. A company’s CFI activities often provide insight into its growth strategy and prospects.

Cash Flows from Financing

Cash Flows from Financing (CFF) encompass the cash transactions related to funding a company through debt, equity, or dividends. This includes cash raised by issuing stocks or bonds and money spent on repaying loans or distributing dividends to shareholders. CFF is critical for understanding how a company funds its operations and growth outside its day-to-day activities.

Cash Flow Example

Let's consider a fictional company, GreenThumb Gardens, a small business that sells organic gardening supplies. In one fiscal year, GreenThumb Gardens generated £5,00,000 in revenue from sales (CFO), spent £1,00,000 on new equipment (CFI), and repaid £50,000 of its bank loan (CFF).

From these activities, GreenThumb Gardens’ Cash Flow statement would show:

a) CFO: £500,000 (inflows from sales) minus £3,00,000 (outflows for operational expenses) = £2,00,000 positive Cash Flow.

b) CFI: £2,00,000 minus £1,00,000 (outflows for equipment purchase) = £1,00,000 positive Cash Flow.

c) CFF: £1,00,000 minus £50,000 (outflows for loan repayment) = £50,000 positive Cash Flow.

This example illustrates how different types of Cash Flow contribute to a business's overall financial health. GreenThumb Gardens has positive Cash Flow from its operations, which is a strong indicator of its ability to sustain and grow its business.

Unlock your Financial Potential—Join in our Capital Market Course today!

Why is Managing Cash Flow so Important?

Proper Cash Flow management ensures a business can meet its obligations, invest in opportunities, and prepare for unforeseen challenges. By regularly creating a Cash Flow Forecast, businesses can better anticipate and plan for cash needs, ensuring smooth operations. Without adequate Cash Flow management, even profitable companies can face liquidity crises threatening survival.

Handling Cash During Times of Change

Cash Flow management becomes even more critical during periods of economic uncertainty or market changes. Companies must have enough cash reserves to weather downturns, manage supply chain disruptions, and pivot strategies as needed. For example, a business that faces a sudden drop in sales due to an economic recession must carefully manage its Cash Flow to avoid layoffs or bankruptcy.

Managing Cash During Periods of Growth

Rapid growth can strain a company’s Cash Flow if not managed properly. As sales increase, so do production, payroll, and inventory costs. Businesses must ensure sufficient working capital to support expansion without overextending themselves. For instance, a startup experiencing a surge in demand must balance investing in new inventory with maintaining a healthy cash cushion.

Optimise your Cash Flow and boost efficiency with our Cash Cycle Management Training. Join today!

How to Manage Your Cash Flow?

Effective Cash Flow management involves maximising inflows and minimising outflows. Here are some strategies to help you manage your Cash Flow mentioned below.

Enhancing Your Cash Flow

To enhance Cash Flow, businesses can focus on accelerating cash inflows and delaying cash outflows. This might include offering discounts for early payments, improving collection processes, and negotiating longer payment terms with suppliers. Additionally, increasing sales and optimising pricing strategies can directly boost cash inflows.

Addressing Cash Shortfalls Promptly

When a cash shortfall arises, it’s crucial to address it quickly to avoid more severe financial problems. This can be done by cutting non-essential expenses, liquidating idle assets, or securing short-term financing. The key is to take proactive steps before the situation worsens, ensuring the business remains solvent.

Impact of Poor Cash Flow Management

Poor Cash Flow management can lead to various adverse outcomes, including operational inefficiencies, missed opportunities, and financial instability.

Excess Inventory

Holding excess inventory ties up cash that could be used elsewhere. This can lead to storage costs, obsolescence, and reduced profitability. Efficient inventory management frees up cash and keeps the business agile.

Extended Payment Cycles

If a company takes less time to collect customer payments, it can create Cash Flow problems. Extended payment cycles delay the availability of cash for other needs, leading to potential cash crunches. Implementing stricter credit policies and improving collection processes can mitigate this issue.

Uncontrolled Spending

Uncontrolled or poorly managed spending can rapidly drain a company’s cash reserves. Without a well-defined Cash Flow Budget and monitoring system businesses may overspend on non-essential items or make hasty financial decisions that harm their Cash Flow. Implementing stringent spending controls and regular financial reviews can prevent such issues.

Unlock the power of secure transactions—Join our Letters of Credit Training now!

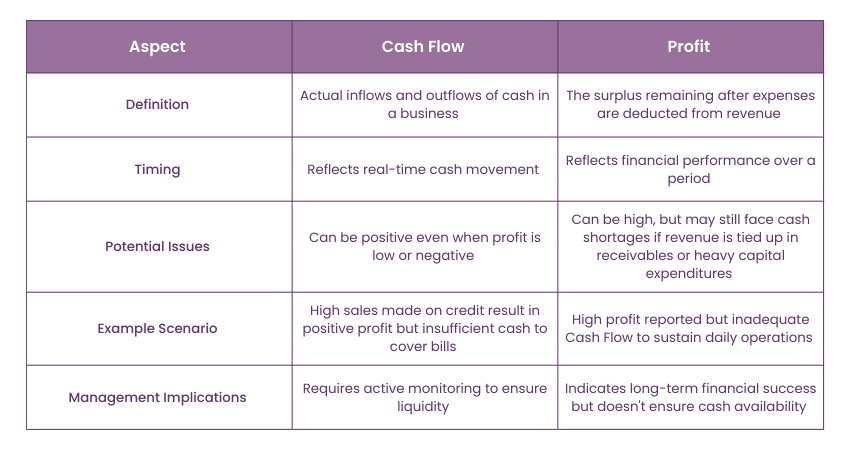

Differences Between Cash Flow and Profit

While Cash Flow and profit are related, they are distinct financial metrics. Profit is the amount of money left over after all expenses have been deducted from revenue, whereas Cash Flow refers to the actual inflows and outflows of cash in a business. A company can be profitable on paper but still experience Cash Flow problems if its revenue is tied up in accounts receivable or has significant capital expenditures.

For example, a business might report a high profit due to large sales, but if those sales are made on credit, the company may need more cash to pay its bills. This highlights why both Cash Flow and profit must be managed carefully to ensure a business's financial health.

Conclusion

Cash Flow is more than just a financial metric; it's the pulse of your business. Mastering cash Flow management empowers you to navigate challenges, seize opportunities, and drive sustainable growth. Whether you're steering through turbulent times or capitalising on a growth spurt, keeping a close eye on your Cash Flow ensures that your business remains on solid financial footing, ready to thrive in any environment.

Take control of your finances—join our Introduction to Credit Control Course today!

Frequently Asked Questions

What are The Key Differences Between Cash Flow and Profit?

Cash Flow represents the actual inflows and outflows of cash in a business, while profit is the surplus after deducting expenses from revenue. A company can be profitable but still needs Cash Flow challenges if its income is tied up in unpaid invoices or if it incurs significant capital expenditures.

How Can Small Businesses Improve Their Cash Flow Management?

They can improve Cash Flow by accelerating receivables, negotiating better payment terms with suppliers, closely monitoring expenses, and keeping a cash reserve for emergencies. Implementing strict budget controls and regularly reviewing financial statements help maintain a healthy Cash Flow.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Accounting Courses. including the Cash Flow Training, Capital Market Training Course and Cash Cycle Management Training Course. These courses cater to different skill levels and provide comprehensive insights into Council Tax Bands.

Our Accounting and Finance Blogs cover a range of topics related to Cash Flow Training, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Cash Flow Training

Cash Flow Training

Fri 25th Apr 2025

Fri 20th Jun 2025

Fri 22nd Aug 2025

Fri 17th Oct 2025

Fri 19th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please