We may not have the course you’re looking for. If you enquire or give us a call on +0800 780004 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Are you maximising your Excel skills as an Accountant? Microsoft Excel serves as a powerhouse tool for Accountants to construct efficient financial models and reports. Just as skilled carpenters rely on their tools to develop sturdy and robust structures, accountants rely on spreadsheet tools like Excel to develop sturdy and robust financial frameworks. Continue reading this enthralling blog to delve deeper into the exploration of the 15 top Excel Skills for Accountants. This includes Pivot tables, ‘Checking Formulas’, and ‘What if Analysis.’ Let’s roll up our sleeves!

Table of Contents

1) Important Excel Skills for Accountants

a) Using pivot tables

b) Sorting

c) Confirming data

d) Checking formulas

e) Advanced Find and Replace for Smart Users

f) Organising Data into Tables

g) What If analysis

h) Using templates

i) Creating Custom Lists

j) Filtering by Color

2) Conclusion

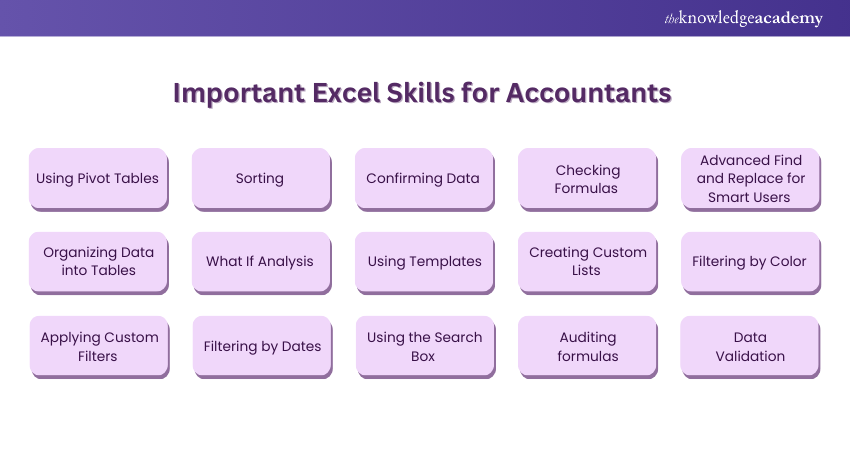

Important Excel Skills for Accountants

Microsoft Excel goes beyond data manipulation; it enables accountants to efficiently manage financial tasks, conduct analysis, and generate valuable insights for informed and seamless decision-making.

These skills enhance productivity and ensure accuracy and precision in financial reporting, making them a vital tool for accountants looking to elevate their proficiency in the field. Let's learn about the significance of mastering important Excel Skills for Accountants and understand why they are indispensable in the field of financing.

1) Using Pivot Tables

Pivot tables are indispensable for accountants to analysing enormous datasets. They allow them to summarise and manipulate data quickly. With pivot tables, accountants can easily create customised reports, analyse trends, and identify patterns within financial data. Therefore, it's an essential skill for accountants to understand how to add fields, apply filters, and format results on Pivot Tables to extract meaningful insights from complex levels of data sets.

2) Sorting

Sorting data is a fundamental skill for any finance professional to organise financial information in Excel. Accountants often deal with extensive lists of transactions, invoices, and accounts, which require complex sorting to facilitate analysis and decision-making. Excel provides various sorting options, such as by value, text, date, or custom criteria, enabling accountants to quickly arrange data in the desired order.

3) Confirming Data

To a ccurate financial reportingg, you require the arrangement of data in a systematic order. Therefore, you must ensure the integrity and accuracy of data in Excel spreadsheets. This involves verifying data entry, reconciling balances, and cross-referencing information with source documents. To this, excel offers tools like data validation and auditing features to help accountants confirm data accuracy, detect errors, and maintain data integrity throughout financial processes.

4) Checking Formulas

Formulas serve as the backbone of financial calculations in Excel. Accountants must be capable of validating formulas to prevent errors that could lead to inaccuracies in financial reportings. To this, Excel provides robust auditing tools, including formula auditing, error checking, and formula evaluation, allowing accountants to review and troubleshoot complex formulas efficiently. In addition, checking formulas regularly ensures the reliability and precision of financial calculations.

5) Advanced ‘Find and Replace’ for Smart Users

Excel's ‘Find and Replace’ feature helps in performing analysis which goes beyond simple text search and ‘replace’ operations. Accountants can utilise the advanced ‘Find and Replace’ feature to perform complex data manipulations. This includes searching with wildcards, using advanced filtering criteria, and replacing data selectively based on specific conditions. Mastering these advanced capabilities enables accountants to expedite data cleaning, formatting, and manipulation precise tasks seamlessly.

6) Organising Data into Tables

Excel tables offer a structured way to smoothly organise and manage financial data. Accountants must be able to convert ranges of data into tables through its built-in features such as automatic filtering, sorting, and calculated columns. By organising data into tables, they can streamline data entry, analysis, and reporting processes, while also improving the visibility and usability of financial information.

7) ‘What If’ Analysis

‘What If’ analysis is a vital Excel application that allows accountants to explore different instances and analyse the impact of various variables on financial outcomes. Excel comes with various ‘What If’ analysis tools, including Goal Seek, Scenario Manager, and Data Tables, which enable accountants to perform sensitivity analysis, scenario modeling, and optimise their goals. By conducting a ‘What If’ analysis, accountants can make informed decisions, forecast future performance, and mitigate risks effectively.

8) Using Templates

Excel templates provide pre-designed formats and layouts for multiple financial tasks, such as budgeting, forecasting, and financial reporting. Accountants should utilise the advanced Excel templates to standardise processes, save valuable time on document creation, and ensure consistency across reports. In addition, customising templates enhances productivity and facilitates accurate financial analysis and reporting.

Upgrade your Charts knowledge in Excel with our Excel Training with Gantt Charts - sign up now!

9) Creating Custom Lists

Custom lists in Excel allow accountants to define custom data sequences, such as months, days, or accounting codes. This feature is particularly useful for accountants to perform repetitive tasks automation, including filling data series or sorting information in a specific order. Moreover, by creating custom lists, accountants can streamline data entry, improve workflow efficiency, and maintain consistency in their financial records.

10) Filtering by Colour

By using the Conditional Formatting of Excel, accountants gain proficiency in highlighting important data points visually using colour-coded formatting rules. In addition, filtering by colour allows accountants to focus on specific categories or exceptions within financial datasets quickly. By applying colour filters, accountants can identify trends, outliers, or discrepancies to facilitate insightful analysis and decision-making.

11) Applying Custom Filters

Excel's filter functionality allows accountants to narrow down data based on specific criteria, such as values, text, or dates. By applying custom filters to financial models, accounts can efficiently extract relevant information from large datasets. This includes filtering transactions by amount, invoices by customer, expenses by category, and custom filters that aim to help accountants analyse data precisely and efficiently.

Enhance your knowledge of business analytics with our Business Analytics With Excel Course - sign up now!

12) Filtering by Dates

Date filtering is a critical skill for accountants working with time-series financial data. Excel provides various options to them for filtering data by date, including date ranges, specific dates, or relative date periods. Moreover, accountants can utilise date filters to analyse financial performance over specific time intervals, track deadlines, or compare trends across different periods effectively.

13) Using the Search Box

Excel is equipped with a search box that simplifies the process of locating specific data within large spreadsheets. Accountants can enter search terms directly into the search box to instantly find occurrences of text, numbers, or formulas within the workbook. This feature saves considerable time and effort when navigating extensive financial documents, enabling accountants to locate information swiftly and focus on analysis tasks.

14) Auditing formulas

Auditing formulas in Excel is crucial for accountants to ensure the accuracy and integrity of financial calculations. This skill involves using tools like Trace Precedents, Trace Dependents, and the Formula Auditing Toolbar to track how data flows through formulas. By auditing formulas, accountants can quickly identify errors, verify complex calculations, and enhance the reliability of financial reports.

15) Data Validation

Data validation in Excel is important for accountants to maintain data accuracy and integrity. This feature allows them to set rules for what data can be entered into specific cells, preventing errors such as incorrect data types or values outside a defined range. Furthermore, by implementing data validation, accountants can streamline data entry, enhance reporting accuracy, and ensure compliance with financial regulations.

Conclusion

We hope you understand these 15 Excel Skills for Accountants. By mastering these 15 essential Excel skills, accountants can navigate through financial complexities with precision and efficiency, ensuring accurate analysis and informed decision-making in dynamic financing. So, get ready to elevate your financial management game by honing these skills and unlocking the full potential of Excel.

Master your Excel shortcut skills with our Microsoft Excel Course - register today!

Frequently Asked Questions

The most used Excel function in accounting is the SUM function. It allows accountants to quickly add numbers to a range, to facilitate efficient calculations for financial statements, budgets, and forecasts. Moreover, mastering the SUM function streamlines data analysis, ensuring accuracy in financial reporting and decision-making.

Excel serves as a powerful tool for data organisation, financial analysis, and reporting. It helps by simplifying budgeting, invoicing, and bookkeeping tasks, allowing accountants to automate calculations and create customisable financial reports.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Microsoft Excel Course, including Microsoft Excel Masterclass, Excel for Accountants Masterclass, and Business Analytics With Excel Masterclass. These courses cater to different skill levels, providing comprehensive insights into What is Excel.

Our Office Applications Blogs cover a range of topics related to Microsoft Excel, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Excel skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming Office Applications Resources Batches & Dates

Date

Excel for Accounting Course

Excel for Accounting Course

Fri 24th Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 25th Jul 2025

Fri 26th Sep 2025

Fri 28th Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please