We may not have the course you’re looking for. If you enquire or give us a call on +46 850282424 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine a company on the brink of expansion, needing substantial funds to realise its vision. How does it navigate this complex financial landscape? This is where Investment Banking Roles come into play. Have you ever wondered what makes these roles so vital in the financial world? Or how they contribute to the growth and success of businesses?

This blog talks about the intricacies of Investment Banking Roles, exploring how they facilitate capital raising, mergers and acquisitions (M&A), and strategic financial advisory. By understanding these roles, you can gain insights into the dynamic Investment Banking world and its impact on the global economy. Let’s dive in!

Table of Contents

1) Investment Banking Overview

2) Investment Banking Roles Explained

a) Mergers and Acquisitions (M&A) Analysts

b) Corporate Finance Analysts

c) Equity Research Analysts

d) Debt Capital Markets (DCM) Specialists

e) Initial Public Offering (IPO) Specialists

f) Sales and Trading Professionals

g) Risk Management Specialists

h) Investment Banking Associates

i) Venture Capital Analysts

j) Private Equity Professionals

3) Getting Started in Investment Banking

4) Investment Banking Career Pros and Cons

5) Conclusion

Investment Banking Overview

In the realm of Asset Management vs Investment Banking, investment banking sits at the crossroads of finance, business strategy, and economic growth, playing a crucial role in capital flows and supporting businesses in raising funds and executing complex transactions. It bridges the gap between investors seeking opportunities and companies needing capital for growth and strategic initiatives. Investment Banks offer multiple services, including:

a) Raising Capital: Facilitating IPOs, secondary offerings, and debt issuances to help businesses secure necessary funds. This enables companies to fuel their ambitions and drive expansion.

b) Mergers and Acquisitions (M&A): Advising on mergers, acquisitions, and divestitures, conducting in-depth analyses, performing due diligence, and structuring transactions to create value for all parties involved.

c) Financial Advisory: Providing strategic advice on corporate finance, restructuring, and risk management. This includes guidance on capital allocation, investment strategies, and financial optimisation. When exploring Corporate Finance vs Investment Banking, both areas involve critical financial decision-making, but with different focuses—corporate finance centers on internal financial strategy, while investment banking typically deals with external transactions and capital raising.

d) Trading and Market Making: Acting as intermediaries in buying and selling financial instruments, providing market liquidity, contributing to price discovery, and executing trades on behalf of clients.

e) Research and Analysis: Producing comprehensive reports on industries, companies, and market trends to guide investment decisions and portfolio strategies.

f) Risk Management: Using advanced techniques to mitigate financial risks and protect investments from market volatility and unforeseen events.

Investment Banking Roles Explained

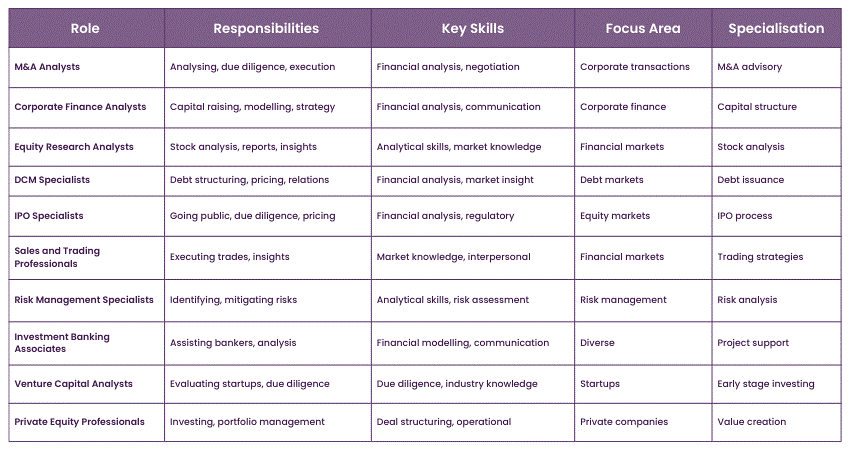

The world of Investment Banking is complex, encompassing a variety of roles that collectively drive economic growth, facilitate capital flows, and support financial innovation. These roles are performed by dedicated professionals who bring their expertise and skills to the table to ensure the successful execution of transactions, strategic decisions, and market insights.

1) Mergers and Acquisitions (M&A) Analysts

M&A Analysts play a crucial role in assessing the strategic and financial viability of possible corporate mergers or acquisitions. They examine financial reports, market patterns, and operational efficiencies to offer vital information to those making decisions.

M&A Analysts are crucial in evaluating transaction feasibility, bargaining terms, and overseeing post-deal integration for success. Their knowledge helps to mold the business world and propel strategic growth initiatives within the corporate sector.

2) Corporate Finance Analysts

Corporate Finance Analysts play a vital part in the Investment Banking team, focusing on analysing financial information, researching markets, and developing strategies for companies. They carefully examine financial documents, analyse projections, and study industry trends to offer valuable insights for decision-making.

Using their expertise in financial modeling and risk evaluation, they play a vital role in supporting mergers, acquisitions, and capital raising efforts. Corporate Finance Analysts help companies optimize their financial structures and align strategies with market dynamics, ultimately driving growth, improving competitiveness, and achieving successful business results. These contributions also influence an Investment Banker Salary, as professionals who excel in these areas often command higher compensation due to their direct impact on company success.

Equip yourself with cutting-edge Investment strategies – register for our Investment Management Course now!

3) Equity Research Analysts

Equity Research Analysts play a pivotal role in the global of Investment Banking. With a pointy attention on dissecting financial markets, industries, and groups, they provide critical insights that guide Investment decisions. Armed with meticulous evaluation and complete research, those experts provide suggestions to Investors, helping them in making informed picks. By unravelling complicated market dynamics and developments, Equity Research Analysts make a contribution to marketplace transparency, green capital allocation, and the growth of each character portfolios and institutional Investments.

4) Debt Capital Markets (DCM) Specialists

Debt Capital Markets (DCM) Specialists primarily orchestrate the issuance and trading of debt securities. Their expertise lies in structuring, pricing, and distributing bonds and other debt instruments on behalf of governments, corporations, and institutions. DCM Specialists navigate the complexities of interest rates, market conditions, and Investor preferences to optimise funding solutions.

By connecting issuers with Investors, they facilitate crucial funding for projects, expansion, and operations, playing a pivotal role in maintaining liquidity, supporting growth, and driving economic progress.

5) Initial Public Offering (IPO) Specialists

Initial Public Offering (IPO) Specialists are pivotal in the adventure of corporations transitioning from personal to public ownership. They assist customer navigate the complicated method of going public, guiding companies through regulatory necessities, valuation checks, and investor relations.

IPO Specialists collaborate with legal, economic, and marketing members to craft compelling narratives that resonate with capacity Investors. By correctly coping with IPO logistics, these specialists allow organisations to access public markets, boost capital for growth, and beautify their visibility. Their knowledge ensures a smooth and a hit IPO, marking a significant milestone in an employer's growth trajectory.

6) Sales and Trading Professionals

Sales and Trading Professionals form a crucial bridge among financial markets and institutional clients. Through their deep market information and interpersonal talents, they facilitate the buying and promoting of diverse economic devices, enhancing market liquidity and rate discovery.

By imparting timely insights, Investment ideas, and executing trades, they empower customers to make informed selections. These specialists play a key position in preserving marketplace efficiency, permitting Investors to manipulate risks and capitalise on possibilities at the same time as contributing to the general functionality of the economic ecosystem.

Unlock strategies to maximise your returns – join our Stock Trading Course now!

7) Risk Management Specialists

Risk Management Specialists are pivotal in ensuring the stability and resilience of monetary institutions and markets. By figuring out, analysing, and mitigating capability risks, they safeguard the detrimental marketplace fluctuations, regulatory challenges, and operational vulnerabilities.

By utilising their expertise in quantitative evaluation, monetary modelling, and strategic planning, Risk Management Specialists play an essential function in maintaining Investor self-belief and upholding the integrity of the economic machine. Their efforts assist establishments proactively navigate uncertainties, making them integral gamers in selling sustainable increase and minimising the effect of capacity disruptions.

8) Investment Banking Associates

Investment Banking Associates are the backbone of the industry, bridging the space between Junior Analysts and senior professionals. Their position entails comprehensive economic evaluation, due diligence, and strategic decision-making, contributing to complex transactions and consumer relationships. With delicate analytical talents and industry understanding, buddies assist in deal execution, economic modelling, and marketplace research.

Their dedication ensures the seamless development of tasks, allows correct valuation, and drives investment strategies. Investment Banking Associates are fundamental in turning in top-tier economic services that empower clients to make knowledgeable decisions and navigate the elaborate panorama of contemporary finance.

9) Venture Capital Analysts

Venture Capital Analysts play a crucial role inside the world of Investment Banking by comparing early-stage startups for capacity investment. With a keen eye for innovation and marketplace tendencies, they examine business models and analyse marketplace capability.

Their insights guide Venture Capital companies in making knowledgeable investment choices that may power technological development, create new markets, and stimulate financial boom. By identifying promising startups and helping them secure funding, Venture Capital Analysts make contributions to shaping the future of industries and fostering entrepreneurial ecosystems

10) Private Equity Professionals

Private Equity Professionals are key players within the global of finance, specialising in Investing capital in privately held companies. Their expertise lies in figuring out promising Investment opportunities, structuring deals, and actively managing portfolio groups to power increase and profitability.

They play a pivotal position in fostering innovation, creating jobs, and revitalising industries. With a focus on long-term fee introduction, Private Equity Professionals make a contribution to shaping the enterprise global by offering not best capital but, additionally strategic insights and operational expertise to assist organisations attain their complete ability.

Getting Started in Investment Banking

Breaking into Investment Banking can be challenging, but with the right approach, it is achievable. Here are some steps to help you get started:

a) Education: A strong academic background is essential. Most Investment Bankers have degrees in finance, economics, business, or related fields. Attending a top-tier university can significantly enhance your prospects.

b) Internships: Securing internships during your studies is crucial. Internships provide practical experience, industry knowledge, and networking opportunities. They also often lead to full-time job offers.

c) Networking: Creating a robust professional network is vital. Attend industry events, join finance clubs, and connect with professionals on platforms like LinkedIn. Networking can be a gateway to job opportunities and mentorship.

d) Skill Development: Develop both hard and soft skills. Proficiency in financial modelling, analysis, and Excel is essential. Moreover, strong communication, teamwork, and problem-solving skills are highly valued.

e) Certifications: Consider obtaining relevant certifications such as the Chartered Financial Analyst (CFA) or Master of Business Administration (MBA). These can enhance your credentials and demonstrate your commitment to the field.

f) Application Process: Prepare thoroughly for the application process. Customise your CV and cover letter to present relevant experience and skills. Practice for interviews, focusing on both technical questions and behavioural aspects.

g) Stay Informed: Keep updated with the industry trends, market news, and major financial developments. This knowledge will not only help in interviews but also in your day-to-day role once you secure a position.

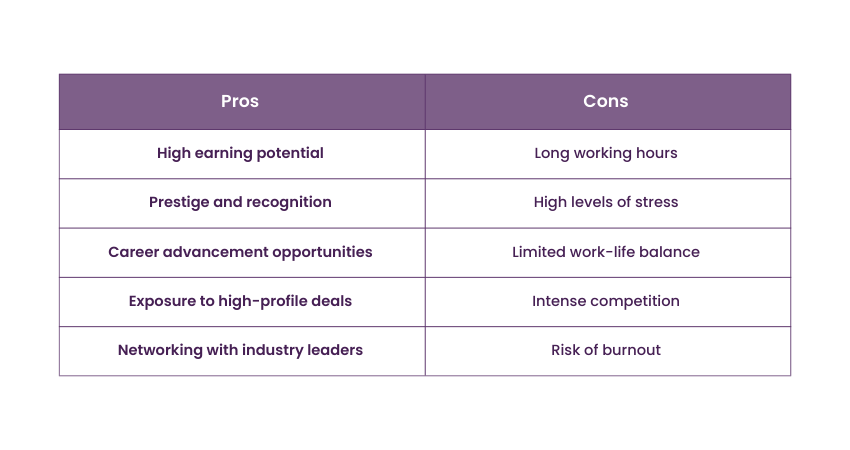

Investment Banking Career Pros and Cons

An Investment Banking career offers a unique blend of opportunities and challenges. Here’s a balanced look at the pros and cons:

1) Benefits:

a) High Earnings: Enjoy substantial salaries and bonuses at all levels

b) Rapid Career Progression: Potential for swift advancement if you perform well

c) Prime Exit Opportunities: Access to excellent exit opportunities, particularly as an Analyst.

d) Stability Against Technological Disruption: The industry is less likely to be disrupted by technology because of its relationship-based sales roles at senior levels.

e) Diverse Exposure: Expose a variety of companies, industries, and management teams.

f) Skill Development: Acquire valuable hard and soft skills that are applicable across different sectors and companies.

g) Performance-Based Advancement: Career progression is closely tied to your performance and contributions, especially as you climb the ladder.

2) Disadvantages:

a) Poor Work/Life Balance: Expect long, gruelling hours; even at senior levels, the lifestyle remains challenging due to frequent travel.

b) Monotonous Tasks: The work can often be dull and repetitive, with significant downtime waiting for others.

c) Career Stagnation: It’s easy to get “stuck in the middle” and not advance to top positions.

d) Limited Mid-Level Exit Opportunities: If you decide to leave the field at mid-levels, your options may be more restricted.

e) Lack of Social Impact: The role often lacks meaningful social contribution unless you become wealthy enough to donate to charities.

f) High Entry Barriers: Breaking into the industry is extremely difficult if you start late, switch careers, or come from a non-target school.

Conclusion

Understanding Investment Banking Roles is crucial for anyone aspiring to enter this dynamic field, especially if you are focused on becoming an Investment Banker. These roles are critical for driving economic growth, facilitating capital flows, and executing high-stakes transactions. Whether advising on mergers, raising capital, or providing market insights, these professionals shape the financial landscape. Mastering these roles can open doors to a highly rewarding career, but it demands commitment, expertise, and resilience.

Elevate your financial expertise with our comprehensive Investment and Trading Training

Frequently Asked Questions

How do Mergers and Acquisitions Create Value?

Mergers and Acquisitions (M&A) create value by combining two or more companies or assets to achieve synergies, economies of scale, market power, or strategic transformation. M&A can transfer assets to more efficient management teams, reduce costs, increase revenues, or enhance innovation.

What Does a Typical Workday Look Like for an Investment Banker?

An Investment Banker mostly dedicate the morning to financial research, the afternoon to meetings with clients and colleagues, and the evening to the creation of pitch books. An Investment Banker may also work on urgent deadlines, handle multiple tasks, and communicate regularly with banks, clients, and other Investment Bankers.

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various Investment and Trading Trainings, including Stock Trading, Real Estate and Investment Banking courses. These courses cater to different skill levels, providing comprehensive insights into Investment methodologies.

Whether you are starting your journey or aiming to elevate your Investment and Trading expertise, immerse yourself in our Business Skills Blogs to discover more insights!

Upcoming Business Skills Resources Batches & Dates

Date

Investment Management Course

Investment Management Course

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please