We may not have the course you’re looking for. If you enquire or give us a call on +65 6929 8747 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

The financial world often categorises income into two primary types: Active Income vs Passive Income. Learning about the distinction between these two Income types is crucial in Financial planning. Active Income is earned through direct efforts, such as salaries from a job, hourly wages, or professional fees. On the other hand, Passive Income is generated from ventures where continuous, active involvement isn't necessary.

This is the basic difference between the two, there’s more to explore beneath the surface. In this blog, you will learn the differences between Active Income vs Passive Income, which can help you plan your Financial journey.

Table of Contents

1) What is Passive Income?

2) Advantages of Passive Income

3) What is Active Income?

4) Advantages of Active Income

5) Key Differences Between Active and Passive Income

6) What Kind of Income Should You Be Earning?

7) Why You Should Diversify Your Income?

8) Conclusion

What is Passive Income?

Passive Income is money earned from ventures that do not require active, daily involvement. Passive Income can include income from resources such as the following:

a) Rental income

b) Dividends from investments

c) Royalties from books or patents

d) Earnings from businesses where the individual is not actively involved in day-to-day operations

To earn Passive Income, initial effort is usually required, but the ongoing time investment is minimal.

Advantages of Passive Income

Passive Income, known for its capacity to generate earnings with minimal ongoing effort, offers several compelling advantages, making it a highly sought-after goal in personal finance management. Here are some benefits of Passive Income:

a) Financial Independence and Security: It provides a steady flow of income without the need for continuous, active work, thereby reducing reliance on a traditional job. This regular cash flow can be a safety net during economic downturns or personal emergencies.

b) Time Freedom: It frees up time, allowing individuals to focus on their passions and hobbies, or spend more time with family and friends. It decouples the direct relationship between time and money, providing the luxury of time, often consumed by a traditional 9-to-5 job.

c) Diversification of Income Sources: Having multiple income streams through various passive sources can reduce the financial risk of relying solely on Active Income. This diversification is a hedge against job loss or economic downturns.

d) Potential for Scalability: Unlike Active Income, which is often limited by the number of hours one can work, Passive Income has the potential to scale. For instance, digital products can be sold to unlimited customers without additional effort.

e) Tax Benefits: Certain types of Passive Income, such as real estate investments, offer tax benefits like depreciation and lower capital gains taxes, potentially increasing the net income compared to active earnings.

Are you interested in learning about Finance? Register now for our Finance for Non-Financial Managers Course!

What is Active Income?

Active Income is the most common income earned through direct, continuous work. It includes wages, salaries, commissions, tips, or any earnings from a business or profession in which you are actively involved. This type of income is essentially trading time for money – you work a certain number of hours and receive payment for the work done during that time. Active Income is typically predictable and regular, forming the backbone of most people's finances. It requires ongoing effort, and the ability to earn is often limited by how many hours one can work in a day.

Advantages of Active Income

Active Income, earned through direct and consistent work, presents several key advantages integral to most individuals' financial health and career development. Let’s look at some advantages of Active Income:

a) Immediate and Predictable Cash Flow: Active Income offers a steady and predictable source of funds, usually in regular paychecks. This consistency is crucial for budgeting, planning, and meeting immediate financial obligations like bills and everyday expenses.

b) Career Development and Growth: It often comes from employment or running a business, which inherently provides opportunities for professional growth. Individuals can advance in their careers, gain new skills, and increase their earning potential over time.

c) Benefits and Perks: Besides the monetary compensation, Active Income roles often come with additional benefits such as health insurance, retirement contributions, paid vacations, and other bonuses that enhance overall financial stability and quality of life.

d) Social Interaction and Networking: Working in a traditional Active Income setting often involves collaboration and exchange with colleagues, clients, or customers, offering valuable networking opportunities and fostering interpersonal skills.

e) Sense of Achievement: Earning Active Income typically results from tangible efforts and achievements, providing a sense of accomplishment and contributing to personal and professional satisfaction.

Key Differences Between Active and Passive Income

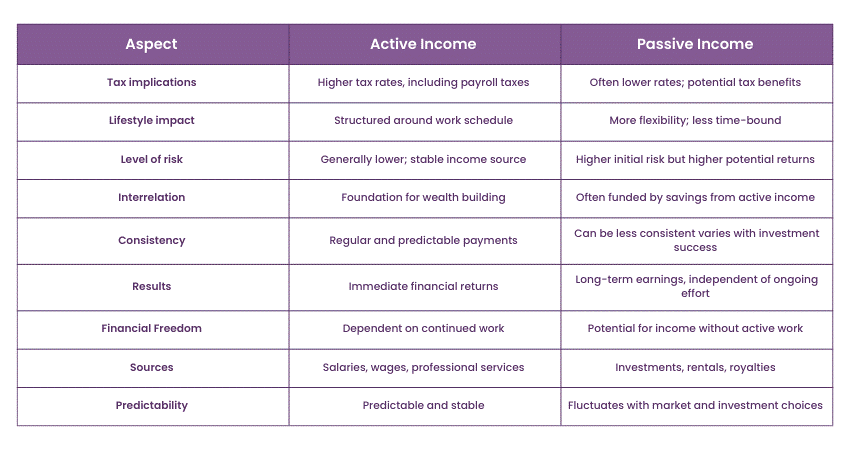

Understanding the key differences between active and Passive Income is crucial for effective financial planning and management. These differences span various aspects, from tax implications to lifestyle impact and risk levels. Let’s look at these points in detail:

1) Tax Implications

Active Income is typically taxed at a higher rate than ordinary income. It often includes additional tax burdens like Social Security and Medicare taxes in many countries. On the other hand, with a passive income, you can enjoy a more favourable tax treatment. For example, income from real estate investments can benefit from deductions like depreciation, and dividends may be taxed lower than ordinary income.

2) Impact on Lifestyle

Active Income demands a significant time commitment, often leading to a structured lifestyle centred around a work schedule. On the contrary, Passive Income offers more flexibility and can free up time, allowing for travel, hobbies, and spending more time with family.

3) Level of Risk

Active Income can be generally perceived as more stable and predictable, especially with regular employment. Passive Income can involve higher initial risk, especially in investments like real estate or stocks, but offers potentially higher long-term returns.

4) Interrelation

Active Income is often used as a foundation to build wealth, which can then be invested to generate Passive Income. On the contrary, Passive Income requires initial capital or effort, often from savings accumulated through Active Income.

5) Consistency

Active Income offers regular, predictable earnings, usually through a steady paycheck. Meanwhile, Passive Income can be less consistent, especially in the early stages of fluctuating markets.

6) Results

In Active Income, there are immediate financial returns for work done but are limited by the number of hours one can work. On the other hand, Passive Income takes time to build but can result in significant, ongoing earnings without proportional effort.

7) Financial Freedom

Active Income tends to tie financial stability to continued employment or business operation. Meanwhile, passive income is often seen as a pathway to financial independence, providing earnings without active work.

8) Sources

Active Income comes from jobs, professional services, or active business operations. On the contrary, Passive Income originates from investments, rental properties, royalties, and other sources that do not require daily involvement.

9) Predictable

Active Income is more predictable and stable, with known and regular payment schedules. On the contrary, Passive Income can fluctuate based on market conditions, investment performance, and other factors.

What Kind of Income Should You Be Earning?

Identify income streams that align with your goals. To ensure financial growth, flexibility, and security, focus on stable, scalable, or passive income sources, such as investments, freelance projects, or business ventures.

Why You Should Diversify Your Income?

Diversifying income minimises risk by spreading earnings across multiple sources. It provides financial resilience against market fluctuations, job loss, or economic uncertainty, ensuring consistent cash flow and long-term stability.

Conclusion

Active and Passive Incomes are fundamentally different in their nature, implications, and role in an individual's financial life. Understanding the nuances between Active Income vs Passive Income will help you successfully build your financial future. From this blog, we hope you know that Active Income provides immediate financial stability and career growth but is limited by time and effort; meanwhile, while potentially riskier and less predictable, Passive Income offers long-term financial freedom and a more flexible lifestyle.

Learn more about financial modelling and helping your business grow- Sign now for our Financial Modelling Course!

Frequently Asked Questions

You’ll need financial literacy, investment strategies, digital marketing, content creation, and time management skills. Depending on your chosen passive income source, understanding automation, property management, or e-commerce can also be essential.

Standard streams include real estate investments, dividend-paying stocks, peer-to-peer lending, creating digital products, affiliate marketing, and renting out property or equipment. These provide recurring income with minimal active involvement over time.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Marketing Courses, including the Passive Income Course, Introduction to Marketing Training and Strategic Marketing Course. These courses cater to different skill levels, providing comprehensive insights into How to Unblock Someone on Facebook.

Our Digital Marketing Blogs cover a range of topics related to Adobe, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Marketing Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Digital Marketing Resources Batches & Dates

Date

Passive Income Course

Passive Income Course

Fri 24th Jan 2025

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please