We may not have the course you’re looking for. If you enquire or give us a call on +65 6929 8747 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Trend Analysis aims to forecast a trend, like a bullish market surge, and persistently follow that trend until data indicates a shift in the trend's direction. Trend Analysis, as a fundamental tool, illuminates the way forward, making sense of the past to anticipate the future. From investors predicting market movements to scientists monitoring climate shifts, its application is far-reaching.

This blog explores the fundamental concepts of Trend Analysis, delving into the essence of trends, data collection, techniques, interpretation, and applications. Learn the significance of Trend Analysis in various fields and discover the tools and techniques to analyse data trends effectively. Read more to learn more.

Table of Contents

1) What is Trend Analysis?

2) Trend trading strategies

3) Types of trends

4) Advantages and disadvantages of Trend Analysis

5) Example of a Trend Analysis

6) Conclusion

What is Trend Analysis?

Trend Analysis, commonly utilised in technical analysis, seeks to forecast future movements in stock prices based on recent trends observed in market data. This method leverages historical data, including price fluctuations and trading volumes, to predict the overall market sentiment's long-term trajectory.

Trend Analysis is a systematic approach aimed at scrutinising data over a period to unveil fundamental patterns, inclinations, or alterations in specific variables or sets of variables. It offers a structured process for distilling valuable insights from historical data, which can play a pivotal role in formulating forecasts, predictions, and strategic decisions.

This encompasses endeavours to ascertain the likelihood of an ongoing market trend, such as upswings in a particular market segment, persisting into the future. It explores the potential for trends in one market domain to influence or give rise to trends in another. While Trend Analysis may involve sifting through extensive datasets, it is important to note that its results are only guaranteed to be partially accurate.

Understand the career development challenges and how to overcome them with our Career Development Masterclass

Trend trading strategies

Trend Traders are driven by the goal of identifying and capitalising on market trends to generate profits. To achieve this, they employ various trend trading strategies that make use of a diverse set of technical indicators. These strategies are designed to streamline the decision-making process and offer valuable insights into market movements. The following are some key trend trading strategies, along with the technical indicators that underpin them:

1) Moving averages: This strategy revolves around the use of moving averages. Trend traders enter long positions when a short-term moving average crosses above a long-term moving average, and they take short positions when the short-term moving average crosses below the long-term moving average. This approach is based on the notion that crossovers signify shifts in market sentiment.

2) Momentum indicators: In this strategy, Traders look for securities exhibiting robust momentum trends. They initiate long positions when security is showing strong momentum and exit such positions when the momentum wanes. The Relative Strength Index (RSI) is often employed to gauge momentum in these strategies.

3) Trendlines and chart patterns: This approach centres on recognising upcard-trending securities and setting stop-loss orders just below significant trendline support levels. When an asset's price begins to reverse, traders exit their positions to secure profits. It relies on identifying trend patterns and key support levels to manage risk effectively.

These indicators serve to simplify complex price data and, in turn, offer valuable insights for trend traders. They can be applied across various time frames, allowing traders to adapt their strategies to match their specific preferences and objectives.

While these strategies and indicators can provide a robust foundation for trend trading, it is often advisable to combine multiple indicators or establish personal guidelines. This helps to ensure that entry and exit criteria for trades are well-defined and aligned with a trader's unique approach. It is worth noting that each indicator can be utilised in diverse ways beyond the basics. This process of experimentation and refinement is crucial to developing a solid and effective trend trading strategy.

Explore the fundamentals of Finance Management and learn budgeting techniques with our Introduction To Managing Budgets Course

Types of Trends

The following are the three primary types of Trends to know:

Uptrend

An uptrend, often referred to as a bull market trend, signifies a positive trajectory in financial markets. This is typically evidenced by one or more of the following conditions:

1) Rising asset prices: Assets and stocks within the market are experiencing an increase in their valuations.

2) Economic expansion: The prevailing economic conditions are favourable, indicating growth and prosperity.

3) Increased employment opportunities: More job opportunities become available, contributing to lower unemployment rates.

4) Positive market sentiment: The economy is transitioning into a favourable phase of the investment cycle, where optimism and confidence in the market prevail.

Uptrends often coincide with constructive changes in a company's business model or improvements in the broader macroeconomic domain. Financial Analysts identify these uptrends by observing a pattern of higher peaks and troughs on a graph representing data over a specific time frame. These "peaks" represent high points, while the "troughs" correspond to low points, and their consistent ascent signifies the presence of an upward trend.

Downtrend

A downtrend, often referred to by Financial Analysts as a bear market, is characterised by several discernible indicators and is a core concept in understanding Bull vs Bear Market dynamics. It typically suggests the following conditions:

1) Declining financial markets: The overall trend in the financial markets is moving in a downward direction, leading to a reduction in the value of various assets and stocks.

2) Economic contraction: The size of the economy is shrinking, and the values of stocks and assets are on a downward trajectory. This can be a sign of economic challenges.

3) Business reassessment: In response to declining sales and challenging market conditions, companies may find it necessary to either close their operations or reevaluate and adapt their business models to remain viable.

4) Competitive adaptation: Businesses may be compelled to explore innovative strategies to maintain their competitiveness in a market undergoing a downturn.

Amid a downtrend, the financial data exhibits a recurring pattern of lower peaks and troughs. The presence of this consistent pattern of diminishing peaks and troughs over a specific time frame is a hallmark of a downtrend, indicative of the overarching bearish sentiment in the market.

Horizontal trend

A horizontal trend, often referred to as a sideways trend, is a market scenario where the prices of stock shares or assets display limited and consistent movement without significant upward or downward shifts. This trend can lead to several notable outcomes:

1) Investor ambiguity: In a horizontal trend, Investors often face challenges in ascertaining the direction of the market. Predicting whether it's an opportune moment for their clients to invest can be a complex and uncertain task. The lack of clear upward or downward movement can result in a sense of ambiguity.

2) Forecasting challenges: Financial professionals may need help in accurately forecasting short-term and long-term market events during a sideways trend. The absence of a clear and discernible trend can make it challenging to provide clients with reliable predictions.

3) Economic implications: Sideways trends can prompt governments and economic policymakers to take measures aimed at stimulating an upward market trend and fostering economic growth. This may involve initiatives to boost investor confidence and encourage increased economic activity.

Horizontal trends, marked by their price stability and minimal fluctuations, often pose a unique set of challenges and uncertainties for market participants. The inability to quickly identify a clear market direction and anticipate future market movements can lead to cautious and strategic decision-making among investors and financial professionals alike.

In response, governments may intervene to steer the market towards a more favourable upward trajectory, fostering economic expansion and stability.

Get your Organisational Skills Training and boost your workplace efficiency with core organisational skills

Advantages and disadvantages of Trend Analysis

The following are the advantages and disadvantages of Trend Analysis:

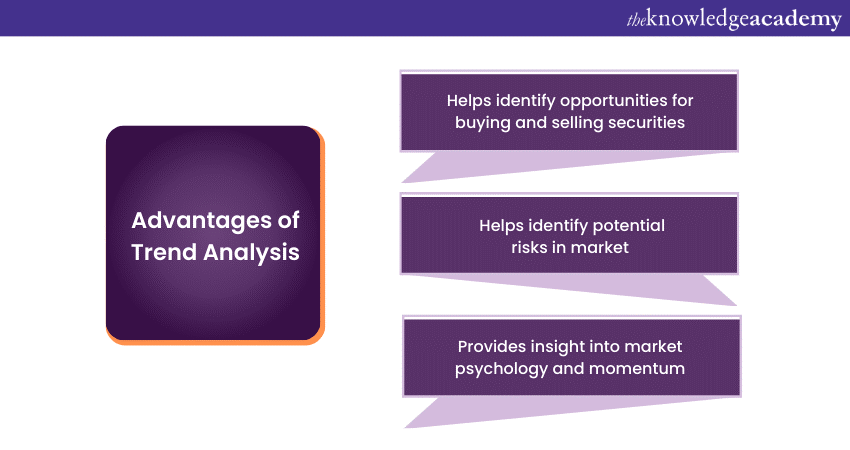

Advantages of Trend Analysis

Trend Analysis presents a multitude of benefits to investors and traders, serving as a potent instrument for pinpointing opportune moments to buy or sell securities, mitigating risks, refining decision-making processes, and augmenting the overall performance of investment portfolios.

This analytical approach harnesses an array of data sources, encompassing financial statements, economic markers, and market data. It deploys diverse methodologies for trend examination, spanning technical analysis and fundamental analysis. By imparting a comprehensive comprehension of the underlying forces steering data trends, Trend Analysis equips investors and traders with the means to render more informed and assured judgments concerning their investments.

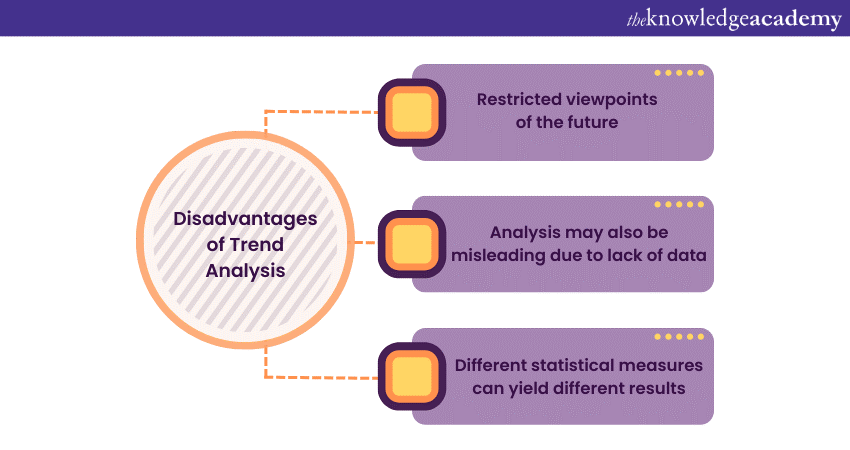

Disadvantages of Trend Analysis

Trend Analysis, while a valuable tool for guiding investment decisions, harbours certain potential drawbacks. One such drawback pertains to the reliance on the accuracy and quality of the data under examination. When the data used is incomplete, riddled with inaccuracies, or otherwise compromised, it can lead to misleading or erroneous analyses.

Another conceivable limitation lies in the fact that Trend Analysis is firmly rooted in historical data. It can offer only a somewhat restricted viewpoint of the future. Although historical data trends do provide valuable insights, it's imperative to acknowledge that the future remains unfixed, and unanticipated events or shifts in market conditions can disrupt established trends. Since Trend Analysis centres on identifying patterns within a designated timeframe, it might only partially consider other pivotal factors that could exert influence on a security's or market's performance.

Trend Analysis frequently relies on statistical metrics to discern patterns within data. The interpretation of these statistical measures can be subjective, and different methods can yield varying outcomes. As such, it is imperative to be cognizant of the constraints and presumptions intrinsic to the statistical techniques in use.

Example of a Trend Analysis

Imagine an Investor contemplating the acquisition of shares in a specific company with an interest in leveraging Trend Analysis to gauge the likelihood of the stock's value appreciating. To carry out this analysis, the investor meticulously compiles data pertaining to the company's financial performance over the preceding half-decade. This data encompasses critical factors such as revenues, expenses, profits, and other essential metrics.

Armed with this wealth of data, the Investor proceeds to craft visual representations in the form of charts that effectively illustrate the underlying trends within the dataset. These charts reveal a consistent and positive trajectory in the company's revenues over the past five years. The profits of the company are observed to have maintained an upward trajectory during the same period. Concurrently, an examination of the broader stock market demonstrates a prevalent upward trend over the specified timeframe.

The Investor employs the technique of linear regression to construct a model that elucidates the connection between the company's profits and the performance of its stock price. This analytical endeavour unveils a robust and affirmative correlation between these two variables. In essence, as the company's profits have experienced growth, there has been a corresponding tendency for its stock price to appreciate.

Considering this comprehensive analysis, the Investor arrives at a decisive conclusion: the stock of the company is poised for continued upward momentum in the foreseeable future. Bolstered by this conviction, they elect to acquire shares of the company, anticipating a favourable return on their investment.

Conclusion

From deciphering the intricacies of trends to interpreting patterns and forecasting the future, Trend Analysis paves the way for informed choices. While it possesses the potential for profound benefits, it is equally vital to acknowledge the limitations and challenges it entails. We hope this blog has aided in improving your understanding of Trend Analysis, its advantages and disadvantages, and examples.

Get your Stategic Planning And Thinking Course and gain in-depth knowledge of key factors involved in implementing strategy!

Frequently Asked Questions

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

Upcoming Career Growth Batches & Dates

Date

Time Management Training

Time Management Training

Fri 23rd May 2025

Fri 18th Jul 2025

Fri 12th Sep 2025

Fri 14th Nov 2025

Fri 16th Jan 2026

Fri 13th Mar 2026

Fri 15th May 2026

Fri 10th Jul 2026

Fri 11th Sep 2026

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please