We may not have the course you’re looking for. If you enquire or give us a call on +65 6929 8747 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Treasury Management is the backbone of a company’s financial health, ensuring assets and liabilities are handled efficiently. As the financial landscape evolves, keeping up with the latest Trends in Treasury Management is more important than ever.

This blog discusses key Trends in Treasury Management, like integrating workflows, embracing cloud technologies, harnessing data analytics, and balancing tech with human expertise. By understanding these trends, treasurers can optimise operations, make smarter decisions, and succeed economic uncertainties with confidence. Stay ahead of the curve and drive success by staying informed about these exciting developments in Treasury Management!

Table of Contents

1) Emerging Trends in Treasury Management

a) Integral Workflows in Treasury Operations

b) Payment-hub Factories and Their Impact

c) Greater Proliferation of Cloud Technologies

d) Technology Marketplace Consolidation

e) Treasurers Go Digital: The Shift to Technology

f) Data Takes Treasury to the Next Level

g) Macro Conditions Forcing Strategic Rethinking

h) Resilience in Treasury Management is Essential

i) Cash Visibility is Key to Capitalising on Opportunities

j) Balancing People and Technology in Treasury

2) Conclusion

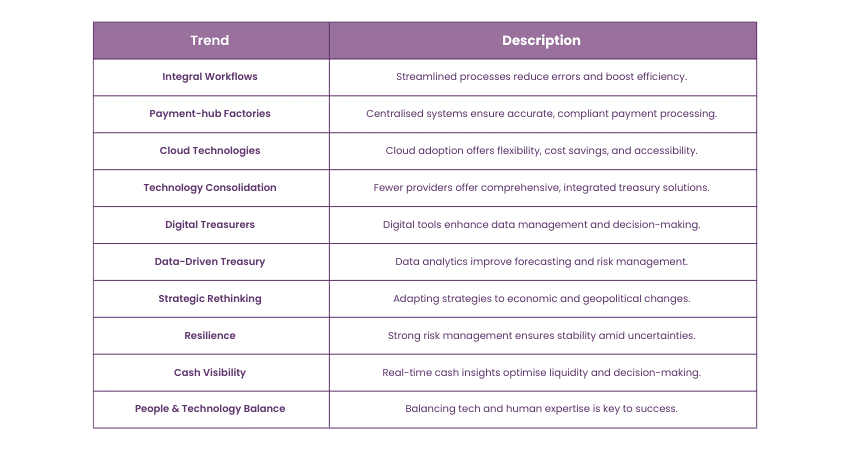

Emerging Trends in Treasury Management

Here are the top 10 Treasury Management trends:

1) Integral Workflows in Treasury Operations

Treasury operations are becoming more streamlined. This means different tasks and processes are being integrated to work together smoothly. It helps in reducing errors and improving efficiency. Overall, it makes the treasury function more effective.

2) Payment-hub Factories and Their Impact

Payment hubs are centralised systems for managing payments. They help in processing payments more efficiently and accurately. This minimises the chances of mistakes and ensures compliance with regulations. As a result, companies can handle their payments better.

3) Greater Proliferation of Cloud Technologies

More treasury functions are moving to the cloud. Cloud technologies offer flexibility and can be scaled up or down as needed. They also help reduce costs and improve accessibility. This makes cloud solutions very popular in Treasury Management.

4) Technology Marketplace Consolidation

The market for treasury technologies is becoming more consolidated. This means fewer but more comprehensive technology providers. It helps treasurers get integrated solutions that cover multiple needs. This consolidation can lead to better and more efficient tools.

Learn effective techniques for managing risk with our Introduction to Credit Control – Join today!

5) Treasurers Go Digital

Treasurers are increasingly adopting digital tools. This shift helps improve data management and decision-making. Digital tools make treasury operations more efficient and accurate. It’s a necessary change for modern Treasury Management.

6) Data Takes Treasury to the Next Level

Data analytics is becoming crucial in Treasury Management. It helps treasurers gain deeper insights into their operations. With better data, they can forecast more accurately and manage risks better. This makes data a key asset for treasurers.

7) Macro Conditions Forcing Strategic Rethinking

Economic and geopolitical changes are impacting treasury strategies. Treasurers need to adapt their plans to deal with these changes. This might involve rethinking risk management and investment strategies. It’s important to stay flexible and responsive.

8) Resilience in Treasury Management is Essential

Building resilience is crucial for Treasury Management. This means having strong risk management practices in place. It helps navigate uncertainties and stay stable. Resilience ensures that the treasury function can handle unexpected challenges.

9) Cash Visibility is Key to Capitalising on Opportunities

Having real-time visibility into cash positions is very important. It allows treasurers to make informed decisions quickly. This can help optimise liquidity and take advantage of opportunities. Good cash visibility is a key to effective Treasury Management.

10) Balancing People and Technology in Treasury

While technology is important, the human element is still crucial. People are needed for strategic decision-making and managing relationships. It’s about finding the right balance between technology and human skills. Both are essential for successful Treasury Management.

Learn accounting standards with our Accounting Course – Join today!

Conclusion

Staying updated with the latest Trends in Treasury Management is crucial for modern treasurers. By integrating workflows, adopting cloud solutions, and maintaining cash visibility, treasurers can optimise operations and capitalise on opportunities. Balancing technological advancements with human expertise ensures strategic decision-making and effective Treasury Management. Keeping an eye on these trends will help treasurers stay ahead and drive success.

Enhance financial decision-making skills with our Treasury Management Course – Sign up now!

Frequently Asked Questions

Data analytics assist treasurers in getting a better understanding of their operation. It enhances efficiency in planning, control, and decision-making through accurate and timely information.

Geopolitical factors such as economic risk and political risk change the way treasurers have to think. They have to be able to move quickly to avoid potential adversities and capture possible opportunities.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting Courses, including the Treasury Management Training, Accounting Course, and Introduction to Credit Control. These courses cater to different skill levels, providing comprehensive insights into Accounting Principles.

Our Accounting and Finance Blogs cover a range of topics related to Treasury Management, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Treasury Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Treasury Management Training Course

Treasury Management Training Course

Sun 15th Dec 2024

Fri 24th Jan 2025

Fri 21st Mar 2025

Fri 2nd May 2025

Fri 27th Jun 2025

Fri 29th Aug 2025

Fri 3rd Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please