We may not have the course you’re looking for. If you enquire or give us a call on +65 6929 8747 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Want to enhance your business's performance cost-effectively? Then, you must try the Flexible Budget model. What is Flexible Budget? It’s an advanced budget model designed for companies working in rapidly changing conditions. The Budget accurately adapts to changes in all business activities to alter output.

This blog uncovers the secrets of a Flexible Budget to make better decisions about business operations. Also, it gives you an accurate picture of how you can improve the efficiency of production with reduced costs. Read further to better understand What is Flexible Budget and how to plan a successful budget respectively.

Table of Contents

1) What is a Flexible Budget?

2) The Levels of Flexible Budget

3) Creating a Flexible Budget

4) Benefits of Implementing a Flexible Budget

5) Drawbacks of Employing a Flexible Budget

6) Effective Strategies for Successful Flexible Budgeting

7) Conclusion

What is a Flexible Budget?

A Flexible Budget is an essential type of Budget that targets businesses in a changing environment. It works in alignment with business cost variations. The Budget contains a variable rate per unit to identify potential increments or decrements in finance needs. Usually, the changes are based on the company's revenue.

It has two parts: Fixed cost and variable cost. The fixed cost section has a fixed cost portion, and the variable cost section has a variable cost portion. The Budget is created depending on the behaviour of fixed and variable costs.

A flexible budget is more advanced than a Static Budget, where the finance team spends a considerable amount of time creating a budget. Often, businesses find themselves in trouble because of the traditional budgeting system. But no worries; a Flexible Budget overcomes the hardships of a Static Budget and provides a full-proof system. The system is also beneficial in unpredictable and volatile markets as well.

The Levels of Flexible Budget

Three levels of Flexible Budget are briefly mentioned below:

1) Foundational Flexible Budgeting

It’s the basic Flexible Budgeting level that changes expenditure relating to revenues. Expenses at a particular revenue level can be calculated by multiplying actual revenue with the finance percentage. It provides an accurate, flexible budget compared to a static budget. The only drawback is that all the details are not provided.

2) Intermediate Flexible Budgeting

Account expenses that exceed the company's revenue fall under the Intermediate Flexible Budgeting. Since revenue is a vital component when it comes to decision-making, this level includes measures of benefits and salaries of employees within the company.

3) Advanced Flexible Budgeting

In Advanced Flexible Budgeting, fixed and variable costs are included as per changes in business activity levels. The goal of this level is to come up with a clear picture of all levels of activity.

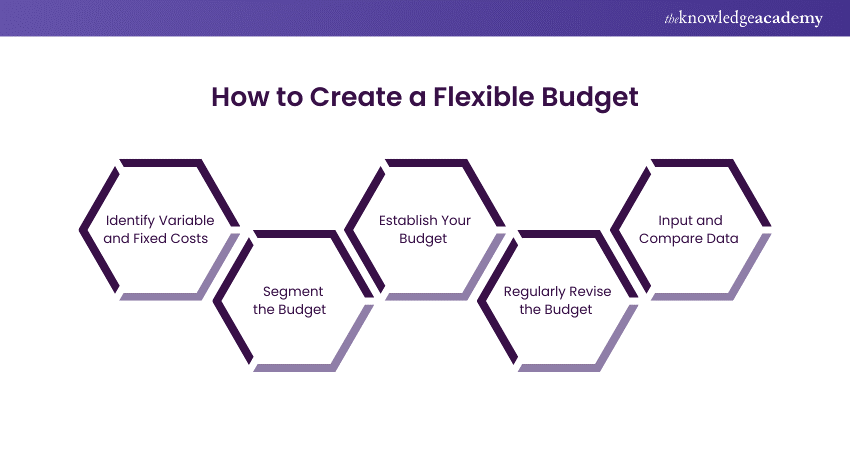

Creating a Flexible Budget

Now, you have understood why a Flexible Budget is essential for business growth. Let’s move on to the next step. Here’s how you can craft a successful Flexible Budget plan step by step:

1) Identify Variable and Fixed Costs

The very first thing you need to perform while drafting a Flexible Budget is to identify the company's fixed and variable costs. Fixed costs include insurance, budgets surrounding marketing, and rent. Variable costs include sales through merchandise.

2) Segment the Budget

The next step is to separate both in the budget sheet depending on spending on each of them. This way, you get a cost per unit for your Budget. You need to calculate revenue and cost percentages for a particular accounting period. As per the estimate, you can adjust the cost percentage of revenue for each category.

3) Establish Your Budget

It’s time to create a budget using your variable and fixed costs. Organise both as per the activity level in budgeting software. You can use functions and formulas to come up with expected costs for the activities.

4) Regularly Revise the Budget

Regularly revising your Flexible Budget plan helps find the gap between actual and expected results. This way, you get to forecast budgets for the future.

5) Input and Compare Data

No, it’s not ended yet. Input your Flexible Budget into accounting software. It is used to compare data from actual expenses to anticipated numbers.

Learn budget Skills with our Introduction To Managing Budgets Course- join now!

Benefits of Implementing a Flexible Budget

Flexible Budget has more benefits than the Static Budget. Three main advantages are as follows:

a) Parameter of Performance: A plan says a thousand words about your business than anything else. Accurate planning enables you to go in the right direction that satisfies your budget variables.

b) Cost Control: You can control your costs by predicting them soon. With a Flexible Budget, the finance team can view ahead and prepare for different scenarios. Cost control can also lower your over-budget variance.

c) Efficient Processes: A flexible Budget comes with a faster budgeting process than a static budget. Now, you can re-forecast or project calculations for scenarios.

d) Motivate Employees: Since a Flexible Budget allows adjustments with costs and revenue, employees can spend wisely to achieve desired goals.

Drawbacks of Employing a Flexible Budget

A flexible Budget has its limitations, too. It may only work for some companies. So, it’s worth knowing the drawbacks of implementing a Flexible Budget.

a) Time-consuming Calculations: The process is time-consuming as it is a complex budget. So, it demands some resources and time to create and develop a Flexible Budget. The Financial Planning and Analysis (FP&A) team can find difficulty using it.

b) Too Much Flexibility: Businesses work with other plans as well. So, the finance team’s ability to create plans gets hindered. Budget experts should handle the complexity of a Flexible Budget carefully.

c) Outdated Quickly: The predictions of a Flexible Budget have a shorter life span despite its flexibility factor. The time and effort a company invests might get invalidated in extreme situations like a pandemic.

d) Less Accountability: Flexible Budget is less accountable due to the absence of discipline. Budget owners must set definite expectations.

e) No Revenue Comparison: A Flexible Budget deals with extreme variance levels, so revenue comparison becomes impossible. This is the biggest drawback of a Flexible Budget.

f) Not Ideal Budget: A Flexible Budget is not an ideal budget as the level of precision decreases with the time and resources it demands. You can’t expect accurate financial results as variations in levels often give far projected outcomes in future.

Unlike the Static Budget, Flexible Budget requires attention to detailing. The Finance team needs to stretch harder to properly support the idea. At one point, you may find it a little challenging due to the high flexibility it offers. Accounting team may find it intimidating however with proper strategy, a Flexible Budget can be easily created.

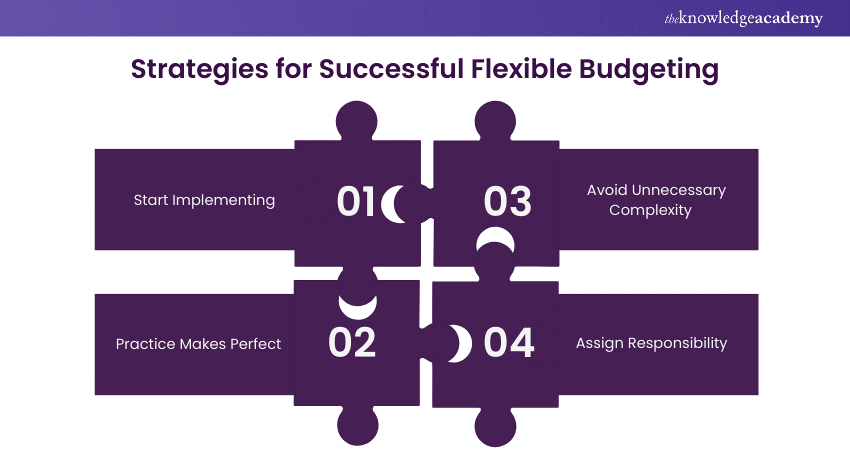

Effective Strategies for Successful Flexible Budgeting

Flexible Strategy is an essential tool for all businesses, so successfully creating it is necessary. Given below are some effective strategies for crafting a successful Flexible Budget plan:

1) Start Implementing

Flexible Budget could look intimidating as it has too many complexities. Top management gurus recommend starting a Flexible Budget without any delay. At first, you will be bad; however, with time, you get to understand how to arrange numbers correctly. With each iteration, you learn things and improve with the process.

2) Practice Makes Perfect

Perfectionists often find themselves delaying things till the very end. This way, you will not be able to create a Flexible Budget. You must begin and let go of the obsession of being perfect. That’s how you craft a sophisticated finance budget for business operations.

3) Avoid Unnecessary Complexity

Sometimes, we create complexities on our own. Don’t be a devil in the details and overcomplicated things. Carefully access things and create a plan that aligns with your business goals. Your plan should reflect an overview of the business objective.

4) Assign Responsibility

For accountability, responsibility is a must. As the business owner, take the initiative to hold a Flexible Budget. Plan and forecast effectively.

Conclusion

In conclusion, you understand how crucial a Flexible Budget is to a business. By altering changes in revenue and costs during a fiscal year, companies can adapt to market fluctuations. However, a concrete, Flexible Budget plan is needed to meet business objectives successfully. The finance team can use budgeting software to assemble variable and fixed costs on a budgeting sheet.

Master productive skills with our Personal Development Courses- register now!

Frequently Asked Questions

A flexible Planning Budget is a budget that adjusts itself depending on the business changing activities. It was formerly designed to align with changes relating to production, sales, and other crucial business activities.

The Flexible Budget formula comprises three components: activity level, variable costs and fixed costs.

Flexible Budget = Fixed costs + (Variable costs per unit x Activity level)

A Flexible Budget prevents businesses from overspending by allowing them to change their activities. It is also flexible and can accurately address uncertain market events, such as fluctuations.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Personal Development Courses, including the Introduction to Managing Budgets and Strategic Planning and Thinking Course. These courses cater to different skill levels and provide comprehensive insights into What is Budget.

Our Business Skills Blogs cover a range of topics related to Personal Development, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business Skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

Marketing Budget Course

Marketing Budget Course

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Fri 5th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please