We may not have the course you’re looking for. If you enquire or give us a call on 800969236 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Ever wondered how to gauge if an investment is worth it? That's where Net Present Value (NPV) comes to your rescue as a financial beacon. NPV helps you gauge if a project's future cash flows are bigger than its current costs, providing clarity into whether the project is a golden opportunity or a potential pitfall.

This blog explores everything you need to know about Net Present Value, including its calculation, benefits, examples and more. So, read on and learn why this financial metric is a must-have tool to unlock the secret to smart financial planning!

Table of Contents

1) What is Net Present Value (NPV)?

2) Formula for Net Present Value (NPV)

3) How to Calculate NPV in Excel?

4) Advantages of Calculating NPV

5) Disadvantages of Using NPV as a Metric

6) Difference Between Negative and Positive NPV

7) Difference Between NPV and Internal Rate of Return (IRR)

8) Conclusion

What is Net Present Value (NPV)?

Net Present Value (NPV) is the value of all future positive and negative cash flows over an investment's entire life discounted to the present. NPV analysis is a type of intrinsic valuation used extensively in finance and accounting. It’s used to determine the value of a business, capital projects, investment security, new ventures, cost reduction programs, and anything else that involves cash flow.

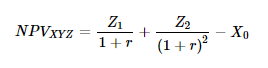

Formula for Net Present Value (NPV)

The formula for Net Present Value is:

Where:

Z1 = Cash flow in Time 1

Z2 = Cash flow in Time 2

R = Discount rate

X0 = Cash outflow in Time 0 (Initial investment or purchase price)

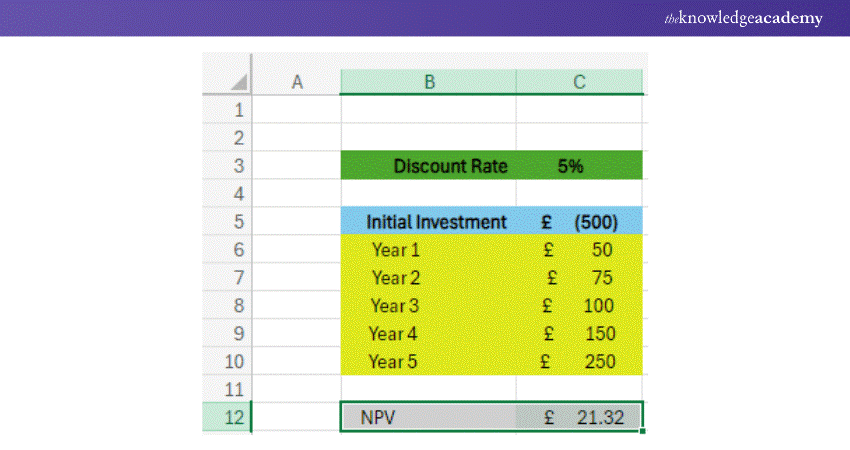

How to Calculate NPV in Excel?

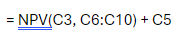

In Excel, the NPV function is a common tool in financial modelling and easily calculates the NPV of a series of cash flows. The NPV function is "NPV," and the full formula requirement is as follows:

=NPV(discount rate, future cash flow) + Initial Investment

In this example, the formula entered into the grey NPV cell is:

Want to equip yourself with the best pricing tactics and demand forecasting methods for your business? Sign up for our Revenue Management Training now!

Example of Calculating Net Present Value (NPV)

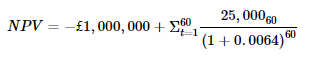

Imagine a company can invest in equipment worth £1 million and is expected to generate £25,000 monthly revenue for five years. Alternatively, the company could put that amount in securities with an expected 8% annual return. Management perceives the equipment and securities as comparable investment risks. There are two major steps to calculate the NPV of the investment as detailed below:

Step 1: NPV of the Initial Investment

Since the equipment is paid for upfront, this is the first cash flow to be included in the calculation. There's no need to account for elapsed time, so the immediate expenditure of £1 million is not discounted.

Step 2: NPV of Future Cash Flows

The following points need to be considered in this step:

a) Identify the Number of Periods (t): The equipment is expected to create monthly cash flow for five years. This means the calculation will include 60 periods after multiplying the number of months in a year by the number of years of cash flows.

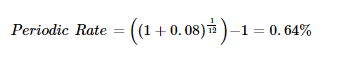

b) Identify the Discount Rate (i): The alternative investment is expected to return 8% annually. However, since the equipment creates a monthly stream of cash flows, the annual discount rate must be converted into a periodic or monthly compound rate. Using the following formula, the periodic monthly compound rate is calculated to be 0.64%:

The full present value calculation equals the present value of the 60 future cash flows minus the $1 million investment:

= £ 242,322.82

Gain broader insight into modern investment strategies in our detailed Investment Management Course – Sign up now!

Advantages of Calculating NPV

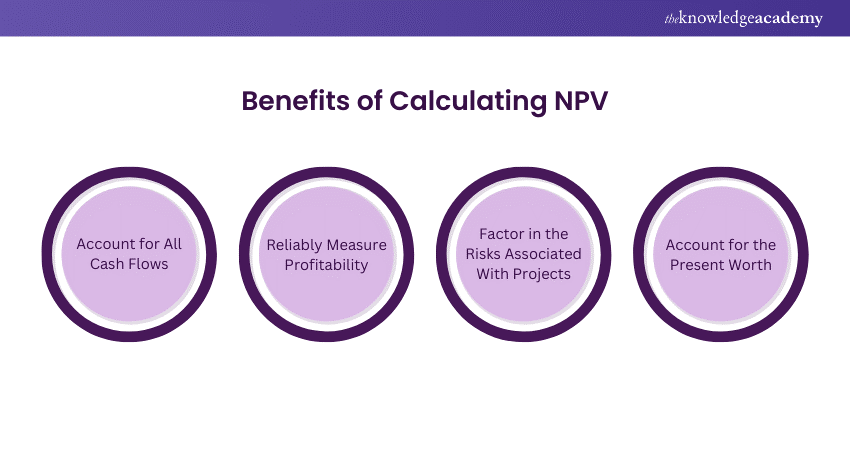

Most businesses utilise NPV calculations to make significant investment decisions. Financial analysts may also be employed to calculate NPV for multiple projects who use spreadsheets or finance software for these calculations. Here are some benefits of calculating NPV:

1) Includes all Cash Flows: NPV considers all types of definable cash flows and factors such as payback periods, which are crucial for organisational decision-making.

2) Accurately Measure Profitability: NPV is a measure of profitability that encourages businesses to invest in projects with lesser risk of losses. It enables investors to analyse projects with long-term value.

3) Accounts for Project Risks: The NPV calculation uses risk factors and discount rates, such as operational and financial risks, to enable an investor to understand the risks associated with an investment. Analysts include risks in the overall calculation of the return on investment (ROI).

4) Considers Present Value: An added benefit of calculating NPV is the assumption that money is worth less than what it'll be in the future. Factors such as inflation reduce the value of money over time. While using NPV, analysts discount future cash flows to assess their present worth.

Disadvantages of Using NPV as a Metric

Despite the numerous benefits, these are some disadvantages of using NPV as a metric to catalyse business decisions:

1) Limits for Comparisons: A business may be unable to compare various projects to determine which is more profitable. This will prove to be a drawback for any investor assessing two company projects and deciding which one to invest in. NPV cannot compare projects of varying sizes. NPV may not always be a consistent benchmark, as large projects may show higher returns than smaller ones.

2) Potential Inaccuracies: The primary drawback of NPV calculation is that the basis of calculation is not an actual rate; it’s an assumed rate of return (RoR). If an analyst calculates the rate to be higher than it may be in the future, it can return a false negative NPV. On the other hand, if they use a lower RoR, the calculation may show a false positive, resulting in unhealthy investments for investors.

3) Risks of Inaccurate Data: Unless the data a financial analyst uses to calculate the NPV is accurate, the formula may give misleading results. This can cause managers to make investment decisions that are detrimental to a business's profitability and growth.

Difference Between Negative and Positive NPV

If the Net Present Value of an investment or project is negative, it means the expected RoR earned on it is less than the discount rate (required RoR or hurdle rate). This doesn’t necessarily mean the project will lose money. It may very well generate accounting profit, but since the RoR generated is less than the discount rate, it's considered to destroy value. If the NPV is positive, it generates value.

Difference Between NPV and Internal Rate of Return (IRR)

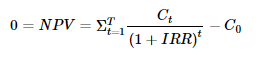

The internal rate of return (IRR) is calculated by employing the NPV formula for the discount rate needed to make NPV equal to zero. This method is used to compare projects of varying time spans based on their projected return rates, helping in the analysis of Present Value vs Internal Rate of Return.

For example, the anticipated profitability of a three-year project can be compared with that of a 10-year project using IRR. However, this may obscure the fact that the RoR on the three-year project is available for only three years and may not be matched when capital is reinvested.

The formula for IRR is as follows:

Where:

Ct = The net cash inflow during t period

C0 = Total initial investment costs

IRR = The internal RoR

t = Number of time periods

Conclusion

In conclusion, Net Present Value is a potent lens offering you a glimpse into the future of your investments. By weighing today’s value against tomorrow’s gains, NPV empowers businesses to make informed financial decisions. Understanding the diverse elements of NPV as covered in this blog will help you pick projects that maximises returns and sustains long-term success.

Master advanced business analysis skills in our comprehensive BCS Advanced International Diploma in Business Analysis – Sign up now!

Frequently Asked Questions

What is the First Step in Determining the NPV?

The first step in determining the NPV is assessing the deposit surplus for each time interval. This surplus, also called "cash flow," is established by calculating the difference between deposits and payouts.

Why is Excel Giving Me the Wrong NPV?

The Excel can give wrong NPV calculations due to the following reasons:

a) Excel assumes that the first time period is 1, instead of 0

b) Including Year 0 in the array can be a bad move

c) Using wrong function or incorrect discount rate

What are the Other Resources and Offers Provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is The Knowledge Pass, and How Does it Work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are the Related Courses and Blogs Provided by The Knowledge Academy?

The Knowledge Academy offers various Business Analysis Courses, including BCS Practitioner Certificate in Modelling Business Processes Training and the BCS Foundation Certificate in Business Analysis Course. These courses cater to different skill levels, providing comprehensive insights into Business Analysis Services.

Our Business Analysis Blogs cover a range of topics related to business success, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Analysis Resources Batches & Dates

Date

BCS Certificate in Business Analysis Practice

BCS Certificate in Business Analysis Practice

Mon 12th May 2025

Mon 9th Jun 2025

Mon 7th Jul 2025

Mon 4th Aug 2025

Mon 1st Sep 2025

Mon 6th Oct 2025

Mon 20th Oct 2025

Mon 3rd Nov 2025

Mon 17th Nov 2025

Mon 1st Dec 2025

Mon 15th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please