We may not have the course you’re looking for. If you enquire or give us a call on 800969236 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Wondering how Personal Tax Allowance can shape your financial world in the tax year 2024/25? You've come to the right place! After all, this allowance is your ticket to earning money before the tax department takes a bite. Whether you are a financial planner or an individual taxpayer, information on the Personal Tax Allowance 2024/25 is crucial for maximising your tax efficiency.

This blog assembles every detail you need, including Income Tax on savings and dividend income, personal tax allowance rules for a second job and tax relief on pension contributions. Read on and make the most of your hard-earned money!

Table of Contents

1) What Is a Personal Tax Allowance?

2) What is the 2024/25 Personal Allowance?

3) What Income Tax band am I in?

4) Income Tax on Savings

5) Tax on Dividend Income

6) Personal Tax Allowance Rules for a Second Job

7) What are the Capital Gains Tax Rates?

8) How will the Tax I Pay be Affected by my Personal Tax Allowance?

9) How Much Tax Relief can I Receive on Pension Contributions?

10) Trading and Property Allowance

11) Conclusion

What is a Personal Tax Allowance?

A Personal Tax Allowance is the amount of money you can obtain in a tax year before you start paying Income Tax. Almost everyone in the UK gets a Personal Tax Allowance, and keeping track of it is important. Things such as tax relief and certain state benefits can shift your personal allowance and transform the amount of tax-free earnings you can have.

In case you earn less than your personal allowance, you can utilise marriage allowance rules to transfer a section of your allowance to your spouse or civil partner. This way, they’ll have to pay less tax. It's important to remember that tax years aren’t the same as calendar years. A tax year begins on April 6th, so the personal allowance applies for the next 12 months.

What is the 2024/25 Personal Allowance?

The standard Personal Tax Allowance for the tax year 2024/25 stands at £12,570. If you qualify for it, you won’t pay Income Tax on your earnings until you hit this threshold. Additionally, if your earnings exceed £12,570, only the income above that threshold will be taxed.

It’s also worth noting that the tax you owe will be spread out over the year. In some situations, you may have to pay more tax than you should. This can happen if you stop working within the tax year or if your pay drops, in which case you can get a tax refund to settle the situation.

What Income Tax Band am I in?

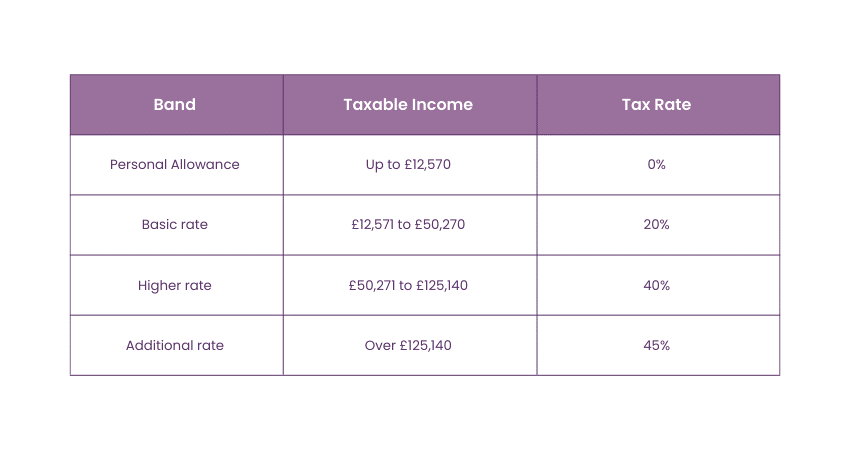

The Income Tax you pay depends on the band y you are classified under. For the 2024/25 tax year in England, Northern Ireland and Wales, these are:

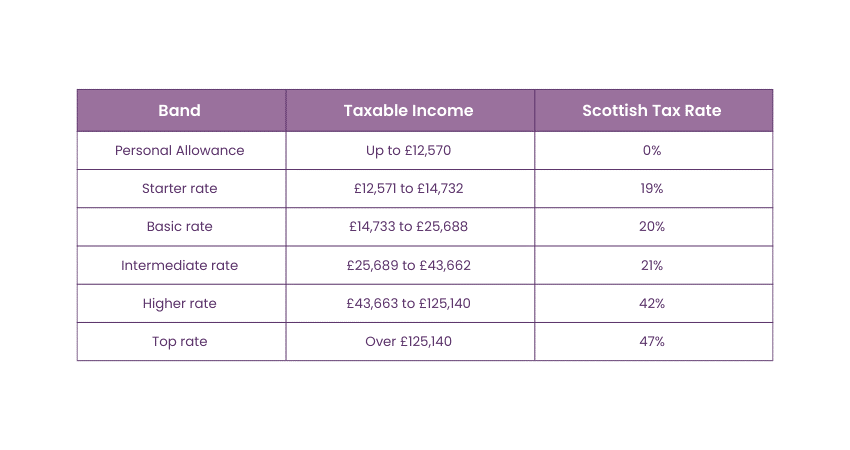

For those who live in Scotland, the Income Tax band will differ from the ones above:

Looking for practical insights into optimising corporate tax strategies? Sign up for our Introduction to UAE Corporate Tax Training now!

Income Tax on Savings

The personal savings allowance is the interest you can earn on savings without paying tax. It depends on your tax bracket:

1) Basic rate taxpayers = £1,000 allowance

2) Higher rate taxpayers = £500 allowance

3) Additional rate = £0 allowance

You may earn up to £5,000 interest without paying tax, known as your starting rate for savings. If your other income, such as wages or pension, is £17,570 or more, you won't be eligible for the starting rate for savings. If that amount is less than £17,570, your starting rate for savings is £5,000 maximum.

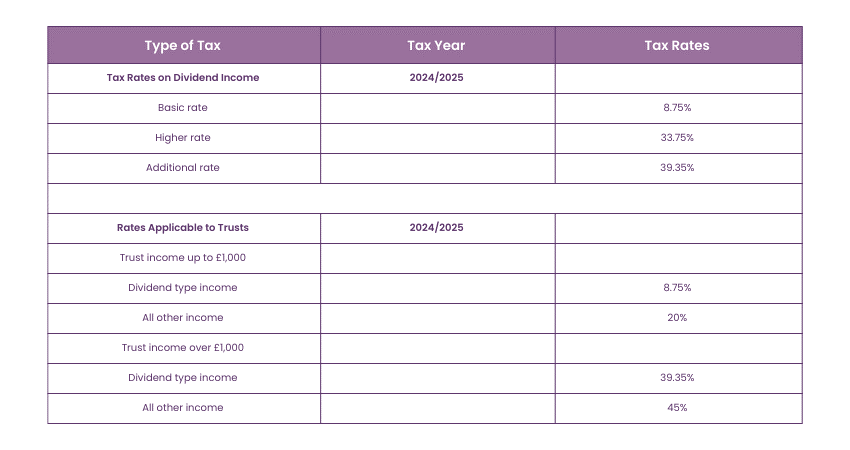

Tax on Dividend Income

The following table summarises the tax rates on dividend income for the tax year 2024/2025. You’ll receive a £500 tax-free dividend allowance, but for anything above it, you’ll need to pay the following:

Personal Tax Allowance Rules for a Second Job

Whichever job the government perceives as your primary employment source, they will treat it as your Personal Tax Allowance. You are entitled to only one Personal Allowance from one employer, which is usually the job for which you are getting paid the most.

Many people take on a second job for the extra money or as a stepping stone for kickstarting their self-employment business journey. Just ensure you know your rights when accepting a second job and how you'll be paying tax and National Insurance on them.

Gain deeper insight into the implications of GST on diverse business operations in our up-to-date GST Course – Sign up now!

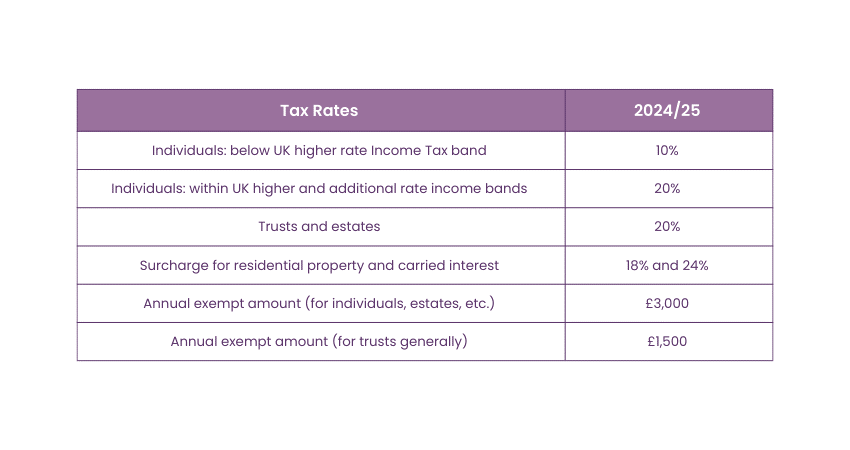

What are the Capital Gains Tax Rates?

If you receive more than £3,000 in gains on an asset you sell, you may have to pay capital gains tax. This includes a property that’s not your main home or certain business assets. A few of these rates have changed for the 2024/25 tax year, which are summarised in the table below:

How Will the Tax I Pay be Affected by My Personal Tax Allowance?

Even when the Personal Tax Allowance remains the same from one tax year to the next, it can affect the tax you owe. For Example, if your pay for the 2024/25 tax year increases, more of your total income will be over the £12,570 threshold (meaning more tax to pay).

If you were earning below £12,570 in the previous tax year, a rise in yearly pay can shift you into the Basic Rate tax band, which applies to the portion of your income above the threshold. It's essential to remember that there’s the National Insurance to consider beyond Income Tax, which comes with its own set of thresholds and rates.

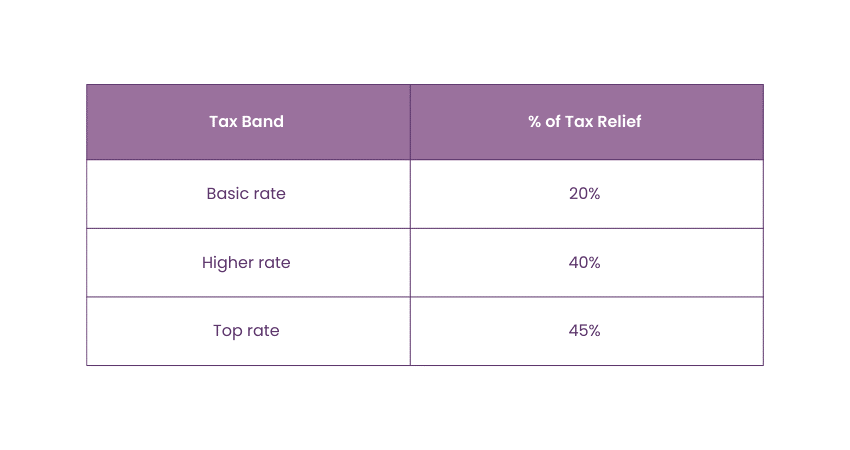

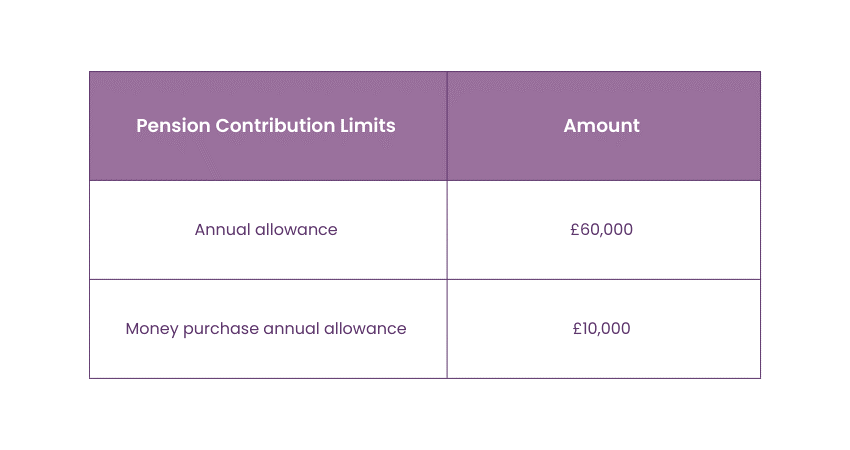

How Much Tax Relief can I Receive on Pension Contributions?

Depending on your tax band, you’ll get a specific percentage of tax relief on pension contributions as shown below:

However, there's a limit to how much can be contributed to all your pensions before facing a tax charge as summarised below:

Trading and Property Allowance

If you are involved in the property trade, the trading or property allowance is something to consider, where you can earn up to £1000 for property or trading a year in tax-free money. Anything more than this amount will need declaring your earnings, registering with HMRC, and filling a Self-Assessment Tax Return. It's important to remember that this allowance cannot be deducted from your business accounts or expenses.

Conclusion

Gaining insight into the Personal Tax Allowance 2024/25 is vital for maximising your income and minimising tax burden. Keeping in mind the personal allowance of £12,570 for the 2024/25 tax year, you can make smarter financial decisions and get the most out of your hard-earned income.

Want to learn how Value Added Tax (VAT) works? Sign up for our comprehensive VAT Training now!

Frequently Asked Questions

No, the personal allowance is not different if you are self-employed. £12,5701 is the UK's standard personal allowance for the 2024/25 tax year. This number is the same regardless of your employment format.

Yes, salaried people can switch between old and the new tax regimes yearly. This flexibility enables individuals to pick the regime that suits their financial situation when filing their Income Tax return.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Tax Courses, including VAT Training and the GST Course. These courses cater to different skill levels, providing comprehensive insights into Council Tax Bands.

Our Accounting and Finance Blogs cover a range of topics related to taxes, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your tax management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Tax Filing Course

Tax Filing Course

Fri 17th Jan 2025

Fri 21st Mar 2025

Fri 16th May 2025

Fri 18th Jul 2025

Fri 19th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please