We may not have the course you’re looking for. If you enquire or give us a call on 800969236 and speak to our training experts, we may still be able to help with your training requirements.

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

As retirement approaches, individuals often seek financial solutions to support their lifestyle and address their changing needs. In the CeMAP Exam, you come across questions related to Reverse Mortgages. It is important to understand the basics of Reverse Mortgages, such as how they work, who they are suitable for, and what the pros and cons are.

We'll also dive into the pros and cons so you can weigh the benefits of boosting your income against potential costs and impacts on inheritances. Understanding the eligibility requirements, like age, homeownership, occupancy, and financial qualifications, is crucial before you take the leap. And, of course, we'll go over the costs involved, including upfront expenses and ongoing fees, so you can assess the financial implications with confidence.

Table of Contents

1) What is a Reverse Mortgage?

2) Cash in equity

3) Types of Reverse Mortgages

4) How does a Reverse Mortgage work?

5) Pros and cons of Reverse Mortgages

6) For whom are the Reverse Mortgage rights for?

7) Reverse Mortgage costs

8) How to avoid scams?

9) How to avoid Reverse Mortgage foreclosure?

10) Should you get a Reverse Mortgage?

11) Conclusion

What is a Reverse Mortgage?

A Reverse Mortgage is a unique kind of loan designed for homeowners of the age of 62 and above. Such a Reverse Mortgage then offers homeowners a way to tap into the equity of their home to convert it into cash, something that most home loans won't allow.

A Reverse Mortgage pays the receiver instead of the receiver paying a monthly mortgage, which can be paid out in a single go, monthly, or a line of credit. In fact, the loan balance does not even need to be repaid until any one of a few specific events, such as the homeowner passing away, selling the home, or moving out permanently, takes place. Of crucial importance, the federal regulations ensure the amount of loan designed is not more than the value of the home at that time.

This will ensure that in case the value of the home depreciates, or in case the homeowner lives a very long life such that the full benefits of the Reverse Mortgage are realised, he or his estate is liable not to pay any shortfall accruing in between the loan balance and the home market value, as there is an inclusion mortgage insurance in the program. Reverse Mortgages can give retirees a lifeline, allowing them extra income without the burden of monthly payments.

However, this means that seniors need to have a crystal-clear view of how such loans work, and their financial burden or that of their heirs is weighed very carefully. This will ensure that, indeed, they are making a sound decision in taking out a Reverse Mortgage suitable for their particular financial situation.

Cash in equity

Senior citizens who own their homes on an almost full property title basis can actually use reverse ones to have access to substantial cash in need. Such mortgages (a.k.a equity mortgages) let homeowners borrow money, consolidating not only their home loan but also any outstanding mortgages on the premises.

However, it becomes imperative to recognise that Reverse Mortgages are cumbersome and costly and may prove to be the number one for just a few homeowners. The eligibility of a Reverse Mortgage that suits the specific purposes and financial needs of individuals is largely dependent on the circumstances.

You can use the household equity only if you sell your house, downsize or borrow against the equity your house is in. Here is precisely where the Reverse Mortgage step is in the game. They can be an adequate resource security package for elderly individuals with modest earnings and only a handful of assets.

Additionally, they are considered to be useful for retirees who need to bring in different types of income to reduce their investments’ risks and some other risks, such as sequence risk or longevity risk. These mortgages serve as a kind of P2P credit without any monthly principal, which helps boost your cash without the necessity of repayments.

Types of Reverse Mortgages

At this point, you have come to know what a reverse mortgage is, so it is time to learn about its varieties. The three types of Reverse Mortgage Houses are available for adoption. Check out the following key types of Reverse Mortgages:

1) Home Equity Conversion Mortgage: While the Instruction: The most popular of them is the Home Equity Conversion Mortgage (HECM) scheme, which is offered by lenders to borrowers whose house value is below the amount of the conforming loan limit - the most common reason. If Reverse Mortgages is one of lending solutions that you want to apply for, then you will certainly be requiring this type of mortgaging terms to be looked into.

2) Federal Housing Administration (FHA) Reverse Mortgage: Traditional route of acquiring a mortgage has a single option i.e. using the services of an FHA-approved lender.

3) Jumbo Reverse Mortgage: If the value of your home is on the border of the limit, you may be able to take out a Proprietary Jumbo Reverse Mortgage or Jumbo Reverse Mortgage.

Empower your mortgage career journey with our cutting-edge CeMAP Courses – embrace innovation and excel in the industry!

How does a Reverse Mortgage work?

Understanding how a Reverse Mortgage works is the key to making informed decisions about whether it's the right move for you. So let's have a look at how it works:

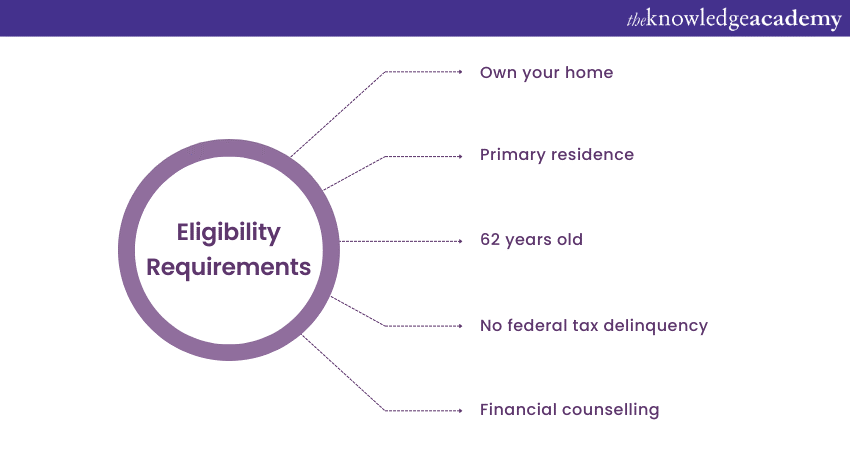

Eligibility requirements

The eligibility prerequisites for a Reverse Mortgage that we are going to talk about next. As for qualification, be sure you touch all the points. You should be at least 62 years of age or developmentally disabled to join. This is how we define or describe this age group.

Secondly, you are either to own a house outright or to have an equity which is sizable built into the house. Plus, there are additional requirements: the property must be a liability for you. It must be the place you intend to stay in, especially where you can call home sweet home.

Another thing to keep in mind is that in a Mastercard, lenders will look for a mortgage so that you will be able to cover property tax, insurance, and maintenance costs. Ultimately, we are all set for the overview of Reverse Mortgage requirements; here we go! Such conditions are applied to give assurance that you are qualified for this special type of monetary product. Here's what you need to know: Here's what you need to know:

a) Age requirement:

The individual in consideration must be at least 62 years old to qualify. This age requisite must be fulfilled by all individuals listed on the Preliminary Subdivision Plan. The fact is, the more you age, the more of this money may be able to become to you as an individual. Take a look at all the pluses of age.

b) Home ownership and occupancy:

That is the one main prerequisite you have to meet to get the Reverse Mortgage. It is just so easy, and that's it! The Reverse Mortgage should be secured by your principal residence- it is the house where you spend your night, the place where you keep your family and cherished memories, or simply “home sweet home”. Note that vacation homes and investment properties are not ever allowed to be included in Reverse Mortgages.

c) Financial qualifications:

Now, here's the deal. Your credit score or pay scale won’t be looked at as the primary factors in the verification process. On the other side, in such scenario you face with the financial necessity to support home affairs forever. For instance, an owner will be being to pay if there's a mortgage, proprety taxes, homeowners insurance and general maintenace. When borrowing money, lenders do their homework to ensure you are able to carry out the repayment exercise.

d) Counselling requirement:

Consuming a Reverse Mortgage, you'll undergo HUD- an approved Reverse Mortgage Counselor's counselling in the first instance. The purpose of this class is to allow you to gain an underlying angle of how Reverse Mortgages function and the characteristics, prices, and threats that come with it. This is your moment to clear up all doubts, highlight problems, and make a cool and calm decision.

e) Collateral protection:

As a Reverse Mortgage borrower, you deliberately have to take some conscious responsibilities, such as paying the property taxes and insurance regularly, besides maintaining the home in excellent condition. In case you are staying away from your place for even a bit longer, for example, this can be because of a prolonged stay in a medical institution due to severe illness, you will be given the option to implement the program.

When gadgets outlast their usefulness, they are usually sold off or simply thrown away. On the other hand, financial independence requires one to have enough knowledge about the rights and responsibilities of handling finances to achieve benefits from it.

Loan amount calculation

Hence, why do they use a Reverse Mortgage instead of another type of loan to find the amount of money available to you? It is these factors that drive a heavy but sometimes pleasant price. Borrowers need to have their homes appraised and provide their age, the interest rate that they have chosen, the type of Reverse Mortgage they are applying for, and any Accrued Expenses associated with the process. Normally, the appraisal value of your older home gets higher the more money that you can get.

Furthermore, the good news is that you can get an array of options for how and where to receive the loan amount. It can take the form of a one-time payment, an available credit line from which you can borrow, fixed monthly or quarterly payments, or a mixture of any of those above. What if I could combine all the good parts of the cakes, ice cream, and cookies from a buffet?

Repayment options

Now, this is expected to happen. The special point about a Reverse Mortgage is that you do not have to worry about going into debt because you can pay it off at any time. The repaying amounts almost always come up after you decide to sell the house which is no longer your primary home.

Whether the beneficiaries make the decision when they sell the asset or when you die, alternatively, you might want the beneficiaries to get the income generated from the property. By that time, the accumulated loan balance, which also includes interest and fees, rests on the borrower's shoulders and needs to be balanced with a repayment plan. In case you need to sell the home, the sale money goes to pay the Reverse Mortgage.

Also, every penny you don't spend on rent, utilities, insurance, and repairs adds up to your equity that you get to keep or pass down to your heir. However, you won’t be required to pay the extra amount either if the balance ends up being higher than the home’s value – in such a case, you or your heirs won’t be asked the difference. Phew!

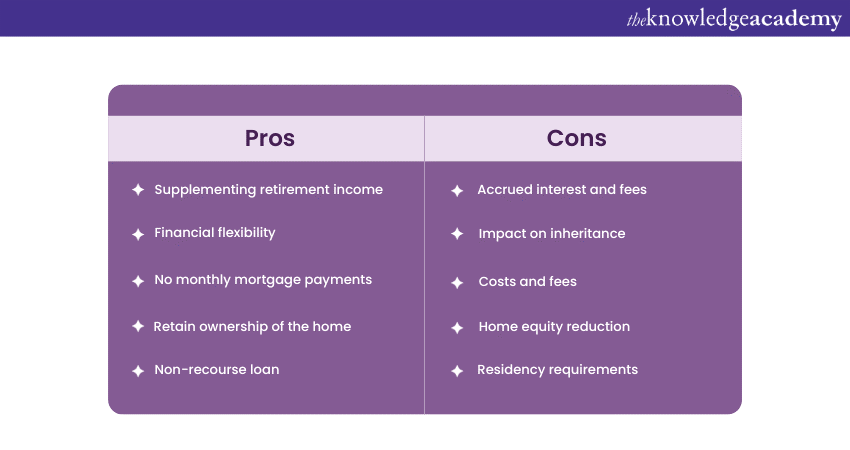

Pros and cons of Reverse Mortgages

It is important to know the pros and cons of Reverse Mortgages, so you are equipped with a well-rounded understanding of Reverse Mortgages. So, let’s have a detailed look at its pros and cons:

Benefits of Reverse Mortgages

Let's, for a moment, recruit both Opinions on the advantages of a Reverse Mortgage. Those homeowners can be game changers by attaining monthly equity if eligible. Check out these benefits:

1) Supplementing retirement income: Relying on your savings might be enough, but if you need some extra money to spend on your retirement, investing can be a viable option for you. A Reverse Mortgage is a fabulous way to supplement your income, saving you a lot of trouble in covering your financial needs during your retirement years and living a comfortable life.

2) Financial flexibility: With the Reverse Mortgage, you are the call. You are in control. Your business is different, so you get to make independent decisions on how you take your loan funds. When it comes to deciding on the services you need – whether you want a full lump sum, a line of credit you tap as much when needed, fixed monthly payments, or any blend – you have full control here. This flexibility will help you to customise the loan to resolve your specific purpose.

3) No monthly mortgage payments: Although there is a Reverse Mortgage alternative, monthly payments have become the most important thing. Finally, you can be at ease and enjoy your life after that .

4) Retain wnership of the home: There are ways to improve air quality in your home so you can keep living there. Here is a great news! There is a Reverse Mortgage that you might have! You are still a property owner, and so long as you keep your home as your main abode, you can rest assured that you will have a loving nest that you can call home.

5) Non-recourse loan: Attention-grabbing taglines incite curiosity, prompt people to switch screens, and provide a memorable message. In most of the cases, Reverse Mortgages are atypically A type of loan that is also called as the non-recourse loan. So either you or your heirs won't be having to put up anything beyond what the house would fetch at an appraisal stage which can be very helpful if the loan ever goes up in value. It grants you that even in economic perils, at least you have this.

Drawbacks of Reverse Mortgages

Now, let's try to balance things out and address the issues related to reversed mortgages. It's important to consider these factors before jumping in:

1) Accrued interest and fees: Over the lapse time, if you make no repayment and/or default, the outstanding balance has interest and fees. Therefore, you could be in a position where the existing equity in your home declines gradually as your mortgage balance increases. Therefore, be fully aware of the eventually also evolving financial expenses of these accumulated costs.

2) Impact on inheritance: In case your plan includes leaving some heritage for your heirs, pay attention to the fact that a Reverse Mortgage rates influence the amount you can pass on to your descendants With the rising size of the loan, in the end, the remaining equity can be considered to shrink, which possibly can make the inheritance smaller.

3) Costs and fees: In the same way as any financial product, costs are also incurred. These are principal origination and closing fees, Mortgage Insurance Premiums, and servicing Charges. However, please be mindful that rates at which such fees are imposed may differ from one lender to the next, hence the need to comprehend the particular fees of the Reverse Mortgage regarding the mortgage you intend to pick.

4) Home equity reduction: The more of your home loan is repaid, the more the relative amount of the equity goes down. This decrease in fairness can be a cause of a lack of opportunities for you; for example, it may be that you will not be able to upgrade your living conditions or use your home as collateral. It is highly advisable to be mindful of the fact of your property’s equity decline as you build up your long-term goals

5) Residency requirements: To ensure everything is in its rightful place, Reverse Mortgages demand that you do some maintenance, and the home will remain the major domicile for you. In case you would for live elsewhere then your debt may become due and you or your heirs to pay the loan balance.

Who is a Reverse Mortgage rights for?

Should they consider a Reverse Mortgage, then they ought to understand that it works somehow like a Home Equity Line of Credit (HELOC). A Reverse Mortgage gives you the possibility to access your home equity as a Line of Credit based on your home value and paid portion. Where a traditional home equity loan requires that you have fixed income and good credit to be secured, Reverse Mortgages do not require that at all. The loan isn't due until you quit living in the home as a primary residence.

Reverse Mortgage is very good support for those Seniors who do not want to pay monthly payments of the loan or most of the time they are unable to give for lots of reasons. It is the only way by which a person can have an opportunity to access home equity without selling a home.

Seniors who may never want to have their home put up as collateral might turn to an unsecured personal loan. However, this involves monthly repayment.

Equip yourself for success in financial advisory with our comprehensive CeMAP Training – unlock new opportunities today!

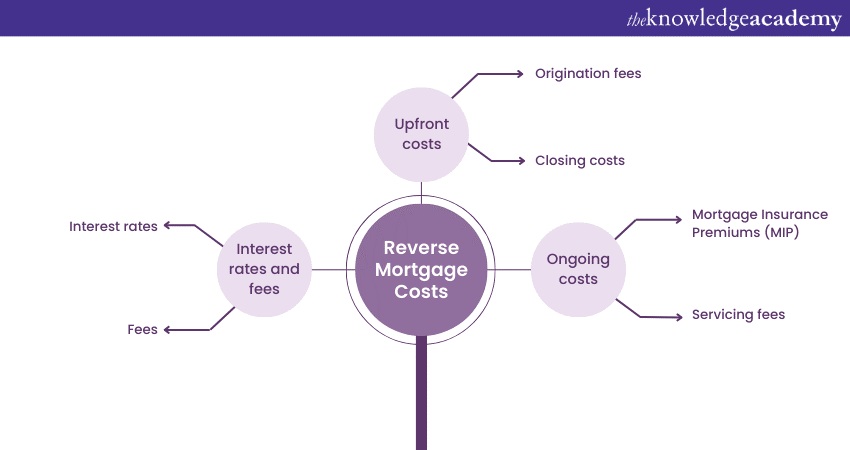

Reverse Mortgage Costs

It's important to know about the costs involved before you make any decisions related to Reverse Mortgage. Here's what you need to consider:

Upfront Costs

1) Origination fees: Now, these adaptation fees will help cover the processing of your Reverse Mortgage loan. They are often a percentage of the principal debt amount; however, the loan provider may decide the percentage based on the individual lender.

2) Closing costs: The closing fees associated with Reverse Mortgages are just like they are with regular mortgages. Crowdfunding platforms will often ask you about extra charges, like appraisal fees, title insurance, recording fees, and miscellaneous costs, with the aim of averting any misunderstandings. In practice, the costs of an option ARM loan can change because of both the amount of loan you get and your property's location.

Ongoing costs

1) Mortgage Insurance Premiums (MIP): If your Reverse Mortgage qualifies to be insured by the Federal Housing Administration (FHA) such as the Home Equity Conversion Mortgage (HECM), then an upfront Mortgage Insurance Premium (MIP) is at the beginning and an annual MIP for the remainder of the life of the loan. This form of insurance is there to protect the creditor in case there is no resell value for a home that has amassed a loan balance of more than its value after loan repayment.

2) Servicing fees: The lenders may charge you for loan servicing including the payment of their fees. This entails taking care of loan management, loan disbursement, and general organisation of the facility as well as other administrative issues. These fees' disparity occurs from lender to lender.

Interest rates and fees

1) Interest rates: The interest rates of a Reverse Mortgage come as accrued interest on the outstanding loan balance over some time. It can be of fixed or adjustable type, making the main contribution to what you will pay at the closing of your Reverse Mortgage.

2) Fees: In addition to the upfront and ongoing costs, there can be other fees included. These might be the credit report fees or counseling fees. Ensure to go through the loan documents very carefully and have a chat with your lender to understand if there are any additional fees.

Understand that costs come with the Reverse Mortgage. This will enable you to measure the financial implications on your part, and if the Reverse Mortgage really is a good fit for you, be very cautious about how you review the Loan Estimate and Closing Disclosure that your lender will issue to you. These are the documents that will give you details of the costs and fees specific to your Reverse Mortgage.

How much can you borrow with a Reverse Mortgage?

The amount of money one may be able to borrow with a Reverse Mortgage varies by the lender and the payment plan one chooses. On the other side, the lowest-cost option, a HECM, will constrain you to a borrowing limit decided by the age of the youngest borrower, the interest rate of the loan, and the lower value between your home's appraised value or the FHA's maximum claim amount. You cannot borrow 100% of the value of your house, rather. There has to be certain equity from your home that will be used to meet loan expenses like mortgage premiums and interest. Below are a few other things required to be known about how much can be borrowed:

a) This amount to be borrowed under a Reverse Mortgage comes under the purview of the age of the youngest borrower to be considered. This provision, by its very nature, always controls the amount to be borrowed by the youngest spouse in case of marriage, even if the person is not named as a borrower.

b) The more valuable your property is, the more you can borrow.

c) Financial assessment under a Reverse Mortgage increases your proceeds since you will not be using any of the proceeds to pay for property taxes and insurance.

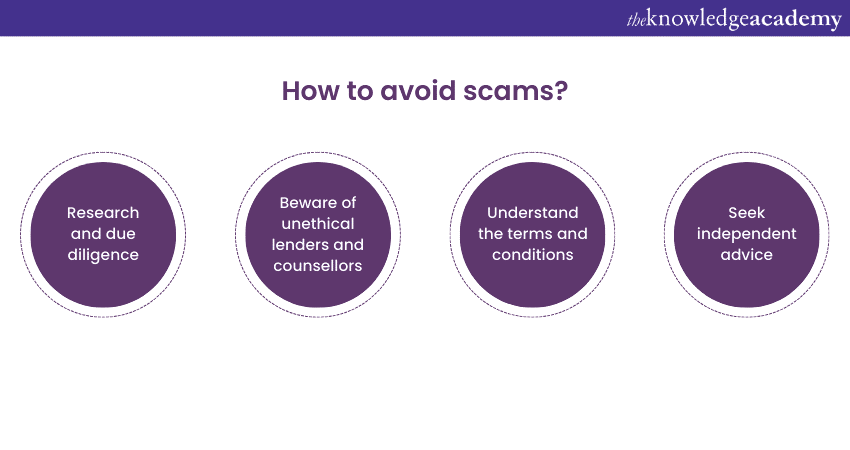

How to avoid scams?

How to avoid scams in Reverse Mortgages is very important to protect your financial security and your property. Here, we provide several strategies on how to avoid fraudulent practices.

1) Undertake your background check on the lender—know a lot more about the lender, the mortgage loan officer, or institution and ensure that they are legit and sanctioned by the Federal Housing Administration (FHA). The validity of their existence can be simply checked by using the lender search tool at the FHA or the financial regulating body of your state.

2) It is better than before the terms of a Reverse Mortgage, a retired couple should seek independent financial advisor help or a HUD-approved counsellor to guide them objectively. This can, in effect, be a way to confirm that the terms are fair and they work in your interest.

3) Understand the terms of the Reverse Mortgage to the maximum possible extent. If the lender does not explain the loan well or is pushing to sign papers quickly, watch out.

4) Be wary of any offers that come in the mail, over the telephone, or in person. Chances are that the scammer has reached out to their victim in these ways. Always confirm such offers using known and trusted communication channels with the right people.

5) Be sure that you have read and understood all documents presented to you before signing; where not clear, some of the terms may be confusing, seek clarification or help from legal personnel.

6) The first thing to do is get in touch with the proper authorities—Federal Trade Commission (FTC), your state attorney general's office, and even the National Reverse Mortgage Lenders Association (NRMLA). And, at that point, if anything appears to be quite off or you're feeling like you are perhaps being scammed, then contact the appropriate authorities by mail.

How to avoid Reverse Mortgage foreclosure?

As far as you do not want to see your house foreclosed when it comes to a Reverse Mortgage and not finding yourself deprived of living, you must do everything to prevent it. Here are some practical steps you can take:

1) Stay updated on property charges: For example, HOA fees, hazard insurance, homeowners insurance, flood insurance, homeowners association dues, and property taxes all require immediate payment. The failure of these payments can cause a Reverse Mortgage loan delinquency.

2) Maintain your home: The Reverse Mortgages would ask you to continue caring for your home, for example, by fixing its roof. Failure to fulfil the maintenance duty, which has also been expressed in the mortgage deed, is a violation of the mortgage contract terms.

3) Understand the loan terms: Familiarise yourself with the terms and conditions of your Reverse Mortgage because they matter the most. This way, you would not make a fault of defaulting since you know what they expect you to do.

4) Occupancy requirements: The requirement for the borrower of a Reverse Mortgage to permanently live in the house is one of the basic terms. Of course, long-term absence is seen as the standard, so it is recommended to stay focused on the rules of absences.

5) Communicate with your lender: If you know that your condition is likely to hinder your capacity to adhere to the terms of the Reverse Mortgage loan agreement (like a long stay at the hospital) and you would like to keep your home longer, then contact your lender in advance. They can be a way either to have solutions suggested to them or to be directed on the issue of the current matter.

6) Consult with counseling agencies: Reverse Mortage counseling agencies which have been HUD approved may help you with decisions pertaining to your Reverse Mortgage, including managing the payment. They are there for you and they can offer tips and tricks that can be used for being arranged.

7) Legal advice: If you are facing the likeliness of a potential foreclosure, no worries, a lawyer, who is specialised in real estate or elder law can provide you what is most appropriate and tailor made.

Should you get a Reverse Mortgage?

Getting a Reverse Mortgage is a big financial decision, so you want to take your time and weigh the pros and cons. Here are some key factors to consider:

Assessing financial needs and goals

First off, consider your financial needs and goals in retirement. What exactly do you want to achieve? Do you look to increase the level of your income for expenses? Do you worry about some healthcare costs? Maybe you would like to get the general financial affairs in order. One important thing is that assessing your financial situation and goals is crucial to help figure out if a Reverse Mortgage can really address your specific needs.

Evaluating alternatives

Don't you really have any other option before you jump into Reverse Mortgage? Have you ever considered downsizing into a much smaller home? This is where the home equity line of credit (HELOC) comes in. And, for sure, do not rule out your retirement savings—maybe tapping those funds is going to help. The evaluation of alternatives allows for a comparison between various strategies and the determination of which suits the circumstances being handled the best.

Looking at long-term plans

Think ahead and consider long-term plans. Where does a Reverse Mortgage fit into the bigger picture? What are going to be the living arrangements of yours? Anticipate health care needs in the future. And what about your heirs — how will it make them feel that this Reverse Mortgage is affecting you? Understanding the following long-term implications might help you make the decision.

Consult your legal and financial advisors

This is the biggie. This is very important. You should get counsel from people specialising in Reverse Mortgages. Benefit from respected Financial and Legal Advisors who may offer counsel on an individual basis. They will help you assess your situation, with the realisation of potential positive outcomes and risks, and assess long-term financial impacts. Having their expertise on your side is going to make all the difference in the decision process.

Conclusion

In conclusion, a solid understanding of Reverse Mortgages and their importance is crucial for homeowners aged 62 and older seeking financial solutions in retirement. Throughout this blog, we have covered everything about Reverse Mortgages, including how they function, the eligibility requirements, the costs involved, decision-making considerations, tips for avoiding scams, and effective loan management strategies.

Take the first step towards a rewarding career in Mortgage advice with our CeMAP training – start your journey today!

Frequently Asked Questions

What are the tax implications of using a Reverse Mortgage in retirement planning?

Reverse Mortgage payments are typically tax-free as they are considered loan proceeds, not income. However, you must still pay property taxes and insurance. Always consult a tax advisor for personalised advice.

How do Reverse Mortgage lenders help optimise financial portfolios?

Reverse Mortgage lenders can optimise financial portfolios by providing additional cash flow through loan proceeds, allowing for better management and diversification of investments without selling other assets.

What are the other resources and offers provided by The Knowledge Academy?

The Knowledge Academy takes global learning to new heights, offering over 3,000 online courses across 490+ locations in 190+ countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

What is Knowledge Pass, and how does it work?

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

What are related courses and blogs provided by The Knowledge Academy?

The Knowledge Academy offers various CeMAP Courses, including the CeMAP Course (Level 1,2 and 3). These courses cater to different skill levels, providing comprehensive insights into Becoming a Mortgage Advisor.

Our Business Skills Blogs cover a range of topics related to Reverse Mortgage, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Business Skills Resources Batches & Dates

Date

CeMAP Course (Level 1,2 and 3)

CeMAP Course (Level 1,2 and 3)

Mon 7th Apr 2025

Mon 9th Jun 2025

Mon 18th Aug 2025

Mon 27th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please