We may not have the course you’re looking for. If you enquire or give us a call on + 1-866 272 8822 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Payroll Processing is a crucial task for all businesses. It involves managing employee compensation, calculating wages, withholding taxes, and ensuring timely payment. The Payroll Management process requires attention to detail, compliance with laws and regulations, and efficient execution to guarantee accuracy and employee satisfaction.

A well-structured Payroll Management process ensures timely and accurate payments to employees while also complying with legal and regulatory requirements. In this blog, you will learn about Payroll Processing, its benefits, the key steps involved, and how to improve it.

Table of Contents

1) What is Payroll Processing?

a) Benefits of Effective Payrolling

2) Key Steps to Process Payroll

3) How to Improve Payroll Process

4) Conclusion

What is Payroll Processing?

Payroll Processing is a fundamental aspect of managing employee compensation in organisations. It involves calculating and distributing wages or salaries to employees based on their work hours, salaries, and other relevant factors. Now that you have understood what it is Payroll Processing let's look at its benefits:

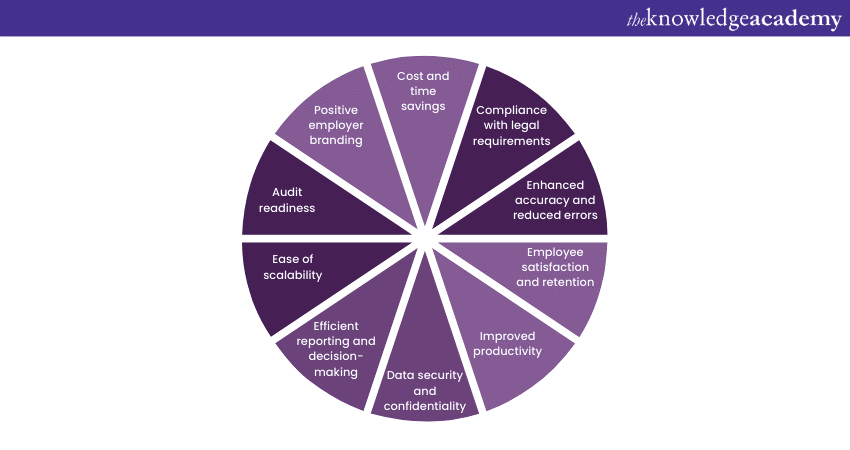

Benefits of Effective Payrolling

Effective Payrolling practices offer numerous benefits for businesses. Let's explore some of the key advantages:

a) Cost and time savings: Efficient Payrolling processes save both time and money. Businesses can streamline operations and allocate resources to other critical areas by automating Payroll tasks and reducing manual efforts.

b) Compliance with legal requirements: Payrolling involves adherence to various tax laws, labour regulations, and reporting obligations. Effective Payrolling ensures compliance, minimising the risk of penalties, fines, and legal issues.

c) Enhanced accuracy and reduced errors: Automated Payrolling systems minimise errors in calculations, data entry, and deductions. This leads to accurate and consistent Payroll Management processing, reducing the chances of payment disputes or employee dissatisfaction.

d) Employee satisfaction and retention: Timely and accurate salary processing contributes to employee satisfaction. When employees receive their wages on time and encounter minimal issues with their paychecks, it boosts morale, trust, and overall job satisfaction. This, in turn, helps with employee retention and reduces turnover.

e) Improved productivity: Effective Payrolling frees up valuable time for HR and finance teams, allowing them to focus on more strategic tasks. Automating repetitive processes increases productivity, and employees can dedicate their efforts to value-added activities.

f) Data security and confidentiality: Payrolling systems often contain robust security measures that protect sensitive employee data. Confidentiality and privacy are ensured, reducing the risk of unauthorised access or data breaches.

g) Efficient reporting and decision-making: Accurate Payroll data provides valuable insights for financial reporting and analysis. Effective Payrolling allows businesses to generate comprehensive reports, track expenses, forecast budgets, and make informed decisions based on reliable data.

h) Ease of scalability: As businesses grow, Payrolling can become more complex. Effective Payrolling practices and systems accommodate scalability, allowing businesses to manage Payroll for an expanding workforce without disruptions or complications.

i) Audit readiness: Well-documented Payrolling processes, accurate records, and compliance with regulations ensure businesses are audit-ready. This provides peace of mind and facilitates a smooth audit process when required.

j) Positive employer branding: Accurate and timely Payrolling creates a positive image of the organisation among employees, stakeholders, and potential talent. It showcases a commitment to professionalism, fairness, and employee satisfaction, enhancing the employer brand.

By implementing effective Payrolling practices, businesses can experience cost savings, compliance, accuracy, employee satisfaction, and improved overall operational efficiency.

Key steps to process Payroll

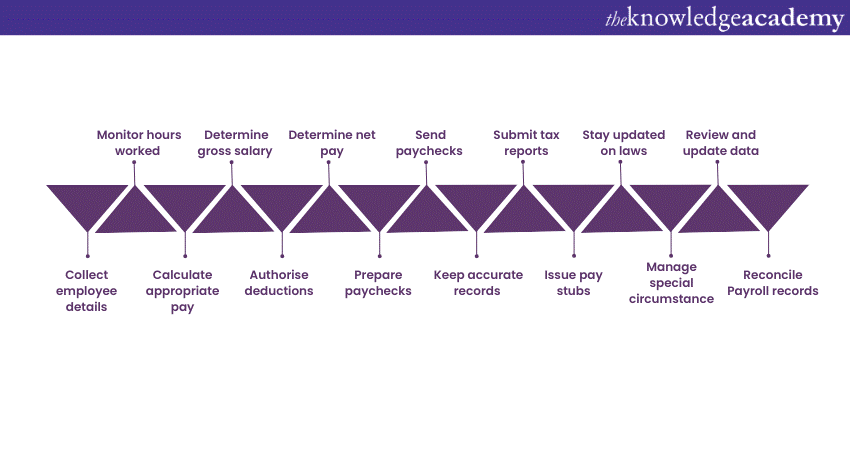

The several essential steps of the Payroll Management process are critical to ensuring timely and accurate employee payment. Here are the key steps involved in this process:

a) Gather employee information: Collect necessary employee details, including names, addresses, tax forms, and bank account information. It is a basic Payroll Process that ensures accurate record-keeping and facilitates smooth processing.

b) Track hours worked: Accurately track the number of hours worked by each employee, including regular hours, overtime, and any additional compensated time. This information is essential for calculating wages and ensuring compliance with labour laws.

c) Determine pay rate: Apply the appropriate pay rate for each employee based on factors such as job position, experience, or union agreements. Ensuring accurate pay rates helps maintain fairness and consistency in compensation.

d) Calculate gross pay: Multiply the hours worked by the pay rate to calculate gross wages for each employee. Accurate calculations of gross wages are vital for ensuring employees receive their rightful earnings.

e) Deduct taxes and withholdings: Withhold federal, state, and local taxes, as well as other authorised deductions, from the gross wages. Adhering to tax laws and withholding obligations is crucial for legal compliance and accurate processing.

f) Calculate net pay: Subtract taxes and deductions from gross wages to determine the net pay—the amount employees will receive in their paychecks. Accurate net pay calculations ensure employees receive their correct take-home pay.

g) Generate paycheck: Prepare paychecks or electronic payment files for direct deposit, ensuring accuracy and proper formatting. This step involves generating pay stubs that detail earnings, deductions, and other relevant information.

h) Distribute paychecks: Provide employees with their paychecks through direct deposit, physical checks, or electronic payment systems. Timely and reliable distribution of paychecks ensures employee satisfaction and timely access to wages.

i) Maintain Payroll records: Keep accurate records of employee wages, tax withholdings, timekeeping, and other Payroll-related information. Proper record-keeping enables compliance with legal requirements and facilitates easy access to Payroll data for audits or inquiries.

j) File Payroll taxes: Submit Payroll tax reports and make tax payments to the appropriate government agencies within the designated timeframes. Timely and accurate tax filing and payment ensure compliance with tax laws and avoid penalties.

k) Provide pay stubs: Issue pay stubs to employees detailing their earnings, deductions, and taxes for each pay period. Pay stubs provide transparency and help employees understand how their pay is calculated.

l) Stay compliant: Stay updated with tax laws, labour regulations, and reporting requirements to ensure compliance with legal obligations. Regularly review changes in regulations to adapt processes accordingly.

m) Handle special circumstances: Process bonuses, commissions, reimbursements, and any other special Payroll circumstances accurately. Special circumstances require attention to ensure accurate compensation and adherence to specific rules or policies.

n) Monitor changes: Regularly review and update employee information, tax withholding forms, and other relevant data as changes occur. Keeping employee records up to date helps ensure accurate processing and avoids discrepancies.

o) Perform reconciliation: Reconcile Payroll records with bank statements and other financial reports to ensure accuracy and detect any discrepancies. Reconciliation helps identify and resolve any inconsistencies or errors in this process.

By following these key steps, businesses can effectively manage their Payroll Process, ensuring accurate and timely payment to employees while maintaining compliance with legal requirements.

Unlock the full potential of Xero Payroll and become a proficient Payroll Manager with our comprehensive Xero Payroll Training – Sign up now!

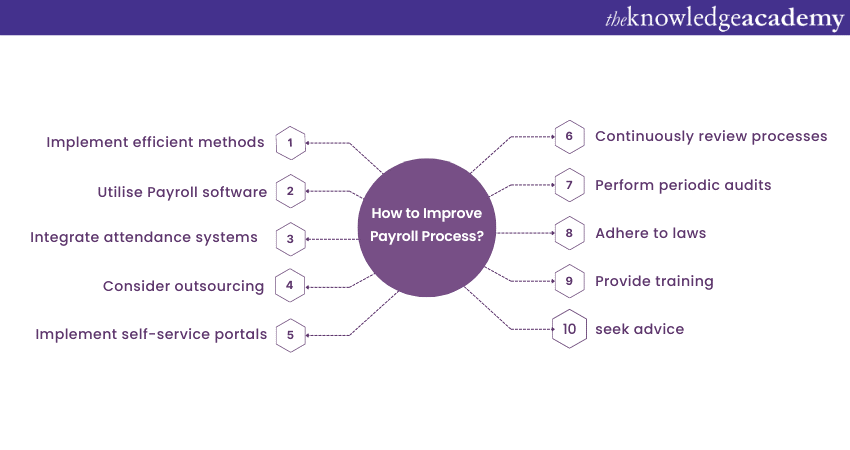

How to Improve Payroll Process

Improving your Payroll Process can increase efficiency, accuracy, and employee satisfaction. Here are some strategies to enhance your Payroll operations:

a) Streamline data collection: Implement efficient methods for collecting employee information, such as online forms or integrated HR systems. This reduces manual data entry and improves data accuracy.

b) Automate calculations: Utilise Payroll Software that automates wage calculations, deductions, and tax withholdings. This minimises errors and ensures accurate payments.

c) Integrate time and attendance systems: Integrating time and attendance systems with your Payroll software streamlines calculating hours worked, overtime, and paid time off. It eliminates manual data entry and improves accuracy.

d) Outsource Payroll: Consider outsourcing your Payroll to specialised service providers. They have expertise in Payroll Management and can handle complex tasks, ensuring accuracy and compliance while freeing up your internal resources.

e) Provide employee self-service options: Implement self-service portals where employees can access their pay stubs, update personal information, and view tax documents. This reduces administrative tasks and empowers employees to manage their Payroll-related needs.

f) Regularly review and update processes: Continuously review your Payroll Management methods to identify areas for improvement. Stay current with tax laws and regulations changes, and ensure your procedures align with best practices.

g) Conduct audits: Perform periodic audits of your Payroll Management methods to identify any discrepancies or errors. This helps maintain accuracy, detect fraud or compliance issues, and ensure Payroll data integrity.

h) Ensure compliance: Stay informed about labour laws, tax regulations, and reporting requirements. Regularly review your Payroll procedures to ensure compliance and avoid penalties.

i) Invest in training: Train your Payroll team on the latest Payroll practices, software updates, and regulatory changes. This ensures they have the necessary knowledge and skills to perform their roles effectively.

j) Seek professional advice: Consult with Payroll experts or seek advice from Payroll service providers to optimise your processes. They can offer insights, guidance, and solutions tailored to your specific business needs.

Applying these strategies can improve your Payroll Management's efficiency, accuracy, and effectiveness. Remember to regularly evaluate and update your procedures to adapt to evolving requirements and industry best practices.

Master the art of Payroll Management and propel your career to new heights with our Introduction To Payroll Course – Sign up now!

Conclusion

We hope you read and understood everything about Payroll Process. A well-executed Payroll Management is crucial for businesses to ensure accurate and timely payments, maintain compliance, and enhance employee satisfaction. By following the key steps, leveraging technology, and staying informed, businesses can streamline their operations and achieve success.

Take control of your financial future and unlock your potential with our expert-led Accounting & Finance Training Courses – Sign up today!

Frequently Asked Questions

Upcoming Accounting and Finance Resources Batches & Dates

Date

Payroll Course

Payroll Course

Fri 17th Jan 2025

Fri 21st Feb 2025

Fri 4th Apr 2025

Fri 6th Jun 2025

Fri 29th Aug 2025

Fri 24th Oct 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please