We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Do sky-high Council Tax Bills make you feel anxious? Uncover the assistance provided by Council Tax Reduction. This government scheme aims to assist individuals and families facing difficulties covering their Council Tax payments. If you have a low income, receive benefits, or face financial challenges, you could qualify for this assistance. Do not allow financial concerns to burden you. In this blog, let’s discover how Council Tax Reduction can positively impact your life.

Table of Contents

1) What is Council Tax Reduction?

2) Who Can Get Money Off Their Council Tax Bill?

3) How do I claim Council Tax Reduction?

4) How Council Tax Reduction is Worked Out?

5) Reductions Based on Your Income

6) Reductions & Discounts Based on Your Property

7) Conclusion

What Is Council Tax Reduction?

Council Tax Reduction (CTR) is a government scheme that helps people struggling with Council Tax Payments. It aims to ease the financial strain on those who need it most and ensure affordability for all.

Eligibility for CTR depends on income, savings, household composition, and other benefits received. Pensioners, people with disabilities, and parents are often prioritised. The reduction amount can vary, from a small discount to a full exemption, depending on your situation.

To apply for Council Tax Reduction, contact your local council. They will evaluate your circumstances based on the details provided. This includes information about your income, savings, household members, and any benefits. The application process can be done online, by phone, or in person at the council office.

Council Tax Reduction can greatly impact your monthly finances, allowing for more flexibility with vital spending. It is crucial for individuals experiencing financial hardship to offer essential assistance and aid in economic stability. If you struggle to pay your council tax, check if you qualify for CTR.

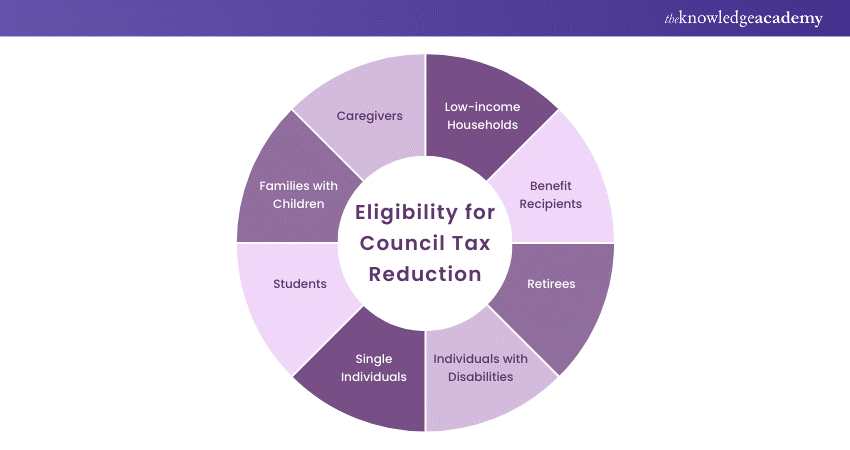

Who Can Get Money Off Their Council Tax Bill?

Many individuals are eligible for a reduction in their Council Tax Bill by applying for Council Tax Reduction. Different factors are set on qualification. The following are the main groups that may be eligible:

1) Low-income Households: Low-income households may get a discount if their income is low. This consists of salaries, retirement benefits, and additional income.

2) Benefit Recipients: Individuals who gain benefits like Jobseeker’s Allowance, Income Support, or Universal Credit usually meet the criteria.

3) Retirees: Individuals collecting a government pension typically receive preferential treatment for Council Tax Reduction. Their savings and earnings are considered.

4) Individuals with Disabilities: If you or a household member has a disability, you may meet the criteria. Additional charges related to having a disability are considered.

5) Single Individuals: Single adults living alone are eligible for a 25% deduction on their council tax bill.

6) Students: Full-time students could qualify for a bonus or receive a discount. Verification of student registering is necessary.

7) Families with Children: Families with children, particularly those with limited incomes, can get assistance. The number of dependents impacts eligibility.

8) Caregivers: Those who care for a disabled individual may be eligible for a discount. Attention needs to be consistent and frequent.

Your local council determines eligibility. They consider your income, savings, household size, and specific needs. If you belong to any of these groups, contact your local council to request a Council Tax Reduction. It has the potential to greatly decrease your council tax expenses, alleviating your financial stress.

Simplify your finances and master your taxes with our Tax Filing Course – Register now!

Who is 'disregarded' for Council Tax?

Some individuals are 'disregarded' for Council Tax purposes, so they need to be factored into the bill calculation. These consist of students in full-time education, student nurses, apprentices, and youth training trainees. Individuals with profound mental disabilities and live-in caregivers responsible for individuals other than their spouse, partner, or minor child are also excluded.

Moreover, those under 18 and 18-19-year-olds in school full-time are eligible. Visitors from the military, diplomats, and foreign language assistants registered with the British Council are also not eligible. If you reside with someone in these groups, you could qualify for a reduction on your Council Tax Payment.

This neglect lessens the total council tax responsibility for households with eligible residents, which could result in manageable savings. It also guarantees that individuals facing unique circumstances are not unfairly penalised for their inability to contribute.

These exceptions are acknowledged to offer financial assistance to those in greatest need, promoting a more equitable and caring society. If a family member fits into one of these groups, contacting your local council is a good idea. This will help you learn about the possible advantages and request any applicable discounts.

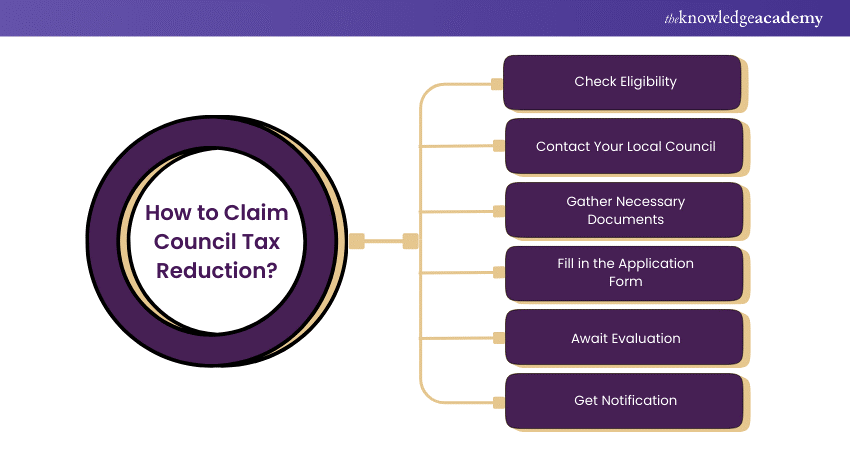

How do I Claim Council Tax Reduction?

Claiming Council Tax Reduction is a straightforward process designed to help ease your financial burden.

1) Check Eligibility: Verify your qualification by determining whether you satisfy the requirements related to earnings, finances, and family situation.

2) Contact Your Local Council: Contact your local council by visiting their website or office to obtain detailed information on how to apply.

3) Gather Necessary Documents: Collect required paperwork, including proof of income, savings, benefits, and details of household members.

4) Fill in the Application Form: Offer all required information online, over the phone, or in person at the nearest council office.

5) Await Evaluation: The board will assess your application and provide you with the outcome.

6) Get Notification: Upon approval, you will be given information on your discount and how it will be deducted from your invoice.

Learn comprehensive GST concepts with our GST Course – Join today!

How Council Tax Reduction is Worked Out?

Let’s understand how Council Tax Reduction is calculated and how it can help you receive potential savings on your bills.

Council Tax Reduction

Council Tax Reduction is calculated considering various factors to ensure that individuals facing financial hardships receive the necessary assistance.

Second Adult Reduction

You may be eligible for a Second Adult Reduction if you have additional adults in your household who are not your spouse and have a low income. This reduction is based on the income of the extra adult, not your own, potentially lowering your Council Tax Bill.

Reductions Based on Your Income

Reductions depending on your income can greatly lower your Council Tax Bill if you fulfil specific criteria.

Low Income or Benefits

You might be eligible for CTR if you have a low household income or receive benefits. The council evaluates all your income, including salaries, benefits, and retirement funds. Savings and capital are also considered when evaluating your eligibility for CTR. If your earnings drop below a specific limit, you may be eligible for a complete or partial decrease in your council tax payment.

Receiving Pension Credit

Elderly individuals frequently receive precedence for CTR. If you receive Pension Credit, you probably meet the requirements for a discount. The precise reduction amount will consider your savings and extra earnings.

Reductions & Discounts Based on Your Property

Reductions and discounts as per your property can provide significant savings on your council tax bill if your property meets specific conditions.

Properties Adapted for a Disabled Person – Drop a Band

If your property has accommodation for a handicapped individual, you could be eligible for a discount. This usually means lowering the property's council tax band by one level, resulting in a decrease in the amount you are required to pay. Adjustments may involve installing wheelchair ramps, additional bathrooms, or designated rooms for the disabled individual.

Properties Being Renovated to Make Them Liveable – Possible 100% Exemption

Buildings being extensively renovated to become liveable may be eligible for a total exemption of 100%. This implies that you may not have to pay council tax while the renovation occurs. To be eligible, the property must be vacant and undergoing significant renovations to make it suitable for living.

Conclusion

Council Tax Reduction provides vital financial assistance for individuals struggling with council tax payments. Whether through income, benefits, or property conditions, these reductions can ease financial burdens. Lower-income families, retirees, and those in homes being renovated or modified for disabilities may be eligible. Consult your local council to determine if you qualify and make use of these beneficial resources.

Gain an understanding of the CFC with our Introduction To UAE Corporate Tax Training- Join now!

Frequently Asked Questions

Low income for Council Tax Reduction varies by local council. It takes in your total household income, benefits, wages, pensions, and benefits. You can apply for a reduction if your income falls below a certain amount.

Well, that depends on your financial situation. Paying over ten months turns out to be two months without payments. This can offer temporary relief. On the other hand, paying over 12 months evenly spreads the cost, making the monthly payment smaller.

Some of the platforms for influencers are Upfluence, Tribe, and AspirelQ. Agencies like Viral Nation and Gleam Futures offer influencers collaboration tools.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Tax Courses, including the Tax Filing Course, GST Course, and VAT Training. These courses cater to different skill levels and provide comprehensive insights into Top 10 Money Management Tips.

Our Business Skills Blogs cover a range of topics related to Business Skills, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Business Skills. The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Tax Filing Course

Tax Filing Course

Sun 6th Oct 2024

Sun 22nd Dec 2024

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please