We may not have the course you’re looking for. If you enquire or give us a call on +44 1344 203999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Imagine an effective Employee Benefits package as a stunning mosaic, where each piece adds to the allure of a job, nurturing loyalty and happiness among Employees. If your organisation hasn’t yet embraced such a package, it’s high time to catch up and adopt this essential strategy.

Employee Benefits span a diverse array of offerings, from essential insurance coverage to enticing perks. They are pivotal in attracting new talent and ensuring current employees remain satisfied. This blog will delve into the various Employee Benefits available, underscoring their significance in today’s workplace.

Table of Contents

1) What are Employee Benefits?

2) Why do Employers Offer Benefits to Employees?

3) Types of Employee Benefits

4) Legally Mandated Benefits

5) How Much do Benefits Cost a Company?

6) Conclusion

What are Employee Benefits?

Employee Benefits such as paid time off, retirement savings, are non-cash provisions of the remuneration package that may come at a cost to the company. Employers may offer benefits for moral reasons, aiming to care for employees' well-being. However, these benefits can also serve business goals by supporting Recruitment and promoting alignment with organisational goals.

Employee Benefits vary drastically depending on the organisation, enterprise, and the particular alternatives and priorities of the personnel. Some corporations may additionally offer a comprehensive bundle that includes healthcare advantages, retirement plans, paid time without work, and professional development possibilities. Others may also concentrate on developing a completely unique place of job lifestyle with perks like free food, onsite health centers, or pet-pleasant policies. The purpose is to provide employees with additional fee past their simple profits, enhancing job pleasure and ultimately attracting and preserving top skills.

Why do Employers Offer Benefits to Employees?

Research by the Society of Human Resource Management (SHRM) shows that 92% of employees view benefits as vital for job satisfaction, which in turn boosts retention and productivity.

a) Attracting Talent: Competitive benefits packages help attract top talent in the job market.

b) Employee Retention: Benefits enhance job satisfaction, reducing turnover rates and retaining valuable employees.

c) Productivity Boost: Employees who feel valued and supported are often more productive and motivated.

d) Health and Well-being: Providing health benefits ensures employees remain healthy, reducing absenteeism and healthcare costs.

e) Work-Life Balance: Benefits, including flexible working hours and paid time off help employees maintain a healthy work-life balance.

f) Legal Compliance: Offering certain benefits helps employers comply with labour laws and regulations.

g) Company Reputation: A robust benefits package enhances the company’s reputation as a desirable place to work.

h) Employee Loyalty: Benefits foster a sense of loyalty and commitment among employees, leading to a more stable workforce.

Types of Employee Benefits

Employee Benefits embody a number of perks designed to enhance work pleasure and appeal to talent. These advantages consist of healthcare, retirement plans, paid day without work, and bendy running alternatives. Here are a few sorts of those benefits:

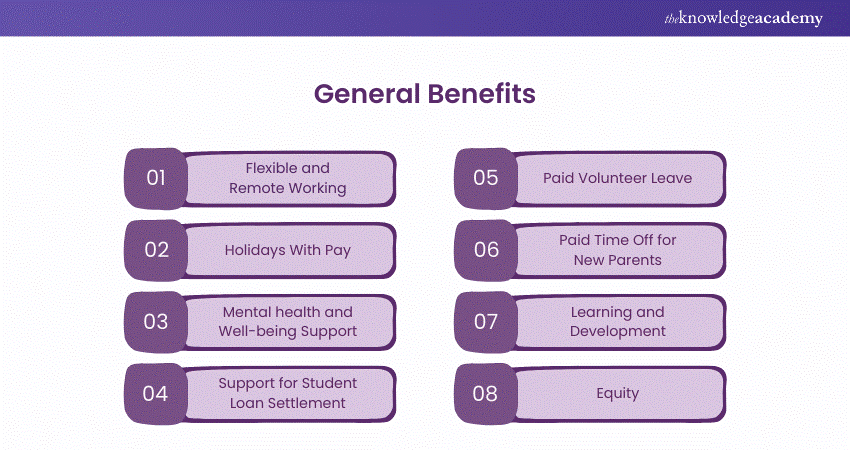

1) General Benefits

General benefits are designed to enhance employee satisfaction and work-life balance, offering perks like flexible working hours, paid holidays, and mental health support. These benefits cater to the diverse needs of employees, promoting a supportive and flexible workplace environment. Some of the general benefits are:

1) Flexible and Remote Working

This benefit allows employees to design their work schedules and locations around their personal lives, leading to reduced commute times and associated stress. It is particularly beneficial in attracting talent that may not be local but is ideal for the role, broadening the talent pool.

Flexible and remote working can significantly enhance employee satisfaction, reduce overhead costs for the company, and lead to a more diverse and inclusive workplace culture.

2) Holidays With Pay

Paid holidays are a widely appreciated component of an employee's benefits package. When you join a company, you often become eligible for Paid Time Off (PTO), which includes paid holidays.

The accumulation of paid holiday hours typically aligns with your work schedule and company policies. The exact amount of PTO you can accumulate may vary depending on your organisation's preferences, but it's common to accrue at least one week of holiday PTO each year. Paid holidays not only provide employees with a well-deserved break but also contribute to a healthy work-life balance.

3) Mental health and well-being Support

The support services offered by health insurance vary based on the size of your company. They may include help in creating a plan for the well-being of employees, offering employee assistance, counselling, and self-care techniques.

Most employers provide online or virtual physician services. Because they allow employees to receive medical advice at a time that works with their other responsibilities, these can help employees feel less stressed.

4) Support for Student Loan Settlement:

When starting with their careers, graduates may ought to address student loans. Some employers offer a helping hand by supplying scholar mortgage compensation alternatives, which lessen the economic stress and free up graduates to focus on their career improvement.

It's well worth noting that corporations hiring younger professionals and recent graduates are greater inclined to provide scholar loan repayment plans as part of their Employee Benefits package deal. By presenting this aid, employers can appeal to and retain top expertise as well as display their commitment to the economic well-being in their group of workers.

5) Paid volunteer leave

In addition to traditional PTO, some employers extend an extra perk to their employees in the form of PTO for volunteering. This benefit encourages employees to engage in charitable activities throughout the year, contributing to their communities and noble causes.

On one hand, it reflects an employer's commitment to corporate social responsibility and community involvement, fostering a positive image for the company. On the other hand, it provides employees with a valuable opportunity to pursue personal interests and passions outside the confines of their work.

This, in turn, can contribute to increased well-being, relaxation, and a refreshed mindset when returning to their regular job duties. As a result, volunteer PTO not only benefits the community but also enhances the overall job satisfaction and performance of employees.

6) Paid Time Off for new Parents

Many employers provide paid time off (PTO) as a non-medical benefit, enabling employees to take scheduled days off work with pay. PTO is often determined by the duration of your employment with the company. As of December 2021, the Holiday Entitlement Law mandates that nearly all full-time employees receive 5.6 weeks of annual leave. Those on part-time and flexible contracts have different statutory entitlements. Additionally, employers offer Statutory Sick Pay (SSP) for up to 28 weeks.

7) Learning and Development:

Some companies provide grants or cover expenses to enable employees to attend training days, exams, and certifications for their professional development. These training sessions often include large groups of new recruits, either from a single company or multiple companies, at a partnered training centre or course. Typically, training days and professional development do not require the use of paid time off or other leave, and employers may permit attendance as part of the working week.8) Equity:

8) Equity

Offering equity or stock options as part of a compensation package is a strategic approach that involves giving employees a direct stake in the company's financial success. This method aligns employees’ personal financial interests with the broader corporate objectives, incentivising them to contribute effectively to the company’s growth and productivity.

This type of compensation is particularly attractive in startup environments, where the initial monetary rewards might be lower than in established companies. Here, equity options serve as a powerful incentive for employees by offering the prospect of substantial financial returns as the company grows.

Boost productivity and drive innovation – sign up for our Employee Training and Development Course.

9) Relocation Expenses:

Professionals frequently travel long distances to reach the office or meet with clients and complete external work. Employers may assist with covering transport costs, accommodation, and expenses for employees who travel extensively for their job. Additionally, employers might cover the costs of international travel by air or sea, enabling employees to attend work-related events, such as conferences.

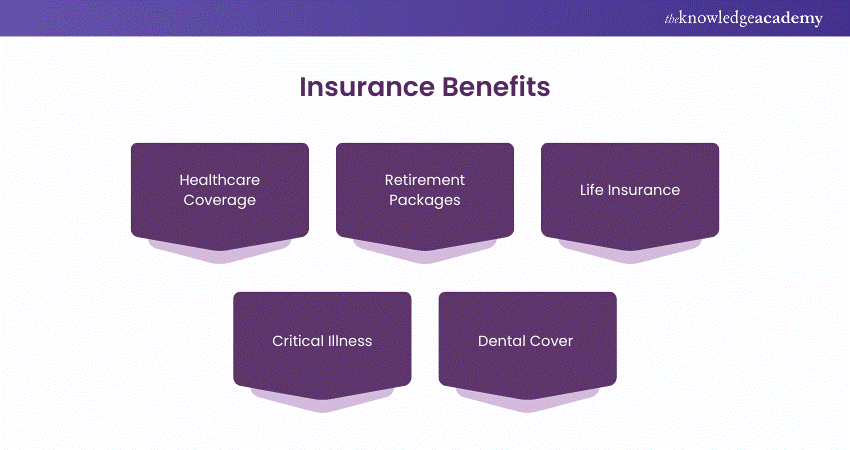

2) Insurance Benefits

Insurance benefits are a key component of employee compensation packages, providing essential financial security and health coverage. Such coverage helps employees manage potential health costs and secure financial stability for themselves and their dependents. Some of the insurance benefits are:

1) Healthcare Coverage

Health insurance, which often forms an integral part of employment benefits packages, provides dental, vision, and health insurance. This widely prevalent benefit at work allows employees' ability to obtain essential medical care, boosting their overall well-being and health.

Regular check-ups, certain medical treatments, diagnostic tests, and prescribed drugs are usually covered by medical insurance.

2) Retirement Packages

In certain comprehensive employment benefits packages, companies extend offerings related to retirement planning and financial security. These programmes aim to help employees prepare for their post-employment years. Retirement plans and matching programmes are often included in these packages.

An important aspect is that employees usually retain full ownership and control over their retirement accounts. This portability offers security and flexibility in managing one's financial future.

3) Life Insurance

Life insurance provides financial security to an employee’s family in the unfortunate event of their death. This benefit is crucial for employees with dependents and provides peace of mind, knowing that their loved ones will be financially protected.

Life insurance can cover expenses like funeral costs and ongoing living expenses for family members, ensuring they are not left in a precarious financial situation.

4) Critical Illness

Critical illness insurance offers a lump sum payment if an employee is diagnosed with a specified illness or condition. This can alleviate the financial burden during a difficult time, allowing the employee to focus on recovery without worrying about income loss or medical bills.

This type of insurance is especially valuable in providing peace of mind to employees, knowing they have support in the event of serious health issues.

5) Dental cover

Many employers provide dental coverage as part of their comprehensive healthcare packages or as a standalone benefit. Dental plans may cover only regular check-ups or extend to include hygienist appointments, X-rays, and procedures.

Ensure that your team is well-versed in company policies by joining our HR Policy Training.

Legally Mandated Benefits

Legally mandated benefits are those that employers are required to provide by federal, state, or local laws. These benefits can include minimum wage, overtime pay, unemployment insurance, FMLA, COBRA, and workers’ compensation. Let’s look at them in detail:

1) Minimum Wage

The federal minimum wage is the lowest hourly rate that businesses can pay their workers, currently set at $7.25 per hour. Some states have established their own minimum wages, which may be higher or lower than the federal rate. Employers must pay employees at least the higher of the federal or state minimum wage. Employees paid less than the minimum wage may be entitled to back pay and other damages.

2) Overtime

Overtime pay is compensation for employees who work more than 40 hours in a workweek. The federal overtime pay rate is time and a half, meaning employees must be paid one and a half times their regular hourly rate for overtime hours. Some states have their own overtime laws, which may differ from the federal rate. Employers must pay the higher of the federal or state overtime rate. Employees not receiving the correct overtime pay may be entitled to back pay and other damages.

3) Unemployment Insurance

Unemployment insurance is government assistance for individuals who lose their jobs through no fault of their own. It helps cover basic expenses while they search for new employment. Eligible workers receive a weekly payment based on their previous earnings, with the duration of benefits varying by state.

4) FMLA

The Family and Medical Leave Act (FMLA) is a federal law providing employees with job-protected, unpaid leave for certain family and medical reasons. Employees can take up to 12 weeks of leave per year, either consecutively or intermittently. To be eligible, employees must have worked for their employer for at least 12 months and have completed at least 1,250 hours in the previous year. The FMLA applies to employers with 50 or more employees for at least 20 weeks in the current or preceding year.

Enhance your team’s communication and conflict resolution skills with our Employee Relations Training.

5) COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) allows employees to continue their group health insurance coverage after leaving their job or losing employer-sponsored health coverage. COBRA applies to employers with 20 or more employees and typically provides coverage for up to 18 months. Beneficiaries are responsible for paying the full premium plus a 2% administrative fee.

6) Workers’ Compensation

Workers’ compensation is a state-mandated benefit providing financial assistance to employees injured at work. It may cover medical bills, lost wages, and death benefits. To qualify, employees must be injured on the job.

Foster a culture of integrity and accountability – register for our Business Ethics Course today!

How Much do Benefits Cost a Company?

While benefits are costly, their crucial role in employee satisfaction means reductions should be minimal. However, not all benefits need to be financially burdensome. Employers can explore cost-effective perks such as:

a) Complimentary meals and snacks

b) Flexible working hours or remote work options

c) Reimbursements for public transport, fuel, and other travel expenses

d) Discounts at local cafes, gyms, restaurants, and childcare facilities

e) Additional leave for training or volunteer work

f) Free parking

g) Mobile phone plans with unlimited calls, texts, and Data

h) Housing and relocation assistance for new employees

i) Wellness initiatives like standing desks and first-aid training.

These innovative benefits are gaining popularity; for instance, 44% of UK organisations have enhanced their wellness offerings. These benefits not only boost morale but can also reduce indirect costs linked to absenteeism and lost productivity, which the Chartered Institute of Personnel and Development estimates at about £1,290 per employee annually.

Make principled decisions in every aspect of your life – sign up for our Personal Ethics Training.

Conclusion

Hopefully, this blog was able to inform you about what Employee Benefits are and the various forms in which they exist. Organisations are not obliged to provide all or even most of them to their employees. However, owing to the vital role these benefits play in employee retention and organisational productivity, employees should have no hesitation in demanding these benefits.

Elevate your organisation’s ethical standards with our Ethics in Workplace Training – join us now!

Frequently Asked Questions

In the Employee Benefits package, several insurance policies are worth including health, life, dental and disability insurance.

Yes, offering these Employee Benefits, including insurance coverage, shows that you care about the health and well-being of the employees.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 19 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various HR Trainings, including Certified HR Advisor, Certified HR Manager, Employment Law Training, Digital Transformation in HR Training and Business Ethics Course. These courses cater to different skill levels, providing comprehensive insights into Human Resources.

Our Human Resources Blogs cover a range of topics related to HR courses, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your HR skills, The Knowledge Academy's diverse courses and informative blogs have you covered.

Upcoming HR Resources – Learn about Human Resources Batches & Dates

Date

Employee Engagement Training

Employee Engagement Training

Fri 3rd Jan 2025

Fri 28th Mar 2025

Fri 23rd May 2025

Fri 4th Jul 2025

Fri 5th Sep 2025

Fri 24th Oct 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please