We may not have the course you’re looking for. If you enquire or give us a call on 44 1344 203 999 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

Accounting Software has become an important tool in Finance and Business industries. It promises improved efficiency, precision, and streamlined Financial Management. Among the many options available, Sage Accounting Software has emerged as a popular choice for organisations looking to revolutionise their financial processes. However, like any other technical tool, there are several Advantages and Disadvantages of Sage Accounting Software.

Thus, it’s crucial to first evaluate the pros and cons and then choose the right Accounting Software for yourself. But how to evaluate the pros and cons of this Software? Worry no more. Read this blog to explore the Advantages and Disadvantages of Sage Accounting Software. Also, learn whether Sage Accounting Software aligns with your organisation's Financial Management goals.

Table of Contents

1) Overview of Sage Accounting Software

2) Advantages of Sage Accounting Software

a) Streamlined Financial Management

b) Enhanced accuracy

c) Time and cost savings

d) Scalability

e) Reporting and analytics

3) Disadvantages of Sage Accounting Software

a) Initial setup complexity

b) Learning curve

c) Cost of ownership

d) Limited mobility

e) Compatibility issues

4) Conclusion

Overview of Sage Accounting Software

Sage Accounting Software is a prominent and comprehensive Financial Management solution in today's business domain. Sage has continually evolved to meet the ever-evolving demands of small startups and large businesses.

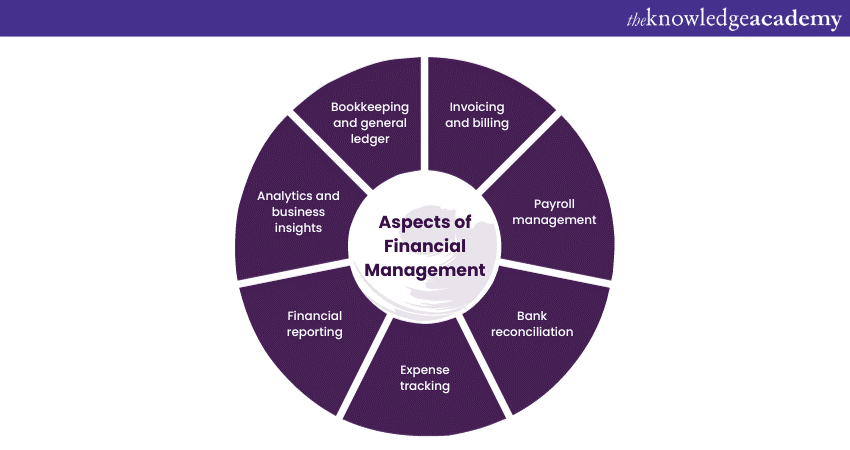

Core functionality

At its core, Sage Accounting Software is designed to facilitate the efficient management of a company's financial processes. It presents a wide range of components and tools that encompass various aspects of Financial Management, including the following:

a) Bookkeeping and general ledger: Sage allows users to hold correct and up-to-date records of financial transactions. It simplifies the often-complex task of double-entry bookkeeping and ensures that financial data is organised and easily accessible.

b) Invoicing and billing: Creating and managing invoices is a breeze with Sage. Users can generate professional-looking invoices, track payments, and send reminders to clients, helping businesses maintain healthy cash flows.

c) Payroll management: Sage offers robust payroll solutions, which are crucial for organisations. It simplifies the payroll process, automating tasks such as calculating wages, taxes, and deductions. This ensures that employees are paid accurately and on time.

d) Bank reconciliation: Reconciling bank statements and ensuring they align with the company's financial records is fundamental in Accounting. Sage automates this process, reducing errors and discrepancies.

e) Expense tracking: Sage provides tools for tracking business expenses, essential for monitoring costs, budgeting, and ensuring compliance with tax regulations.

f) Financial reporting: Sage's reporting capabilities are extensive. It allows users to generate various financial reports, including balance sheets, income reports, and cash flow statements. These reports provide insights into a company's financial health and aid decision-making.

g) Analytics and business insights: Sage offers analytics and business intelligence features beyond standard reporting. Users can analyse data trends, identify Key Performance Indicators (KPIs), and gain valuable insights to drive business growth and strategy.

One of the standout features of Sage Accounting Software is its adaptability. It is not a one-size-fits-all solution; it is highly customisable to serve the precise necessities of different industries and business sizes. Users can select from various modules and add-ons to customise the Software to their requirements. This scalability makes Sage a versatile choice for startups looking to grow and established enterprises seeking a flexible Financial Management solution.

Sage offers both cloud-based and on-premises versions of its Accounting Software. This flexibility lets businesses determine the deployment method that aligns with their Information Technology (IT) infrastructure and preferences. The cloud-based option provides accessibility from anywhere with an internet connection, while the on-premises version offers greater control over data storage and security.

Sage Accounting Software often provides localisation features, including support for various currencies, tax codes, and languages. Moreover, integration with other software and systems is essential in today's interconnected business environment. Sage recognises this need and offers integration capabilities with various third-party applications, including Customer Relationship Management (CRM) systems, e-commerce platforms, and payment gateways. This ensures that Sage can seamlessly fit into your existing technology ecosystem.

Unlock your potential and elevate your Financial Management skills with our comprehensive Sage 50 Accounts Training - sign up now!

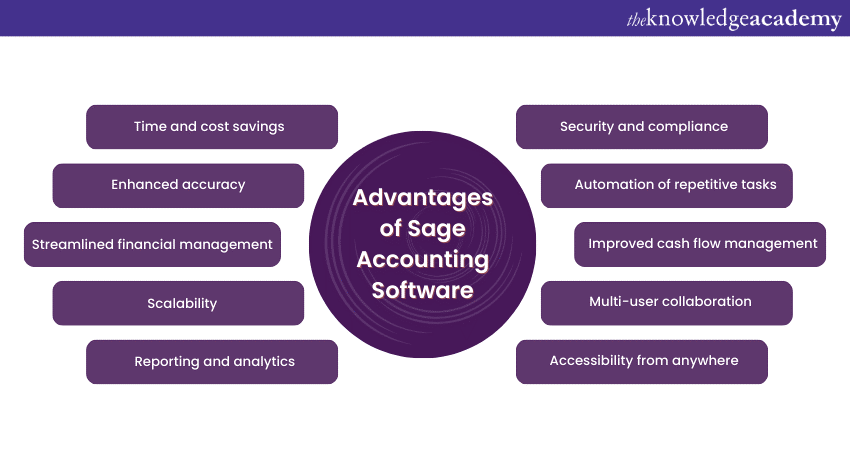

Advantages of Sage Accounting Software

Sage Accounting Software is a powerful and versatile instrument for businesses aiming to facilitate their Financial Management processes. Its multiple benefits make it a favoured choice for organisations of all sizes and industries. Want to know how? Let's explore the key benefits of using Sage Accounting Software in detail:

Streamlined Financial Management

Sage Accounting Software excels in simplifying Financial Management processes. It provides a centralised platform to manage financial transactions, records, and documents efficiently. This streamlining of financial tasks reduces the need for manual data entry, minimising errors and saving valuable time. This streamlining of financial tasks can profoundly impact your organisation by providing the following:

a) Efficient workflow: With Sage, the financial workflow becomes systematic. It guides the organisations through data entry, reconciliation, and reporting processes, ensuring that everything is noticed and duplicated.

b) Reduced manual labour: By automating routine financial tasks, Sage minimises the need for manual data entry. This saves time and reduces the risk of data entry errors, which are common in manual accounting.

c) Improved organisation: Sage categorises and organises financial data logically, making it easy to find and access. This organisation simplifies audits, financial analysis, and tracking of economic trends.

Enhanced accuracy

Accurate financial records are paramount for any business. Sage Accounting Software automates calculations and data entry, reducing the likelihood of human errors common in manual accounting. This enhanced accuracy ensures that financial data is reliable and up-to-date, facilitating better decision-making and transparency. Sage Accounting Software excels in providing that your financial data is precise and error-free by providing the following:

a) Automated calculations: Sage performs complex calculations automatically, reducing the chances of mathematical errors. Whether it is calculating taxes, payroll, or depreciation, the Software handles it with precision.

b) Error checks: Sage includes built-in errors and validation rules alerting organisations about discrepancies or inconsistencies. This proactive approach helps them catch and correct mistakes before they become significant issues.

c) Consistency: With Sage, financial data is recorded consistently and follows established accounting principles. This consistency enhances the reliability of financial records and reports.

Time and cost savings

Automation is a core feature of Sage Accounting Software. Organisations can decrease the time spent on routine administrative work by automating tasks such as data entry, invoice generation, and payroll processing. This boosts productivity and translates into cost savings, as you can allocate resources more efficiently. Efficiency is a significant Advantage of Sage Accounting Software, and this efficiency translates into both time and cost savings by providing the following:

a) Time efficiency: Automating repetitive tasks, such as data entry, invoice generation, and payroll processing, frees up valuable employee time. Staff members can redirect their efforts toward more strategic studies, contributing to increased productivity.

b) Reduced labour costs: Sage lowers labour costs by automating duties that would otherwise need manual labour. This is especially useful for small businesses with little resources to allocate to administrative work.

c) Minimised overtime: Automating tasks means fewer late nights or overtime hours for accounting teams. Sage ensures that financial processes are completed within standard working hours.

Scalability

One of Sage's standout Advantages is its scalability. Whether a small business or a large enterprise, Sage can adapt to all evolving requirements. Organisations can begin with a basic package and develop their use of the Software as their business grows. This scalability ensures that Sage remains a valuable tool as an organisation’s financial requirements become more complex. Sage's scalability is notable for businesses with growth aspirations and provides the following Advantages:

a) Start small, expand later: Sage allows organisations to start with a basic package and add more advanced features or modules as their business grows. This scalability ensures that Sage remains aligned with evolving financial needs.

b) Multi-entity support: Sage can accommodate complex accounting structures for organisations with multiple entities or subsidiaries. They can manage various business units efficiently within a single software solution.

c) Integration with other systems: As a business expands, it may need to integrate Sage with other software or systems. Its scalability ensures that it can seamlessly integrate with the organisation’s growing technology ecosystem.

Reporting and analytics

Effective Financial Management involves more than just recording transactions; it requires analysing data to make informed decisions. Sage Accounting Software offers robust reporting and analytics tools that enable you to generate various financial reports.

Organisations can track KPIs, analyse trends, and gain valuable insights into their financial health. These features empower them to make strategic decisions and refine their business strategies. Sage's robust reporting and analytics capabilities offer several advantages for Financial Management that are as follows:

a) Data-driven decisions: Sage provides a wide range of pre-built reports and customisable templates. This empowers organisations to analyse financial data, track KPIs, and identify trends, supporting data-driven decision-making.

b) Timely insights: The real-time access to financial data in Sage allows organisations to generate reports on demand. Thus, organisations are not limited to month-end or year-end reporting cycles, ensuring they always have up-to-date information.

c) Customisation: Sage's reporting tools are highly customisable. Organisations can tailor reports to meet the specific needs of their business, whether it is industry-specific metrics or unique performance indicators.

Security and compliance

Protecting sensitive financial data is paramount. Sage Accounting Software places a strong emphasis on safety. It includes data encryption, user authentication, and access controls to safeguard financial information from unauthorised access or breaches. Sage assists in maintaining compliance with tax regulations and accounting standards, reducing the risk of legal issues and penalties. Thus, Sage offers robust advantages to organisations in the following areas:

a) Data encryption: Sage employs advanced encryption techniques to protect sensitive financial data. This ensures that financial information remains confidential and secure from external threats.

b) User authentication: Access to Sage is controlled through user authentication. Only authorised personnel can access financial records, reducing the risk of unauthorised data manipulation.

c) Compliance support: Sage assists businesses in adhering to tax regulations, accounting standards, and legal requirements. It helps them avoid costly compliance violations and associated penalties.

Improved cash flow management

Sage Accounting Software offers tools for monitoring and managing cash flow. Organisations can track income, expenses, and outstanding payments to maintain a healthy cash flow. This feature is precious for small businesses that must closely manage their finances to ensure sustainability and growth.

Multi-user collaboration

Collaboration is essential in a business environment. Sage Accounting Software allows multiple users to access and work on financial data simultaneously. This feature is invaluable for accounting teams, as it enhances collaboration, reduces bottlenecks, and speeds up financial processes.

Accessibility from anywhere

With cloud-based versions of Sage Accounting Software, organisations can access their monetary data from anywhere with an internet connection. This flexibility is crucial in today's remote work environment, allowing you to manage your finances even when you are not in the office. It also enables real-time collaboration with team members and accountants, enhancing efficiency and responsiveness.

Join our comprehensive Financial Management Training and gain the knowledge and expertise to excel in the world of finance.

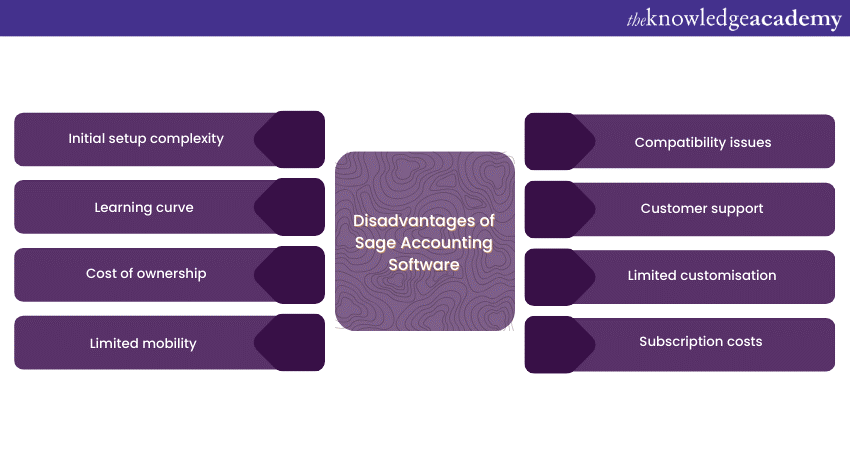

Disadvantages of Sage Accounting Software

After learning about its Advantages, it’s time to explore the Disadvantages of Sage Accounting Software. Let's look at each of them in detail and learn how this Software can become a bane for organisations:

Initial setup complexity

Setting up Sage Accounting Software can be complex, especially for businesses without experience with such systems. It often requires careful configuration to match an organisation’s specific accounting needs, chart of accounts, tax codes, and reporting structures. This complexity can result in delays and increased implementation costs.

Implementing Sage effectively may necessitate the assistance of IT professionals or consultants who are well-versed in the Software. This adds a layer of cost and complexity, particularly for small businesses with limited resources.

Learning curve

Sage Accounting Software has a learning curve, especially for users who need to become more familiar with accounting principles and Software. Employees may need training to use this Software efficiently. During the transition period, productivity might decrease temporarily as users adapt to the new system.

While Sage strives to be user-friendly, some users may find its interface less intuitive, mainly if they are accustomed to more simple Accounting Software. This can extend the learning curve and lead to frustration among users.

Cost of ownership

Sage Accounting Software typically involves an initial investment for software licenses. The cost can vary depending on the edition and features you require. Fees may be associated with purchasing hardware or upgrading existing infrastructure to support this Software.

Beyond the initial investment, there may be ongoing costs, such as subscription fees, maintenance fees, and costs associated with software updates or patches. These recurring expenses can strain the budget, particularly for small businesses with limited financial resources.

Limited mobility

Sage's traditional on-premises software installations limit mobility. Users may need to be physically present in the office to access the software and financial data. This lack of flexibility may be a significant disadvantage in today's increasingly remote work environments.

While Sage offers cloud-based versions of its Software, these may come with additional costs and may not provide the same mobility and accessibility as other cloud-based accounting solutions.

Compatibility issues

Integrating Sage Accounting Software with other business applications or third-party tools can be challenging. Compatibility issues may arise when trying to sync data with CRM systems, e-commerce platforms, or other software your business relies on. These integration challenges can hinder the overall efficiency of your operations and result in data discrepancies.

Sage may have a more limited ecosystem of third-party integrations than other Accounting Software providers. This can limit your ability to customise and extend the Software's functionality to meet your unique business needs.

Customer support

The quality of customer support for Sage Accounting Software can vary. Some users have reported needing help to obtain timely and effective assistance when facing technical issues or questions. Inconsistent support quality can lead to frustrations and disruptions in your accounting processes.

While Sage offers customer support, premium support services often come at an additional cost. Small businesses with limited budgets may find these added expenses burdensome, especially if they encounter issues that require frequent support.

Limited customisation

While Sage offers a limited degree of customisation in tailoring the Software to highly specific or unique business needs, customisation beyond its capabilities may require additional development work or third-party tools, increasing complexity and cost.

Some businesses with industry-specific requirements, such as complex inventory management or specialised reporting, may find that Sage's out-of-the-box solutions must fully address their needs. This can necessitate workarounds or additional software solutions, potentially increasing the overall complexity of your Financial Management system.

Subscription costs

While many modern software solutions offer subscription-based pricing models, the cumulative cost of Sage's subscription fees can be significant over time. This can concern businesses operating on tight budgets or looking to manage ongoing operational expenses.

Economic fluctuations can impact subscription-based software costs. Changes in exchange rates or economic conditions may result in unexpected price increases, which can strain a business's financial stability.

Conclusion

In Financial Management, Sage Accounting Software stands as a compelling option. While it offers a wealth of Advantages that can transform how businesses handle their finances. The Software comes with a plethora of Disadvantages as well. Thus, it’s crucial for businesses first to evaluate the Advantages and Disadvantages of Sage Accounting Software and then make a choice whether it fits their organisational goals.

Join our comprehensive Accounting Masterclass and learn how to prepare a company’s financial statements.

Frequently Asked Questions

It is an HMRC-approved software for Making Tax Digital for VAT and Income Tax, ensuring compliance with UK tax regulations.

Sage is considered a robust solution for bookkeeping, especially for medium to large-sized businesses, offering in-depth financial reporting and a comprehensive set of features.

The Knowledge Academy takes global learning to new heights, offering over 30,000 online courses across 490+ locations in 220 countries. This expansive reach ensures accessibility and convenience for learners worldwide.

Alongside our diverse Online Course Catalogue, encompassing 17 major categories, we go the extra mile by providing a plethora of free educational Online Resources like News updates, Blogs, videos, webinars, and interview questions. Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

The Knowledge Academy’s Knowledge Pass, a prepaid voucher, adds another layer of flexibility, allowing course bookings over a 12-month period. Join us on a journey where education knows no bounds.

The Knowledge Academy offers various Accounting & Finance Training, including the Sage 50 Accounts Training, Bookkeeping Course, and Financial Management Course. These courses cater to different skill levels, providing comprehensive insights into Financial Modelling.

Our Business Skills Blogs cover a range of topics related to Finance, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Financial Management skills, The Knowledge Academy's diverse courses and informative blogs have got you covered.

Upcoming Accounting and Finance Resources Batches & Dates

Date

Finance for Non Financial Managers

Finance for Non Financial Managers

Fri 3rd Jan 2025

Fri 10th Jan 2025

Fri 17th Jan 2025

Fri 24th Jan 2025

Fri 7th Feb 2025

Fri 14th Feb 2025

Fri 21st Feb 2025

Fri 28th Feb 2025

Fri 7th Mar 2025

Fri 14th Mar 2025

Fri 21st Mar 2025

Fri 28th Mar 2025

Fri 4th Apr 2025

Fri 11th Apr 2025

Fri 2nd May 2025

Fri 9th May 2025

Fri 16th May 2025

Fri 23rd May 2025

Fri 6th Jun 2025

Fri 13th Jun 2025

Fri 20th Jun 2025

Fri 27th Jun 2025

Fri 4th Jul 2025

Fri 11th Jul 2025

Fri 18th Jul 2025

Fri 25th Jul 2025

Fri 8th Aug 2025

Fri 15th Aug 2025

Fri 22nd Aug 2025

Fri 29th Aug 2025

Fri 5th Sep 2025

Fri 12th Sep 2025

Fri 19th Sep 2025

Fri 26th Sep 2025

Fri 3rd Oct 2025

Fri 10th Oct 2025

Fri 17th Oct 2025

Fri 24th Oct 2025

Fri 7th Nov 2025

Fri 14th Nov 2025

Fri 21st Nov 2025

Fri 28th Nov 2025

Fri 5th Dec 2025

Fri 12th Dec 2025

Fri 19th Dec 2025

Fri 26th Dec 2025

Top Rated Course

Top Rated Course

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please